May 2020

28

PAYE Modernisation: What it is and how has it changed payroll processes?

PAYE modernisation came into full effect from January 2019. With this new system, employers are required to report employee pay and deductions to Revenue as their employees are paid.

The aim, ultimately, is to make things simpler. By operating in real-time, Revenue can ensure that the correct tax deduction is being made at the right time for every employee. In turn, employees have online access to payroll information that has been submitted to Revenue by their employer in real-time.

Arguably the most taxing aspect of PAYE modernisation, if you’ll pardon the pun, is that it places substantial responsibilities onto businesses and payroll providers. It's their responsibility to ensure that the correct business processes and practices are in place.

Revenue expects you to get it right, but the change is undoubtedly a significant administrative burden on small employers who process their payroll manually. If you don’t have compliant software, the relevant information must be tracked manually and sent to Revenue through Revenue Online System (ROS).

If that sounds like a headache, it’s because it is. But it doesn’t need to be the case. With the right payroll software in place, the submission of payroll data can be seamless while also introducing many real-time reporting benefits to businesses and employees.

BrightPay has worked closely and will continue to work closely with Revenue to keep our payroll software compliant. BrightPay easily caters for the needs of PAYE Modernisation, removing any heavy lifting on your part.

Change - especially legislative change - comes with its challenges. For businesses that have worked manually (and happily so) for a long time, PAYE modernisation can easily be interpreted as throwing a spanner in the works.

But PAYE modernisation is a chance to make a big leap forward. Revenue integrated payroll software can simplify the payroll process and drastically reduce the administrative cost. Submitting payroll information in real-time eliminates the need for P30s, P35s, P45s, P46s and P60s which further reduces administrative processing.

The benefits are there to be grasped, all you need is the right payroll solution in place. BrightPay won Payroll Software of the Year 2018 and 2019 and enjoys a 99% customer satisfaction rating. There’s no better partner to make the most of PAYE modernisation.

Book a demo today to discover how BrightPay’s award-winning software can improve your payroll reporting processes.

May 2020

27

BrightPay Customer Update: June 2020

Welcome to BrightPay's June update. Our most important news this month include:

-

Returning Staff to Work

-

Temporary COVID-19 Wage Subsidy Scheme - Operational Phase

-

How to download the Revenue Instruction from ROS

-

Free Webinar: Important COVID-19 Payroll Updates & Return to Work Safely Policies

Important COVID-19 Payroll Updates

The government has announced the first steps to ease the coronavirus restrictions with a roadmap in place for lockdown measures to be slowly lifted. Understand how to adapt your payroll processes to accommodate for the schemes and subsequent updates.

Temporary COVID-19 Wage Subsidy Scheme - Operational Phase

During the Operational Phase of the scheme, Revenue will calculate employees' previous average net weekly pay and their maximum personal subsidy amount and provide this information to employers. This will be in the form of a Revenue instruction (in CSV format), which employers must download from within their ROS account and import into their payroll software. Revenue are updating the TWSS files daily to include employees that have been rehired after 1 May 2020 and notified to Revenue in an RPN. Where relevant, the Revenue instruction file must be downloaded from ROS again and re-imported into the payroll software.

Return to Work Safely Protocol

The Irish Government has introduced a Return to Work Safely Protocol for all businesses to follow. This introduces mandatory measures for organisations to take care of their people and safeguard their health and well-being. All workplaces must adapt their workplace HR policies, procedures and practices to comply fully with the COVID-19 related public health protection measures identified as necessary by the HSE.

Rehiring Employees After Layoff - The Payroll Implications

Thousands of shops, businesses and construction sites have reopened as part of the first phase of the easing of COVID-19 restrictions. Many businesses are now able to re-engage their staff that had previously been placed on layoff. Can these employees qualify for the Wage Subsidy Scheme? How does this affect payroll?

Jan 2020

22

Child’s play: Amazing payroll software that’s simple to use

All of us, in the hyper-connected internet era, have found ourselves at a loss when using some software, website or app. You just want to do one thing, or you want to set something up and...you just can’t.

It might feel like specific software or apps are testing us in some way. Only those who can navigate through the narrow tunnels of this software are genuinely worthy, in some weird twist on the Arthurian legend of Excalibur.

But all of this struggle defeats the entire purpose of working digitally and efficiently, particularly for already busy professionals like accountants. All payroll software should be straightforward to use and set up. This is true for BrightPay’s payroll software, and even easier again is BrightPay Connect - the payroll add-on offering cloud integration and an online portal.

BrightPay Connect requires no downloads or manual data input. Everything is automatically available for your clients, where your clients can just log in to their own password-protected portal anytime, anywhere. The online portal gives clients access to all employee payslips, employee leave and payroll reports that you would have previously emailed to clients each pay period.

And there are levels to this, too. Senior employees or managers can be given different levels of administration to approve leave, change employee details, view employee payslips, and access payroll reports.

We understand that you don’t offer one-size-fits-all service to your clients, and your payroll software functionality needs to match that. BrightPay is flexible, and your involvement in the payroll process can be ramped up or scaled back as required.

BrightPay’s employer self-service portal has built-in features giving your clients a ready-to-go and easy-to-use HR solution. HR documents can be uploaded including employee handbooks and contracts, disciplinary documents, company newsletters, training material and more.

Clients can also manage all leave for their employees. These features will automate and streamline many of the day-to-day HR functions that your clients deal with. The benefits of the payroll service you offer cascades down throughout the business.

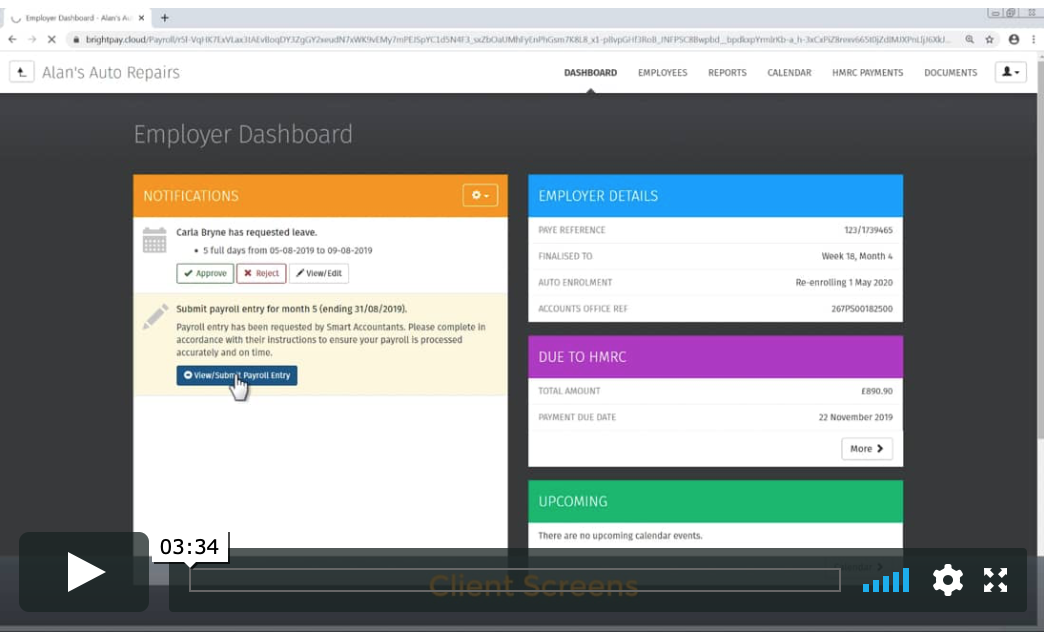

BrightPay Connect gives accountants the ability to send requests to their clients where the clients can now enter payments, additions and deductions for their employees and can also add new starters through their online employer dashboard.

From there, BrightPay Connect goes one step further with the approval feature allowing you to securely send clients a payroll summary for them to approve before the payroll is finalised. Ultimately, your client will be accountable for ensuring that the payroll information is 100% correct before the payroll is finalised.

Very quickly, your payroll bureau becomes an indispensable part of the business’s administration. By embracing cloud innovation, accountants can really streamline and automate much of the payroll process. And with BrightPay’s easy-to-use, automated software, it’s a low touch, easy-to-manage process. What more can you ask for?

Book a demo today to discover how BrightPay’s award-winning software can improve your payroll processes and save you time.

Nov 2019

29

BrightPay Customer Update: December 2019

Welcome to our December update where you will find out about the latest hot topics and events affecting payroll. Our most important news this month include:

- How will auto enrolment affect you in 2022?

- BrightPay Connect monthly subscription pricing - How does it work?

- 2019 HR & Employment Law Landscape - What you need to know

Plans to auto-enrol workers in pension schemes by 2022

In 2022, all employers are likely to have certain auto enrolment mandatory duties to complete by law. As a nation, we are not saving enough for our retirement. Many are planning to rely solely on their state pension which could lead to a reduced standard of living. The Irish government aims to bring in an auto enrolment system where all employers will enrol their employees into a workplace pension scheme and contribute towards the employee pension pot.PAYE Modernisation: One year on - was it a success?

BrightPay has teamed up with Revenue for a series of free PAYE Modernisation webinars. In this webinar, we will look back on PAYE Modernisation in 2019 and decide if the new real time payroll reporting system has been a success. We’ll also deep dive into the evolution of cloud technology in payroll.

- Part 1: Discover the common mistakes employers make and learn what’s to come in 2020.

- Part 2: Learn how BrightPay Connect’s cloud platforms can improve your payroll efficiency.

Watch this short video to see how your business can benefit from BrightPay Connect

BrightPay Connect is our cloud add-on that works alongside BrightPay payroll software. Automatically store payroll information in the cloud and enable online access anywhere, anytime for you, your employees and your accountant. You will be up and running in seconds. Find out how BrightPay Connect can improve your payroll processes with a free online demo.

New BrightPay Connect Feature for Bureaus

This is what you must be offering as part of payroll (And why clients will LOVE it)

Client Payroll Entry

The Payroll Entry Request allows clients to easily and securely enter their employee’s hours, saving bureaus hours of administrative time. Additions and deductions that have been set up by the bureau in the payroll software can also be selected by the employer. All of the information included in the Payroll Entry Request (payments, additions, deductions and new starters) will seamlessly flow through to the bureau’s portal, ready for payroll processing.

Client Payroll Approval

BrightPay Connect’s Payroll Approval Request allows bureau users to securely send their clients a payroll summary before the payroll is finalised. Clients can review and authorise the payroll details for the pay period through their online employer dashboard. Ultimately, your client will be accountable for ensuring the payroll information is 100% correct before the payroll is finalised. Additionally, there is an audit trail of the requests being approved by the client.

Nov 2019

27

How cloud payroll portals can improve your cybersecurity

Until the recent past, small businesses were unlikely targets for sophisticated cyber-attacks. But in the internet era, things have changed dramatically.

SMEs are doing more business online than ever and they are using cloud services that don’t use strong encryption technology. It’s turned your average SME into a likely, lucrative target. There’s a lot of sensitive data to be had, and if it’s behind a door with an easy lock to pick then all the better.

This new reality is on display in official statistics. Over four in ten businesses (43%) and two in ten charities (19%) experienced a cybersecurity breach or attack in 2018, according to the government’s cybersecurity breaches survey.

Three-quarters of businesses (74%) and over half of all charities (53%) surveyed also identified cybersecurity as a high priority for their organisation’s senior management. It’s likely GDPR and its stiffened sanctions for breaches and blunders has a lot to do with this heightened priority.

Payroll processing is a key innovation battleground in this new era of hacks and data regulation. Clients want the convenience of online access to their payroll information, but they also demand (and require) the very best in security.

For a bureau, offering best-in-class cybersecurity is a valuable way to add and demonstrate value, with very little actual effort on your part. A bureau using the most secure cloud payroll facility will offer data security as standard.

Meanwhile, the security itself is actually handled by the software supplier and the infrastructure they provide. All you need to do is make the right choice when it comes to picking a software partner.

When using BrightPay Connect in conjunction with your BrightPay desktop application, for instance, all communication between both systems is carried out on a safe channel with maximum security.

BrightPay utilises all manner of best practice to guard against nefarious tactics such as data injection, authentication hacking, cross-site scripting, exposure flaws, request forgery, and the many other types of vulnerabilities.

BrightPay Connect utilises the Microsoft Azure platform to give users reliability, scalability, data redundancy, geo-replication and timely security updates out of the box.

As a payroll bureau, cybersecurity is a critical commercial area. You must be able to promise security to both current and prospective clients. By investing in payroll software that offers cloud integration powered by the latest tech, that’s an easy promise to keep. Being at the bleeding edge of cybersecurity has never been simpler.

Book a demo today to discover more ways that BrightPay Connect can protect your business.

Nov 2019

20

Important Pricing Update for BrightPay 2020

To ensure that our investment in technology keeps pace with Revenue’s changing landscape and to facilitate the increase in customer support resources, we are changing our pricing for 2020. This new pricing structure is designed to better match usage and support requirements with price.

Unlike many of our competitors, we’ve added hundreds of powerful features and enhancements and heavily invested in additional customer support staff, all so that you don’t have to worry. 99.9% of the time everything will run smoothly but if you ever have problems we will be there to help you. Payroll is way too important not to have a first-class backup service. We believe our pricing remains excellent value and continues to be very competitive when compared to the options from other providers.

Nov 2019

8

BrightPay Customer Update: November 2019

Welcome to our November update where you will find out about the latest hot topics and events affecting payroll. Our most important news this month include:

-

Important Pricing Update for BrightPay 2020

-

Free Webinar - PAYE Modernisation: The story so far

-

Parent’s Leave & Benefit Bill... Paid leave is on the way for all new parents!

Important Pricing Update for BrightPay 2020

To ensure that our investment in technology keeps pace with Revenue’s changing landscape and to facilitate the increase in customer support resources, we are changing our pricing for 2020. This new pricing structure is designed to better match usage and support requirements with price.

Unlike many of our competitors, we’ve added hundreds of powerful features and enhancements and heavily invested in additional customer support staff, all so that you don’t have to worry. 99.9% of the time everything will run smoothly but if you ever have problems we will be there to help you. Payroll is way too important not to have a first-class backup service. We believe our pricing remains excellent value and continues to be very competitive when compared to the options from other providers.

Why Customers Love Us

"When I rang support, I was answered straight away, no holding, and my query answered quickly. My payroll is a joy to do, easy and quick."

Félim O'Connor, Photofast Ltd.

"Having previously used Sage payroll software, I wish that I had used BrightPay much sooner. It is such an improvement and so much easier to use."

Lynda Blake, Day-to-Day Bookkeeping

"Knowing that your exceptional customer service continues after the sale plays a big part in my decision to use and highly recommend BrightPay. Would like to say a big THANK YOU."

Eileen Mc Williams

"Best payroll software I have used. Very user friendly and the reports that can be complied are great because they can be tailored depending on what you want in the report."

Caroline Moynihan, Quiet Moment Tearooms

Free Webinar - PAYE Modernisation: The story so far

This webinar is specifically tailored for employers where we will look back on PAYE Modernisation in 2019 and decide if the new real-time payroll reporting system has been a success. We are delighted to welcome Sinead Sweeney from Revenue who will review some of the most common mistakes employers have made to date and what employers should expect in 2020.

New BrightPay Connect Subscription Pricing Model

From January 2020, customers will be billed on a usage subscription model based on the number of active employees in the billing month. Once signed up for a BrightPay Connect account, you will be invoiced monthly in arrears through our new online billing system. There are no contracts or ties. Should you decide to stop using Connect, no notice is required. Payroll Bureaus on a bureau package will be charged based on the total number of active employees in respect of clients that are synchronised to BrightPay Connect (not on a client-by-client basis). Our 2020 order system will be available shortly.

Free Webinar: Make your payroll bureau stand out with online client platforms

Discover simple ways to impress your clients and make your payroll service stand out. Grow your practice, improve efficiency and save time and money. Register for this free webinar to see how new cloud technologies are positively impacting the way bureaus offer payroll services.

Oct 2019

16

BrightPay Customer Update: October 2019

Welcome to BrightPay's October update where you will find out about the latest hot topics and events affecting payroll. Our most important news this month include:

-

PAYE Modernisation in 2020: What you need to know

-

BrightPay’s new employee SmartPhone App

-

Budget 2020 – Employer Focus

Backing up your payroll data in 2019

Disasters happen. It’s all part of being in business: Fire, flood, theft, you name it. If you own premises or an office, it might happen to you. Did you access your free BrightPay Connect cloud backup facility yet? In 2019 we gave all of our BrightPay customers a FREE BrightPay Connect licence. Automatically store payroll information in the cloud and enable online access anywhere, anytime for you and your employees.

Free CPD accredited webinar | PAYE Modernisation: The story so far

During this PAYE Modernisation webinar, BrightPay's MD Paul Byrne looks back at the story so far and decides whether or not the new real time payroll reporting system has been a success. In this free CPD accredited webinar, we will review some of the most common mistakes employers have made to date and what employers should expect in 2020. Part two will deep dive into how online payroll platforms can improve your efficiency.

Places are limited. Book early to avoid disappointment.

Have you invited your employees to use their FREE smartphone app?

Our new employee self-service smartphone and tablet app is available with our cloud add-on BrightPay Connect. It’s completely free to all BrightPay customers for 2019. The user-friendly app streamlines the payroll processing while reducing the number of payroll queries from employees. The benefits for employees include:

- Instant access to current & historic payslips.

- Request leave on the go.

- View HR documents such as employee contracts & handbooks.

- Edit personal contact information including address and phone number details.

HR & Employment Law Landscape - Free Webinar

Business Owners and Managers are all too aware of the on-going challenges and constant changes in the area of Employment Law and HR Best Practice. This webinar will offer the opportunity to keep abreast of change and plan for the future. Places are limited.

Aug 2019

27

More capacity, more time: Payroll as a cloud service

Payroll processing has never exactly been the belle of the ball. Businesses disliked it because it’s onerous, while accountants loathe it because payroll has proven difficult to monetise. Not to mention, the work is complex and there are bountiful opportunities to mess it up.

But now, payroll is finally having a moment. Cloud portals have altered the landscape, unlocking new productivity and profits for businesses and accountants. Moving beyond the confines of the desktop and connecting payroll software to the cloud opens all sorts of new, exciting prospects.

The benefits of cloud allows constant and iterative improvements because software companies can offer added benefits and additional layers of access via the web, rather than through more traditional, unsecured methods like sending attachments via email. This formula for progress holds true for cloud payroll accessibility. Synching your payroll data to the cloud enables new features, fully supported by a remote access infrastructure for your clients that’s always improving the payroll process.

As for your clients and their employees, a cloud portal can act as an in-house HR system, streamlining many internal payroll administrative duties. For employees, there is just one login to view employee documents and a company noticeboard. Employers can upload documents such as employment contracts, staff handbooks, privacy policies, training manuals. The employer can decide whether the employee should have access to view the document or not, using it as a central location for everything to do with each individual employee.

Cloud integration updates your information in real time which is easily accessible at any time via any device with internet access. Whether it’s just checking something after hours, or enabling flexible online access to payroll information creates freedom. Cloud payroll portals are making it easier and cheaper to provide payroll services at scale for all of your clients. Drudge work is automated, it’s more collaborative, and a simple, intuitive online interface speeds up your work.

But the potential profits from online payroll platforms aren’t just about payroll itself. Time is money, as the old saying goes. Less work filling in boxes means more time spent on lucrative work such as advisory services, consulting and new business development. All throughout the accounting profession, we’ve seen that when firms cut the time spent on traditional services like bookkeeping, tax preparation and now payroll, they can then take on additional clients and projects, using the same number of staff.

More capacity, more time, more flexibility, more collaboration, more profits: the benefits of cloud automation and remote self-service portals will seep into every corner of your practice.

Book a BrightPay Connect demo today to increase your profits from your payroll service.

Aug 2019

7

Save the trees: Instant access to payroll data with no paper trail

We don’t get paychecks anymore, do we? The concept has been banished to TV shows set in the 1960s, where we see a down-on-their-luck salesman contemplate their paper cheque with sad resignation.

Outside of these cultural portrayals, we’ve all moved along to bank transfers. And yet, there’s still one hangover from the era of manual, paper led payroll: the payslip.

Many of us, despite receiving our pay electronically, will receive a paper payslip detailing precisely how much we’ve earned and the taxes we’ve paid. Often these slips will clutter on the employee’s desk, unsecured and aimless.

But how much can you innovate with the old fashioned payslip, anyhow? Quite a bit, actually. This resource heavy, old school process can be taken entirely online. All employee payslips can be securely stored and instantly accessible on BrightPay Connect.

From here, individual employees can also access their HR documents such as their contract of employment through a personal self-service portal as and when they need it. That’s less legwork for you and a simple, well-organised process for the employee.

This can completely replace the more labour intensive process you have now. Payslips can be set up by the user to be automatically available on BrightPay Connect with an email notification to employees, eliminating the need to email them or print it out to hand out, one-by-one manually.

But, of course, employers should still have the choice to do it their way. The business can always email, download or print payslips from BrightPay Payroll. Whichever way the client would prefer is fine, but it remains seamless for you, the accountant.

It’s all about what’s most comfortable. With 24/7 access to employee payslips and other payroll reports, missing payslips and confusion will be consigned to the past. No more manual processes, no more unnecessary legwork - just the information when you need it, in one location, accessible from anywhere for the accountant, employer and employee.

And with BrightPay Connect, the self-service process empowers the employee beyond payslips. The self-service portal is a powerful, multi-purpose cloud tool.

Employees can access their own personal leave calendar, view remaining holiday days, view sick leave taken, request annual leave, view and change their contact information, access payslips and other payroll and employment-related documents. Clients can even give managers access to approve leave for their department and restrict access the other sensitive payroll information such as employee salaries. It’s payroll software with integrated cloud automation that’s about so much more than just pay.

Book a BrightPay Connect demo today to see just how much time cloud automation and integration can save you.