Emergency Basis

EMERGENCY TAX

The Emergency Basis of PAYE and USC should be applied when the employer has not received, in respect of the employee, either:

- a tax credit certificate for the current year, or

- a form P45 for the current year or previous year,

- the employee has given the employer a completed form P45 indicating that the emergency basis applies,

- the employee has given the employer a completed P45 without a PPS number and not indicating that the emergency basis applies.

A refund of tax or USC should not be made to the employee where the emergency basis is in use.

Once Revenue issue a valid tax certificate for the employee to the current employer, the employer should cease operating the emergency basis and follow the instructions as per the new tax credit certificate for the operation of PAYE tax and USC.

Different rules for emergency tax apply depending on whether or not the employee has provided the employer with their PPS number.

Where the employee does not provide their PPS number

Where the employee does not provide their PPS Number, the higher rate of tax applies to all earnings.

If a new employee does not hold a PPS number they should be advised to call in person to any Social Welfare Local Office and ask for Leaflet SW100 to apply for a PPS number. When they have been allocated their PPS number from the Department of Social Protection, the Revenue Form 12A should be completed and sent to Revenue to apply for Tax Credits and SRCOP

Where the employee provides their PPS number

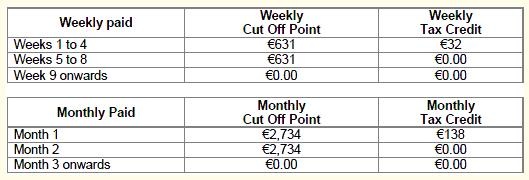

Where the employee provides their PPS number the provisional tax credits and standard rate cut-off point to be granted.

The 2013 PAYE Tax Emergency rates of deduction are:

The rates at which tax is to be deducted are the rates of the standard rate of income tax and the higher rate of income tax in force for the relevant year.

USC Emergency Rates of deduction

While the rules applicable to emergency tax operable in PAYE include a gradual escalation in emergency tax rates over a given period, in USC there is just a flat % rate (with no cut-off point) applied to all payments.

Employee commences employment and provides the employer with their PPS number

Week 1 Gross Salary €700

PAYE

SRCOP applicable €631, taxable at 20%

Balance of €69, taxable at 41%

Tax Credit applicable €32

€631 x 20% = 126.20

€ 69 x 41% = 28.29

154.49

Less Tax Credit - 32.00

PAYE payable 122.49

USC

Cut Off Point €0.00

Rate of 7% applicable to €700

USC Payable €700 x 7% = 49

Total PAYE & USC payable €171.49

Employee commences employment and does not provide the employer with a PPS number

Week 1 Gross Salary €700

PAYE

Total Salary, taxable at 41%

Tax Credit applicable €0.00

€700 x 41% = 287.00

PAYE payable 287.00

USC

Cut Off Point €0.00

Rate of 7% applicable to €700

USC Payable €700 x 7% = 49

Total PAYE & USC payable €336.00

NB. The basis to be applied to the calculation basis of PAYE and USC deductions applied to an employee's salary are always tied.

- PAYE Cumulative

- USC Cumulative

- PAYE Week One / Month One

- USC Week One / Month One

- PAYE Emergency

- USC Emergency

The only exception to this rule is Exempt cases. An employee can hold PAYE exmpt status but the standard USC rates and COP apply on either a Week1 or Cumulative basis.

Likewise an employee can be USC exempt but subject to PAYE on a Week 1 or Cumulative basis.

Need help? Support is available at 01 8352074 or brightpayirelandsupport@brightsg.com.