Additional Superannuation Contribution (ASC)

Additional Superannuation Contribution (ASC) was introduced on 1st January 2019, it replaced the Pension Related Deduction (PRD). Whereas PRD was a temporary emergency measure, ASC is a permanent contribution in respect of pensionable remuneration.

Application of ASC

Assessing ASC

Unlike PRD, ASC is only chargeable on pensionable remuneration. Pensionable remuneration includes:

- Basic Pay (excluding non-pensionable overtime) due to the public servant in respect of that period, and

- Allowances, emoluments and premium pay (or it's equivalent) which are treated as pensionable pay

ASC Treatment

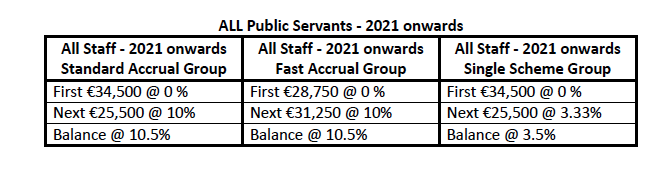

ASC Rates and Thresholds

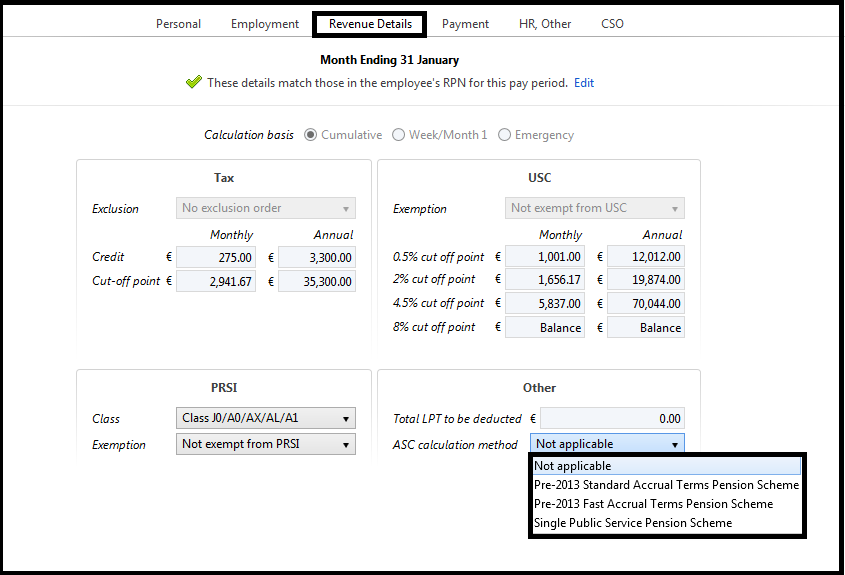

Setting up the ASC Deduction in BrightPay

Go to Employees > select employee to whom the deduction will apply > Revenue Details > Select the appropriate ASC calculation method > 'Save Changes'.

Payslips

Additional Superannuation Contribution will display separately on the Employees Payslip as ASC under the deductions section.

Need help? Support is available at 01 8352074 or brightpayirelandsupport@brightsg.com.