Apr 2021

1

BrightPay Customer Update: April 2021

Welcome to BrightPay's April update. Our most important news this month include:

-

Does the TWSS Reconciliation affect me?

-

Online Payslips: Their benefits and why you should use them

-

1 Year On – COVID-19 & Working from Home

TWSS Reconciliation – What you Need to Know

Most employers who availed of the TWSS should now have received a ROS inbox message in relation to the reconciliation process. Find out what you need to know about the TWSS reconciliation process and ensure you meet the June 30th 2021 deadline to accept the reconciliation.

The Vaccine & The New World of Work

As vaccines roll out and employee’s return to the workplace employers are looking to form their vaccine policy. Join our employment law experts for a free webinar on April 28th where we will provide you with all the information you need to know about managing COVID-19 in the workplace including the vaccine policy.

Good Friday – Bank Holiday or Public Holiday?

As Easter approaches, we remind employers that Good Friday is NOT a statutory public holiday. Easter Monday, on the other hand, is a Public Holiday. In respect of each public holiday, an employee is entitled to a paid day off on the holiday, a paid day off within a month, an extra day’s annual leave, or an extra day’s pay, as decided by the employer.

Take Advantage of BrightPay Connect

Learn how technology and automation turn daunting payroll tasks into a smooth and profitable process. Join our upcoming webinar on 6th April where we will look at how to address the challenge that most accountants face, over-servicing and under-charging.

Greener Supply Chain with BrightPay

Here at BrightPay we take environmental responsibility very seriously and are committed to developing our business towards ecological sustainability at both a company and an individual level. Our new carbon efficient offices will open in 2021. We have also recently established a passionate Green Team to educate, promote and inspire sustainability to our employees and our loyal customers Subscribe to BrightPay’s sustainability newsletter to follow our journey.

Mar 2021

30

How does the TWSS Reconciliation affect me?

Are you wondering why you now owe Revenue money as a result of The Temporary Wage Subsidy Scheme (TWSS)?

For the first 6 weeks of the TWSS back in March 2020, during the transitional phase, Revenue refunded a flat rate of €410 per employee per pay period, regardless of the employees' earnings. In a lot of cases this €410 exceeded the subsidy that the employee was entitled to receive, and it was made very clear from the start that there would be a reconciliation to rectify this overpayment.

The scheme was designed to assist employers and employees impacted by COVID-19, and to encourage companies to keep their workers on the payroll. If you didn’t avail of the TWSS then you won’t have a TWSS reconciliation.

On Monday 22nd March 2021, Revenue advised that most employers can now access their TWSS reconciliation balances in Revenue’s Online Service (ROS). The reconciliation balance is based on the actual information provided to Revenue by the employer.

The TWSS reconciliation period opened on 22 March 2021 and employers have until the end of June to review and accept the reconciliation amounts. Revenue are strongly recommending that employers take the time to read & understand the guidance before accepting the reconciliation amounts.

Approximately 40% of the employers that availed of TWSS are balanced. Revenue have said they will not pursue companies that owe a balance of under €500 as they will be considered balanced.

BrightPay hosted a TWSS reconciliation webinar with guest speakers from Revenue on 24th March 2021. During the webinar, we discussed the reconciliation process and had a Questions & Answers session at the end. Watch the webinar on-demand now.

You can also click here to register for our next webinar, which takes place on 21st April 2021

Related Articles:

Mar 2021

16

TWSS Reconciliation – An Important Update

One year after the introduction of the Temporary Wage Subsidy Scheme (TWSS), the Revenue reconciliation process is finally underway. Revenue have now compared the total subsidy amounts paid to employees, against the subsidy amounts paid to the employer. This has allowed Revenue to determine the amount of TWSS owed back to Revenue from employers.

All employers who availed of the TWSS will receive a Statement of Account in their ROS inbox on Monday 22nd March 2021. Employers will have until the end of June to review the detailed information and accept the reconciliation amounts. Once you have accepted the reconciliation calculation, you will either be paid any additional amount due to you by Revenue or be required to repay any amount that you owe to Revenue.

Free Webinar

Join Thesaurus Software for a free webinar on Wednesday 24th March at 10.30 am. In this webinar, we will be joined by a guest speaker from Revenue who will discuss what you need to know about the TWSS reconciliation process. Plus, we will demonstrate how to cross-check reconciliation amounts with the payroll software and how payroll automation can help your business during COVID-19.

Agenda

- TWSS Reconciliation Process

- Reconciling amounts in Thesaurus Payroll Manager

- Reconciling amounts in BrightPay

- How payroll automation can help you with COVID-19

*** High demand for this webinar. Book your place now to avoid disappointment. ***

If you are unable to attend the webinar at the specified time, simply register and we will send you the recording afterwards.

Related Articles:

Mar 2021

12

Online Payslips: Their benefits and why you should use them

Why switch to online payslips?

Online payslips have a number of benefits

The best payroll software not only makes processing payroll easy but also allows employees to quickly access their payslips. Gone are the days when payslips were printed and manually sent out by post. These days employees look for easy and immediate access to their wage information.

BrightPay Connect, an optional cloud portal that integrates with BrightPay payroll, provides new useful and impressive features. It allows you to secure your payroll data to the cloud and provides employers and employees with their own payroll dashboard which can be accessed through the web or by a smartphone app. Offering payslips online can bring numerous advantages to your business. Let’s take a look at five benefits of having payslips in the cloud.

1. Saves Time

BrightPay Connect and BrightPay payroll software are fully integrated. This means that once you’ve finalised the pay period on BrightPay, the payslips will automatically appear in the online portal according to your specified date and time settings. Your payroll processor no longer needs to spend time emailing or printing payslips. With BrightPay Connect, it’s quick and automatic.

2. Cost-Effective

Electronic payslips are cost-effective. You can reduce your spend on paper, print and postage. Even better, you can save money on labour time too. Less time spent on yet another administrative task frees up your employees so they can concentrate on more urgent responsibilities.

3. Environmentally Friendly

Switching to online payslips is an easy and quick win to help make your business more green. By providing payslips through a cloud portal, you can reduce the amount of waste you produce. Creating an environmentally friendly work environment also has the added benefit of appealing to employees who are eco-conscious.

4. Ensures GDPR Compliance

Payroll data contains sensitive personal information that must comply with all requirements set out by the GDPR. For instance, in the case of emailing payslips you are required to password protect them and set unique passwords for each employee. However, if you want to simplify the process while ensuring you’re compliant with the GDPR and all of its requirements, then using a secure cloud portal is the solution. Using BrightPay Connect, you can be assured you are GDPR compliant.

5. Cloud Security

Not only does BrightPay Connect ensure GDPR compliance but it also makes sure your employee data is protected from cyber-attacks, such as distributed denial-of-service (DDoS) attacks, authentication hacking, exposure flaws and request forgery. By utilising Microsoft Azure, BrightPay Connect keeps your employee’s payslip information safe when it is in transit and when it’s being stored.

Book a demo of BrightPay Connect today to discover more features that can help you streamline your payroll and HR processes.

Related Articles:

Mar 2021

10

COVID-19 & Working from Home - 1 Year On

It’s been exactly one year since BrightPay sent all employees to work from home for 2 weeks as a mysterious flu-like disease called COVID-19 began spreading across Ireland and the UK. Those 2 weeks have turned in 52 weeks... and counting.

On March 10th 2020, employees were given access to all the tools and resources needed to work from home well in advance of the lockdown panic that came towards the end of March 2020. BrightPay worked with employees to try and strike a balance between ensuring employees could be productive and focused when not in the office, whilst also juggling often hectic home lives as we all adjusted to lockdown. Keeping in-touch and keeping moral up was a key priority.

The company was in a fortunate position to be able to continue employing all members of staff during such a scary and uncertain time. BrightPay’s COVID-19 response plan involved additional staffing and increased hours to assist customers. With payroll being an essential service and part of every business, the show had to go on!

BrightPay has been at the forefront for employers and accountants when it comes to The Coronavirus Job Retention Scheme (CJRS) and were the first payroll software provider to release software upgrades to cater for the schemes as changes were announced. BrightPay’s overall response to COVID-19 was rated 98.6% in a recent customer survey, and this included payroll upgrades, webinars, online guidance and customer support.

BrightPay won the COVID-19 Hero Award (supplier) at the Accounting Excellence Awards that took place recently. There were a number of criteria that were considered by the panel for this award. Judging took into account the speed, time and relevance of businesses’ COVID-19 response and how many customers accessed it.

Despite all the COVID-19 scheme changes, upgrades and webinars, the developers have been kept busy constantly improving the software and introducing new features. BrightPay’s optional add-on product, BrightPay Connect now supports two-factor authentication sign in. This means you can add an extra layer of security to the employer login on your BrightPay Connect account in case your password is stolen.

As remote and flexible working are now the new normal, BrightPay in tandem with BrightPay Connect now allows for a completely seamless "working from home" experience where there are multiple individuals who work on or require access to the same employer files. BrightPay Connect can help you prevent conflicting copies of the payroll, including an ‘other user check’ and a ‘version check’ when opening the payroll.

Let’s hope we all return to a somewhat normal life within the next year, and that I won’t be writing ‘working from home 104 weeks later’ this time next year. BrightPay wishes you the very best as we enter Year 2 of living with COVID-19.

If you are looking to change payroll software provider or looking to bring your payroll in-house, please don’t hesitate to get in touch. Book a free 15-minute online demo to see how BrightPay can change your world of payroll.

Related Articles:

Mar 2021

8

International Women’s Day 2021

Thesaurus Software is proud to be supporting International Women’s Day 2021.

The theme of International Women’s Day this year is “Choose to Challenge”, a theme we wholeheartedly agree with. When we challenge the norms, the status quo, the “because that’s just the way it is”, we create change. At Thesaurus Software we firmly believe that change is necessary for development and improvement, so much so that it is embedded in our core values.

This year we are enhancing our Inclusion and Diversity efforts, in the hope that all staff will feel comfortable in bringing their whole self to work. International Women’s Day is our first day of celebration this year, our aim is not only to celebrate our women, but to raise awareness of inclusion more generally.

Promoting Gender Equality at Thesaurus

We are proud to say that we have always had a strong representation of women right across our company.

Our senior management team is 66% female. Across the Company as a whole, we are 64% female.

As we grow, we are continuously looking at how we can best assist our employees to grow and be themselves. In the last six months, we have introduced two key initiatives which help us achieve this.

- Firstly, LinkedIn Learning has been made available to all employees. LinkedIn Learning has been a game-changer for our employees and opened the window on learning and awareness.

- Secondly, we have just introduced paid maternity and paternity leave. We really hope that this will help new parents to be successful both at work and at home.

Our Female Leaders

We asked some of our female leaders for their thoughts on working in leadership;

“It’s important that all managers inspire, engage, and encourage their team. This is what I strive for. As a female manager, I’m very privileged to work for a company that recognises and promotes these values for both men and women equally. Females in any workplace should never underestimate what they are capable of achieving” - Karen Bennett, Chief Commercial Officer

“My advice to my 20-year-old self would be to think of your career as a marathon, not a sprint. Don’t ever settle on the first job or career path you undertake, if you are not invested in it. Allow yourself the time to discover what are you passionate about doing. Finding a job that I love has certainly helped me reach the point in my career that I’m at today.” - Victoria Clarke, Product Development Manager

“As a woman working for Thesaurus Software for the past 23 years and fast approaching retirement, I feel I am now entering the most exciting period of my career at Thesaurus Software and rather than winding down, the journey forward in this fast-growing company, supported by our amazing CEO, Paul Byrne has no limits.” - Ann Tighe, Senior Business Development Manager

“Working at Thesaurus as a woman in management, I feel inspired by other female leaders and peers within the company to lead my team with the same encouragement I feel every day. I have always felt hugely supported as a woman within Thesaurus which has provided me with the tools I need to motivate and empower my team, particularly as I progressed into the management role.” - Cailin Reilly, Sales Manager

“After joining Thesaurus Software as a Marketing Intern, I never thought that I would be where I am today after just 6 years. Working at Thesaurus Software has really given me the opportunity to progress, both in terms of personal and professional development. No two years have been the same and it has been an exciting time to be part of the team, helping the company grow to where it is today.” - Rachel Hynes, Marketing Manager

IWD 2021 in Thesaurus

Some of our fantastic team have taken part in the IWD challenge, standing up socially distantly and choosing to challenge. See their fab pictures below.

This year, we will also be using our LinkedIn Learning platform to raise awareness around inclusion and equity in the workplace. We have a series of short informative videos addressing a range of topics that we will share with staff remotely during March.

Our message to all our employees today is, bring your whole self to work, your thoughts and ideas are valued, we love to hear them. Working together, trusting, respecting and supporting each other we can only do great things.

Feb 2021

8

BrightPay Connect: Two Factor Authentication Explained

As security is a large concern for many businesses nowadays as data breaches are a threat to all entities, Two Factor Authentication can now be enabled as a feature for users of BrightPay Connect. Two Factor Authentication is a second layer of protection to re-confirm the identity for users logging into Connect through an internet browser or through BrightPay. This improves security, protects against fraud and lowers the risk of data breaches as users can access sensitive employer and employee data in Connect with the increased security layer.

BrightPay Connect is an optional cloud add-on feature that works with BrightPay. BrightPay Connect provides a secure, automated and user-friendly way to backup and a self-service dashboard to both accountants and employers so they can access payslips, payroll reports, amounts due to Revenue, annual leave requests and employee contact details.

How it works

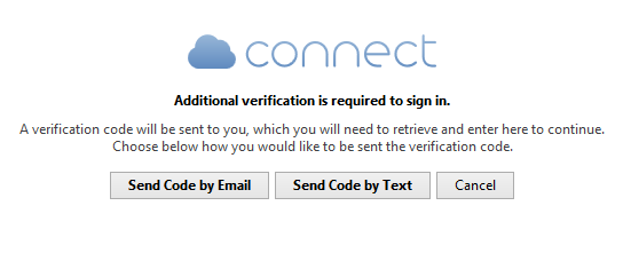

If Two Factor Authentication is enabled for a Connect account, when any user on the Connect account tries to sign into Connect via their internet browser here or through BrightPay, they will be asked to enter in a security code that needs to be sent to them. The user can select to have the security code to be sent by email or by text to the user.

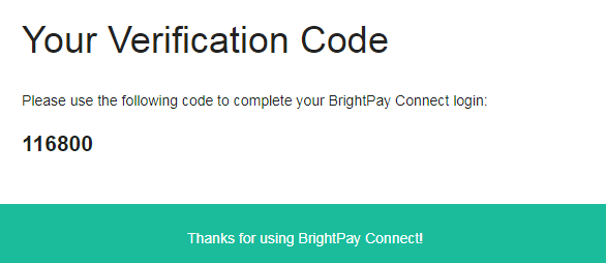

Once the user receives the security code the user enters this in the 'verify code' field and selects 'Verify Code'. The user will only be able to access the security code if they have access to the email account or mobile device. The random generated 6 digit security code will expire after fifteen minutes so a new code will have to be sent if the code is not used in the time limit.

This Two Factor Authentication uses a second security measure of identification ensuring the user is the correct user when logging into Connect. It adds an additional layer of security to an already secure hosted platform and gives the user more reassurance that their payroll data is safer and more secure.

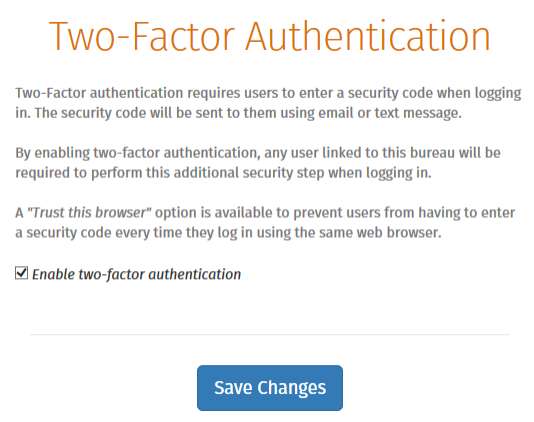

To Enable this option in Connect when you are logged in > Go to 'Settings' > Go to 'Two Factor Authentication' > Tick the box > 'Save Changes'.

Related Articles:

Feb 2021

2

BrightPay Customer Update: February 2021

Welcome to BrightPay's February update. Our most important news this month include:

-

Online support – Hundreds of BrightPay help guides at your fingertips

-

Lockdown 3.0 - What have payroll processors learned?

-

What to do in BrightPay when employees are on the Pandemic Unemployment Payment

EWSS Q&A – Common Questions Answered

As we are back in lockdown, some businesses are just now availing of the EWSS for the very first time. Here we have answered some of the most common queries that our customer support team are being asked.

Free Webinar: A Recap of Recent Wage Subsidy Scheme Changes

The past couple of months have seen a number of updates to both the TWSS and the EWSS, including TWSS reconciliation, employee tax bills, EWSS eligibility and subsidy rates. Register for this free webinar to make sure you keep up to date with the most recent updates.

Coming in February: BrightPay Connect supports two-factor authentication sign in

With two-factor authentication, you can add an extra layer of security to the employer login on your BrightPay Connect account in case your password is stolen. Instead of only entering a password to log in, you’ll also enter a code or use a security key.

Working from home with BrightPay

All BrightPay licences can be activated on up to 10 PCs, meaning you can easily process payroll whether you’re in the workplace or working from home. BrightPay Connect can help you prevent conflicting copies of the payroll, including an ‘other user check’ and a ‘version check’ when opening the payroll.

Feb 2021

1

EWSS Q&A - Common Support Queries

Due to the changes and updates to the COVID-19 Government schemes, our support team put together the top four common questions – asked by you and answered by us!

When earnings fluctuate and are within the limits for the Employment Wage Subsidy Scheme (EWSS) in some pay periods and not others, do we need to untick EWSS for the employee?

No. There is no need to remove the tick for EWSS, our software will remove the indicator from the payroll submission (PSR) in the pay periods the earnings fall outside the relevant limits.

The subsidy being received is more than we are paying the employees, do we pay the employees the difference or will we owe that money back to Revenue?

In some scenarios the employer will receive a subsidy greater than the wages they are paying; they will not have to repay that money to Revenue. The employee should only be paid the wages that are due and not any extra. In other scenarios the subsidy received from Revenue will be less than the wages they are paying.

What payments are permitted under EWSS e.g., can you pay the employees commission?

Yes. The EWSS is a subsidy payable to employers, therefore, it will not show on employee payslips or in myAccount. Under EWSS employers are required to pay employees in the normal manner i.e., calculating and deducting Income Tax, USC and employee PRSI through the payroll. Employees should be paid the wages that are due to them which can include commission, overtime etc.

When employees are claiming the Pandemic Unemployment Payment (PUP) from the Department of Social Protection, do we need to do anything on the payroll?

Yes. You should ensure that the employee’s payment is changed to zero, continue to update them with zero pay until such time you are paying them wages again.

More information can be found in the COVID-19 guidance section on our website or by visiting the COVID-19 Resources Hub.

Related Articles:

- Budget 2021: Employer Payroll Focus

- 7 Steps To Returning To Work After COVID-19

- BrightPay: The COVID Heroes of the Accounting World

Jan 2021

26

Lockdown 3.0 - What have payroll processors learned?

Lockdown hasn't been easy for any of us - you could say it's been a bit of a 'coronacoaster'. COVID-19 has made us realise what’s important to us. Whether that be connecting more with family or re-connecting with old friends through the social platforms we are so grateful to have during this time. As we are currently in lockdown 3.0, let's look back on some of the key lessons learned as a payroll processor over the past year during this time of crisis.

Importance of Remote Access

Payroll is one of the core functions of running any business, and so it is something that needs to be completed on time and without errors. When working from home, your staff might not be able to access all the tools and documents that they would normally be able to access, especially if your systems are on-premises solutions and files and documents are physical hard copies.

Due to COVID-19 and having to work remotely from home, it is now a necessity to be able to access your payroll data from home. Your payroll software should easily facilitate remote working with additional user access. BrightPay can be installed on up to 10 PCs per licence key, and this means that payroll processing is possible by up to 10 users, or from 10 different locations. This is very handy for if you have a number of employees working from home, all needing access to the payroll software.

We have also introduced new multi-user features that work in conjunction with BrightPay Connect, our optional cloud add-on, to improve the working from home experience. These new features include ‘version checking’ when opening an employer, and an ‘other users check’ when opening an employer. This new "working from home" integration gives you all the benefits of the cloud while utilising the power and responsiveness of your local device.

Importance of Reliable Software

The past year has been very frustrating for payroll processors. Not only had you the added workload of processing subsidy claims, but you also had to learn about the various schemes and ensure you kept up to date with the latest guidelines. That’s why it’s so important to use reliable payroll software from a reliable company.

We kept BrightPay up to date to cater for the relevant scheme changes, and we tried to automate as much as possible in the payroll software to make your life easier.

In a recent survey, we achieved a 98.7% rating for our overall handling of COVID-19 including customer support, payroll upgrades, COVID-19 webinars and online support. We also won a COVID-19 Hero Award, and this is because of our response to COVID-19 and how we have helped our customers throughout the past few months.

Importance of Cloud Backups

As most businesses are now working remotely for the foreseeable future, it leaves many businesses exposed to data loss. This is why cloud backups are so important.

If you only keep your payroll data on your desktop, you are at risk of losing the information. Have you thought about what would happen if your computer broke down or was hacked? How would you get your payroll data back quickly? Would employees still get paid if the information was lost?

BrightPay Connect is our optional add-on that works alongside the payroll software. BrightPay Connect provides a secure and user-friendly way to automatically backup and restore your payroll data on your PC to and from the cloud. It’s simply an added layer of data protection to keep your payroll data safe so you never lose your payroll data again.

Importance of Automation

Whether you’re an employer processing payroll in-house for your business, or an accountant or bureau processing payroll for a number of clients, automation is key. How much time do you spend managing annual leave, answering employee leave balance enquiries, retrieving lost payslips, and communicating with employees in general? Now is the time to eliminate those admin-heavy tasks!

Self-service online portals are changing the way businesses interact and communicate with their employees, whilst providing the cloud functionality to get things done smarter and faster. BrightPay Connect includes the ability to manage employee leave, communicate with employees, automate payslip distribution, run payroll reports and much more.

Book a demo of BrightPay Connect today to discover more features that can help you streamline your payroll and HR processes.