Feb 2013

5

Employment Permits Bill

Legislation aimed at protecting undocumented migrant workers is being progressed as a priority by the Department of Jobs, Enterprise and Innovation.

The proposed legislation will address, amongst other matters, an important legal issue identified in a recent High Court decision. In August 2012, the High Court overturned a Rights Commissioner's award of over €91,000 in favour of a foreign national employed as a restaurant worker.

The Court found that the employee’s contract of employment was substantively illegal in the absence of the appropriate employment permit and that he was therefore not entitled to the award.

The proposed legislation will protect migrant workers whose employment in Ireland is unlawful by reason of not having a work permit. The Department recently confirmed that it is expected that the Bill will be published in the first quarter of this year.

Bright Contracts – Employment contracts and handbooks.

BrightPay – Payroll Software

Dec 2012

10

2013 Budget Summary for Employers

The Budget was announced by Ministers Brendan Howlin and Michael Noonan on 05th December. Below is a summary of changes which affect employers.

PAYE

The Income Tax rates remain at 20% and 41% for 2013. There are no changes to Personal Tax Credits or Standard Rate Cut Off Points.

USC

There are no operational changes to the treatment of USC for employers.

From an employee prospective there are no changes to the Standard rates or Cut Off Points in relation to USC, they are the same as last year.

The annual income exemption threshold of €10,036 continues to apply for 2013, the process of employee self election to Revenue still applies.

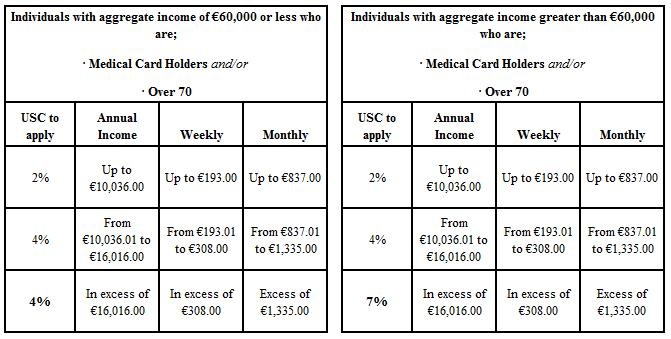

What has changed are the rules applied to medical card holders and those aged over 70. Previously these individuals would have qualified for a reduced rate of USC of 4% (reduced from 7%) on earnings in excess of €16,016. From 01st January 2013 this USC break no longer applies, to previously qualifying individuals, whose aggregate income for 2013 will exceed €60,000

- Medical Card holders (regardless of age) with aggregate income of €60,000 or more

- Individuals aged 70 or over with aggregate income of €60,000 of more

The P2C (Tax Credit File) issued by Revenue will allocate the correct USC rates and Cut Off Points per employee. As was the case in 2012, no action is to be taken by the employer other than to apply the details of the latest tax credit file.

It is important that you apply the latest detail as per the 2013 P2C/tax credit file as soon as it is received and if possible before completing the first pay period in order to avoid a claw back of USC for any individuals who qualified for the reduced higher rate of USC in 2012 but no longer qualify in 2013.

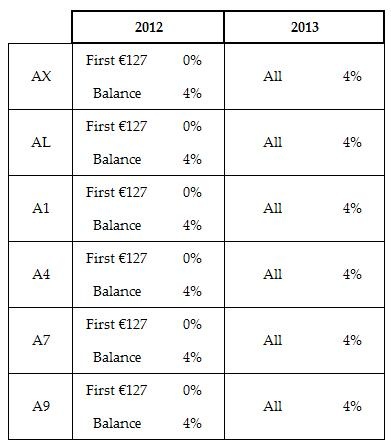

PRSI

The Employee's PRSI-Free Allowance of €127 per week (for those paying PRSI Class A, E and H) and €26 per week (for those paying PRSI Class B, C and D) will be abolished from 01st January 2013.

Employees who earn €352 or less per week continue to have no liability to make a PRSI contribution and are not affected by the abolition of the weekly PRSI-Free Allowance.

For those employees in private sector employment the changes are;

From 01st January 2014, the exemption from PRSI applying to all employees with unearned income only, i.e. income generated from wealth such as investment income, deposit interest and rental income, will be abolished.

PRSI minimum contribution

The minimum annual PRSI contribution for people with annual self-employed income over €5,000 increases from €253 per annum to €500 per annum.

Maternity/Adoptive Benefit

Maternity and Adoptive Benefit will be taxable for all claimants with effect from 1 July 2013. As with all Department of Social Protection benefits it is not subject to USC.

Health and Safety Benefit, payable to pregnant or breastfeeding mothers, is a form of Maternity Benefit and will also be subject to the same tax rules as Maternity Benefit.

Once Revenue issue guidelines relating to the procedures to be adopted by employers to operate the taxation of Maternity Benefit we will issue a payroll upgrade, this will be prior to effective date of 01st July 2013.

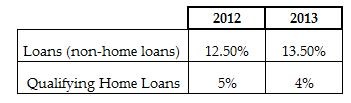

Preferential loan rates

Where an employer extends a loan to an employee, with effect from 01st January 2013, there are the following changes apply;

Top Slicing Relief

Top Slicing Relief will no longer be available for persons who receive an ex-gratia payment, excluding statutory redundancy, where the amount is €200,000 or more. This provision has effect for payments made on or after 1 January 2013.

Revenue Job Assist and Employer Job (PRSI) Incentive Scheme

A scheme called the ‘Plus One Initiative’ will replace both the Revenue Job Assist and Employer Job (PRSI) Incentive Scheme. Full details of this change have yet to be will be announced.

Local Property Tax (LPT)

From 1 July 2013, residential property owners will be liable for an LPT based on the self-assessed market value of their property on 1 May 2013. Once Revenue issue guidelines relating to the procedures to be adopted by employers to deduct and remit this tax to Revenue we will issue a payroll upgrade, this will be prior to effective date of 01st July 2013.

See our article “Local Property Tax (LPT) effective from 01st July 2013” for further information.

Statutory Sick Pay Scheme

Despite speculation throughout the latter half of 2012 a Statutory Sick Paye scheme was not announced in the 2013 Budget.

Bright Contracts – Employment contracts and handbooks.

BrightPay – Payroll Software

Dec 2012

10

USC Exempt Status v USC Exempt Income

Employers should be wary of the difference between USC exempt status (as per P2C/tax credit certificate) and employees in receipt of USC exempt income.

If an employee expects their income to be less than €10,036 in the tax year they can contact Revenue to make a declaration of same, it is only the employee themselves that can make this declaration. Revenue will update the employees USC status to USC exempt and issue a new P2C/tax credit to the employer. The employer will follow this instruction and USC will not be deducted from the employee accordingly.

If an employee is in receipt of USC exempt income, e.g. Community Employment Participants, Department of Social Protection payments, these employees will not necessarily hold USC exempt status on the P2C/tax credit certificate. The exempt income itself should be flagged as USC exempt within the payroll.

Bright Contracts – Employment contracts and handbooks.

BrightPay – Payroll Software.