Jan 2019

28

PAYE Modernisation is now live - but how do I comply?

By now, all employers in Ireland should know about Revenue’s new PAYE Modernisation legislation. This system came into effect on January 1st 2019 and brought with it a new and improved method of reporting PAYE information to Revenue.

PAYE Modernisation has brought many changes to the payroll process. With the new system, employers are required to send real time payroll submissions to Revenue containing details of their employees’ PAYE information. These submissions must be sent to Revenue on or before the date an employee is paid every pay period. In most cases, this means a file will be submitted either weekly or monthly.

What happens if I don’t comply?

Non-compliant employers can expect Revenue intervention with non-compliance penalties and fines. An employer is responsible for deducting the tax and paying over the liability to Revenue and so non-compliance will result in interest to be paid by the employer.

The current penalty regime includes a fixed penalty of €4,000 for each breach of the PAYE legislation. It also includes a fixed penalty of €3,000 imposed on the company secretary for each breach. These penalties can be imposed on a per-item basis, so if you are even a mid-sized employer, these penalties can build up.

Free eBook: Surviving PAYE Modernisation!

Download your free copy of our PAYE Modernisation guide for employers. In this guide, we discuss practical PAYE Modernisation tips that every employer needs to know. Make sure you avoid fines for non-compliance.Download free guide

Find out more with our free PAYE Modernisation webinars

Revenue has teamed up with Thesaurus Software for a series of free PAYE Modernisation webinars. During the webinars, we will look at what has happened since PAYE Modernisation has gone live and what challenges businesses are facing. Click here to book your place on one of our upcoming webinars.

Jan 2019

24

Last chance to register! Free CPD accredited webinar with Thesaurus Software & Revenue

PAYE Modernisation, One Month On!! New Year, New Payroll Legislation

Thesaurus Software and Revenue have teamed up for another series of free PAYE Modernisation webinars featuring a brand new agenda. We will look at what has happened since PAYE Modernisation has gone live and the challenges businesses are facing.

The first webinar in the series takes place on January 30th and is CPD accredited for accountants. Due to the high level of interest, this webinar is almost booked out with just 50 places remaining. Book your place now to avoid disappointment.

The webinars are aimed at giving you an overview of how the new real time reporting system works, the benefits of this new system and how to make sure that your business is PAYE Modernisation compliant. We will peel back the PAYE Modernisation legislation to outline clearly how PAYE Modernisation affects the payroll process and what is expected from you in 2019 and going forward.

Register here | View extra dates added

Free PAYE Modernisation eBook:

Surviving PAYE Modernisation! What to do to complyDownload your free copy of BrightPay’s PAYE Modernisation guide for employers. In this guide, we discuss practical PAYE Modernisation tips that every employer needs to know.

Download free guide

Thesaurus Software & PAYE Modernisation

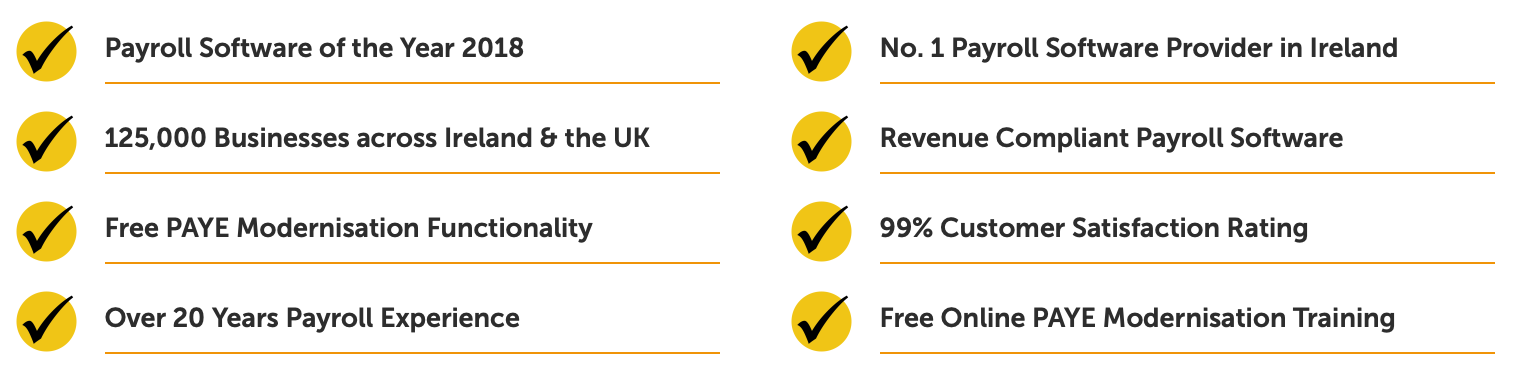

Thesaurus Software is the number one payroll software provider in Ireland with two different payroll packages to choose from - Thesaurus Payroll Manager and BrightPay. Both systems include full PAYE Modernisation functionality at no extra cost. We have worked closely with Revenue to ensure that both systems are fully compliant.

Our products are used to process the payroll for over 125,000 businesses across Ireland and the UK. BrightPay won the Payroll Software of the Year 2018 award at the Accounting Excellence awards. With a 99% customer satisfaction rate, our customers can rest assured that all required functionality is catered for.

We have made it easier than ever before to switch to BrightPay - You can import your payroll data from Sage, Collsoft, Big Red Book, and many others.

Book a BrightPay demo | Watch short PAYE Modernisation video | Download 60 day free trial

Jan 2019

14

PAYE Modernisation, One Month On!! New Year, New Payroll Legislation

PAYE Modernisation was introduced on the 1st of January 2019 and affects the way all employers process payroll. It is the most significant change ever to the Irish PAYE system. It is important that all employers and payroll processors understand their new real time reporting obligations.

Free PAYE Modernisation Webinars

Thesaurus Software and Revenue have teamed up for another series of free, CPD accredited PAYE Modernisation webinars. These upcoming webinars have a new agenda. We will look at what has happened since PAYE Modernisation has gone live and at the challenges businesses are facing.

The webinars are aimed at giving you an overview of how the new real time reporting works, the benefits of this new system and how to make sure that your business is PAYE Modernisation compliant. We will peel back the PAYE Modernisation legislation to outline clearly how PAYE Modernisation affects the payroll process and what is expected from you in 2019 and going forward.

Due to the high level of interest, it is expected that the training webinars will soon be completely booked out. Book your place now to avoid disappointment.

Webinar Agenda

- What is PAYE Modernisation and how to comply?

- How PAYE Modernisation will streamline your processes

- The benefits of PAYE Modernisation

- Recent updates and changes to PAYE Modernisation

- Reporting to Revenue in real time

- Making corrections to the payroll

- The approach to non-compliance and penalties

- How Thesaurus Payroll Manager & BrightPay are supporting your PAYE Modernisation journey.

- Guest Speaker: Revenue

The first webinar in the series takes place on January 30th and is CPD accredited for accountants and payroll bureaus. Due to phenomenal demand, we have also added more dates in February.

Thesaurus Software & PAYE Modernisation

Thesaurus Software is the number one payroll software provider in Ireland with two different payroll packages to choose from - Thesaurus Payroll Manager and BrightPay. Both systems include full PAYE Modernisation functionality at no extra cost. We have worked closely with Revenue to ensure that both systems are fully PAYE Modernisation compliant.

Our products are used to process the payroll for over 125,000 business across Ireland and the UK. BrightPay won the Payroll Software of the Year 2018 award at this year’s Accounting Excellence awards. With a 99% customer satisfaction rate, our customers can rest assured that all required functionality is catered for.

We have made it easier than ever before to switch to BrightPay or Thesaurus Payroll Manager - You can import your payroll data from Sage, Collsoft, Big Red Book, and many others in a matter of minutes.

Jan 2019

10

BrightPay Customer Update: January 2019

Extended Customer Support Hours

To assist our customers with the transition to PAYE Modernisation, our customer support now offer extended and Saturday opening hours until Saturday 16th February including early mornings and evenings. Revenue is also assisting employers with the transition to PAYE Modernisation, with extended customer support hours and Saturday opening hours from Monday 17th December until Saturday 16th February including early mornings and evenings.

View BrightPay opening hours | View Revenue opening hours

BrightPay Product Training - Payroll & PAYE Modernisation

We are running free BrightPay 2019 online training sessions. The training session will cover full PAYE Modernisation functionality, including the typical payroll run with PAYE Modernisation, processing new starters and leavers, making corrections to the payroll and much more.

What does PAYE Modernisation look like in BrightPay?

We have worked closely with Revenue to ensure BrightPay can easily cater for the needs of PAYE Modernisation. Watch our short video to see how BrightPay streamlines real time reporting to easily comply with PAYE Modernisation.

PAYE Modernisation webinar with guest speaker from Revenue - New 2019 dates added due to high demand

BrightPay and Revenue have teamed up to bring you free webinars where we discuss what has happened since PAYE Modernisation has gone live and what challenges businesses are facing. Due to phenomenal demand, we have added new PAYE Modernisation webinars in January and February. Due to the high level of interest, it is expected that the training webinars will soon be completely booked out. Book your place now to avoid disappointment.

******* Do you have your ROS Digital Cert for PAYE Modernisation? *******

The computer that you run your BrightPay 2019 software on will need to have your ROS Digital Cert installed on it. If you are currently able to log into ROS from your computer, then you are fine. Otherwise, you should copy the cert (the .p12 or .p12.bac file) from the machine that you use for ROS to the machine that you use for processing payroll.

Don’t forget to backup your payroll files for PAYE Modernisation

It is very important to take backups of payroll data with PAYE Modernisation. To help our customers with PAYE Modernisation, we are providing one FREE cloud backup with every BrightPay 2019 payroll purchase. Users can easily backup their payroll data to the cloud, which can be restored at any time. Customers will be issued with one FREE BrightPay Connect 2019 licence (worth €59) with their BrightPay 2019 licence.

Purchase BrightPay 2019 here | Book BrightPay Connect demo

BrightPay Payroll & PAYE Modernisation Help Videos

We have created a number of help videos to give you an insight into what the payroll and PAYE Modernisation functionality will look like in BrightPay. Videos include how to import from the previous year, retrieving your employee RPNs, submitting your payroll data to Revenue and how to add your ROS digital certificate.

How will PAYE Modernisation affect employees?

Employers will now need to connect to ROS before calculating pay and deductions to ensure that they are using the most up-to-date tax credits and cut-off points. They will also have to report these deductions to Revenue every time employees are paid. Employees will then be able to view pay and deductions on myAccount on the Revenue website.

Still not convinced about BrightPay?? This is what you need to know:

Jan 2019

9

Our customer support team are here to help

To assist our customers with the transition to PAYE Modernisation, our customer support now offer extended and Saturday opening hours until Saturday the 16th of February 2019.

Our opening hours for this period are as follows:

- Monday to Thursday - 8 am to 7 pm

- Friday - 8 am to 6 pm

- Saturday - 9 am to 1 pm

Our customer support team can be contacted on 01 8352074 or support@brightpay.ie.

We will continue to monitor demand for customer support and will change or extend hours if required. It is also important to note that we will not have a full complement of staff during these extended hours.

Online Support

In addition to our telephone and email support, we also have extensive on-screen and online support to help you through all of the new features.

- Click here for online documentation (also accessible by clicking F1 within the payroll software)

- Click here for quick step-by-step video tutorials

Product Training

We are also running online training sessions on how to use BrightPay 2019. These one-hour training sessions are free to attend and run on a daily basis. Click here for upcoming training sessions or here to watch it on demand.