Oct 2021

13

Budget 2022 - Employer Payroll Focus

Income Tax

There is no change to tax rates for 2022, the standard rate will remain at 20% and the higher rate at 40%.

- The Standard Rate Cut Off Point (SRCOP) has been increased by €1,500

- The Personal Tax Credit increased by €50 from €1,650 to €1,700

- The Employee Tax Credit increased by €50 from €1,650 to €1,700

- The Earned Income Credit increased by €50 from €1,650 to €1,700

Universal Social Charge (USC)

- Exemption threshold remains at €13,000

- There are no changes to the rates of USC

- The 2% USC rate band has increased by €608, from €20,687 to €21,295

USC Rates & Bands 2022

€0 – €12,012 @ 0.5%

€12,013 – €21,295 @ 2%

€21,296 – €70,044 @ 4.5%

€70,045 + @ 8%

Medical card holders and individuals aged 70 years and older whose aggregate income does not exceed €60,000 will continue to pay a maximum rate of 2%.

The emergency rate of USC remains at 8%.

Non-PAYE income in excess of €100,000 will continue to be subject to USC at 11%.

Employment Wage Subsidy Scheme

The Employment Wage Subsidy Scheme (EWSS) will continue until the end of April 2022 in a graduated form.

- The current rates will remain for October and November 2021

- Employers availing of EWSS on December 31st 2021 will continue to be eligible until April 30th 2022, assuming they meet the eligibility criteria which will continue to be a 30% reduction in turnover/customer orders in 2021 compared to 2019

- EWSS will close to new employers from January 1st 2022

- For December, January and February a two-rate structure will apply as follows:

Level of subsidy the employer will receive is per paid employee

| Employee Gross Weekly Wages | Subsidy Payable |

| Less than €151.50 | Nil |

| From €151.50 to €202.99 | €151.50 |

| From €203 to €1,462 | €203 |

| More than €1462 | Nil |

- For March and April 2022, a flat rate subsidy of €100 will apply

- The reduced rate of employer’s PRSI will no longer apply for the final two months of the scheme

National Minimum Wage

The National Minimum Wage will increase by 30 cent from €10.20 to €10.50 per hour from January 1st 2022.

Pay Related Social Insurance (PRSI)

The weekly threshold for the higher rate of employer PRSI will increase to €410 from €398, this is in line with the increase in the National Minimum Wage.

Parent’s Leave

Parent’s leave has been increased by two weeks, this brings it up to seven weeks from July 2022.

VAT

The reduced rate of 9% VAT for the tourism and hospitality sector will continue to apply until the end of August 2022.

Social Welfare Payments

There will be a €5 increase in all weekly Social Welfare payments with effect from January 2022. The maximum personal rate of Illness Benefit will be increased to €208 per week. Maternity Benefit, Parent’s Benefit and Paternity Benefit will be increased to €250 per week.

Remote Working

Where an employer does not pay the e-working allowance (€3.20 per day) to an e-worker, employees will be able to claim tax relief on 30% of the cost of vouched expenses for heat, light and broadband in respect of the days worked from home.

Extension of BIK Exemption for Electric Vehicles

The BIK exemption for battery electric vehicles will be extended out to 2025 with a tapering effect on the vehicle value. This measure will take effect from 2023. For BIK purposes, the original market value of an electric vehicle will be reduced by €35,000 for 2023, €24,000 for 2024 and €10,000 for 2025.

Related articles:

Feb 2021

1

EWSS Q&A - Common Support Queries

Due to the changes and updates to the COVID-19 Government schemes, our support team put together the top four common questions – asked by you and answered by us!

When earnings fluctuate and are within the limits for the Employment Wage Subsidy Scheme (EWSS) in some pay periods and not others, do we need to untick EWSS for the employee?

No. There is no need to remove the tick for EWSS, our software will remove the indicator from the payroll submission (PSR) in the pay periods the earnings fall outside the relevant limits.

The subsidy being received is more than we are paying the employees, do we pay the employees the difference or will we owe that money back to Revenue?

In some scenarios the employer will receive a subsidy greater than the wages they are paying; they will not have to repay that money to Revenue. The employee should only be paid the wages that are due and not any extra. In other scenarios the subsidy received from Revenue will be less than the wages they are paying.

What payments are permitted under EWSS e.g., can you pay the employees commission?

Yes. The EWSS is a subsidy payable to employers, therefore, it will not show on employee payslips or in myAccount. Under EWSS employers are required to pay employees in the normal manner i.e., calculating and deducting Income Tax, USC and employee PRSI through the payroll. Employees should be paid the wages that are due to them which can include commission, overtime etc.

When employees are claiming the Pandemic Unemployment Payment (PUP) from the Department of Social Protection, do we need to do anything on the payroll?

Yes. You should ensure that the employee’s payment is changed to zero, continue to update them with zero pay until such time you are paying them wages again.

More information can be found in the COVID-19 guidance section on our website or by visiting the COVID-19 Resources Hub.

Related Articles:

- Budget 2021: Employer Payroll Focus

- 7 Steps To Returning To Work After COVID-19

- BrightPay: The COVID Heroes of the Accounting World

Oct 2020

15

Budget 2021: Employer Payroll Focus

Here are the main points from Budget 2021, as delivered by Minister for Finance Paschal Donohoe.

Pay As You Earn (PAYE)

There is no change to tax rates for 2021, the standard rate will remain at 20% and the higher rate at 40%.

In addition, there is no change to Standard Rate Cut Off Points (SRCOPs).

Earned Income Tax Credit

The Earned Income Tax Credit will be increased by €150 from €1,500 to €1,650 to bring it in line with the PAYE tax credit.

Dependent Relative Tax Credit

The Dependent Relative Tax Credit will be increased by €175 from €70 to €245 to support families with caring responsibilities.

Universal Social Charge (USC)

- Exemption threshold remains at €13,000

- 2% threshold increased by €203 from €20,484 to €20,687

- Due to the increase to the 2% threshold, the income chargeable at 4.5% reduces from €49,560 to €49,357

- There are no changes to the rates of USC

For 2021, USC will apply at the following rates for those earning in excess of €13,000

| Rate Bands | Rate |

| Up to €12,012 | 0.5% |

| Next €8,675 | 2% |

| Next €49,357 | 4.5% |

| Balance | 8% |

Medical card holders and individuals aged 70 years and older whose aggregate income does not exceed €60,000 will pay a maximum rate of 2%.

The emergency rate of USC remains at 8%.

Non-PAYE income in excess of €100,000 is subject to USC at 11%.

National Minimum Wage

The National Minimum Wage will increase by 10 cent from €10.10 to €10.20 per hour from January 1st 2021.

Pay Related Social Insurance (PRSI)

The weekly threshold for the higher rate of employer PRSI will increase to €398 from €395, this is in line with the increase in the National Minimum Wage.

State Pension Age

The age to qualify for the State Pension will remain at 66 for 2021, it was due to increase to 67.

Illness Benefit

The ‘waiting days’ for Illness Benefit will reduce from 6 days to 3 days for all new claims from the end of February 2021.

Parent’s Leave

Parent’s Benefit has been increased by three weeks, this brings it up to five weeks. The leave must be taken during the first year following the birth of a child.

Wage Subsidy Scheme

The Employment Wage Subsidy Scheme (EWSS) is due to continue until 31st March 2021, a wage subsidy scheme in some form is expected to be in place until the end of 2021.

Warehousing of Tax Liabilities

The tax debt warehousing scheme will be expanded to include repayments of the Temporary Wage Subsidy Scheme (TWSS) owed by employers.

Covid Restrictions Support Scheme (CRSS)

A new scheme was introduced for businesses impacted by Covid-19 restrictions, it will provide support for businesses that have had to close because of Covid-19. The scheme is operational from October 13th until March 31st 2021.

The payment will be calculated as a percentage of the business’s average weekly VAT exclusive turnover in 2019 subject to a maximum payment of €5,000 per week. The first payments are expected to be made in Mid-November.

VAT

The 13.5% rate of VAT for the tourism and hospitality sector will be reduced to 9% from November 1st 2020, the reduced rate will remain in place until December 31st 2021.

For the latest payroll updates, don’t miss our next free webinar where we are joined by Revenue.

Webinar: Wage Subsidy Scheme with Revenue

10.30am | 19th November

Webinar Agenda

- TWSS Reconciliation

- Employment Wage Subsidy Scheme - Key Points

- Employer & Employee Eligibility Criteria

- Operation of Payroll & Processing of Subsidy Claims

- Operating EWSS with BrightPay & Thesaurus Payroll Manager

- Q&A Panel Discussion

If you are unable to attend the webinar at the specified time, simply register and we will send you the recording afterwards.

Related Articles:

BrightPay COVID-19 Resource Hub

Blog: Customer update October 2020

On-demand COVID-19 Webinars

Mar 2020

19

Local Property Tax (LPT) – Payment Date Deferred

In a move designed to ease cash flow pressure on property owners amid the Coronavirus outbreak, Revenue has announced it is deferring the collection of Local Property Tax (LPT) for those paying by Annual Debit Instruction or Single Debit Authority payment.

These payments were due on 21st March 2020, the deduction date will change to 21st May 2020.

Property owners who have opted to make a payment by Annual Debit Instruction or Single Debit Authority do not need to advise Revenue or take any action. The payment date will automatically change to 21st May 2020.

Details can be found here.

Oct 2018

10

Budget 2019 Employer Payroll Focus

Pay As You Earn (PAYE)

- There was no change to tax rates for 2019, the standard rate will remain at 20% and the higher rate at 40%.

- Standard Rate Cut Off Points (SRCOPs) will be increased by €750 from 1st January 2019.

Earned Income Tax Credit

The Earned Income Tax Credit will be increased by €200 from €1,150 to €1,350.

Home Carer Tax Credit

The Home Carer Tax Credit will be increased by €300 from €1,200 to €1,500.

Universal Social Charge (USC)

- Exemption threshold remains at €13,000

- 4.75% rate reduced to 4.5%

- 2% threshold increased by €502 from €19,372 to €19,874

- No change to 8% rate

For 2019, USC will apply at the following rates for those earning in excess of €13,000

| Rate Bands | Rate |

| Up to €12,012 | 0.5% |

| Next €7,862 | 2% |

| Next €50,170 | 4.5% |

| Balance | 8% |

Medical card holders and individuals aged 70 years and older whose aggregate income does not exceed €60,000 will pay a maximum rate of 2%.

The emergency rate of USC remains at 8%.

Non PAYE income in excess of €100,000 is subject to USC at 11%.

National Training Levy

The National Training Levy of 0.8% which is collected as part of the employer PRSI contribution will increase to fund further and higher education, the increases are as follows:

- 0.9% in 2019

- 1% in 2020

Pay Related Social Insurance (PRSI)

With the increase in the National Training Levy which is collected as part of the employer PRSI contribution, employer PRSI will increase as follows:

- 8.6% increased to 8.7%

- 10.85% increased to 10.95%

The weekly threshold for the higher rate of employer PRSI will be increased from €376 to €386.

The rates of PRSI for Class S will remain unchanged but the range of benefits available to Class S contributions will be extended to include Jobseeker’s Benefit in late 2019.

Benefit in Kind (BIK) - Electric Cars

The 0% rate of BIK introduced in Budget 2018 for electric vehicles provided by an employer to an employee has been extended until 2021 with a cap of €50,000 on the Original Market Value of the vehicle.

National Minimum Wage

The National Minimum Wage will increase from €9.55 to €9.80 per hour in respect of hours worked on or after 1st January 2019.

Social Welfare Payments

There will be a €5 increase in all weekly Social Welfare payments with effect from week commencing 25th March 2019. The maximum personal rate of Illness Benefit will be increased to €203 per week. Maternity Benefit and Paternity Benefit will be increased to €245 per week.

Paid Parental Leave

The Budget provides for 2 additional weeks paid parental leave per parent (paid by the DEASP) to be introduced in November 2019. The leave must be taken during the first year following the birth of a child.

Are you missing out on our newsletter? We will not be able to email you without you subscribing to our mailing list. You will be able to unsubscribe at anytime. Don’t miss out - subscribe today!

Nov 2017

20

Taxation of Illness Benefit - 2018

Currently, employers are required to tax Illness Benefit and Occupational Injury Benefit payments paid to employees by the Department of Employment Affairs and Social Protection (DEASP).

With effect from 1st January 2018, employers will no longer be responsible for taxing Illness Benefit. From this date Revenue will tax Illness Benefit by adjusting employee's tax credits and/or rate bands. Revenue will receive real-time interfaces of taxable DEASP income and the adjusted tax credits and/or rate bands will be notified to employers via P2C files. As a result of this change there will be more frequent P2Cs for employees. While payroll operators will no longer need to tax Illness Benefit, it will be extremely important to implement amended P2Cs immediately.

In addition, from 1st January 2018 Illness Benefit letters will no longer be delivered to the ROS Inbox. In light of this change, employers may need to review their sick pay schemes.

Related Articles -

Thesaurus Payroll Software | BrightPay Payroll Software

Oct 2017

11

Budget 2018 - Employer Payroll Focus

Pay As You Earn (PAYE)

- There was no change to tax rates for 2018, the standard rate will remain at 20% and the higher rate at 40%.

- Standard Rate Cut Off Points (SRCOPs) will be increased by €750 from 1st January 2018.

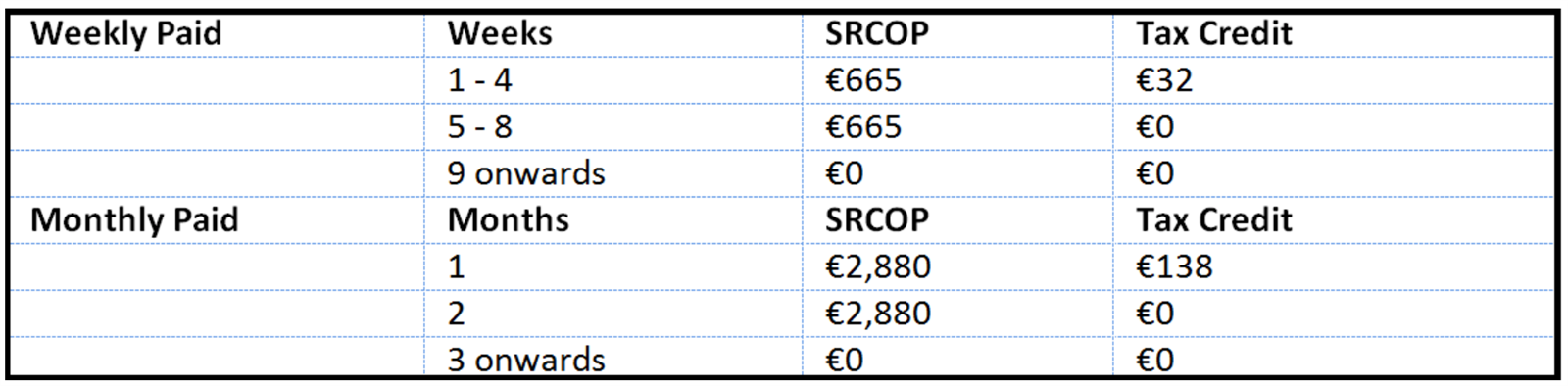

Emergency Basis of PAYE

Employee provides PPS Number:

Where an employee does not provide their PPS Number the higher rate of 40% tax applies to all earnings.

Earned Income Tax Credit

The Earned Income Tax Credit will be increased by €200 from €950 to €1,150.

Home Carer Tax Credit

The Home Carer Tax Credit will be increased from €1,100 to €1,200.

Universal Social Charge (USC)

- Exemption threshold remains at €13,000

- 2.5% rate reduced to 2%, threshold for this rate increased from €18,772 to €19,372

- 5% rate reduced by 0.25% to 4.75%

- No change to 8% rate

Medical card holders and individuals aged 70 years and older whose aggregate income does not exceed €60,000 will pay a maximum rate of 2%.

The emergency rate of USC remains at 8%.

PRSI & USC

The Minister outlined his intention to establish a working group in 2018 to carry out a review of the possible integration of PRSI and USC.

National Training Levy

The National Training Levy of 0.7% which is currently collected as part of the employer PRSI contribution will increase to fund further and higher education, the increases are as follows:

- 0.8% in 2018

- 0.9% in 2019

- 1% in 2020

Pay Related Social Insurance (PRSI)

There were no changes to general PRSI thresholds or employee PRSI announced in the Budget. However, as the National Training Levy is increasing and it is collected as part of the employer PRSI contribution, employer PRSI will increase as follows:

- 8.5% increased to 8.6%

- 10.75% increased to 10.85%

Benefit in Kind (BIK) - Electric Cars

A 0% rate of BIK will apply to electric vehicles provided by an employer to an employee in 2018 which is available for private use. Electricity used by the employee in the workplace to charge the car will also be exempt from BIK.

PAYE Modernisation

PAYE Modernisation will be effective from 1st January 2019. Budget 2018 has allocated €50 million for a project to enhance Revenue's IT capacity and to ensure employer compliance.

National Minimum Wage

The National Minimum Wage will increase from €9.25 to €9.55 per hour in respect of hours worked on or after 1st January 2018.

- Workers under age 18 will be entitled to €6.69 per working hour

- Workers in their first year of employment over the age of 18 will be entitled to €7.64 per working hour

- Workers in their second year of employment over the age of 18 will be entitled to €8.60 per working hour

Social Welfare Payments

There will be a €5 increase in all weekly Social Welfare payments with effect from 26th March 2018. The maximum personal rate of Illness Benefit will be increased to €198 per week. Maternity Benefit and Paternity Benefit will be increased to €240 per week.

Sep 2017

18

Long Service Awards - Appreciation to staff

Have you employees with 20 plus years of service? If so why not say thank you with a gift.

Revenue Commissioners offer tax relief on long service awards, which is considered to be at least 20 years of service. Tax relief on long service awards can be in addition to the small benefit exemption.

Employers can reward employees for long service with tangible articles with a value up to a maximum of €50 per year of service, starting at 20 years of service and every 5 years thereafter.

- 20 years of service – value up to €1,000

- 25 years of service – value up to €1,250

- 30 years of service – value up to €1,500

- 35 years of service – value up to €1,750

The award must be a tangible article e.g. a gold watch, it does not apply to awards made in cash.

Tax will not be charged provided:

• The cost to the employer does not exceed €50 per year of service

• The award is made in respect of service not less than 20 years

• No similar award has been made to the recipient within the previous 5 years

Where any of the conditions are not met PAYE, PRSI & USC must be applied on the full amount.

Details can be found on Revenue's website

New PAYE Modernisation legislation to be in place by Jan 2019

Mar 2017

31

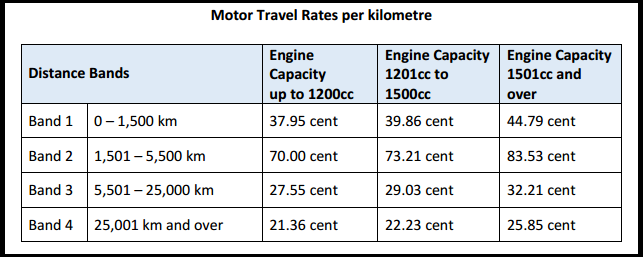

Important Information for Employers - Changes to Civil Service Travel Rates

Where employees use their own private cars or motorcycles for business purposes, reimbursement in respect of allowable motoring expenses can be effected by way of flat-rate mileage allowances.

There are two types of mileage allowance schemes which are acceptable for tax purposes if an employee bears all the motoring expenses:

- The prevailing schedule of Civil Service rates; or

- Any other schedule with rates not greater than the Civil Service rates

The Department of Public Expenditure and Reform has recently published circulars with new Civil Service Travel Rates, the revised rates are effective from 1st April 2017. The distance bands have increased from two to four with a lower recoupment rate for the first 1,500 kilometres.

Business travel carried out between 1st January and 31st March 2017 will not be affected by these new bands and rates, business travel to date from 1st January 2017 will count towards the cumulative business travel for the year.

Motor Travel Rates - Effective from 1st April 2017

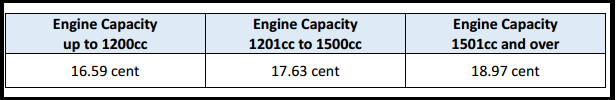

Reduced Motor Travel Rates per kilometre

The reduced rates are payable to Civil Service employees who undertake a journey associated with their job but not solely related to the performance of their duties, such as:

- Attendance at confined promotion competitions

- Attendance at approved courses of education

- Attendance at courses or conferences

- Return visits home at weekends during a period of temporary transfer

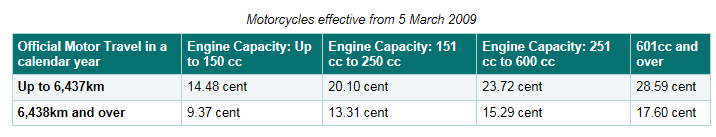

The Motor Travel Rates for motorcycles and bicycles remain unchanged as follows:

Motorcycle:

Bicycle: 8 cent per km

Please note, there are changes to subsistence rates which are also effective from 1st April 2017.

Please click here for the circular on Motor Travel Rates, and here for the circular on Subsistence

Sep 2016

10

Jobs & Pensions Service – New Online Service for Employees

The Jobs & Pensions Service available from Monday 12th of September 2016 is a new online service for employees. Irish employees can register their new job (or private pension) with Revenue using the service.

The Jobs and Pensions service replaces the Form 12A, meaning employees must register their first job in Ireland using the service. After registering employment using the service a tax credit certificate will issue to both the employer (P2C) and employee.

The service can also be used by employees who are:

• changing jobs provided the previous job has been ceased on Revenue records, employees will be able to see when they log in if the previous job has been ceased

• starting a second job in addition to their main job

• starting to receive payments from a private pension

Access to the service is available in myAccount, employees must register to use the service.

Employers should:

• encourage new employees to register for myAccount

• provide new employees with the information required to register their new job (registration can be done in advance of the start date):

- tax registration number

- start date of the new job

- pay frequency

- staff number is one has been allocated

• no longer submit a P46 form where employees register their own job using the service

• continue to upload P45(3) as normal

• continue to issue P45s immediately on cessation of employment

• operate the emergency basis for PAYE & USC if a pay day occurs before receipt of either P45 or P2C

Further information on the service can be found in Revenue’s Employer Notice September 2016, which can be found here.