May 2020

27

BrightPay Customer Update: June 2020

Welcome to BrightPay's June update. Our most important news this month include:

-

Returning Staff to Work

-

Temporary COVID-19 Wage Subsidy Scheme - Operational Phase

-

How to download the Revenue Instruction from ROS

-

Free Webinar: Important COVID-19 Payroll Updates & Return to Work Safely Policies

Important COVID-19 Payroll Updates

The government has announced the first steps to ease the coronavirus restrictions with a roadmap in place for lockdown measures to be slowly lifted. Understand how to adapt your payroll processes to accommodate for the schemes and subsequent updates.

Temporary COVID-19 Wage Subsidy Scheme - Operational Phase

During the Operational Phase of the scheme, Revenue will calculate employees' previous average net weekly pay and their maximum personal subsidy amount and provide this information to employers. This will be in the form of a Revenue instruction (in CSV format), which employers must download from within their ROS account and import into their payroll software. Revenue are updating the TWSS files daily to include employees that have been rehired after 1 May 2020 and notified to Revenue in an RPN. Where relevant, the Revenue instruction file must be downloaded from ROS again and re-imported into the payroll software.

Return to Work Safely Protocol

The Irish Government has introduced a Return to Work Safely Protocol for all businesses to follow. This introduces mandatory measures for organisations to take care of their people and safeguard their health and well-being. All workplaces must adapt their workplace HR policies, procedures and practices to comply fully with the COVID-19 related public health protection measures identified as necessary by the HSE.

Rehiring Employees After Layoff - The Payroll Implications

Thousands of shops, businesses and construction sites have reopened as part of the first phase of the easing of COVID-19 restrictions. Many businesses are now able to re-engage their staff that had previously been placed on layoff. Can these employees qualify for the Wage Subsidy Scheme? How does this affect payroll?

Nov 2019

20

Important Pricing Update for BrightPay 2020

To ensure that our investment in technology keeps pace with Revenue’s changing landscape and to facilitate the increase in customer support resources, we are changing our pricing for 2020. This new pricing structure is designed to better match usage and support requirements with price.

Unlike many of our competitors, we’ve added hundreds of powerful features and enhancements and heavily invested in additional customer support staff, all so that you don’t have to worry. 99.9% of the time everything will run smoothly but if you ever have problems we will be there to help you. Payroll is way too important not to have a first-class backup service. We believe our pricing remains excellent value and continues to be very competitive when compared to the options from other providers.

Nov 2019

8

BrightPay Customer Update: November 2019

Welcome to our November update where you will find out about the latest hot topics and events affecting payroll. Our most important news this month include:

-

Important Pricing Update for BrightPay 2020

-

Free Webinar - PAYE Modernisation: The story so far

-

Parent’s Leave & Benefit Bill... Paid leave is on the way for all new parents!

Important Pricing Update for BrightPay 2020

To ensure that our investment in technology keeps pace with Revenue’s changing landscape and to facilitate the increase in customer support resources, we are changing our pricing for 2020. This new pricing structure is designed to better match usage and support requirements with price.

Unlike many of our competitors, we’ve added hundreds of powerful features and enhancements and heavily invested in additional customer support staff, all so that you don’t have to worry. 99.9% of the time everything will run smoothly but if you ever have problems we will be there to help you. Payroll is way too important not to have a first-class backup service. We believe our pricing remains excellent value and continues to be very competitive when compared to the options from other providers.

Why Customers Love Us

"When I rang support, I was answered straight away, no holding, and my query answered quickly. My payroll is a joy to do, easy and quick."

Félim O'Connor, Photofast Ltd.

"Having previously used Sage payroll software, I wish that I had used BrightPay much sooner. It is such an improvement and so much easier to use."

Lynda Blake, Day-to-Day Bookkeeping

"Knowing that your exceptional customer service continues after the sale plays a big part in my decision to use and highly recommend BrightPay. Would like to say a big THANK YOU."

Eileen Mc Williams

"Best payroll software I have used. Very user friendly and the reports that can be complied are great because they can be tailored depending on what you want in the report."

Caroline Moynihan, Quiet Moment Tearooms

Free Webinar - PAYE Modernisation: The story so far

This webinar is specifically tailored for employers where we will look back on PAYE Modernisation in 2019 and decide if the new real-time payroll reporting system has been a success. We are delighted to welcome Sinead Sweeney from Revenue who will review some of the most common mistakes employers have made to date and what employers should expect in 2020.

New BrightPay Connect Subscription Pricing Model

From January 2020, customers will be billed on a usage subscription model based on the number of active employees in the billing month. Once signed up for a BrightPay Connect account, you will be invoiced monthly in arrears through our new online billing system. There are no contracts or ties. Should you decide to stop using Connect, no notice is required. Payroll Bureaus on a bureau package will be charged based on the total number of active employees in respect of clients that are synchronised to BrightPay Connect (not on a client-by-client basis). Our 2020 order system will be available shortly.

Free Webinar: Make your payroll bureau stand out with online client platforms

Discover simple ways to impress your clients and make your payroll service stand out. Grow your practice, improve efficiency and save time and money. Register for this free webinar to see how new cloud technologies are positively impacting the way bureaus offer payroll services.

Oct 2019

16

BrightPay Customer Update: October 2019

Welcome to BrightPay's October update where you will find out about the latest hot topics and events affecting payroll. Our most important news this month include:

-

PAYE Modernisation in 2020: What you need to know

-

BrightPay’s new employee SmartPhone App

-

Budget 2020 – Employer Focus

Backing up your payroll data in 2019

Disasters happen. It’s all part of being in business: Fire, flood, theft, you name it. If you own premises or an office, it might happen to you. Did you access your free BrightPay Connect cloud backup facility yet? In 2019 we gave all of our BrightPay customers a FREE BrightPay Connect licence. Automatically store payroll information in the cloud and enable online access anywhere, anytime for you and your employees.

Free CPD accredited webinar | PAYE Modernisation: The story so far

During this PAYE Modernisation webinar, BrightPay's MD Paul Byrne looks back at the story so far and decides whether or not the new real time payroll reporting system has been a success. In this free CPD accredited webinar, we will review some of the most common mistakes employers have made to date and what employers should expect in 2020. Part two will deep dive into how online payroll platforms can improve your efficiency.

Places are limited. Book early to avoid disappointment.

Have you invited your employees to use their FREE smartphone app?

Our new employee self-service smartphone and tablet app is available with our cloud add-on BrightPay Connect. It’s completely free to all BrightPay customers for 2019. The user-friendly app streamlines the payroll processing while reducing the number of payroll queries from employees. The benefits for employees include:

- Instant access to current & historic payslips.

- Request leave on the go.

- View HR documents such as employee contracts & handbooks.

- Edit personal contact information including address and phone number details.

HR & Employment Law Landscape - Free Webinar

Business Owners and Managers are all too aware of the on-going challenges and constant changes in the area of Employment Law and HR Best Practice. This webinar will offer the opportunity to keep abreast of change and plan for the future. Places are limited.

Jun 2019

5

BrightPay Customer Update: June 2019

PAYE Modernisation Update: Payroll and tax details now available to employees in myAccount

With real time reporting now in place for employers, Revenue has turned their focus to the benefits of this new system for employees. Since the 15th of May, all employees can now view their payroll details, as reported by their employer, through myAccount. Employers should be aware that employees can now view any discrepancies between payroll details on an employee’s payslip and those reported to Revenue.

Read more | Revenue help guide

The hidden benefits of an employee self-service system

The ability for employees to view and edit their own data is one of the most important advancements of HR in recent years. Providing employees with remote access to view personal information is also a best practice recommendation of the GDPR. It's obviously true that employees have a lot to gain from a self-service system, but what about HR personnel, managers and everyone else involved in the payroll and HR process? They benefit too!

The importance of backing up your payroll data

Disasters happen. It’s all part of being in business: Fire, flood, theft, you name it. If you own premises or an office, it might happen to you. While an act of God can’t always be helped, you can be prepared too. Of course, you’ll have insurance; but what about your priceless payroll data? For a payroll bureau or business, these payroll files underpin the vital task of paying employees.

From the support desk: Can BrightPay be accessed from multiple users on different machines?

BrightPay employer data files can be stored on a shared network drive or cloud drive to be accessed by multiple PCs. The BrightPay software application must be installed on each individual PC you wish to use to access the shared location. A single BrightPay licence allows for up to five installations.

More FAQs | Online Documentation | Video Tutorials

New User Management Interface for Connect

Our new User Management feature for BrightPay Connect makes it more seamless and quicker for users to be set up or amended. It offers the option to select permissions for multiple employers at one time for a standard user. There is also a new permission to allow standard users to connect and synchronise employers from BrightPay to Connect and a new feature to mark an employer as confidential.

GDPR: 1 Year On

It’s been one year since the introduction of the GDPR, and employers and accountants are reviewing their systems, processes and procedures on an ongoing basis to ensure they are doing their best to avoid hefty non-compliance penalties. Find out how BrightPay Connect can help you overcome some of the key challenges GDPR presents when processing payroll.

Apr 2019

17

BrightPay Customer Update: April 2019

Why employees love self-service apps (and you should too!)

As a concept, self-service is nothing new. From paying at the supermarket self-service checkouts to online banking, consumers don’t want to have to wait for something if they know they can get it themselves. It’s no different in the workplace. With a self-service system, employees can download payslips, request annual leave, look at policies and HR documents and update personal information - all without once contacting HR personnel.

Read more | BrightPay Self-Service App

Say goodbye to sick days - A hidden benefit of BrightPay Connect

Some businesses have noticed a reduction in sick days since implementing employee self-service systems. As sick days are much more visible on screen to both employees and their managers, this likely acts as an incentive to keep sick days to a minimum. With BrightPay Connect, employees can view their annual leave and sick days instantly from their smartphone or tablet.

Did you miss it? Watch our employment legislation webinar on demand now

New employment legislation was introduced in March bringing significant changes to employment law. The new Act requires employers to provide employees with key terms of employment in writing within 5 days of starting employment, as well as providing greater protection for those in casual working arrangements. This short webinar highlights the key legislative changes and gives practical advice to employers on how to comply.

How BrightPay Connect is helping with GDPR

It’s been almost one year since the introduction of the GDPR; many businesses are reviewing their systems, processes and procedures on an ongoing basis to ensure they are doing their best to avoid hefty non-compliance penalties. Find out how BrightPay Connect can help your business comply with the GDPR legislation.

Employee Self-Service: Reduce Your Workload Immediately

With BrightPay Connect, the powerful and secure online portal for employees gives them access to view and retrieve historic payslips and other payroll documents, eliminating requests to their manager. Employees can also update their basic personal details including address, contact details, and emergency contact details online. This will ultimately reduce administration duties for managers, thus empowering employees.

Mar 2019

13

BrightPay Customer Update: March 2019

Have you activated your free BrightPay Connect licence?

All BrightPay 2019 purchases include a complimentary BrightPay Connect licence (worth €59). BrightPay Connect is an add-on product that allows you to automatically backup your payroll data to the cloud with online self-service portals for employers and employees. It is important to note that BrightPay Connect needs to be activated before it will backup your data.

Activate BrightPay Connect | Book a BrightPay Connect demo

New employment legislation brings significant changes to employers

The new employment legislation requires employers to provide employees with key terms of employment in writing within 5 days of starting employment, as well as providing greater protection for those in casual working arrangements. Failure on the behalf of individuals to comply with the new legislation will give rise to a criminal conviction resulting in a fine of up to €5,000 or imprisonment of up to 12 months.

Find out more | Free webinar | Book a Bright Contracts demo

BrightPay Connect’s Employee SmartPhone App

BrightPay’s employee self-service smartphone and tablet app is available with our BrightPay Connect add-on. Employee mobile apps offer many benefits for employers, employees, and the business as a whole. The user-friendly portal will streamline payroll processing while reducing the number of payroll queries from employees.

Read more | Download employee app

Free eBook: How to avoid PAYE Modernisation mistakes

It is important that employers are aware of and understand their new real time reporting obligations. Employers need to be aware that mistakes can be very costly. Employers who fail to comply can expect Revenue intervention with non-compliance penalties and fines. In this guide, we discuss the key changes with PAYE Modernisation and what employers need to do to avoid non-compliance penalties from Revenue.

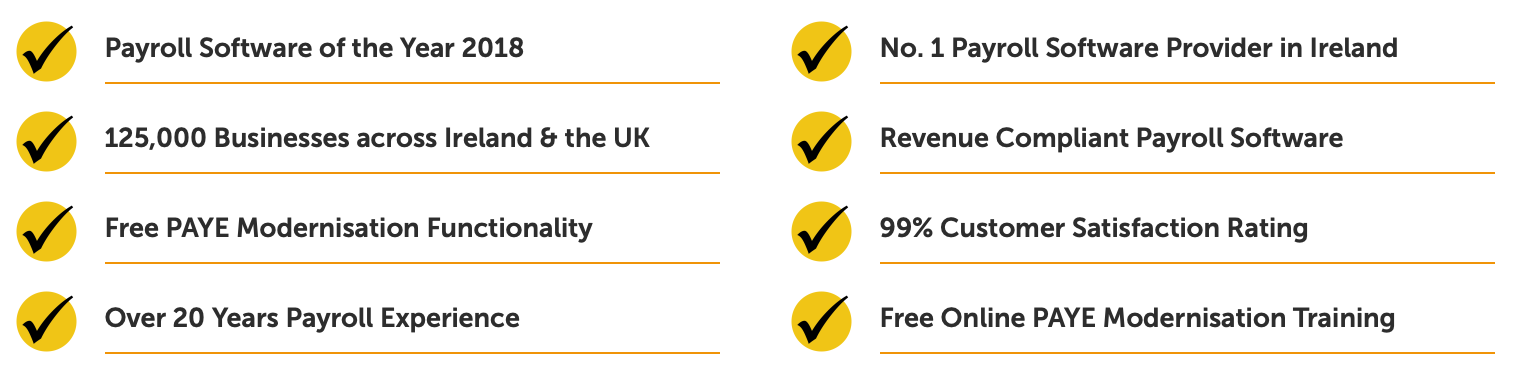

Thinking about switching to BrightPay? Book a demo today

BrightPay was created by Thesaurus Software - the number one payroll software provider in Ireland. BrightPay won Payroll Software of the Year 2018 at the Accounting Excellence awards. With a 99% customer satisfaction rate, our products are used to process the payroll for over 200,000 businesses across Ireland and the UK.

“I tried BrightPay’s 60 day free trial. It was so easy to use that I purchased it after a week. Since switching to BrightPay my payroll is a joy to do, easy and quick.” - Félim O'Connor, Photofast Ltd.

Book a BrightPay demo | View customer testimonials

Free Webinar: PAYE Modernisation, Three Months On!! New Year, New Payroll Legislation

Free webinar with guest speaker from Revenue. Find out what has happened since the introduction of PAYE Modernisation and what challenges businesses are facing. During the webinar, we will peel back the PAYE Modernisation legislation to outline clearly how PAYE Modernisation affects the payroll process and what is expected from you in 2019 and going forward.

View agenda | Book your place now

PAYE Modernisation: How to deal with employees commencing and leaving employment

Employers are required to notify Revenue of any new employees or employees who have left their employment. Since January 1st 2019, employers are no longer required to submit a P45 Part 3 or a P46 to Revenue to register a new employee. Instead, an employer will now submit a Revenue Payroll Notification (RPN) request for the new employee.

Jan 2019

10

BrightPay Customer Update: January 2019

Extended Customer Support Hours

To assist our customers with the transition to PAYE Modernisation, our customer support now offer extended and Saturday opening hours until Saturday 16th February including early mornings and evenings. Revenue is also assisting employers with the transition to PAYE Modernisation, with extended customer support hours and Saturday opening hours from Monday 17th December until Saturday 16th February including early mornings and evenings.

View BrightPay opening hours | View Revenue opening hours

BrightPay Product Training - Payroll & PAYE Modernisation

We are running free BrightPay 2019 online training sessions. The training session will cover full PAYE Modernisation functionality, including the typical payroll run with PAYE Modernisation, processing new starters and leavers, making corrections to the payroll and much more.

What does PAYE Modernisation look like in BrightPay?

We have worked closely with Revenue to ensure BrightPay can easily cater for the needs of PAYE Modernisation. Watch our short video to see how BrightPay streamlines real time reporting to easily comply with PAYE Modernisation.

PAYE Modernisation webinar with guest speaker from Revenue - New 2019 dates added due to high demand

BrightPay and Revenue have teamed up to bring you free webinars where we discuss what has happened since PAYE Modernisation has gone live and what challenges businesses are facing. Due to phenomenal demand, we have added new PAYE Modernisation webinars in January and February. Due to the high level of interest, it is expected that the training webinars will soon be completely booked out. Book your place now to avoid disappointment.

******* Do you have your ROS Digital Cert for PAYE Modernisation? *******

The computer that you run your BrightPay 2019 software on will need to have your ROS Digital Cert installed on it. If you are currently able to log into ROS from your computer, then you are fine. Otherwise, you should copy the cert (the .p12 or .p12.bac file) from the machine that you use for ROS to the machine that you use for processing payroll.

Don’t forget to backup your payroll files for PAYE Modernisation

It is very important to take backups of payroll data with PAYE Modernisation. To help our customers with PAYE Modernisation, we are providing one FREE cloud backup with every BrightPay 2019 payroll purchase. Users can easily backup their payroll data to the cloud, which can be restored at any time. Customers will be issued with one FREE BrightPay Connect 2019 licence (worth €59) with their BrightPay 2019 licence.

Purchase BrightPay 2019 here | Book BrightPay Connect demo

BrightPay Payroll & PAYE Modernisation Help Videos

We have created a number of help videos to give you an insight into what the payroll and PAYE Modernisation functionality will look like in BrightPay. Videos include how to import from the previous year, retrieving your employee RPNs, submitting your payroll data to Revenue and how to add your ROS digital certificate.

How will PAYE Modernisation affect employees?

Employers will now need to connect to ROS before calculating pay and deductions to ensure that they are using the most up-to-date tax credits and cut-off points. They will also have to report these deductions to Revenue every time employees are paid. Employees will then be able to view pay and deductions on myAccount on the Revenue website.

Still not convinced about BrightPay?? This is what you need to know:

Dec 2018

18

BrightPay Customer Update: December 2018

Your PAYE Modernisation Survival Checklist

We have created an 8 step checklist to help you understand what you need to know about submitting your payroll data to Revenue in real time. Stay off Revenue’s naughty list and be ready for the PAYE Modernisation changes.

8 Step Checklist | Book a demo

ROS Digital Cert - A Must Have for PAYE Modernisation

The computer that you run your 2019 BrightPay software on will need to have your ROS Digital Cert installed on it. If you are currently able to log into ROS from your computer, then you are fine. Otherwise, you should copy the cert (the .p12 or .p12.bac file) from the machine that you use for ROS to the machine that you use for processing payroll. This is something you might want to do before the 1st of January 2019.

What does PAYE Modernisation look like in BrightPay?

We have been working with Revenue to make sure BrightPay can easily cater for the needs of PAYE Modernisation. Watch our short video to see how BrightPay will streamline real time reporting to easily comply with PAYE Modernisation.

Watch video here | Book a demo

PAYE Modernisation Training Webinar - Extra dates added due to high demand

Due to phenomenal demand, we have added extra dates for our PAYE Modernisation online training webinars with a guest speaker from Revenue. Due to the high level of interest, it is expected that the training webinars will soon be completely booked out. With almost 1,000 people registered for each of these webinars, there are limited places left. Register now to avoid disappointment.

PAYE Modernisation webinar dates

FREE cloud backup software with every BrightPay purchase (valued at €59)

It is vital to take backups of payroll data with PAYE Modernisation. To help our customers, we are providing a FREE BrightPay Connect 2019 licence (worth €59) with every BrightPay payroll purchase. Users can easily backup their payroll data to the cloud, which can be restored at any time.

PAYE Modernisation Changes for business with separate branches / offices

PAYE Modernisation does not lend itself to operating separate branches / offices using the same employer registration number nor does it lend itself to processing groups of staff separately e.g. directors on one payroll and other staff on a second payroll. There are various reasons for this including:

- full visibility of all payroll data per digital cert

- difficulty in ensuring uniqueness of employment IDs

- ensuring that line item IDs are not duplicated

An employer can have as many employer registration numbers as they want. The solution is to register another number and obtain another cert.

BrightPay Payroll & PAYE Modernisation Help Videos

We have created a number of help videos to give you an insight into what the payroll and PAYE Modernisation functionality will look like in BrightPay. Videos include how to import from the previous year, retrieving your employee RPNs, submitting your payroll data to Revenue and how to add your ROS digital certificate.

The Dos and Don'ts of offering PAYE Modernisation as a service

This guide for payroll bureaus examines practical tips to ensure PAYE Modernisation will be a smooth and profitable process. Discover effective strategies that make it feasible for accountants to make a profit from PAYE Modernisation.

Free Employer Guide: PAYE Modernisation unravelled! You NEED to get this right…

In this guide, we discuss how PAYE Modernisation will affect your business and your real time reporting obligations to Revenue. You must be ready by the 1st of January deadline.

Thinking about changing payroll software provider?

It is important to make sure you choose payroll software that will cater for your payroll needs. The ideal payroll solution will automate the new PAYE Modernisation processing for your business. Your payroll provider should also offer some form of FREE training to help you prepare for your real time reporting obligations. We have two comparison tables that looks at the differences between BrightPay vs. Big Red Book and BrightPay vs. Collsoft. BrightPay also won the 2018 Payroll Software of the Year!!

BrightPay vs. Big Red Book | BrightPay vs. Collsoft

Reasons to Switch to BrightPay for PAYE Modernisation

BrightPay is the payroll software that will significantly reduce the time required to perform these administrative PAYE Modernisation tasks. The biggest advantages of BrightPay include:

- Revenue compliant & PAYE Modernisation compatible

- 99% customer satisfaction rating

- 2018 Payroll Software of the Year award

- FREE payroll & PAYE Modernisation training

- Extended customer support hours over December & January

- Number one payroll software provider in Ireland

- Free phone and email support

Are you missing out on the BrightPay newsletter? We will not be able to email you without you subscribing to our mailing list. You will be able to unsubscribe at anytime. Don’t miss out - sign up to our newsletter today!

Nov 2018

14

BrightPay Customer Update: November 2018

Free PAYE Modernisation Training – Only 20 Places Left

We have teamed up with Revenue to offer employers and payroll bureaus online training webinars to help you prepare for PAYE Modernisation. With just a few short months before PAYE Modernisation takes effect, these online training webinars will discuss how PAYE Modernisation will affect payroll processing and what is expected from you going forward. All webinars are CPD accredited and free to attend. Places are limited.

- 5th December: PAYE Modernisation: 1 Month to Deadline | Register here

- 6th December: The dos and don'ts of manually processing your payroll with PAYE Modernisation | Register here

- 13th December: PAYE Modernisation is coming to town: How to stay off Revenue's naughty list | Register here

Free Cloud Backup for BrightPay Customers - BrightPay Connect (Valued at €59)

It is much more important to take backups of payroll data with PAYE Modernisation. To help our customers, we are providing a FREE BrightPay Connect 2019 licence with every BrightPay payroll purchase. Users can easily backup their payroll data to the cloud, which can be restored at any time.

Switch to BrightPay Payroll & get FREE Cloud Backup worth €59

New customers can now get a BrightPay 2018 licence for FREE plus free cloud backup software worth €59 when you switch and pre-order BrightPay 2019. Offer applies to new customers only who switch from a different payroll software provider to BrightPay. Free offer valid on BrightPay 2018 licences only when you purchase BrightPay 2019. Reasons to choose BrightPay include:

- Free PAYE Modernisation functionality

- Payroll Software of the Year 2018

- 99% customer satisfaction rating

- 5 star rating on Software Advice

- Extended customer support hours for PAYE Modernisation

- Unlimited employers & unlimited employees

- Free PAYE Modernisation training with guest speaker from Revenue

Book a demo | Switch to BrightPay

We’re here to help with PAYE Modernisation - Extended Customer Support Hours

To assist our customers with the transition to PAYE Modernisation, our customer support will have extended and Saturday opening hours from Monday 17th December until Saturday 16th February including early mornings and evenings.

View opening hours | Contact support

How to comply with PAYE Modernisation in 8 easy steps

It is important that all employers understand the upcoming changes to the Irish PAYE system. PAYE Modernisation will affect all employers and it will be important to ensure 100% compliance to avoid penalties and fines. Follow these 8 steps to find out what you need to know about submitting your payroll data to Revenue in real time.

8 Step Checklist | Book a demo

Bureaus Only: 10 Quick Tips to a Successful PAYE Modernisation Strategy for Payroll Bureaus

PAYE Modernisation changes the payroll process forever. Payroll bureaus and accountants should look to increase the prices they charge for payroll and PAYE Modernisation services to compensate for the additional work required. In this guide, we examine the best practices to consider which will improve profits and increase Revenue.

PAYE Modernisation Compliance: We’re ready!!

Please be assured that BrightPay 2019 will fully cater for the new PAYE Modernisation system and that we aim to make it as seamless as possible for you. Users will be able to seamlessly retrieve RPNs and submit PSRs through to Revenue with just a few clicks. There is no additional charge for PAYE Modernisation. Book a demo to see just how easy PAYE Modernisation will be with BrightPay.

Book a PAYE Modernisation demo

Limitations of manually processing payroll with PAYE Modernisation

With the introduction of PAYE Modernisation, the payroll process will be time consuming, frustrating and costly where businesses use a manual process. PAYE Modernisation is the biggest change to affect PAYE processing since it’s conception. The objective of the new system is to improve the way in which businesses, employees and Revenue communicate with each other.

Get your ROS Digital Cert for PAYE Modernisation

The computer that you run your payroll from will need to have your ROS Digital Cert installed on it. If you are currently able to log into ROS from that computer, then you are fine. Otherwise you should copy the cert (P12 file) from the machine you use for ROS to the machine you use for your payroll. This is something you might want to do in advance of January. You can find help on this here.

Are you missing out on the BrightPay newsletter? We will not be able to email you without you subscribing to our mailing list. You will be able to unsubscribe at anytime. Don’t miss out - sign up to our newsletter today!