Dec 2018

18

Stranger Danger! - Be aware when processing your tax rebate

Ah humans, we’re a lovely bunch aren’t we? An industrious lot some might say. Always finding ways to adapt, to evolve…...to manipulate. No matter what, if a situation exists where someone can be scammed, then get in line sweetie because there is already a slew of people that have beat you to it. It’s no different this time.

With the introduction of PAYE Modernisation a number of dodgy tax refund websites have sprung up left right and centre with the aim of conning you, yes YOU, out of your hard earned punts and pignins.

These sites basically offer to process tax refunds on your behalf and “all” they ask in return is 10% of the final amount of your rebate whilst also asking you to input your personal details such as your DOB, bank details, PPSN number, and so on. So never mind that this is a pretty bad deal already, the worst thing is that all they do is take the exact same information that you just typed in, and then type the exact same information into the Revenue website and charge you for the courtesy of doing so!

Daylight robbery doesn’t even cover it. The absolute CHEEK of it doesn’t even cover it either! People are needlessly giving these sites a cut of their tax refund, as well as their personal details….for nothing! Zilch. Zero. Nada!

Now I’ve known some amadán úfásachs in my life. There was a boy in my class, Séamus, who thought that teachers lived in the staff room and that chocolate milk came from brown cows. My own mother thought I was going to grow up to be a nice respectable young woman. HA! But giving someone online your details and money for nothing? Now that is just plain stupid. #sorrynotsorry

So what has this got to do with PAYE Modernisation? Where is my tax refund? How come I’ve never seen a baby pigeon? Well, under the new PAYE system, employers have to report employees’ pay and deductions each time they are paid instead of once a year. For anyone who is not properly registered under the PAYE system (for example, a foreign national newly arrived to Ireland) they will be put on emergency tax until they’re registered. This will most likely result in a surge of people claiming tax rebates throughout the year.

Now besides the sheer silliness of it all there is also a more insidious side to all this. I have a feeling the “STRANGER DANGER” of the current generation will be “do not give your bank details to someone who asks for it online”. Not only that, but with all the details you are required to enter they basically have everything they need to impersonate you online whenever they want.

There is also an additional risk that these companies will overstate expense estimates on your behalf in the hope of getting a bigger refund, thus a higher percentage of their cut. If you are later audited by Revenue and they found that you used one of these websites that supplied fake information on your behalf (even without your knowledge) then you, yes YOU, and not the company would be liable for interest and penalties.

Be safe, be savvy, be sassy. That’s my motto. (That, and “there’s always time for a chicken nugget”). Think twice before using these sites or, you know, just don’t! It’s really not that arduous to apply for a refund yourself so don’t be lazy; it will be one less headache to deal with.

To keep up with the latest payroll news, check out our new Bright website. There, you'll be able to register for any of our upcoming payroll webinars and download our payroll guides.

Related Articles:

Dec 2018

18

What's New in BrightPay 2019?

BrightPay 2019 is now available (for new customers and existing customers). Here’s a quick overview of what’s new:

2019 Tax Year Updates

2019 rates, thresholds and calculations for PAYE, USC, PRSI, LPT and ASC (previously PRD).

PAYE Modernisation

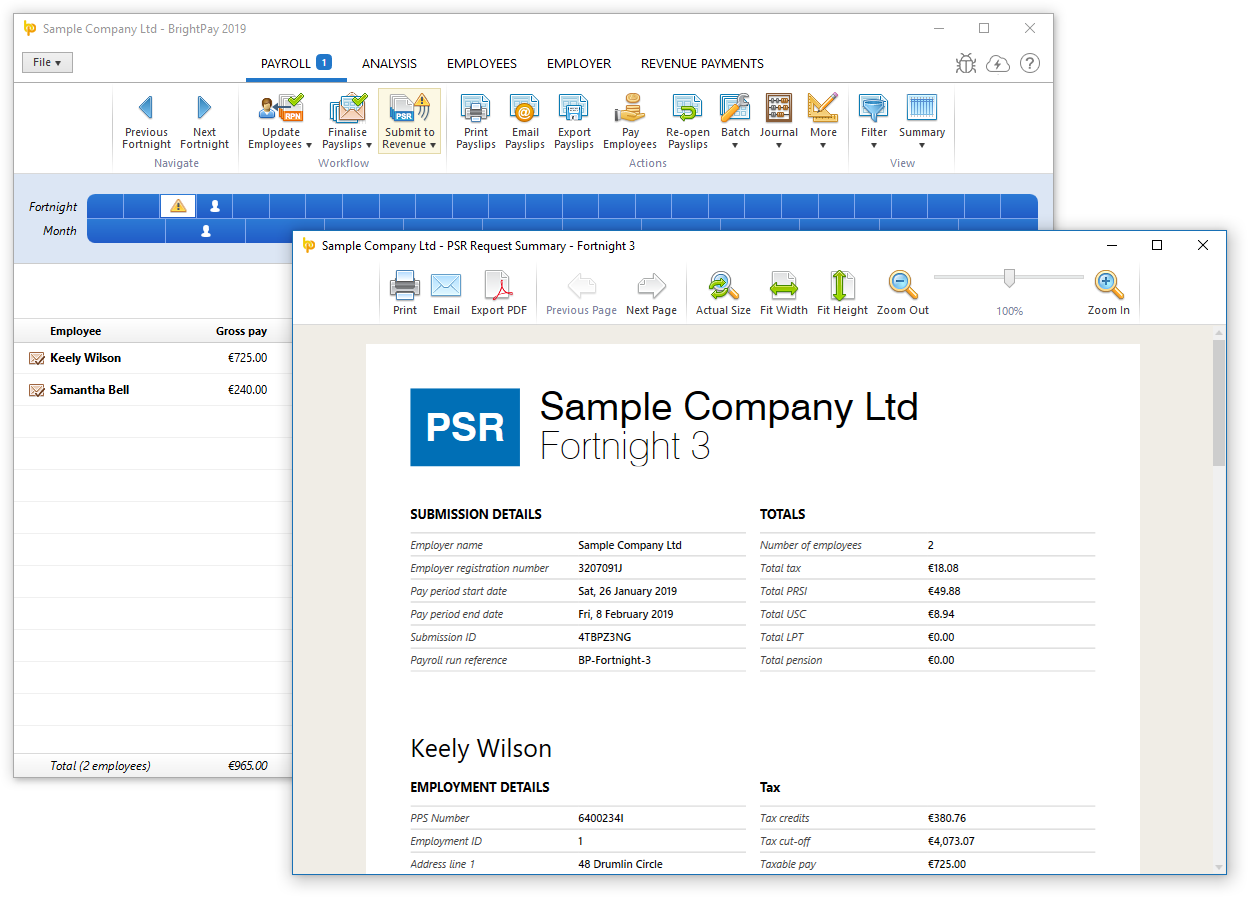

From 1st January 2019, in the most significant reform of the PAYE system in Ireland since its introduction, employers no longer submit end-of-year payroll returns, but are rather required to report their employees' pay and deductions to Revenue each time they are paid. BrightPay not only ensures you are kept fully compliant with the new requirements, but makes it really clear and easy.

- Easily import your Revenue certificate (required to authenticate your submissions to Revenue).

- Check for Revenue Payroll Notifications (RPN) each pay period, and keep your employees up to date in line with Revenue's instructions. Where RPN updates are detected, they can be previewed and applied with a single click.

- Send a Payroll Submission Request (PSR) for each employee payment. BrightPay provides a full print/email-friendly preview of PSR content, and walks you through the process of sending to Revenue.

- BrightPay tracks the state of all your employees each pay period, and alerts you where RPNs need to be checked for or updated from as well as where PSRs need to be sent (or re-sent).

- At a glance comparison and reconciliation of the tax liabilities recorded in BrightPay against the tax liabilities as reported by Revenue.

- BrightPay stores all Revenue communication logs for your reference, and relays any submission errors back to you in a clear, user-friendly format.

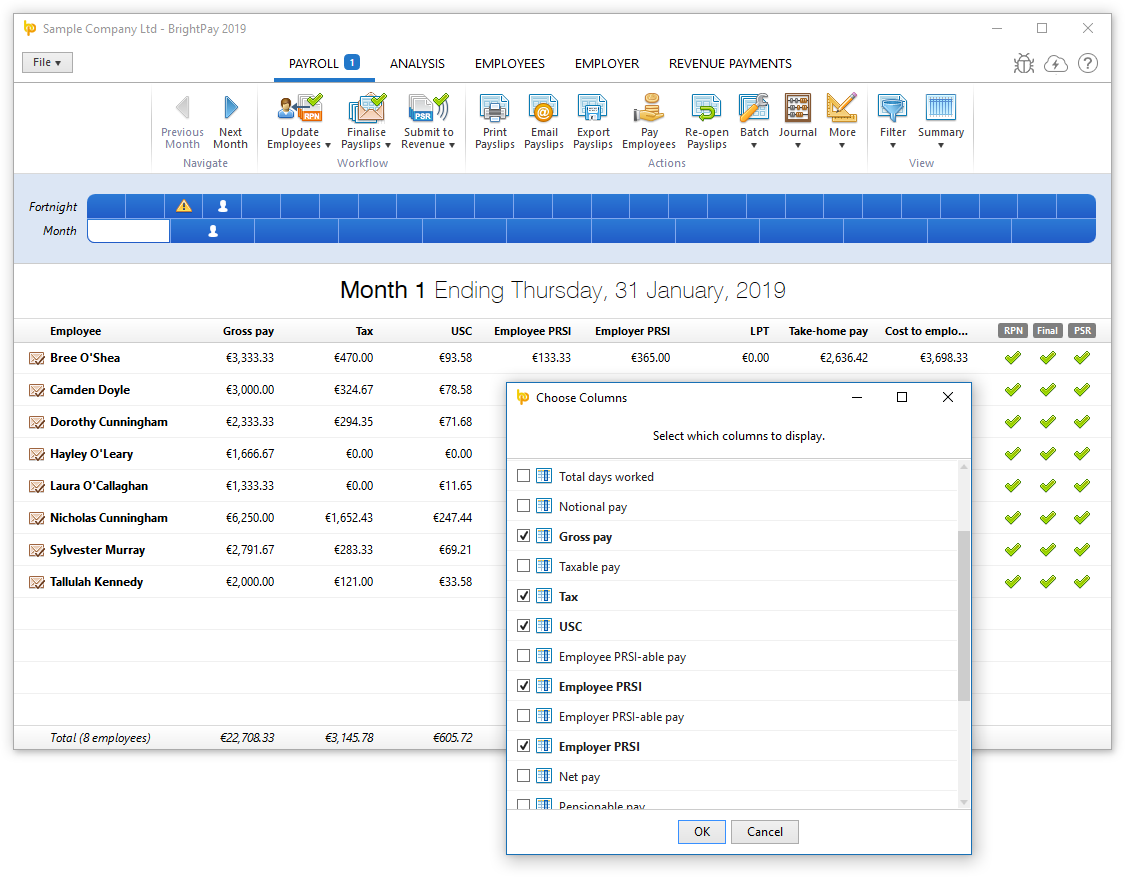

Ability to Edit the Columns of the Period Summary View

A popular customer request has been to show columns for number of hours worked and pension contributions on the BrightPay period summary view. In BrightPay 2019, you can now easily include these, as well as many more additional column options.

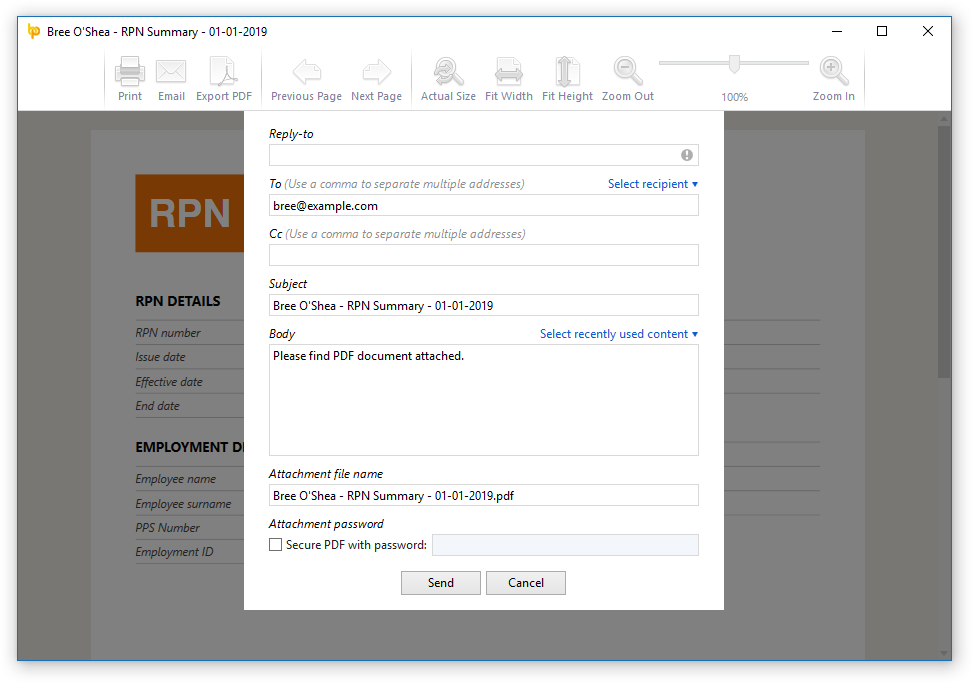

Ability to Quickly Email any Document/Report

There is a new Email button in the print preview of documents and reports in BrightPay which allows you to easily send it as a PDF attachment in an email. Where and when applicable, BrightPay makes it easy and quick to select the relevant employee, client or previously used recipient.

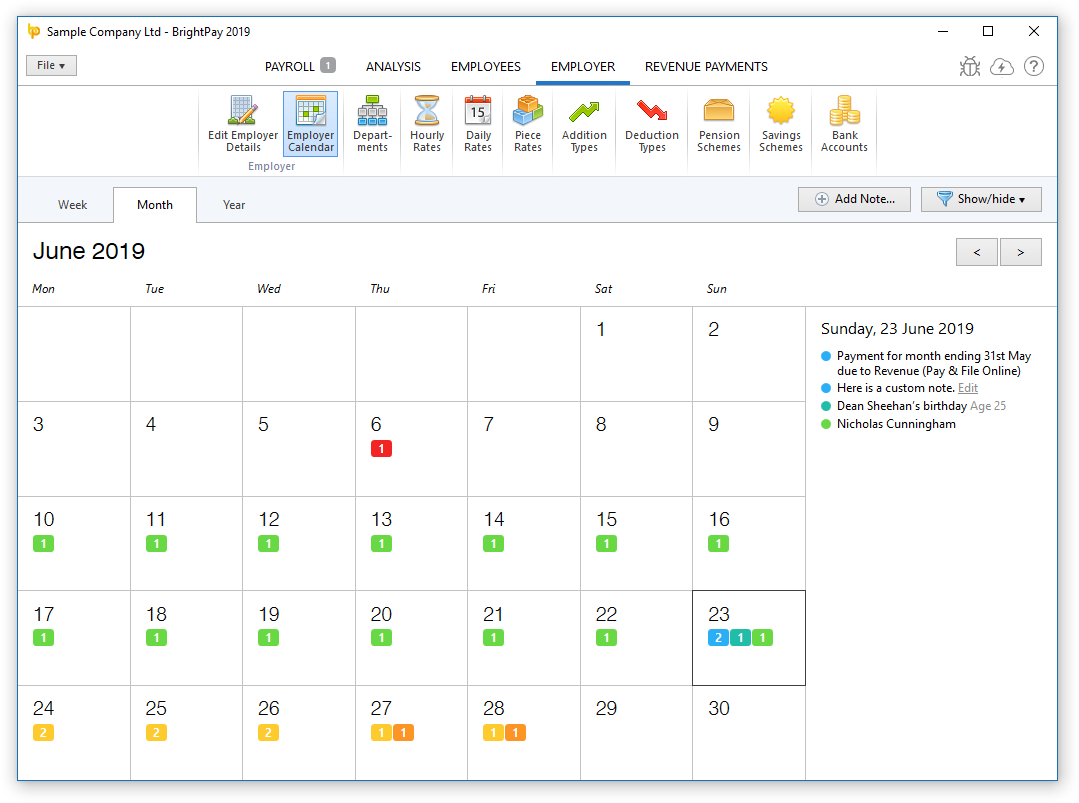

New Feature: Employer Calendar

There is a new employer-wide calendar in the EMPLOYER section of BrightPay which amalgamates all the employee events along with other key payroll dates into a single view:

- Switch between Year, Month or Week view.

- Shows combined events for all employees (i.e. those entered on the employee calendar, as well as birthdays)

- Includes general tax year events and deadlines.

- Ability to filter which kinds of events are displayed on calendar and in the day event list.

- Ability to add/edit/delete your own notes.

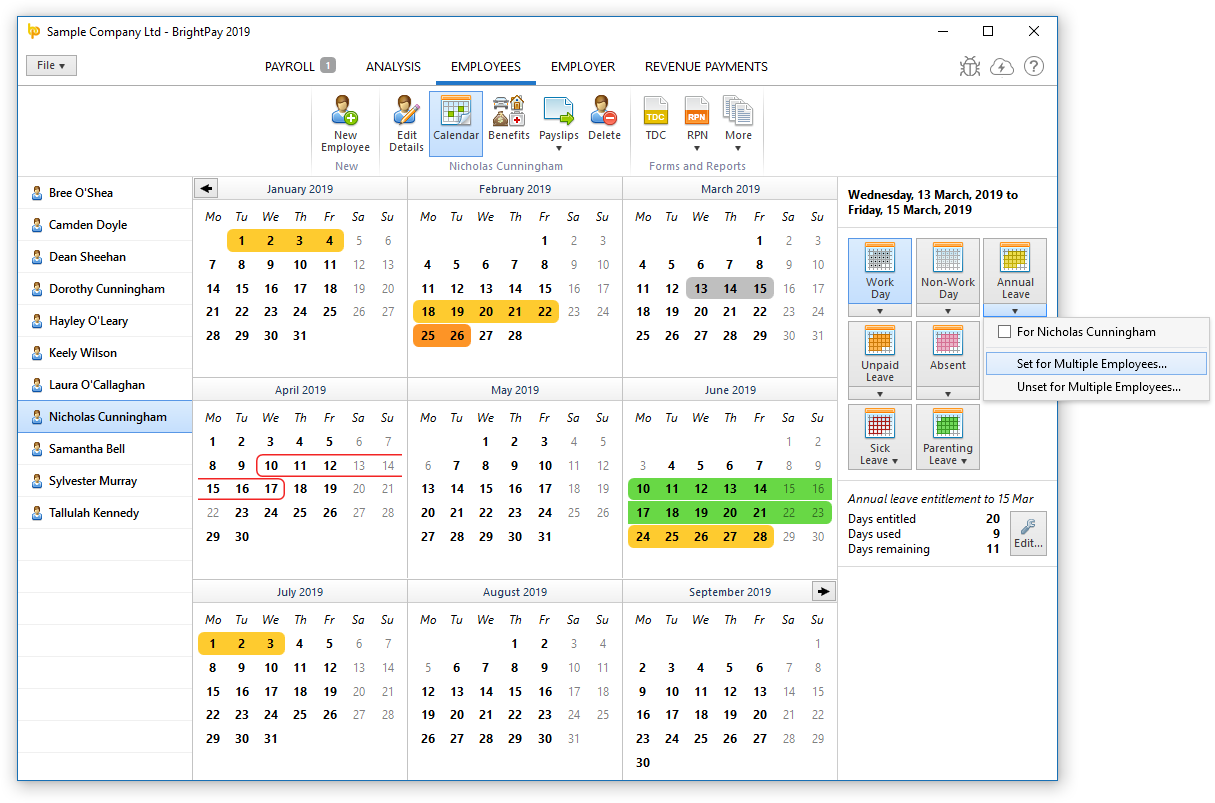

Employee Calendar Improvements

- Ability to batch set working days, non-working days and leave days for multiple employees at once.

- Holding the Ctrl key allows you to select (or unselect) multiple arbitrary days on the calendar.

Other 2019 Changes in BrightPay

- When a text input field receives focus via keyboard tabbing, its content is all selected automatically.

- Adds several more customisability options for payslip production.

- When zero-ising payslips, you can now choose to zero-ise only the overtime (or non-overtime)hourly/daily payments.

- Enables specific period payments, daily payments, hourly payments, piece payments, additions and deductions to be explicitly hidden on printed payslip.

- Enables specific period payments, daily payments, hourly payments, piece payments, additions and deductions to be given a custom description to appear on printed payslip.

- Ability to set whether or not an hourly rate/payment should accrue hour-based annual leave entitlement.

- For 'accrued' annual leave days/hours, ability to manually specify additional accrued days/hours not accounted for in payroll (i.e. an adjustment).

- Annual leave accrual is now calculated up to end of the currently open pay period (rather than up to the end of the last finalised pay period).

- Net to gross functionality can now do ‘Take-home pay to gross’ and ‘Cost-to-employer to gross’.

- Printing page setup is now centralised into the File menu of BrightPay.

- Ability to control whether or not the PDF export settings are remembered between usages.

- Lots of minor improvements throughout the entire BrightPay user interface, as well as the latest bug fixes.

What's Next?

We're continually at work on the next version of BrightPay, developing new features and making any required fixes and improvements. See our release notes to keep track of what has been changed to date at any time.

Dec 2018

18

BrightPay Customer Update: December 2018

Your PAYE Modernisation Survival Checklist

We have created an 8 step checklist to help you understand what you need to know about submitting your payroll data to Revenue in real time. Stay off Revenue’s naughty list and be ready for the PAYE Modernisation changes.

8 Step Checklist | Book a demo

ROS Digital Cert - A Must Have for PAYE Modernisation

The computer that you run your 2019 BrightPay software on will need to have your ROS Digital Cert installed on it. If you are currently able to log into ROS from your computer, then you are fine. Otherwise, you should copy the cert (the .p12 or .p12.bac file) from the machine that you use for ROS to the machine that you use for processing payroll. This is something you might want to do before the 1st of January 2019.

What does PAYE Modernisation look like in BrightPay?

We have been working with Revenue to make sure BrightPay can easily cater for the needs of PAYE Modernisation. Watch our short video to see how BrightPay will streamline real time reporting to easily comply with PAYE Modernisation.

Watch video here | Book a demo

PAYE Modernisation Training Webinar - Extra dates added due to high demand

Due to phenomenal demand, we have added extra dates for our PAYE Modernisation online training webinars with a guest speaker from Revenue. Due to the high level of interest, it is expected that the training webinars will soon be completely booked out. With almost 1,000 people registered for each of these webinars, there are limited places left. Register now to avoid disappointment.

PAYE Modernisation webinar dates

FREE cloud backup software with every BrightPay purchase (valued at €59)

It is vital to take backups of payroll data with PAYE Modernisation. To help our customers, we are providing a FREE BrightPay Connect 2019 licence (worth €59) with every BrightPay payroll purchase. Users can easily backup their payroll data to the cloud, which can be restored at any time.

PAYE Modernisation Changes for business with separate branches / offices

PAYE Modernisation does not lend itself to operating separate branches / offices using the same employer registration number nor does it lend itself to processing groups of staff separately e.g. directors on one payroll and other staff on a second payroll. There are various reasons for this including:

- full visibility of all payroll data per digital cert

- difficulty in ensuring uniqueness of employment IDs

- ensuring that line item IDs are not duplicated

An employer can have as many employer registration numbers as they want. The solution is to register another number and obtain another cert.

BrightPay Payroll & PAYE Modernisation Help Videos

We have created a number of help videos to give you an insight into what the payroll and PAYE Modernisation functionality will look like in BrightPay. Videos include how to import from the previous year, retrieving your employee RPNs, submitting your payroll data to Revenue and how to add your ROS digital certificate.

The Dos and Don'ts of offering PAYE Modernisation as a service

This guide for payroll bureaus examines practical tips to ensure PAYE Modernisation will be a smooth and profitable process. Discover effective strategies that make it feasible for accountants to make a profit from PAYE Modernisation.

Free Employer Guide: PAYE Modernisation unravelled! You NEED to get this right…

In this guide, we discuss how PAYE Modernisation will affect your business and your real time reporting obligations to Revenue. You must be ready by the 1st of January deadline.

Thinking about changing payroll software provider?

It is important to make sure you choose payroll software that will cater for your payroll needs. The ideal payroll solution will automate the new PAYE Modernisation processing for your business. Your payroll provider should also offer some form of FREE training to help you prepare for your real time reporting obligations. We have two comparison tables that looks at the differences between BrightPay vs. Big Red Book and BrightPay vs. Collsoft. BrightPay also won the 2018 Payroll Software of the Year!!

BrightPay vs. Big Red Book | BrightPay vs. Collsoft

Reasons to Switch to BrightPay for PAYE Modernisation

BrightPay is the payroll software that will significantly reduce the time required to perform these administrative PAYE Modernisation tasks. The biggest advantages of BrightPay include:

- Revenue compliant & PAYE Modernisation compatible

- 99% customer satisfaction rating

- 2018 Payroll Software of the Year award

- FREE payroll & PAYE Modernisation training

- Extended customer support hours over December & January

- Number one payroll software provider in Ireland

- Free phone and email support

Are you missing out on the BrightPay newsletter? We will not be able to email you without you subscribing to our mailing list. You will be able to unsubscribe at anytime. Don’t miss out - sign up to our newsletter today!

Dec 2018

12

Back to Basics - Disciplinary Steps and Sanctions

Another question that comes up from time to time is how and when to initiate the disciplinary procedures - How many warnings can an employee receive before being dismissed? When do I give a final warning? Can I fire my employee for committing an offence of gross misconduct?

The first step is always to inform the employee of issues that you may have, even minor issues; whether it is with their job performance, their time keeping, or even a breach of company rules, by means of informal counselling. The employee must be given the appropriate time/measures to defend themselves or at least be given the chance to rectify the problem. Prior to taking the decision to invoke the disciplinary procedure, the employer must ensure that the situation has been thoroughly investigated.

The following disciplinary procedures should apply in matters of discipline; constant repetition of minor offences, willful negligence or unsatisfactory performance or complaints, that are found to be proven against the employees.

The stages in the procedure are as follows:

• Stage 1 - Verbal Warning

• Stage 2 - First Written Warning

• Stage 3 - Final Written Warning - The final written warning will state clearly that the next stage may be termination of employment if conduct and/or performance does not improve.

• Stage 4: Action Short of Dismissal - In exceptional circumstances, and depending on the individual case, The Company may exercise its discretion to suspend with or without pay. Demotion to a lower position or rate of pay and transfer to another position may also be considered. This is action short of dismissal.

• Stage 5: Dismissal - In an instance of gross misconduct, a full investigation will be conducted and a disciplinary meeting will be held. This will follow the normal procedures outlined above, but the outcome, if found to be gross misconduct, will almost certainly result in dismissal due to the serious nature of the situation.

At each stage in the procedure a disciplinary meeting should be held, where all the facts will be considered and any mitigating circumstances discussed, as well as timelines imposed for improvements, etc. Where a warning is issued, a copy will be placed on the employees personnel file for a defined period. All warnings issued under this procedure will state clearly that the employee will be liable for further disciplinary action should their performance not improve or should there be a further breach of company rules or procedures. In the event of no further transgression occurring and the performance improving, the warning will be removed after a period of no more than 12 months and the employee’s file will be clear. The employee will also be advised of his/her right to appeal against disciplinary action taken.

This is an area where employer’s need to tread carefully, at all times fair procedures must be applied and the company’s’ policy regarding disciplinary steps and sanctions should be adhered to. Once these steps are followed there is no reason why an employer cannot dismiss an employee without repercussions. Most employers tend to fall down and lose Unfair Dismissal cases brought against them, not because they didn’t have disciplinary procedures in place, but because they did and they failed to actually follow them.

Bright Contracts has a very robust Discipline and Grievance Policy set out in its Handbook with all the relevant procedures that an employer needs. To download a free trial of Bright Contracts click here. To request an online demo of Bright Contracts, click here.

To keep up with the latest payroll news, check out our new Bright website. There, you'll be able to register for any of our upcoming payroll webinars and download our payroll guides.

Thesaurus Payroll Software | BrightPay Payroll Software

Related Articles:

Dec 2018

5

Rewarding your staff has never been easier

Your business can’t function without your employees, which is why it’s so important to keep them all happy. Rewarding employees and recognising their dedication is directly linked with loyalty, increased morale and motivation in the workplace.

With Thesaurus payroll software and One4all, it’s never been easier to say thank you to your employees. Thesaurus Payroll Manager customers can purchase gift cards directly from the payroll dashboard from One4all.

Under the small benefits exemption scheme, employers can reward each of their employees with up to €500 completely tax-free each year. The payment must be non-cash so naturally, gift cards provide a great solution.

Thesaurus Payroll Manager will track employer usage, per employee to ensure employers keep within revenue guidelines for the small benefits exemption scheme.

There are specific conditions to qualify for the non-cash or gift card payment which you can read here

Are you missing out on the Thesaurus newsletter? We will not be able to email you without you subscribing to our mailing list. You will be able to unsubscribe at anytime.Don’t miss out - sign up to our newsletter today!

BrightPay Payroll Software | Thesaurus Payroll Software

Related Articles:

Dec 2018

4

PAYE Modernisation and SMEs - Why you need to get with the programme

The deadline for PAYE Modernisation is fast approaching but a significant number of SMEs are not ready. Even though there is still time, there are still many employers who process their payroll using a manual system. At this point all employers really should be taking the new PAYE legislation seriously and starting to prepare for the new changes. You know who has been preparing for PAYE Modernisation? Payroll software providers - that’s who!! Needless to say, I’m talking about BrightPay Software here.

Imagine it’s the Apocalypse; The End Of Days. BrightPay are the rednecks in the underground shelter with their AK-47s, mountains of tinned food and a water distiller in the back that doubles as a hooch factory. You are the procrastinator standing outside in the rain with an umbrella fighting a raccoon for tonight’s dinner. Get the picture?

Basically all payroll providers have known The Flood is coming. BrightPay has spent months upon months building a big ass boat i.e. making sure their payroll software will be compatible with the new Real Time PAYE system whilst also making their customers’ lives easier.

It is undeniable that these new changes, however beneficial, will have the most impact on small businesses. Unfortunately, many small enterprises do not use a dedicated payroll software and it means they will have to manually upload all of their payroll data every pay period. And the problem is that Revenue expect all businesses, regardless of size or location, to comply with the new changes the minute they come into force on the 1st of January 2019. (It’s equal rights, equal fights all over again).

I’ve talked in a previous post about how beneficial the new changes to PAYE are going be. But for SMEs that’s besides the point as they will be doing all the extra work if they use a manual system. But to be fair, Revenue are working on the assumption that most businesses have, you know, “gotten with the times” and are no longer using manual payroll methods. I’m sure Bridey from Skeheenarinky manages the bingo books just fine with a pen and paper but you know what Bridey? It’s time to get with the programme.

The point is, if you are not using payroll software, the time has now come to adapt and evolve. The system will not just be easier, it will be fully integrated with Revenue. Is there a more beautiful term in business? (Well..actually..“profit”.. “bonus”..“this meeting has been cancelled” - are all great but hey, you get the idea).

Now if like Bridey you are adamant that you’re not using some computer robot thingy that they make confusing on purpose just to make you feel silly in front of your grandkids then you have the option of using Revenue’s online system (ROS) to report payments and deductions. However, ROS will not compute the deductions that need to be taken from salaries. You will have to do that all yourself. And that means less time in the bingo hall with the girls admiring Frank’s new cane.

Why not do yourself a big fat favour and come join the payroll revolution by purchasing BrightPay to handle all your PAYE Modernisation obligations. Not only will it take the extra work off your hands, it will take EVEN MORE work off your hands by automating your payroll process and ensuring that you are PAYE Modernisation compliant. BrightPay also have a team of support staff that will assist you with the transition.

Go on Bridey, what have you got to lose? Go to BrightPay’s website to find out more.

Thesaurus Payroll Manager | BrightPay Ireland

Are you missing out on the BrightPay newsletter? We will not be able to email you without you subscribing to our mailing list. You will be able to unsubscribe at anytime. Don’t miss out - sign up to our newsletter today!

Related Articles: