Jul 2013

22

Government is offering Vouchers for €2,500

Is your Business online? If not, the Government is offering Vouchers for €2,500 to assist you! If yes, have you an ecommerce site – is it working for you?

The evidence is that if your company engages in online trading - your business is more likely to grow twice as fast.

The first phase of the state's National Digital Strategy will provide vouchers worth €2,500 to small firms who want to build their presence on the web. The funds will go to 2,000 businesses around the country to help them "prioritize digital, get the resources, training and expertise needed to develop an online trading presence". The Vouchers will be available for redemption in 2014. Watch this space - Thesaurus Software will alert all our customers as to commencement of the application process.

There will be no geographic restrictions on the vouchers, so businesses from across Ireland will be able to apply. Quotas for different areas will not apply.

Some six out of 10 Irish adults now shop online and 61% of consumers plan to increase their online expenditure. However, 73% of this is leaking out of this economy to international vendors. There’s no point in trying to stop that, but what we can do is compete and sell our wares and services online.

The plan also aims to reduce the number of people who don't use the internet – so called non-liners – by 50pc to 288,000 by the end of 2016.

Launching the plan, communications minister Pat Rabbitte said the State needed to focus more on the practical aspects of doing business online. "Governments tend to focus on the engineering side of the internet – building out the hardware. We need to get more small businesses set up for Ecommerce."

Bright Contracts – Employment contracts and handbooks

BrightPay – Payroll Software

Jul 2013

11

JobsPlus - New Irish Employer Incentive

JobsPlus is a new employer incentive which encourages employers to employ jobseekers on the live register. The scheme replaces the Revenue Job Assist and Employer Job (PRSI) Exemption Scheme from the 1st July 2013; the scheme will be operated by the Department of Social Protection.

There are two levels of payment:

- A payment of €7,500 over 2 years to the employer for each employee recruited who has been unemployed for between 12-24 months

- A payment of €10,000 over 2 years to the employer for each employee recruited who has been unemployed for more than 24 months

Payment will be made monthly in arrears by Electronic Fund Transfer over a 24 month period. Income received from the initiative will not be considered as revenue/income for income or corporation tax purposes.

To qualify for JobsPlus, employers must meet the following conditions:

- The employer must be registered for PAYE with the Revenue Commissioners

- The employer must be tax compliant, employers will be requested to give an officer of the Department of Social Protection permission to check their status with the Revenue Commissioners and to obtain a Tax Clearance Certificate using Revenue’s on line service at the time of application

- The employer must offer a full time position for a minimum of 30 hours per week and the employee must work at least 4 days in any 7 day period

- The employer must give details of the company when applying e.g. size of the workforce, bank details etc

To apply for the scheme employers log on to www.jobsplus.ie and complete the online application form, if approved the Department of Social Protection will revert to the employer via email.

Bright Contracts – Employment contracts and handbooks

BrightPay – Payroll Software

Jul 2013

7

Classification of working directors

Up to now the classification for PRSI purposes, of directors of limited companies who work in that company (“proprietary directors”), has been determined on a case by case basis. This determination takes into consideration the Code of Practice for Determining the Employment or Self-employment Status of Individuals. (http://www.welfare.ie/en/Pages/Code-of-Practice-for-determining-Employment-or-Self-Employme.aspx )

Under the provisions of Section 16 of the Social Welfare and Pensions (Miscellaneous Provisions) Act 2013 proprietary directors who own or control 50% or more of the shareholding of the company, either directly or indirectly, cannot be an employee of that company. This provision comes into effect from 1 July 2013.

In these circumstances the individual is classified as self-employed and is liable to pay PRSI at Class S.

The classification of proprietary directors who own or control less than 50% of the shareholding of the company will continue to be determined on a case by case basis, taking into consideration the Code of Practice for Determining the Employment or Self-employment Status of Individuals.

The new provision will apply to proprietary directors both prospectively and retrospectively.

Where these provisions are to be applied retrospectively, a person has the option of electing to have the decision, in relation to his or her employment prior to the enactment of the legislation, made under the Code of Practice for Determining the Employment or Self-employment Status of Individuals. Any decision will only apply to the period of employment prior to the enactment of the legislation.

Bright Contracts – Employment contracts and handbooks

BrightPay – Payroll Software

Jul 2013

4

Maternity benefit tax could cost women up to €3,000

Mothers and pregnant women face losses of up to nearly €3,000 a year as part of the tax on maternity benefit which came into force on July 1st.

Women’s representatives said the measure was a mean-spirited move by the Government.

The tax will contribute €15m to the exchequer in 2013, and €40m per full year from then on.

But the National Women’s Council yesterday expressed concern that many women were not aware when the reductions in benefit would take affect.

Its policy advisor Ann Irwin explained: “It’s a very mean-spirited move in a lot of ways. Even the commission on taxation has said that maternity benefit should remain outside the tax net. It’s there for mothers to nurture children when outside the workforce.

“The benefit payments are an important acknowledgment for mothers of the cost of having a baby in Ireland.”

Opposition parties have branded the new tax measure as “anti-family” and it could see working mothers pay up to €2,700. Mothers will pay different rates depending on their top-up payments from their employer as well as assessments on their means.

The tax could see benefits reduced by up to €103 a week, the council said.

The Department of Social Protection paid out €309m in maternity benefit payments in 2011.

Mothers get between €217.80 and €260 a week in payments for 26 weeks.

The council said women who got employer top-up payments would be worst affected but that it remained unknown how many would be affected by the levy.

But ministers have insisted women overall will not be worse off. Some had been receiving high payments while on maternity leave, ministers have also said.

However, Ms Irwin said many women remained in the dark about the tax. “The first they may know about it while on leave is when their next pay package comes in.”

Bright Contracts – Employment Contracts and Handbooks

BrightPay – Payroll Software

Jun 2013

19

BrightPay 13.2, With Local Property Tax (LPT) Support, is Now Available

Local Property Tax (LPT) payroll deductions will become mandatory for applicable employees from 1st July 2013 onwards. Revenue have already started to issue updated P2Cs with LPT amounts.

You will need to upgrade to BrightPay version 13.2 to handle LPT payroll deductions. When you next launch BrightPay, the upgrade should be automatically detected – just follow the instructions on-screen. If you have any problems upgrading, please contact us.

BrightPay 13.2 Release Notes

Local Property Tax (LPT)

- Ability to import P2C files which contain total LPT amounts. Total LPT amounts can also be entered manually.

- LPT calculation and inclusion of LPT values on payslips and workings.

- P45 and P45 Part 3 updated to support LPT values (both ROS files and printable versions).

- P30 updated to support LPT values (on-screen, ROS files, and printable versions).

- Several LPT fields have been added to analysis.

- Ability to enter LPT year-to-date information in a mid-year employer setup.

Other features, improvements and bug fixes:

- Ability to print employee calendar.

- Ability to print annual leave entitlement calculation.

- Ability to enter previous employment figures for P46 employees (before, it was only possible for P45 Part 3 employees).

- Ability to import several new mid-year year-to-date values when importing employees from CSV.

- Fixed an issue in which an incorrect PRSI class is stated on the P45 for an employee who had one or more zero-pay payslips.

- Fixes an issue in which certain USC rates/bands and previous employment figures are not correctly imported from a P2C file.

- Fixes an issue in which incorrect year-to-date values are shown on the Tax Deduction Card of an employee who started during the tax year.

Bright Contracts – Employment contracts and handbooks.

BrightPay – Payroll Software

Jun 2013

1

Taxation of Maternity Benefit, Adoptive Benefit & Health & Safety Benefit

From 1st July 2013 Maternity Benefit, Adoptive Benefit & Health & Safety Benefit payable by the Department of Social Protection will be taxable in full. These payments will be taxable but will not be subject to USC or PRSI.

The Revenue Commissioners have confirmed that employees in receipt of Maternity Benefit, Adoptive Benefit or Health & Safety Benefit will have their tax credit and standard rate cut-off point reduced to reflect the benefit they have received. As the benefit will be taxed by Revenue and not at source the recipients will continue to receive the same payment from the Department of Social Protection.

Employers will be advised of the adjusted tax credits and standard rate cut-off points on the tax credit certificates (P2C’s). As the benefit will be taxed by reducing the employee’s tax credits and standard rate cut-off point, employers are NOT to include figures for the benefit on Revenue forms i.e. P45, P60 or P35L.

Bright Contracts – Employment contracts and handbooks.

BrightPay – Payroll Software

Apr 2013

25

What you as an employer need to know about LPT (Local Property Tax)

An employee may opt with Revenue for their LPT liability to be collected by deduction from their salary/wages.

Revenue will communicate to you how much you should deduct from employees in the P2C file (details of tax credits and cut off points) which will be sent to your ROS inbox in June 2013. The LPT field is a new field within the P2C file and BrightPay will detect it automatically once imported into the software. Paper tax credit certificates will also contain this new LPT field and BrightPay will have a new field for inputting the LPT amount manually.

LPT deductions commence for pay dates from 1st July 2013 and, in accordance with Revenue guidelines, BrightPay will deduct the LPT amount evenly over the remainder of the 2013 year. Where, in any pay period, there is insufficient pay to enable deduction of LPT, the balance remaining will be spread evenly over the remaining pay periods.

The LPT deduction, the amount deducted to date and the balance of LPT still to be deducted will be shown on payslips.

The amount you pay to the Collector General by way of a P30 (monthly or quarterly) will include the LPT amount that you have collected. P45s and P60s will also include a new LPT field.

We will be releasing an upgrade in June to handle all of the above.

As with all other statutory deductions, you will be obliged to deduct LPT in accordance with the P2C instruction from Revenue. If an employee has an issue, they must contact Revenue directly. You, as employer, have no discretion in the matter! Revenue can pursue you as employer for any amounts you fail to deduct, charge interest on late payment and fine you for non-compliance.

Bright Contracts – Employment contracts and handbooks.

BrightPay – Payroll Software

Feb 2013

5

Employment Permits Bill

Legislation aimed at protecting undocumented migrant workers is being progressed as a priority by the Department of Jobs, Enterprise and Innovation.

The proposed legislation will address, amongst other matters, an important legal issue identified in a recent High Court decision. In August 2012, the High Court overturned a Rights Commissioner's award of over €91,000 in favour of a foreign national employed as a restaurant worker.

The Court found that the employee’s contract of employment was substantively illegal in the absence of the appropriate employment permit and that he was therefore not entitled to the award.

The proposed legislation will protect migrant workers whose employment in Ireland is unlawful by reason of not having a work permit. The Department recently confirmed that it is expected that the Bill will be published in the first quarter of this year.

Bright Contracts – Employment contracts and handbooks.

BrightPay – Payroll Software

Dec 2012

10

2013 Budget Summary for Employers

The Budget was announced by Ministers Brendan Howlin and Michael Noonan on 05th December. Below is a summary of changes which affect employers.

PAYE

The Income Tax rates remain at 20% and 41% for 2013. There are no changes to Personal Tax Credits or Standard Rate Cut Off Points.

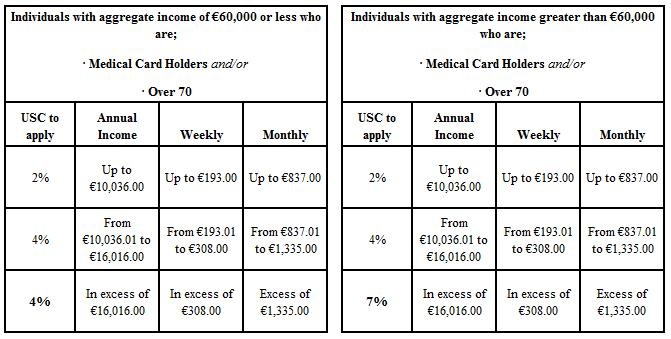

USC

There are no operational changes to the treatment of USC for employers.

From an employee prospective there are no changes to the Standard rates or Cut Off Points in relation to USC, they are the same as last year.

The annual income exemption threshold of €10,036 continues to apply for 2013, the process of employee self election to Revenue still applies.

What has changed are the rules applied to medical card holders and those aged over 70. Previously these individuals would have qualified for a reduced rate of USC of 4% (reduced from 7%) on earnings in excess of €16,016. From 01st January 2013 this USC break no longer applies, to previously qualifying individuals, whose aggregate income for 2013 will exceed €60,000

- Medical Card holders (regardless of age) with aggregate income of €60,000 or more

- Individuals aged 70 or over with aggregate income of €60,000 of more

The P2C (Tax Credit File) issued by Revenue will allocate the correct USC rates and Cut Off Points per employee. As was the case in 2012, no action is to be taken by the employer other than to apply the details of the latest tax credit file.

It is important that you apply the latest detail as per the 2013 P2C/tax credit file as soon as it is received and if possible before completing the first pay period in order to avoid a claw back of USC for any individuals who qualified for the reduced higher rate of USC in 2012 but no longer qualify in 2013.

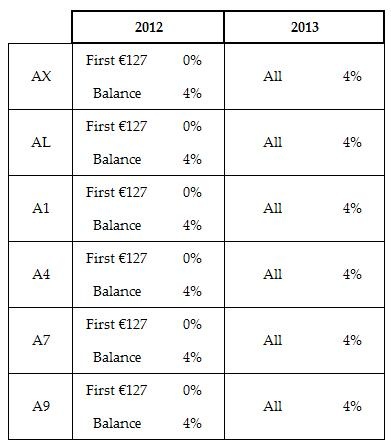

PRSI

The Employee's PRSI-Free Allowance of €127 per week (for those paying PRSI Class A, E and H) and €26 per week (for those paying PRSI Class B, C and D) will be abolished from 01st January 2013.

Employees who earn €352 or less per week continue to have no liability to make a PRSI contribution and are not affected by the abolition of the weekly PRSI-Free Allowance.

For those employees in private sector employment the changes are;

From 01st January 2014, the exemption from PRSI applying to all employees with unearned income only, i.e. income generated from wealth such as investment income, deposit interest and rental income, will be abolished.

PRSI minimum contribution

The minimum annual PRSI contribution for people with annual self-employed income over €5,000 increases from €253 per annum to €500 per annum.

Maternity/Adoptive Benefit

Maternity and Adoptive Benefit will be taxable for all claimants with effect from 1 July 2013. As with all Department of Social Protection benefits it is not subject to USC.

Health and Safety Benefit, payable to pregnant or breastfeeding mothers, is a form of Maternity Benefit and will also be subject to the same tax rules as Maternity Benefit.

Once Revenue issue guidelines relating to the procedures to be adopted by employers to operate the taxation of Maternity Benefit we will issue a payroll upgrade, this will be prior to effective date of 01st July 2013.

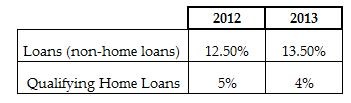

Preferential loan rates

Where an employer extends a loan to an employee, with effect from 01st January 2013, there are the following changes apply;

Top Slicing Relief

Top Slicing Relief will no longer be available for persons who receive an ex-gratia payment, excluding statutory redundancy, where the amount is €200,000 or more. This provision has effect for payments made on or after 1 January 2013.

Revenue Job Assist and Employer Job (PRSI) Incentive Scheme

A scheme called the ‘Plus One Initiative’ will replace both the Revenue Job Assist and Employer Job (PRSI) Incentive Scheme. Full details of this change have yet to be will be announced.

Local Property Tax (LPT)

From 1 July 2013, residential property owners will be liable for an LPT based on the self-assessed market value of their property on 1 May 2013. Once Revenue issue guidelines relating to the procedures to be adopted by employers to deduct and remit this tax to Revenue we will issue a payroll upgrade, this will be prior to effective date of 01st July 2013.

See our article “Local Property Tax (LPT) effective from 01st July 2013” for further information.

Statutory Sick Pay Scheme

Despite speculation throughout the latter half of 2012 a Statutory Sick Paye scheme was not announced in the 2013 Budget.

Bright Contracts – Employment contracts and handbooks.

BrightPay – Payroll Software

Dec 2012

10

USC Exempt Status v USC Exempt Income

Employers should be wary of the difference between USC exempt status (as per P2C/tax credit certificate) and employees in receipt of USC exempt income.

If an employee expects their income to be less than €10,036 in the tax year they can contact Revenue to make a declaration of same, it is only the employee themselves that can make this declaration. Revenue will update the employees USC status to USC exempt and issue a new P2C/tax credit to the employer. The employer will follow this instruction and USC will not be deducted from the employee accordingly.

If an employee is in receipt of USC exempt income, e.g. Community Employment Participants, Department of Social Protection payments, these employees will not necessarily hold USC exempt status on the P2C/tax credit certificate. The exempt income itself should be flagged as USC exempt within the payroll.

Bright Contracts – Employment contracts and handbooks.

BrightPay – Payroll Software.