Feb 2021

8

BrightPay Connect: Two Factor Authentication Explained

As security is a large concern for many businesses nowadays as data breaches are a threat to all entities, Two Factor Authentication can now be enabled as a feature for users of BrightPay Connect. Two Factor Authentication is a second layer of protection to re-confirm the identity for users logging into Connect through an internet browser or through BrightPay. This improves security, protects against fraud and lowers the risk of data breaches as users can access sensitive employer and employee data in Connect with the increased security layer.

BrightPay Connect is an optional cloud add-on feature that works with BrightPay. BrightPay Connect provides a secure, automated and user-friendly way to backup and a self-service dashboard to both accountants and employers so they can access payslips, payroll reports, amounts due to Revenue, annual leave requests and employee contact details.

How it works

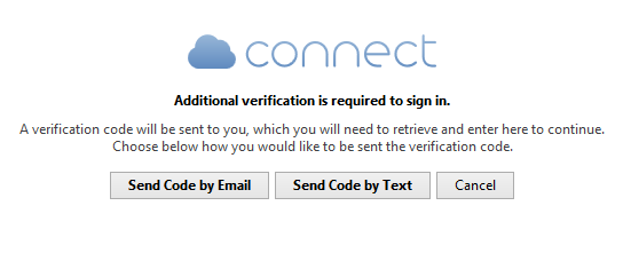

If Two Factor Authentication is enabled for a Connect account, when any user on the Connect account tries to sign into Connect via their internet browser here or through BrightPay, they will be asked to enter in a security code that needs to be sent to them. The user can select to have the security code to be sent by email or by text to the user.

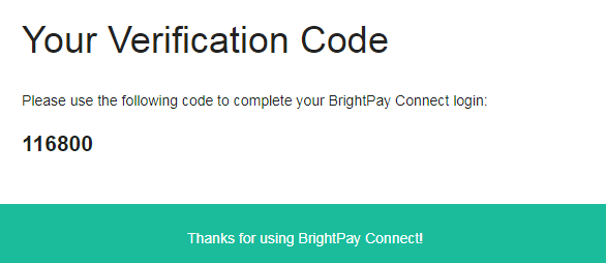

Once the user receives the security code the user enters this in the 'verify code' field and selects 'Verify Code'. The user will only be able to access the security code if they have access to the email account or mobile device. The random generated 6 digit security code will expire after fifteen minutes so a new code will have to be sent if the code is not used in the time limit.

This Two Factor Authentication uses a second security measure of identification ensuring the user is the correct user when logging into Connect. It adds an additional layer of security to an already secure hosted platform and gives the user more reassurance that their payroll data is safer and more secure.

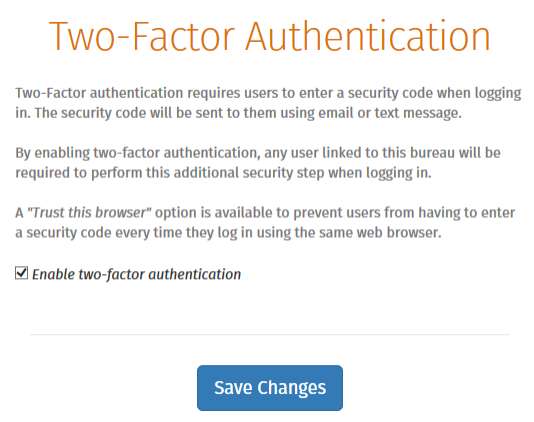

To Enable this option in Connect when you are logged in > Go to 'Settings' > Go to 'Two Factor Authentication' > Tick the box > 'Save Changes'.

Related Articles:

Feb 2021

2

BrightPay Customer Update: February 2021

Welcome to BrightPay's February update. Our most important news this month include:

-

Online support – Hundreds of BrightPay help guides at your fingertips

-

Lockdown 3.0 - What have payroll processors learned?

-

What to do in BrightPay when employees are on the Pandemic Unemployment Payment

EWSS Q&A – Common Questions Answered

As we are back in lockdown, some businesses are just now availing of the EWSS for the very first time. Here we have answered some of the most common queries that our customer support team are being asked.

Free Webinar: A Recap of Recent Wage Subsidy Scheme Changes

The past couple of months have seen a number of updates to both the TWSS and the EWSS, including TWSS reconciliation, employee tax bills, EWSS eligibility and subsidy rates. Register for this free webinar to make sure you keep up to date with the most recent updates.

Coming in February: BrightPay Connect supports two-factor authentication sign in

With two-factor authentication, you can add an extra layer of security to the employer login on your BrightPay Connect account in case your password is stolen. Instead of only entering a password to log in, you’ll also enter a code or use a security key.

Working from home with BrightPay

All BrightPay licences can be activated on up to 10 PCs, meaning you can easily process payroll whether you’re in the workplace or working from home. BrightPay Connect can help you prevent conflicting copies of the payroll, including an ‘other user check’ and a ‘version check’ when opening the payroll.

Feb 2021

1

EWSS Q&A - Common Support Queries

Due to the changes and updates to the COVID-19 Government schemes, our support team put together the top four common questions – asked by you and answered by us!

When earnings fluctuate and are within the limits for the Employment Wage Subsidy Scheme (EWSS) in some pay periods and not others, do we need to untick EWSS for the employee?

No. There is no need to remove the tick for EWSS, our software will remove the indicator from the payroll submission (PSR) in the pay periods the earnings fall outside the relevant limits.

The subsidy being received is more than we are paying the employees, do we pay the employees the difference or will we owe that money back to Revenue?

In some scenarios the employer will receive a subsidy greater than the wages they are paying; they will not have to repay that money to Revenue. The employee should only be paid the wages that are due and not any extra. In other scenarios the subsidy received from Revenue will be less than the wages they are paying.

What payments are permitted under EWSS e.g., can you pay the employees commission?

Yes. The EWSS is a subsidy payable to employers, therefore, it will not show on employee payslips or in myAccount. Under EWSS employers are required to pay employees in the normal manner i.e., calculating and deducting Income Tax, USC and employee PRSI through the payroll. Employees should be paid the wages that are due to them which can include commission, overtime etc.

When employees are claiming the Pandemic Unemployment Payment (PUP) from the Department of Social Protection, do we need to do anything on the payroll?

Yes. You should ensure that the employee’s payment is changed to zero, continue to update them with zero pay until such time you are paying them wages again.

More information can be found in the COVID-19 guidance section on our website or by visiting the COVID-19 Resources Hub.

Related Articles:

- Budget 2021: Employer Payroll Focus

- 7 Steps To Returning To Work After COVID-19

- BrightPay: The COVID Heroes of the Accounting World