CWPS - rate change 1st February 2022

CWPS contribution rates are based on the recommended contribution rate specified in the Sectoral Employment Orders (SEOs) for the construction sector.

The weekly rates for Pension and Sick Pay contributions will change on 1st February 2022.

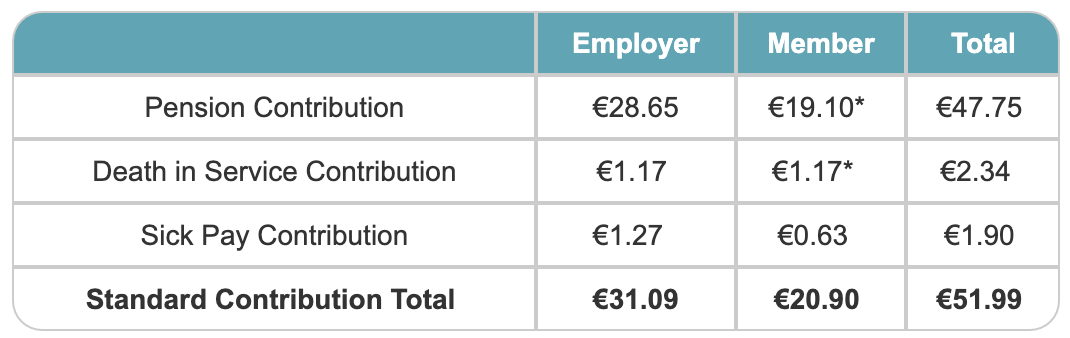

The Pension, Death in Service and Sick Pay standard contribution rates to apply from 1st February 2022 are:

Updating the CWPS rates in BrightPay:

As soon as the 1st February 2022 rate change date is reached in your payroll, BrightPay will automatically uplift any statutory CWPS rates being applied to employee payslips:

Please note: where non-statutory CWPS rates have been entered on an employee's payslip, BrightPay will not uplift these automatically.

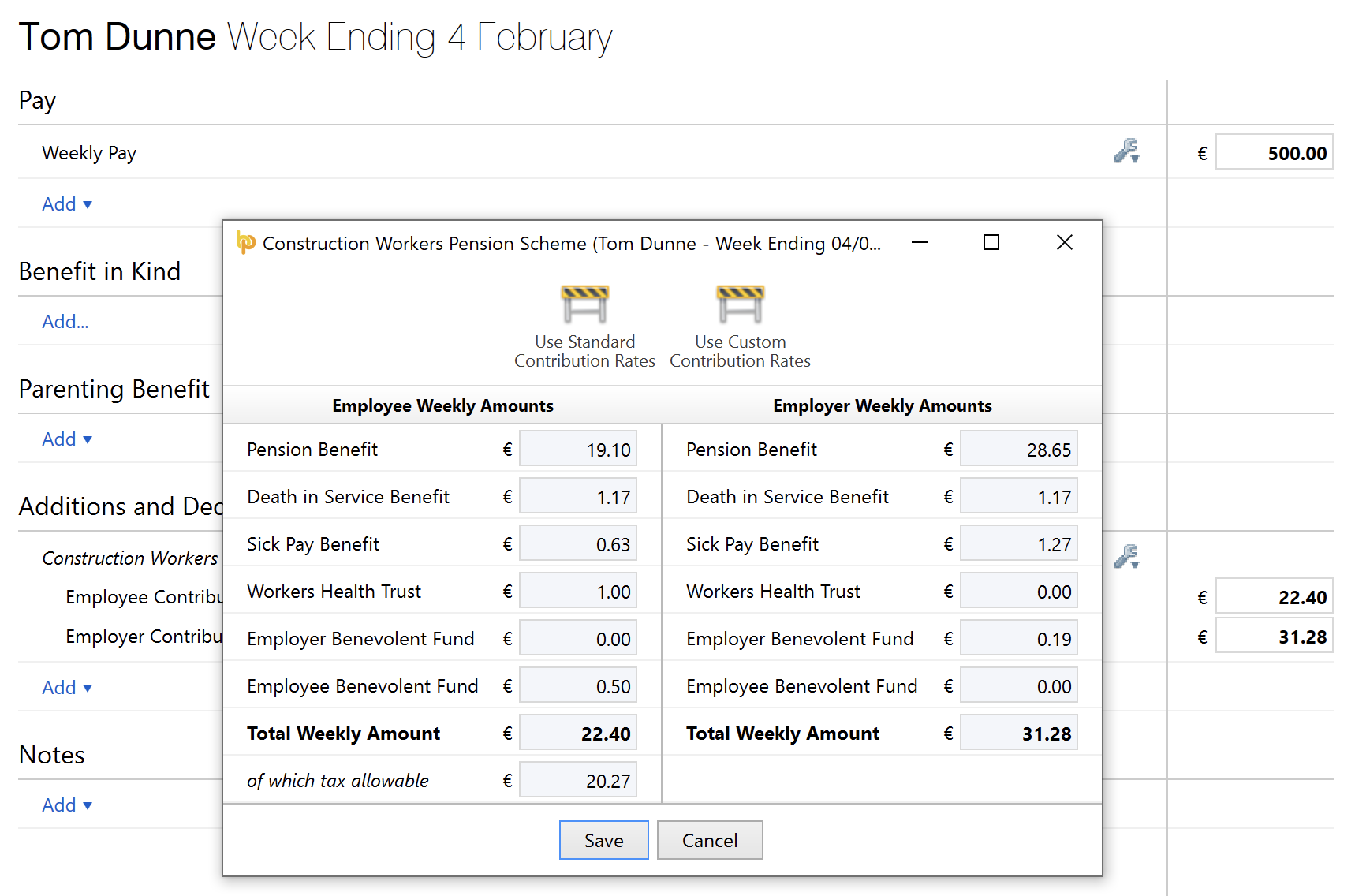

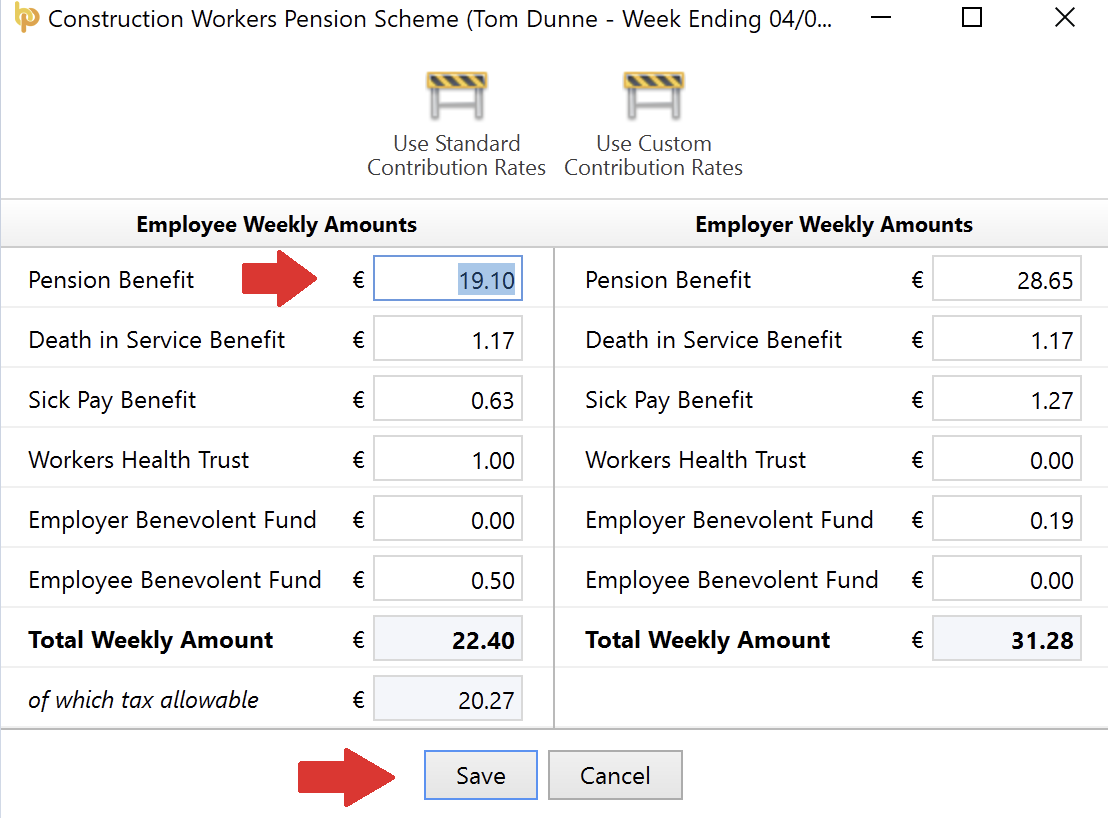

Instead, the user must access the CWPS utility and manually enter the new rate changes themselves. This can be done by clicking the CWPS 'edit' button on the employee's payslip, followed by 'View/Edit Details'.

Enter the new rates accordingly, followed by 'Save':

Voluntary CWPS rates

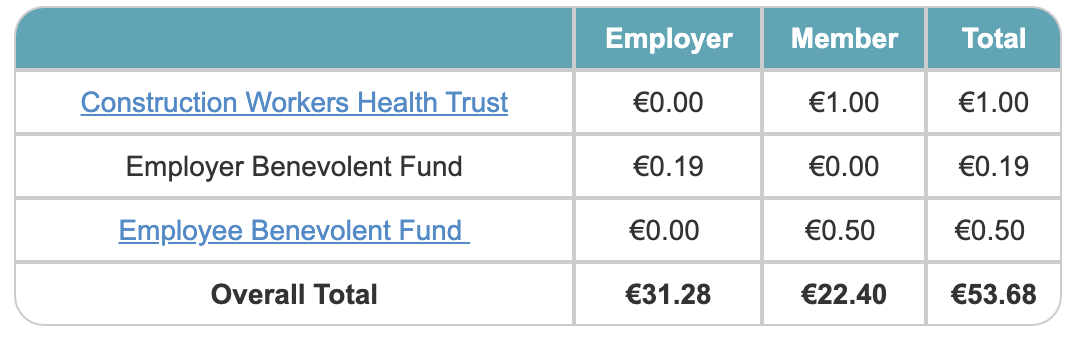

CWPS also facilitates the collection of some voluntary weekly industry deductions for Construction Workers Health Trust and the Benevolent Funds which can be paid as a combined payment with the Pension, Sick Pay and Death in Service contributions.

There are no changes to these rates as at 1st February 2022 and remain as follows:

Need help? Support is available at 01 8352074 or brightpayirelandsupport@brightsg.com.