Local Property Tax (LPT)

Local Property Tax (LPT) is a tax payable on the market value of residential properties and is administered by Revenue.

Property owners have a number of payment options available to them - one of which is a deduction from their periodic payroll.

There are 2 circumstances under which LPT may be deducted from an employee’s salary:

- where the individual voluntarily elects to pay through the payroll

- where Revenue enforce the collection of LPT via deduction from salary

LPT is a statutory deduction and is to be deducted from an employee’s Net Pay.

Employer Responsibilities

- Employers must not make an LPT deduction from an employee’s salary without specific instruction to do so by Revenue.

- Employees cannot issue this instruction to their employer themselves - they must contact Revenue to arrange an instruction to be issued to their employer.

- Employers must remit any LPT collected to Revenue in the same manner as other payroll deductions.

- Once the LPT deductions commence, the employer is obliged to apply the deductions and spread them evenly over the remaining pay days in the year.

- The employee cannot request that the employer pause the deduction, nor can the employer make this decision either.

- Employers are required to keep records relating to LPT for a period of 6 years.

Deductions through the Payroll

- The employer must follow any LPT instruction received by Revenue on the Revenue Payroll Notification (RPN) and is required to start the deduction from the next pay period after the date of receipt of the RPN.

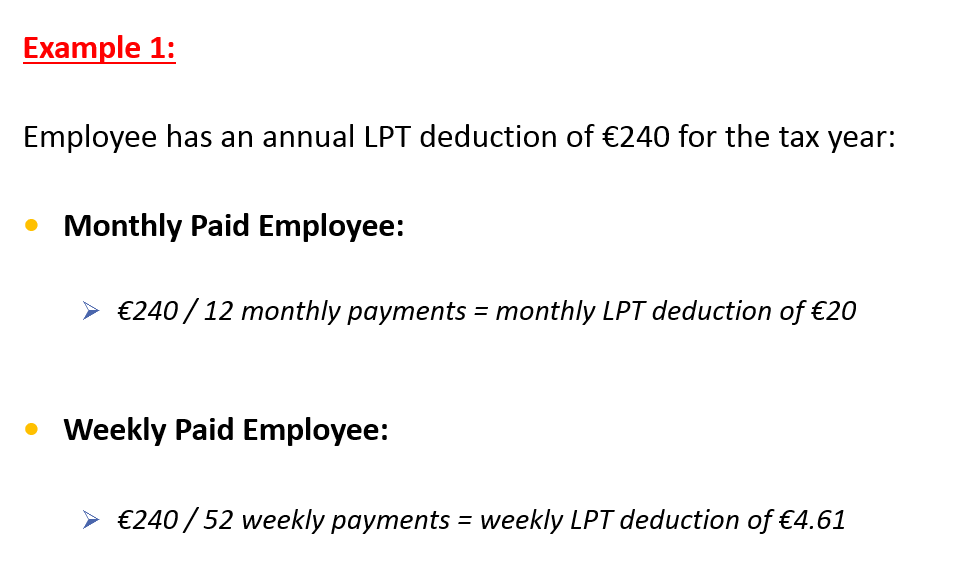

- Once LPT deductions commence for an employee, the employer is obliged to apply these deductions and spread them evenly over the remaining pay days in the year.

- Details of the LPT deduction must be recorded on the employee’s payslip.

- Once an LPT deduction instruction is issued, an employee can subsequently arrange an alternative payment method with Revenue if they wish.

- An employer cannot refund LPT - Revenue will issue any refund due.

- PAYE, PRSI, USC, ASC and pension contributions all take priority over LPT.

- LPT should not be deducted from:

- the reimbursement of tax free expenses

- The payment of Revenue approved tax free travel and subsistence payments

- A post-cessation payment

- An employee who holds a PAYE Exclusion Order (as an RPN is not issued where a PAYE Exclusion Order is in place).

Insufficient Pay

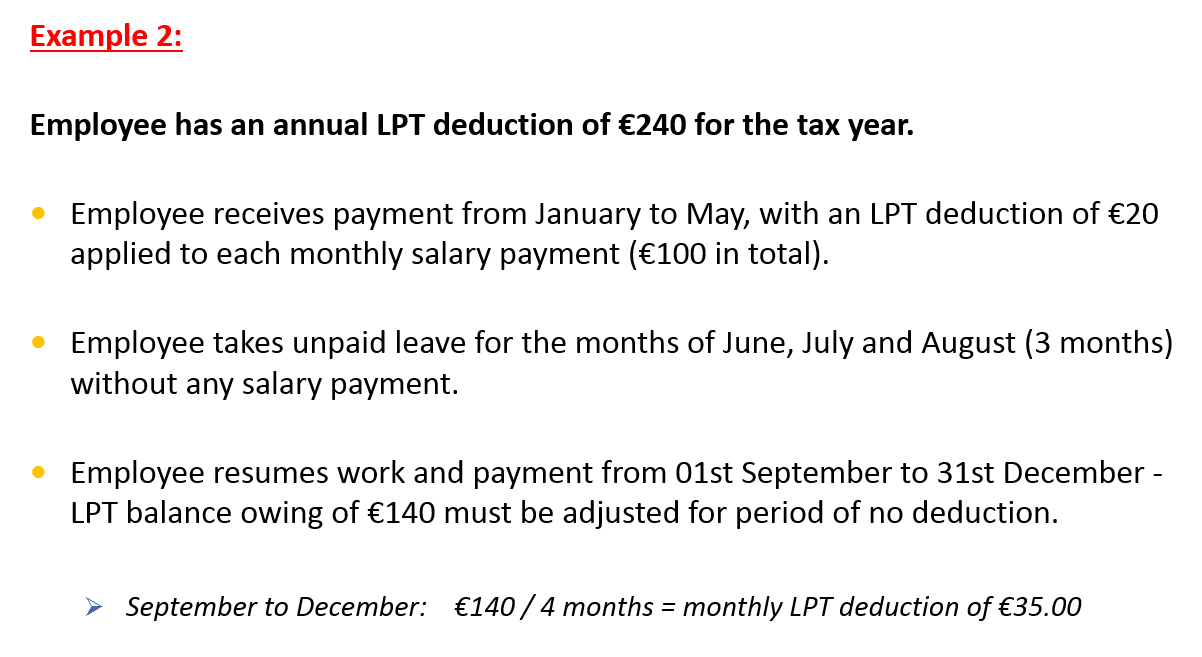

- Where an employee has insufficient pay in a particular pay period to meet their periodic LPT liability, the employer is only required to deduct the amount of LPT that their NET pay will permit.

- Where an employee receives no pay in a pay period, no LPT deduction will be taken.

- In both these instances, a recalculation will take place in the next pay period and the outstanding amount of LPT will be spread evenly again over the remaining pay periods.

- Where an employer has not been able to collect the full amount of LPT from an employee, this will be a matter for Revenue to address with the individual.

Returns to Revenue

An employer must include the amount of LPT deducted from each employee (where applicable) on their payroll submission to Revenue.

The LPT deducted must then be paid over to Revenue at the same time as their PAYE, PRSI and USC liability is due.

Need help? Support is available at 01 8352074 or brightpayirelandsupport@brightsg.com.