Oct 2018

8

BrightPay Customer Update: October 2018

Free PAYE Modernisation Training Webinar

We have teamed up with Revenue & IPASS to bring you free CPD accredited webinars to help you prepare for PAYE Modernisation. With just over two months before PAYE Modernisation takes effect, these webinars will discuss how PAYE Modernisation will affect payroll processing and what is expected from you going forward. Both webinars are CPD accredited and free to attend. Places are limited.

- 25th October - Guest Speaker: IPASS | Register here

- 7th November - Guest Speaker: Revenue | Register here

BrightPay wins ‘Payroll Software of the Year’

BrightPay was announced the winner of ‘Payroll Software of the Year’ at this year’s Software Excellence Awards. It’s a great achievement for BrightPay to win this prestigious award. The winner was decided by a public vote, whereby members are asked to rate the software systems they use to determine the best products on the market.

Extended Customer Support Hours

To assist our customers with the transition to PAYE Modernisation, our customer support will have extended and Saturday opening hours from Monday 17th December until Saturday 16th February including early mornings and evenings.

View opening hours | Contact support

Budget 2019 - Employer Payroll Focus

Budget 2019 was announced on Tuesday October 9th 2018 . This is a summary of the measures that will have a direct effect on employers with regards to payroll.

Switch to BrightPay Payroll and get a free licence worth €299

New payroll bureau customers can now get a BrightPay 2018 bureau licence for FREE when you switch and pre-order BrightPay 2019. Offer applies to new customers only who switch from a different payroll software provider to BrightPay. Free offer valid on BrightPay 2018 bureau licences only when you purchase BrightPay 2019.

Book a demo | Switch to BrightPay

PAYE Modernisation checklist to ensure 100% compliance

It is important that all employers understand the upcoming changes to the Irish PAYE system. PAYE Modernisation will affect all employers and it will be important to ensure 100% compliance to avoid penalties and fines. Find out the key factors you need to consider when preparing for its introduction with our PAYE Modernisation checklist.

BrightPay secures investment from Hg

We are very excited to announce that BrightPay has secured investment from Hg, a specialist technology investor. This partnership benefits BrightPay as we can access the experience and support of Hg and its network, whilst retaining voting control of the business. “It’s great to secure an investment from a firm who both knows our market and has the experience to help us develop the business.”

Did you miss it? Important information regarding PAYE Modernisation

We recently sent out an email to all customers regarding PAYE Modernisation detailing a number of things you need to be aware of or to check in advance of January. Please be assured that our 2019 software will fully cater for the new system and that we aim to make it as seamless as possible for you.

View email | Book PAYE Modernisation demo

BrightPay Connect: The perfect HR solution for your business

BrightPay Connect has built-in features giving employers an easy to use HR solution where employers can seamlessly manage employee leave and upload HR documents, such as contracts of employment. Employees can request leave through their employee portal or smartphone app. These features will automate and streamline many of the day-to-day HR functions that you deal with.

BrightPay Connect | HR Features

Are you part of an association that needs help with PAYE Modernisation?

We are working with a number of associations that are helping their members with PAYE Modernisation. We are offering a free partnership platform to Irish associations where we can provide free PAYE Modernisation training and free training on our payroll software products. Our partnership platforms enable us to offer association members introductory discounts.

Are you missing out on BrightPay's newsletter? We will not be able to email you without you subscribing to our mailing list. You will be able to unsubscribe at anytime. Don’t miss out - sign up to our newsletter today!

Aug 2018

1

BrightPay Customer Update: GDPR & PAYE Modernisation Special Edition

PAYE Modernisation Explained

PAYE Modernisation or real-time reporting (RTR) will enable Revenue to ensure that employees are receiving their correct tax credits and cut-off points throughout the year. This compares with the current PAYE reporting which is done through P35s on a yearly basis.

Learn more | Frequently asked questions

Free GDPR Webinar | Guest Speaker: Data Protection Commissioners

Graham Doyle, Head of Communications from the Data Protection Commissioners office will be joining us to discuss GDPR and the effect it is having on all businesses. This FREE CPD accredited webinar will look at what is new in GDPR, how it may affect your business and what have we learned from the GDPR 3 months on. We will also look at how BrightPay can help your organisation utilise the new regulation to benefit you, your customers, suppliers and employees.

Manually Calculating Payroll with PAYE Modernisation

A significant number of employers are still processing their payroll using a manual or spreadsheet system. A manual approach may seem like an attractive option but can result in inaccurate payroll processing. From January 2019, employers will be required to submit their payroll returns electronically and in real-time, each payroll run, allowing Revenue to access the most up-to-date information.

Privacy Policies - A GDPR Requirement

One of the main principles of the GDPR is that data shall be processed lawfully, fairly and in a transparent manner. These three elements overlap and all three must be satisfied in order to demonstrate compliance. The GDPR stipulates that anywhere personal data is being collected, either directly or indirectly, Privacy Notices should be in place.

PAYE Modernisation FREE webinar in conjunction with Revenue

We have teamed up with Sinead Sweeney who is the PAYE Modernisation Change Manager for the Revenue Commissioners. The webinar will peel back the legislation to help you understand and implement the new changes for your business. The objective of PAYE Modernisation is for Revenue, employers and employees to have access to the most accurate, up-to-date information relating to pay and statutory payroll deductions. Places are limited.

Employer webinar: 4th September | Bureau webinar: 6th September

GDPR: Do I need consent from my client’s employees? (Bureaus Only)

Many bureaus have expressed concern and confusion in relation to getting consent from their client’s employees and securely distributing payslips. Payroll bureaus do not need to seek consent from individual employees that the payroll is processed for. However, the employer will need to inform their employees that they are sharing their personal information with a third party.

GDPR: Frequently Asked Questions

Our GDPR experts have put together a list of some of the frequently asked questions that we have been asked by our customers regarding the General Data Protection Regulation. Additionally, the legislation states that whenever a data controller (e.g. business/employer) uses a data processor (e.g. payroll bureau) there needs to be a written contract or Data Processor Agreement in place.

View all FAQs | Template Data Processor Agreement

Are you missing out on BrightPay's newsletter? We will not be able to email you without you subscribing to our mailing list. You will be able to unsubscribe at anytime. Don’t miss out - sign up to our newsletter today!

Jun 2018

6

BrightPay Update: June 2018

PAYE Modernisation: Understanding and implementing the new legislation

The way in which we communicate and send payroll information to Revenue is changing. The objective of PAYE Modernisation allows for Revenue, employers and employees to access the most accurate, up-to-date information relating to pay and statutory payroll deductions. PAYE Modernisation will be effective from the 1st of January 2019 and will apply to all employers.

Bureau webinar | Employer webinar

Free Webinar: Payroll Data & GDPR - What you need to know

Employers must take steps to protect and securely manage employees’ personal data to comply with GDPR. Equally, where a business outsources their payroll to a third party (payroll bureau), they are legally obliged to provide assurances to safeguard the payroll information they manage on behalf of their clients. Places are limited.

How has BrightPay prepared for GDPR?

Data Protection has always been a concern for BrightPay and we have always aimed to act with complete integrity in this regard. In preparation for GDPR, we have had to complete a total review on how we gather, maintain and use data. We have taken steps to securely protect our customers information including increased encryption, securely deleting files from our servers and updating our privacy policies in line with GDPR.

Key changes | Updated privacy policy

PAYE Modernisation - The Facts

PAYE Modernisation is a mandatory payroll requirement that will be introduced from the 1st January 2019. It won’t change the way you calculate your PAYE information, it just means that you will need to send your data through to Revenue in real time. Every time you pay your employees (i.e. each pay period), you will need to submit PAYE information to Revenue, through an API link via your payroll software.

Read full article | Register for webinar

BrightPay Connect’s NEW Employee Smartphone App

BrightPay’s employee self-service smartphone and tablet app is available with our cloud add-on BrightPay Connect. The advancement of employee mobile apps offers many different advantages for employers, employees, and the business as a whole. For employers and HR Managers, the user-friendly portal will streamline payroll processing while reducing the number of payroll queries from employees.

GDPR - What to include in your template Data Processor Agreement

Whenever a data controller uses a data processor there needs to be a written contract in place. The contract is important so that both parties understand their responsibilities and liabilities. The GDPR sets out certain information which needs to be included in the contract.

Find out more | Template Data Processor Agreement

How BrightPay Connect can help with GDPR!

Where possible, the data controller should offer self-service remote access to a secure system providing individuals with access to their personal data. BrightPay Connect is a self-service option which provides online access 24/7. Employees can view and download current and historic payslips, P45’s and P60’s. Annual leave can also be requested which flows through as a notification for the employer to approve. Employee contact information can be edited and updated, keeping records accurate at all times. For payroll bureaus, clients can instantly access payslips, payroll reports, an employee leave calendar and amounts due to Revenue.

Are you missing out on BrightPay's newsletter? We will not be able to email you without you subscribing to our mailing list. You will be able to unsubscribe at anytime. Don’t miss out - sign up to our newsletter today!

Mar 2018

29

BrightPay - April Update

Please confirm whether you want to hear from us (GDPR related) - Important Update

From May 2018, we will not be able to email you about webinar events, special offers, legislation changes, other group products and payroll related news without you subscribing to our newsletter. This is due to the GDPR legislation. You will be able to unsubscribe at anytime. Don’t miss out - sign up to our newsletter today!

PAYE Modernisation is arriving on 1st January 2019. Be Ready!

The way you process payroll is changing forever. PAYE Modernisation is a new system that is being introduced where all employers must comply and implement the new PAYE changes. From the 1st January 2019, payroll will need to be processed in real time, where employers will be required to calculate and report their employees pay and deductions as they are being paid. Guest Speaker: Sinead Sweeney from Revenue

Find out more | Register for free webinar

Free Webinar: What does GDPR mean for your business?

Employers process large amounts of personal data, not least in relation to their customers and their own employees. Consequently, the GDPR will impact most if not all areas of the business and the impact it will have cannot be overstated.

Employer Webinar: 8th May | Bureau Webinar: 1st May

Rate BrightPay on Google Reviews

As a valued customer, your feedback is very important to us. Please share your views about BrightPay on Google Reviews. The review takes about 2 minutes to complete and helps potential new customers understand what you like about us. Click on the link below and you will see BrightPay on the right hand side. Click ‘Google Reviews’.

Start review here | Read customer testimonials

New SEO gives enhanced employment rights to plumbers and fitters

The Sectoral Employment Order (SEO) now replaces the old Registered Employment Agreement system which was ruled unconstitutional in 2013. This is the second SEO that has been enacted after the Construction Industry SEO was introduced last October. The SEO sets out increased employment rights for those plumbers and fitters working in the industry.

BrightPay Connect can help with GDPR!

Under the GDPR legislation, where possible the controller should be able to offer self-service remote access to a secure system which would provide the individual with direct access to his or her personal data. BrightPay Connect is a self-service option which will give you, your clients and their employees online remote access to view payslips and other payroll documents 24/7.

Register for GDPR webinar | Book a demo

Feb 2018

5

BrightPay Customer Update - February 2018

PAYE Modernisation is coming…. Are you ready?

The Irish PAYE system is currently undergoing a massive overhaul, with new changes being implemented from 1st January 2019. This is called PAYE Modernisation. The existing system was introduced nearly 60 years ago and so this update is long overdue. What do you need to do to prepare for this new system?

Employer Webinar (27th March) | Bureau Webinar (28th March)

Increase to Minimum Wage from January 2018

The National Minimum Wage for an experienced adult worker has now increased to €9.55 per hour from January 1st 2018. This is the third year in a row that the National Minimum Wage has been increased but this is by far the largest with an increase of .30c.

Is it discrimination to top up Maternity Benefit but not Paternity Benefit?

September 2016 saw the introduction of Paternity Leave, that for the first time ever allowed fathers/partners to take two weeks paid leave on the birth of a child/placement of a child for adoption. The question then arose that if by topping up Maternity Benefit, would an employer by default have to top up Paternity Benefit?

Read full article | What is Bright Contracts?

Keep your payroll data secure with BrightPay Connect

With BrightPay Connect, you don't need to worry about manually backing up your payroll data. The add-on will automatically and securely backup your payroll information each pay period ensuring that you never lose your payroll data. This also protects the payroll data against ransomware and similar threats.

Introducing…. New Features for BrightPay 2018

BrightPay 2018 is now available to download with a number of exciting new features. This year, we have introduced a payroll journal export to accounting packages, including nominal ledger mappings to Sage, Xero and Quickbooks.

Automatic Enrolment - Mandatory Pension Reform for Ireland

The Irish Government aims to bring in an automatic enrolment system where all employers would enrol their employees into a workplace pension scheme. All employers are likely to have certain mandatory duties to complete, including choosing a suitable pension scheme, informing employees about their rights and making an employer contribution to each employee’s pension pot.

Free Webinar: GDPR for Payroll Bureaus

The countdown is on!! The General Data Protection Regulation (GDPR) comes into effect on 25th May 2018, however this date is a deadline as opposed to a starting point. With hefty non-compliance fines, it is important to make sure you are prepared. Register now for our free, CPD accredited webinar which takes place on 8th March.

BrightPay Newsletter - Are you missing out?

GDPR is changing how we communicate with you. After May 2018, we will not be able to email you about webinar events, special offers or other news without you subscribing to our newsletter. Don’t miss out - sign up to the BrightPay newsletter today!

Dec 2017

20

BrightPay 2018 is now available!

BrightPay 2018 is now available!

BrightPay 2018 is now available to download. The bureau licence is just €299 + VAT per tax year and includes unlimited employers, unlimited employees and free phone and email support.

Book a BrightPay demo and find out why our customers give us a 99% satisfaction rate. Still not convinced? Why not download a 60 day free trial to see what all the fuss is about.

Customer Testimonials:

- “BrightPay is an excellent product. Quick and efficient to use and they have a helpline that is always available to talk you through a query.”

- “I am very happy about BrightPay Payroll, easy to set up, easy to use, very good value for money.”

- “Easy. Efficient. Excellent.The program speaks for itself.”

- “BrightPay has been the perfect fit for our business- it has reduced our workload and in turn increases productivity within our business.”

- “Best payroll software I have used. Couldn't say enough good things about it! I recommend it to all the payroll users I know.”

Upcoming Webinars

25th January: How will PAYE Modernisation affect your payroll bureau - Find out more

22nd February: Irish Employment Law Overview - Find out more

8th March: GDPR for your Payroll Bureau - Find out more

Each webinar is CPD accredited and free to attend. If you are unable to attend a webinar at the specified time, simply register and we will send you the recording afterwards.

Sign up to BrightPay’s newsletter

Do you want to hear more about future CPD events, free ebooks, industry updates and special offers? Sign up to our newsletter. You will have the option to unsubscribe at anytime.

BrightPay Payroll Software | Thesaurus Payroll Software

Related Articles

Dec 2017

7

BrightPay Customer Update - December 2017.

Free Webinar - How will PAYE Modernisation affect your business?

PAYE Modernisation is probably the biggest overhaul of the PAYE system since PAYE itself was introduced back in 1960. It will have wide ranging effects on all employers across Ireland. Places are limited.

Employers: 24th January | Bureaus: 25th January

Sign up to BrightPay’s newsletter

Do you want to hear more about future CPD events, free ebooks, industry updates and special offers? Subscribe to BrightPay’s newsletter today. You will have the option to unsubscribe at anytime.

Auto Enrolment to be introduced by 2021

Today, we are all living longer healthier lives. However, as a nation, we are not saving enough for our retirement. The Irish government aims to bring in an auto enrolment system where all employers would be required to enrol their employees into a workplace pension scheme and contribute towards the employee pension pot.

Changes to Illness Benefit from 1st January 2018

With effect from 1st January 2018, employers will no longer be responsible for taxing Illness Benefit. From this date Revenue will tax Illness Benefit by adjusting employee's tax credits and/or rate bands.

Cut down on payroll processing time with BrightPay Connect

Employers across Ireland are automating the process of providing payroll and HR documents to employees, such as payslips, P60s, employment contracts and company handbooks. Annual leave management can also be simplified and automated giving you more time to focus on pressing business matters.

Free Webinar - What does GDPR mean for your business?

The General Data Protection Regulation (GDPR) comes into effect on 25 May 2018. Employers process large amounts of personal data, not least in relation to their customers and their own employees. Consequently, the GDPR will impact most if not all areas of businesses and the impact it will have cannot be overstated.

Employers: 30th January | Bureaus: 8th March

Payroll for bureaus: From loss leader to profit centre (bureaus only)

New technologies can positively impact the way bureaus offer payroll services. There are several exciting developments that are happening right now in the cloud. Be ready to offer a new level of payroll and HR services by embracing new-world online technologies.

Oct 2017

19

Customer Update - October

Free Webinar: What you NEED to know about PAYE Modernisation

PAYE Modernisation is probably the biggest overhaul of the PAYE system since PAYE itself was introduced back in 1960. It will have wide ranging effects on all employers. Register now for our free webinar to find out what you need to know about PAYE Modernisation. Speakers include Paul Byrne (Thesaurus Software) & Sinead Sweeney (Revenue)

CPD Webinar: GDPR for your Payroll Bureau (Bureaus Only)

Data protection and how personal data is managed is changing forever. On 25 May 2018 the new General Data Protection Regulation (GDPR) will come into force. The GDPR is a European privacy regulation replacing all existing data protection regulations. Register now for our free, CPD accredited webinar to find out how this new legislation will affect your payroll bureau.

"What do you mean... Do I have a backup?” - A day in the life of Customer Support

One of the most common calls on the support line is from a distressed customer who tells us they have lost their payroll information. Reasons for the loss of this information are varied and could be anything from a laptop being stolen, a virus attacking the computer or fire or water damage to the computers in the office.

Take a look at BrightPay Payroll Software

Brought to you by Thesaurus Software, Ireland's number one payroll provider. With over 100,000 businesses across Ireland and the UK, you can guarantee BrightPay is the perfect solution for your bureau. BrightPay's bureau licence includes unlimited employers, unlimited employees and free support - all for just €299 per year.

BrightPay Connect - Try for Free

We are giving customers one free BrightPay Connect 2017 licence. With BrightPay Connect, employers can login to their own personal employer dashboard where they can access employee payslips, payroll reports and a company wide calendar. It also includes a self-service portal for employees to view payslips and request annual leave.

Redeem your free licence / Book a demo

New Automatic Enrolment Pension System to be in place by 2021?

Brian Hayes MEP has called on Minister for Social Protection, Regina Doherty to start work on the introduction of an automatic enrolment pension system, whereby all Irish private sector employees would be automatically enrolled into a pension scheme.

BrightPay Customer Survey: The Results are in!

In our recent survey, we were delighted to discover that BrightPay has a 99% customer satisfaction rate. Customers are also highly satisfied with our customer support team, with a satisfaction rate of 98%.

Oct 2017

11

Budget 2018 - Employer Payroll Focus

Pay As You Earn (PAYE)

- There was no change to tax rates for 2018, the standard rate will remain at 20% and the higher rate at 40%.

- Standard Rate Cut Off Points (SRCOPs) will be increased by €750 from 1st January 2018.

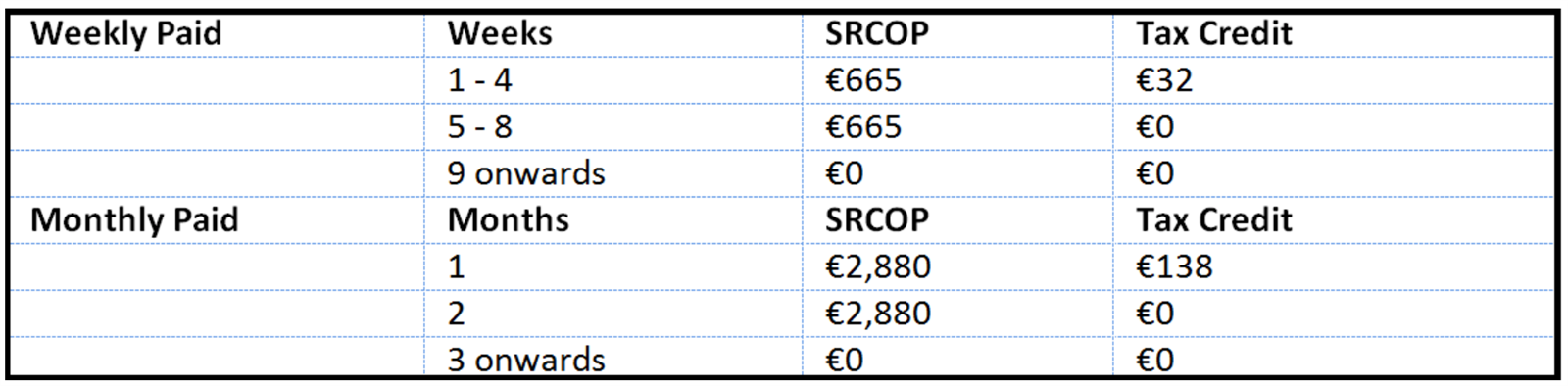

Emergency Basis of PAYE

Employee provides PPS Number:

Where an employee does not provide their PPS Number the higher rate of 40% tax applies to all earnings.

Earned Income Tax Credit

The Earned Income Tax Credit will be increased by €200 from €950 to €1,150.

Home Carer Tax Credit

The Home Carer Tax Credit will be increased from €1,100 to €1,200.

Universal Social Charge (USC)

- Exemption threshold remains at €13,000

- 2.5% rate reduced to 2%, threshold for this rate increased from €18,772 to €19,372

- 5% rate reduced by 0.25% to 4.75%

- No change to 8% rate

Medical card holders and individuals aged 70 years and older whose aggregate income does not exceed €60,000 will pay a maximum rate of 2%.

The emergency rate of USC remains at 8%.

PRSI & USC

The Minister outlined his intention to establish a working group in 2018 to carry out a review of the possible integration of PRSI and USC.

National Training Levy

The National Training Levy of 0.7% which is currently collected as part of the employer PRSI contribution will increase to fund further and higher education, the increases are as follows:

- 0.8% in 2018

- 0.9% in 2019

- 1% in 2020

Pay Related Social Insurance (PRSI)

There were no changes to general PRSI thresholds or employee PRSI announced in the Budget. However, as the National Training Levy is increasing and it is collected as part of the employer PRSI contribution, employer PRSI will increase as follows:

- 8.5% increased to 8.6%

- 10.75% increased to 10.85%

Benefit in Kind (BIK) - Electric Cars

A 0% rate of BIK will apply to electric vehicles provided by an employer to an employee in 2018 which is available for private use. Electricity used by the employee in the workplace to charge the car will also be exempt from BIK.

PAYE Modernisation

PAYE Modernisation will be effective from 1st January 2019. Budget 2018 has allocated €50 million for a project to enhance Revenue's IT capacity and to ensure employer compliance.

National Minimum Wage

The National Minimum Wage will increase from €9.25 to €9.55 per hour in respect of hours worked on or after 1st January 2018.

- Workers under age 18 will be entitled to €6.69 per working hour

- Workers in their first year of employment over the age of 18 will be entitled to €7.64 per working hour

- Workers in their second year of employment over the age of 18 will be entitled to €8.60 per working hour

Social Welfare Payments

There will be a €5 increase in all weekly Social Welfare payments with effect from 26th March 2018. The maximum personal rate of Illness Benefit will be increased to €198 per week. Maternity Benefit and Paternity Benefit will be increased to €240 per week.

Oct 2017

10

BrightPay Ireland - Customer Survey - The Results are in!

Opinions and feedback from our customers matter to us. We love to hear comments and suggestions from users in order to improve the customer experience. Last month we conducted a customer survey to get an insight into what customers think about BrightPay and find out what new features our customers want.

The survey also looked at customer satisfaction rates, software performance and customer support. We were delighted to discover that BrightPay has a 99% customer satisfaction rate. Customers are also highly satisfied with our customer support team, with a satisfaction rate of 98%. Many customers agree that BrightPay saves them time (99.5%) and money (99.4%).

The survey also looked at awareness of PAYE Modernisation. 23% of customers were unaware of this upcoming change to the PAYE system, which will be effective from 1st January 2019. BrightPay’s parent company, Thesaurus Software, recently hosted a number of free PAYE Modernisation webinars, with a guest speaker from Revenue. The webinars incorporated everything you need to know about PAYE Modernisation. Watch the PAYE Modernisation training session on demand.

Customer Testimonials

We also received a number of customer testimonials from the survey - all of which will be added to the BrightPay website in due course. Some of our favourite testimonials received include:

- "I am now in my fourth PAYE year since I switched to BrightPay. I wish that I had switched sooner. I would have saved a lot of money without any reduction in the quality of service I provided to my clients, not to mention one or, two enhancements."

- "BrightPay is a very user friendly payroll system. The feature to go back and amend a previous weeks payslip for an individual employee instead of having to go back and amend all employees is a great feature."

- "I am very happy about BrightPay Payroll, easy to setup, easy to use, very good value for money. I've recommended it to a couple of businesses. There is the same story, all happy!"

- "Best payroll software I have used. Very user friendly and the reports that can be compiled are great because they can be tailored depending on what you want in the report. Couldn't say enough good things about it! I recommend it to all the payroll users I know."

- "BrightPay is an excellent product. Quick and efficient to use and they have a helpline that is always available to talk you through a query. I would even recommend this product to someone who has little knowledge of payroll because most of the calculating is programmed in."

- "I tried BrightPay free trial. After the first week I purchased it. It was so easy to use. When I rang support, I was answered straight away, no holding, and my query answered quickly and explained that even I could understand it. Since using BrightPay my payroll is a joy to do, easy and quick."

- "BrightPay is very easy to use for my small business. Without it I would be very worried about making a mistake so it gives me total peace of mind."

- "BrightPay has been the perfect fit for our business - it has reduced our workload and in turn increases productivity within our business."

Prize Winners

As a thank you for taking part in the survey, we are giving away four €50 Amazon vouchers. We are delighted to announce that the winners are:

- John Ganly - Blanchardstown Amalgamated Sports Ltd

- Geraldine Grennan - PJ Grennan Ltd

- Elaine Donnelly - Irish Theatre Institute

- Eugene O'Donovan - SME Finance

The BrightPay team will be in contact with the winners shortly.

We appreciate all the feedback received from this year’s survey and would like to say a massive thank you to everyone who took part.

Useful Links

- What is PAYE Modernisation?

- Revenue moves to PAYE Modernisation / Real Time Reporting

- PAYE Modernisation in BrightPay Payroll

- BrightPay Payroll Software / Thesaurus Payroll Manager