Accommodation

BENEFIT IN KIND - ACCOMMODATION

IT IS IMPORTANT TO READ THE FOLLOWING NOTES CAREFULLY BEFORE PROCEEDING.

IMPORTANT NOTES ON BENEFIT IN KIND

PAYE, USC & PRSI must be operated by employers in respect of the taxable value of most benefits in kind and other non-cash benefits provided by them to their employees. The amount to be taken into account is referred to as "notional pay".

SMALL NON-CASH BENEFITS NOT EXCEEDING €250

Where an employer provides a small non-cash benefit (that is a benefit not exceeding €250) PAYE, USC & PRSI need not be applied to that benefit. No more than one such benefit given to an employee in a tax year will qualify for such treatment. Where a benefit exceeds €250 in value the full value of the benefit is subjected to PAYE, USC & PRSI.

Benefit in Kind on Accommodation

Where accommodation is owned and provided by the employer for use by an employee, the value of the taxable benefit is subject to PAYE, USC & PRSI.

Employee required to live on premises

A taxable benefit will NOT arise where an employee (not director) is required by terms of his or her employment to live in accommodation provided by the employer in part of the employer's business premises so that the employee can properly perform his or her duties, i.e. night care staff, governors, chaplains in prisons, caretakers etc.

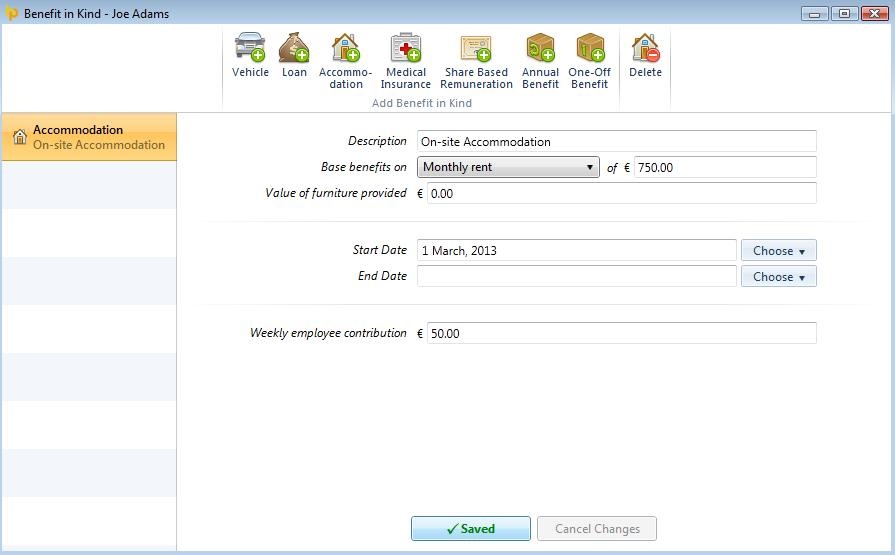

Processing Benefit in Kind on Accommodation in BrightPay

To access this utility go to Employees, select the employee in question from the listing and click Benefits on the menu toolbar, followed by Accommodation.

1) Description - enter a description for the accommodation.

2) Base benefits on – select whether the benefit is to be based on property value or monthly rent, and enter the value of this.

3) Value of furniture provided - enter the value of any furniture provided.

4) Start Date - enter the start date of the benefit provided.

5) End Date - enter the end date of the benefit provided if this ceases within the same tax year.

6) Employee contribution - enter any amount made good by the employee directly to the employer towards the cost of providing the accommodation.

7) Click Save to save the Benefit In Kind entry.

The 'Notional Pay' will be added to the employee's gross income each pay period to ensure that the correct PAYE, Universal Social Charge and PRSI are charged.

Need help? Support is available at 01 8352074 or brightpayirelandsupport@brightsg.com.