Oct 2015

27

Small Benefit Exemption Scheme - Increase in threshold

The Minister for Finance Michael Noonan is set to fast track an increase in the threshold for the Small Benefit Exemption Scheme. The current threshold is €250; this will double and will increase to €500. The last time the threshold was increased was in 2005 when it was increased from €100 to €250. The move is contained in the Finance Bill, published last week. The new rules were expected to be implemented from 1st January 2016 however, The Department of Finance say the change will be implemented in time for Christmas.

Under the Revenue Commissioner’s Approved Small Benefit Exemption Scheme employers can provide employees with a small benefit, this small benefit is not subject to PAYE, USC or PRSI.

The following rules apply:

• The benefit cannot be cash, cash payments are fully taxable

• Only one such benefit can be given to an employee in one tax year

• Where a benefit exceeds the threshold the full value of the benefit is subject to PAYE, USC & PRSI

• The benefit can not form part of a "salary sacrifice" scheme

The small benefit is traditionally given as a voucher often at Christmas, as mentioned above only one such benefit can be given to an employee in one tax year. Where more than one benefit is given in a tax year only the first benefit will qualify under the Small Benefit Exemption Scheme.

Full details of Finance Bill 2015 can be found on Revenue’s website

http://www.revenue.ie/en/practitioner/law/bills/finance-bill-2015/index.html

Oct 2015

15

Budget 2016 – Employer Payroll Focus

Tax Rates and Standard Rate Cut Off Points (SRCOPs)

There has been no change to tax rates or SRCOPs. The standard rate of tax will remain at 20% and the higher rate of tax will remain at 40%.

There has been no change to the SRCOP and Tax Credits on the Emergency Basis of tax.

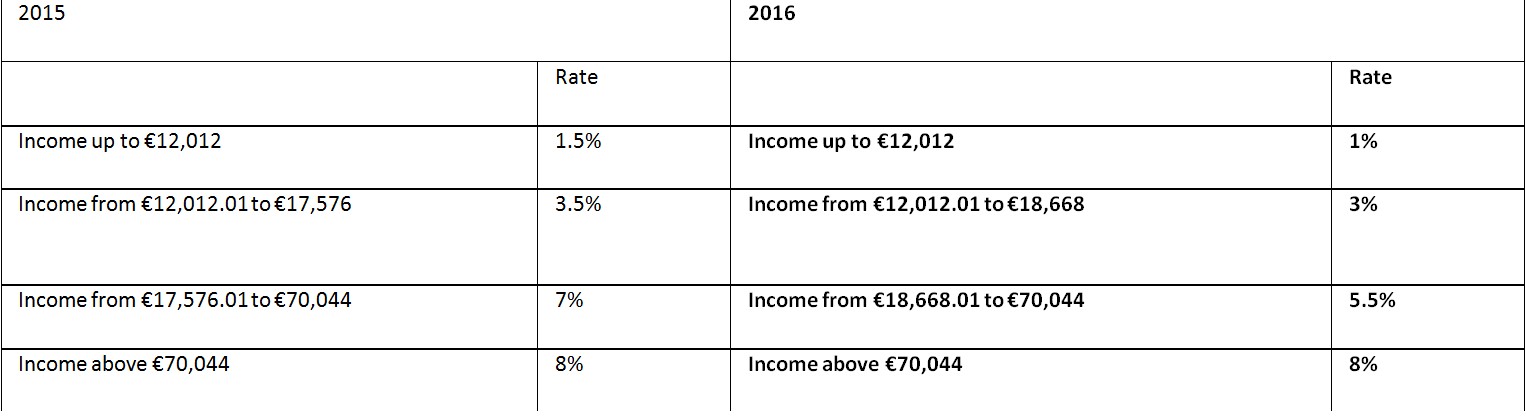

Universal Social Charge (USC)

The annual threshold for USC has been increased to €13,000 from €12,012.

Please note full medical card holders and individuals aged 70 and over whose aggregate income does not exceed €60,000 will pay a maximum rate of 3%.

The emergency rate of USC remains at 8%.

PRSI

Increase from €356.01 to €376.01 in the weekly threshold at which liability to employer’s PRSI increases from 8.5% to 10.75%.

A tapered PRSI credit has been introduced for employee PRSI; the PRSI credit will commence in respect of weekly income of €352.01 and will taper out as a weekly income reaches €424.

For earnings between €352.01 and €424, the maximum weekly PRSI credit of €12.00, is reduced by one-sixth of earnings in excess of €352.01.

Example:

Gross weekly earnings of €377

Maximum PRSI Credit €12

One-sixth of earnings in excess of €352.01

(€377-€352.01 = €24.99/6) (€4.17)

Reduced PRSI Credit €7.83

PRSI @ 4% €15.08

Less: Reduced PRSI Credit €7.83

Employee PRSI Weekly Liability €7.25

Sep 2015

28

Free business event for employers in the North East - Taking care of business

After previous successful events, Revenue is participating in another free one-stop-shop event for SMEs, “Taking Care of Business”. If you own or manage a small business, or are thinking of starting your own business, you should visit www.takingcareofbusiness.ie to register as places are limited.

This is an initiative organized by the Department of Jobs, Enterprise & Innovation.

The events have been designed to help small and start-up businesses understand and benefit from the services provided by a range of State Bodies.

Attendees will:

• Meet with representatives from a number of State Offices & Agencies

• Get information & advice on running your business

• Find out ways to save your business money

• Receive support to help you in your business

This half-day event will take place on Thursday, 8th October in the Westcourt Hotel, Drogheda, Co. Louth.

To find out more and to register, please visit www.takingcareofbusiness.ie

Sep 2015

28

New Fathers to receive Paternity Benefit

It has been revealed today that the State will commence paying out two weeks’ worth of paternity benefit from June next year. The measure is a central plank of the Coalition's childcare strategy due to be announced as part of next month's Budget.

There will also be a special focus on reducing the cost of pre-school and after-school care services, especially for families who have children with special needs. The childcare package will be treated in a similar fashion in the Budget to the reform of the Universal Social Charge (USC).

Meanwhile, Children's Minister James Reilly said reducing the cost of pre-school and crèche facilities for families, especially those with children with special needs, will also be kicked started in 2016. However, he did not specify the form in which benefits will be paid to families.

Speaking to the Irish Independent, Dr Reilly said the package would aim to end "poor quality childcare" that can have a "detrimental effect on children".

Specific measures aimed at reducing the burden on parents will be brought in incrementally over the life-span of the next Government. But sources say there are considerable negotiations still required before an overall package is agreed. However, agreement has been reached on the issue of paternity benefit.

Sep 2015

1

5 ways to avoid a bad hire

1. Know exactly what you are looking for in a candidate

Before making a hire, you should have a clear idea of what you want from your new employee. Profile to make sure that you get a true reflection of the interviewee, they should be well prepared and confident. If they are nervous you may not see what they can bring to your organisation. Therefore, make sure that all applicants know what to expect. Will there be 1 interview or 2? Will there be an assessment or a presentation? If the applicants are prepared they will feel more relaxed and at ease. Profile your ideal candidate so you can then target your search more effectively. This can be done by looking at your best employees and what makes them successful. When it comes to interviewing candidates have specific questions prepared that prove they are the correct person for the job.

2. Don’t rush the hiring process

Don't rush the process. Take the time to find a candidate with the right skill set and experience level. If you are eager to fill a vacancy, it’s easy to rush the hiring process. However quick fixes rarely work out and it you are in any way doubtful of a candidate trust your gut and do not hire them. Recruitment must be focused on the long-term benefits for your company. A bad hiring decision means you are likely to fill a position twice before finding the correct person.

3. Widen your search criteria

Think outside the box when seeking job applicants. Don’t just rely on job boards. While they have their value, it’s worth extending your search beyond these. Social media gives companies a low-cost way to publicize jobs to thousands or millions of people. Instead of blasting out job ads on your company’s main Twitter feed, Facebook page or LinkedIn profile, set up a separate page that is dedicated to career seekers. You’ll get better returns, and avoid spamming your followers with irrelevant information.

On Facebook, for example, companies can create a separate “jobs” tab on the main company page. This strategy allows you to target open positions only at candidates who are actively looking for a new job. LinkedIn, on the other hand, can help you generate targeted leads by utilizing current employees as brand ambassadors. Ask employees to promote job positions on their own pages to extend your reach to candidates in the same industry or with the same skill set.

4. Give a comprehensive job description and company profile

A clear and comprehensive job description is key to attracting candidates who fit well with the role you’re working to fill. Before embarking on this process, you will need to have developed a clear sense of the role, responsibilities, and qualifications for the position you wish to fill. Once your team has clarified these dimensions, you can begin to craft the job description.

5. The most experienced may not be the best fit for your company

While you want to employ someone who can hit the ground running, the candidate with the most experience isn’t automatically a better hire than someone more junior. Those falling short on experience are often seeking a new challenge and are enthusiastic to prove themselves. Bear this in mind and that it may be worth your while to hire on potential rather than experience.

Aug 2015

6

New annual leave changes to benefit employees on long-term sick

With effect from 1st August 2015, employees will be able to accrue annual leave while they are on long-term sick leave. This new measure brings the Organisation of Working Time Act into line with recent rulings of the Court of Justice of the EU, giving workers in Ireland the same rights as everybody all over Europe.

Under the new changes, an annual leave carry-over period of 15 months after a leave year will apply to those employees who could not, due to illness, take annual leave during the relevant leave year or during the normal carry-over period of six months.

In addition, if a worker's employment is terminated, payment in lieu of untaken accrued annual leave will apply to leave which was untaken as a result of illness in circumstances where the employee leaves the employment within a period of 15 months following the end of the leave year during which the statutory leave entitlement accrued.

Jul 2015

27

Minimum Wage Vs Living Wage

Minimum Wage

The minimum wage is the lowest rate of pay that employers can legally pay to workers. Presently in Ireland the minimum wage stands at €8.65 per hour (apart from exceptions for apprentices etc.). However a low pay commission group is to be established and is expected to recommend an increase of €0.50 per hour. The commission is likely to be modelled on a similar body in the UK, which has employer and trade union representatives. Tánaiste Joan Burton said the minimum wage needs to be kept under constant review due to cost of living increases.

Employers’ groups such as Ibec and business groups such as the restaurant sector are strongly opposed any increase in the minimum wage and believe that any increase will inevitably lead to job losses and risk the economy’s fragile recovery. “There is no justifiable economic argument for imposing a 6% increase on SMEs when inflation is practically zero,” ISME’s Mark Fielding said. The Small Firms Association called on the government to reject the proposals, and freeze the minimum wage for the next three years.

Meanwhile the Unite trade union expressed its disappointment believing the proposed rise does not go far enough in its submission to the commission, it had sought a €1 increase.

The Living Wage

A living wage is based on the amount an individual needs to earn to cover the basic costs of living. A coalition of groups says this is about €11.45 an hour, significantly above the minimum wage of €8.65 an hour. Earnings below the living wage suggest employees are forced to do without certain essentials so they can make ends-meet. Ms Burton has encouraged employers to commit to paying a “living wage” to their employees. She has that this will benefit society by giving lower paid workers more spending power and reducing reliance on social welfare. However Ms Burton said the move towards a living wage should initially be on a voluntary basis, rather than a legally enforceable level of pay like the national minimum wage. In recent days Ikea in Ballymun announced that it will be introducing the living wage for all Irish and UK employees. Ms Burton has said “If people get a living wage, they have more spending power, more financial independence and can move away from welfare dependency. It benefits the family and the exchequer.”

Jul 2015

8

New Bill allows for Attachment of Earnings or deduction from Social welfare for recovery of debt of between €500 and €4000

Creditors will be allowed to apply to the District Court for debts to be recovered by either attachment of earnings or deductions from social welfare payments under the terms of a Bill to be published by the Government recently.

The Minister's statement said the new Bill seeks to implement a number of recommendations of a 2010 Law Reform Commission report and provides access to new district court procedures to deal with certain debts where debtors "won't pay".

The debts covered are above €500 and less than €4,000 in value.

The statement says a creditor will continue to be obliged to obtain a judgment debt order from the district court, which establishes that there is an enforceable debt.

However, the new Bill will add he possibility of getting a district court to enforce the debt by means of either attachment of earnings or deductions from social welfare payments, as appropriate.

Ms Fitzgerald said the new options will be primarily of use to small businesses, tradespeople and the self-employed and utilities like Irish Water trying to recover debts from those who can afford to pay, but won't pay Consumer debts owed to financial institutions or licensed moneylenders and arising from loans are excluded. She said there are also very specific court-based protections for debtors who cannot pay.

Jul 2015

1

PAYE Anytime

What is PAYE Anytime?

PAYE Anytime is the Revenues On-Line Service for employees. The service offers PAYE tax payers a secure way to manage their tax affairs online. PAYE Anytime is a self assessment system so employees are responsible for the information they provide.

You can register for PAYE Anytime by going to revenue.ie or by clicking on the below link.

https://www.ros.ie/selfservice/enterRegistrationDetails.faces

Fill in your personal details and a Revenue Pin will be posted to you.

What can you do on PAYE Anytime

• View your own tax records

• You can claim a wide range of tax credits

• You can use your profile to update your personal details; revenue can then use this information to suggest additional tax credits you may be entitled to

• You can claim a repayment for items such as health expenses (all receipts should be kept for a 6 year period)

• Request a P21 balancing statement (end of year review) for any of the last 4 years

• You can enter your bank account details so any refund due to you can be deposited directly to your bank account (revenue will not deduct money from your account if you have a tax liability)

• You can also declare additional income earned such as B.I.K’s and dividends

• If you are jointly accessed you can reallocate some of your tax credits or standard rate band between you and your spouse

• If you have multiple incomes you can reallocate your tax credits or standard rate band between your incomes

You don’t have to submit a paper claim when you submit transactions through PAYE Anytime. The service cannot be used by employees who submit a Form 11 or a Form 12 tax return to revenue on an annual basis.

PAYE Anytime now allows you to view your tax records from any computer or smart phone.

May 2015

22

IPASS - Annual Payroll Conference

IPASS (IRISH PAYROLL ASSOCIATION) held their annual payroll conference in Croke Park on the 21st May. Paul Byrne and Audrey Mooney from Thesaurus Software Limited attended the conference. They enjoyed meeting the other exhibitors, the delegates and listening to the guest speakers. The speakers included Lindsay Melvin the CEO of the Chartered Institute of Payroll Professionals (CIPP), John Kelly from the National Employment Rights Authority (NERA), representatives from Revenue and Department of Social Protection (DSP).

It was also an opportunity to show our payroll product BrightPay which is available for Irish and UK payroll. BrightPay is a simple but powerful payroll software package that makes managing payroll quick and easy. It is designed for small to medium sized businesses, accountants and other payroll bureau providers.

BrightPay Ireland can be downloaded from www.brightpay.ie

BrightPay UK can be downloaded from www.brightpay.co.uk

BrightPay installs as a trial version, which you can use licence free for 60 days at no cost.

Thank you and congratulations to Noelle Quinn and the IPASS team for another successful and enjoyable annual conference.