Jun 2021

30

EWSS changes under Ireland’s Economic Recovery Plan

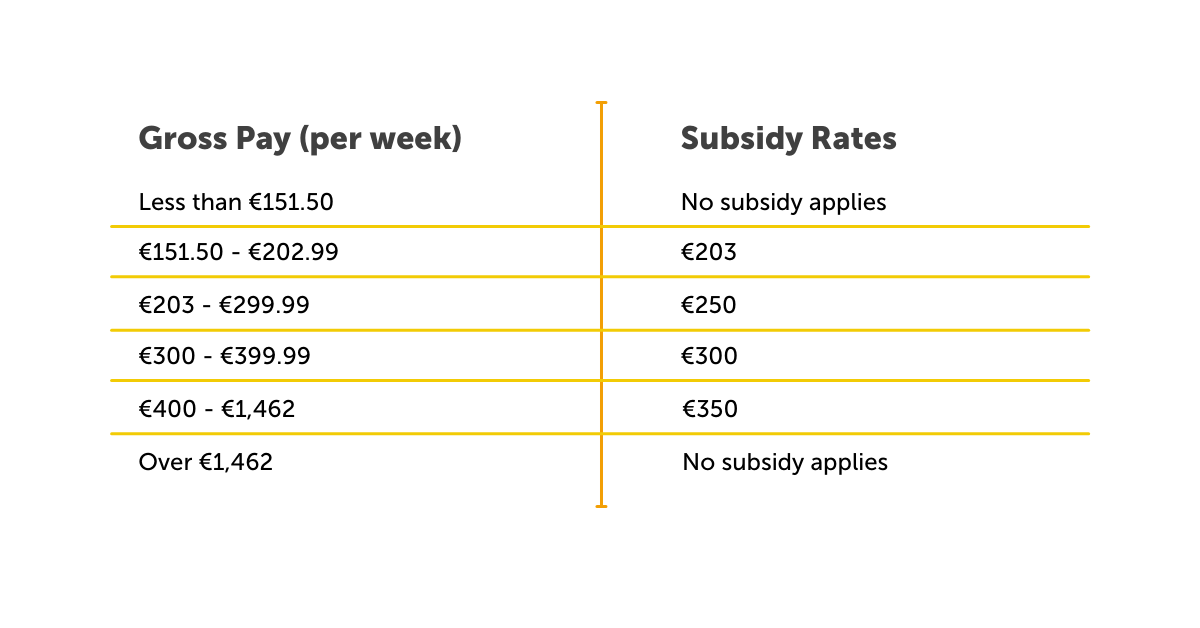

On the 1st of June 2021, the Government announced that the Employment Wage Subsidy Scheme (EWSS) would be extended until the 30th of December 2021 to support businesses as they continue to reopen and recover from the COVID-19 pandemic. The rates below will continue for July, August and September 2021.

A decision on the subsidy rates that will apply for October 2021 onwards, is expected to be announced toward the end of August or early September.

A decision on the subsidy rates that will apply for October 2021 onwards, is expected to be announced toward the end of August or early September.

The Government have set out an economic recovery plan for Ireland with measures to help businesses who have experienced significant negative economic disruption due to COVID-19 with a minimum of a 30% decline in turnover or in customer orders. The period for this been extended from 6 months to 12 months under the new recovery plan. If you are unsure whether you are within the guidelines or need more clarity, please see further Revenue guidance.

Although the EWSS is a subsidy payable to employers only and will not impact employee payslips, the scheme must still be administered through the payroll. Employers must operate PAYE on all payments, including regular deduction of income tax, USC and employee PRSI from your employees’ pay. With BrightPay payroll software you can simply tick that you wish to 'claim EWSS subsidy for this employee in this pay period' when processing the payroll.

Remember, you must continue to review your eligibility status on the last day of every month to ensure you continue to meet the eligibility criteria. If you no longer qualify, you should de-register for EWSS with effect from the following day and untick the EWSS tickbox in the payroll software.

Want to find out more about the Employment Wage Subsidy Scheme? Register for our next webinar on the 27th of July where our panel of payroll and HR experts will answer any questions that you may have.

Related articles:

Jun 2021

3

Avoid Annual Leave Backlog

Managers will likely be in a situation where many employees will request to take leave at the same time. Whether it’s during the summer months, winter months or during school holidays, there will be higher demand at certain times of the year. But how do you handle it?

Employers should have a clear policy on holiday requests. Typically, a “first-come, first-served” approach works well. While it might not be possible to please everyone and give them their requested time off, it is important that you deal with annual leave requests in a way that is transparent and fair to all employees.

With the average annual leave in Ireland at 4 weeks per year, a recent survey from Irishjob.ie revealed that the average employee only uses 60% of their full annual leave per year. Not taking the full allocation of annual leave has absolutely no benefit for employees. It also has no benefit for employers as if staff are not taking enough rest throughout the year it can lead to burn out and unproductivity. Employees should be encouraged to take their full annual leave days every year to avoid this.

Where possible, managers should allow and accept the annual leave requested. However, managers have the right to decline holiday requests (with the correct notice) if the timing of leave would result in the business being understaffed and unmanageable.

If your business is faced with a high demand for annual leave for certain time periods every year, you can require employees to take annual leave on dates chosen by the employer. Employers must give the employee at least one month notice before the period of leave requested.

By introducing BrightPay Connect, employees can access a self-service portal via an app on their smartphone or tablet device. They will be able to request leave 24/7 from anywhere, meaning they don’t need to be in the workplace to request leave. When an employee requests leave, the employer will get a notification to login to their online portal to approve or reject the leave. The requests will be time stamped so you can see the order in which they come in. Employers can access a company-wide calendar that will display all leave so that you can ensure adequate staffing before approving an annual leave request.

You can have multiple users on BrightPay Connect meaning each department/line manager can approve leave for their own department. More information on user access and permissions can be found here.

Book a 10-minute online demo of BrightPay Connect to discover how it can benefit your business.

Related articles

Jun 2021

1

BrightPay Customer Update: June 2021

Welcome to BrightPay's June update. Our most important news this month include:

-

Automatic enrolment delayed until 2023

-

How to use BrightPay when working remotely

-

Ransomware: How to protect your payroll data

Protect your payroll data from ransomware attacks

With the recent ransomware attack on the HSE still disrupting Irish health services, the subject of ransomware is on all our minds. Taking backups of your data is so important in order to quickly restore data to get back up and running as soon as possible. All data in BrightPay Connect is stored securely within Microsoft Azure data stores, access to which have been tightly restricted to a limited set of servers and IP addresses.

Employment Wage Subsidy Scheme extended

The EWSS continues to be a requirement for many, with 43% of small businesses still availing of the scheme. Yesterday it was announced that the scheme would be extended until 31 December 2021 with a modification to widen eligibility. The enhanced rates of support and the reduced rate of Employers’ PRSI will remain in place until at least September.

How to manage the annual leave backlog as the country Reopens

A self-service system is the simplest way to manage your staff's annual leave – both from a HR and employee perspective. Give employees control to request annual leave, view leave taken and leave remaining all through an app on their smartphone or tablet.

30 days until TWSS Reconciliation deadline

Employers have until June 30th, 2021, to:

- Accept the reconciliation calculation issued by Revenue

- Make corrections to payslips if necessary, or

- Make an enquiry through MyEnquiries

How Cloud innovation can help simplify the payroll process

By introducing cloud innovation to your business, employers can work more efficiently by streamlining administrative processes and delegating manual tasks to employees. Download our free guide to find out more.

May 2021

31

Ransomware: How to protect your payroll data

Unfortunately, we have all become way too familiar with certain concepts over the course of the past year. Concepts such as R number, variants etc. With the recent ransomware attack on the HSE still disrupting Irish health services, the subject of ransomware is on all our minds.

One of the important lessons that we can take from ransomware is how we should have backups to quickly restore data to get back up and running as soon as possible, if data was lost after a breach.

If you use BrightPay Connect alongside our payroll software, you can be assured that you already have this covered.

All data in BrightPay Connect is stored securely within Microsoft Azure data stores, access to which have been tightly restricted to a limited set of servers and IP addresses. These data stores are replicated across multiple data centres to protect against a major data loss event impacting a particular data centre. Furthermore, the data itself is encrypted and multiple versions of your employer data are retained as a further safeguard. All traffic into and out of BrightPay Connect is encrypted using SSL and we undergo regular penetration testing to ensure our public-facing applications are secure and resilient.

This should provide some comfort for you if you are already using BrightPay Connect.

If the payroll data on your own device is compromised, it should be worthless as many of the key fields (e.g. PPSN, names, bank details) are already encrypted within the software.

If you do not use BrightPay Connect, please ensure that you keep regular external backups of your data. You might even consider using BrightPay Connect for this. View the pricing model for BrightPay Connect where users are billed on a monthly subscription, based on usage where you only pay for what you use.

There are many other BrightPay Connect benefits that we would be delighted to show you on a free 15-minute demo. Book now.

Related Articles:

May 2021

26

Automatic enrolment delayed until at least 2023

The introduction of automatic enrolment in Ireland will be delayed until at least 2023. The scheme's purpose is for workers to supplement their state pension as a shocking 40% of private sectors workers rely solely on the state pension to fund their retirement. This will mean by law, that employers will have to enrol their employees in a workplace pension scheme. Auto enrolment was supposed to be introduced at the beginning of 2021. It’s now looking like it will be rolled out in 2023, but it could be extended yet again as the full details for auto enrolment are still being ironed out by the government.

How will auto enrolment work in Ireland?

During the phased roll out of auto enrolment, employees will be required to make initial minimum default pension contributions of 1.5% of their qualifying earnings, increasing by 1.5 percentage points every 3 years thereafter to a maximum contribution of 6% at the beginning of year 10.

Employers will be required to make matching (tax deductible) pension contributions on behalf of the employee at the specified contribution rate to help fund their retirement. This means that employees, employers and the State will each contribute to the member’s account.

What are the criteria?

Employees between the ages of 23 and 60 who earn €20,000 or more per annum (across all employments) will be automatically enrolled into a pension scheme with no waiting period. All employees outside of these criteria may opt in themselves. Mandatory auto enrolment requirements won’t apply to any employee who is already a member of a pension scheme, provided the scheme meets certain minimum standards.

Automatic enrolment will be an earnings-related workplace savings system where employees will retain the freedom to opt out if they wish.

Can I prepare for auto enrolment?

It's important that employers understand what they need to do and prepare early. Employers should educate themselves on auto enrolment and familiarise themselves with the terminology. Businesses may need to think about one-off costs to set up an auto enrolment pension scheme, as well as the ongoing cost of paying money into the scheme and managing the process.

If you are a new business and employing staff for the first time after auto enrolment is introduced, your legal duties for automatic enrolment will begin on the day your first member of staff starts work. There will be guidance and support available to ensure that businesses comply with auto enrolment.

Will my payroll software cater for this?

If you’re fortunate enough to use a good payroll software then this will handle and automate the administrative duties for you. With BrightPay, there will be no additional charge for any of the auto enrolment features. All of this will be included as part of your payroll software package, which also includes free customer phone and email support.

At BrightPay, we already experienced the rollout of auto enrolment in the UK. Auto enrolment phased in at the beginning of October 2012, starting with the larger UK companies. Every company in the UK enrolled employees into a pension scheme by 1st February 2018. BrightPay UK introduced auto enrolment features which enabled users to automate and simplify the entire process, so we are already experts in the field and well prepared for the rollout in Ireland.

The extension of auto enrolment beyond 2023 looks very possible as the target market for auto enrolment is younger, lower-paid workers in sectors such as Wholesale and Retail Trade, Accommodation and Food Services, Construction and Industry. These sectors have been worst affected by the COVID-19 pandemic. Adding an extra cost to these employers and employees who have been living off the pandemic unemployment payment (PUP) for the past year, to suddenly start paying into a pension fund, seems unfair and unlikely.

Related Articles:

May 2021

19

Returning to work and the (controversial) vaccine policy

As we finally leave Level 5 lockdown, we are taking one step closer to a more ‘normal’ life. As such, more businesses will be opening, more employees will no longer need to claim the Pandemic Unemployment Payment, and new employees will be hired. All of this means that employers have a busy few months ahead of them. There are a number of challenges associated with returning to work. As expected, businesses will need to adhere to the guidelines set out by the HSE and carry out risk assessments, while also managing administrative duties such as the annual leave backlog. Going forward, they will also need to look at how they manage and implement more permanent working from home solutions, as well as tackle the issue of a vaccine policy.

An upcoming webinar, hosted by Bright Contracts, our sister product, will discuss the new legislation surrounding working from home to ensure you are compliant, how to return your employees safely to the workplace when phased returns to the office begin and how to address the topic of vaccines and the workplace with your employees. This webinar has been specifically designed for employers and their Human Resources department.

The webinar will address:

- Working From Home: New legislation

- Return to Work Safely Protocol

- Vaccine Policy

- No Jab, No Job

These challenges may seem daunting at first, but if you’re prepared, you can ensure a smooth and safe return to the workplace and even use the changes to support improvements to your business and employee relationships. Managing a team, with some working from home and others in the office, will require regular communication. An online employer and employee portal can offer significant help with this. With an online portal, such as BrightPay Connect, an employer can communicate with the whole company or share confidential documents with specific employees such as those working remotely or are returning from leave. To learn more about this, click here.

Related Articles:

- Online Payslips: Their benefits and why you should use them

- COVID-19 & Working from Home - 1 Year On

- TWSS Reconciliation – An Important Update

May 2021

13

How to Manage the Annual Leave Backlog as the Country Reopens

Employers are well used to staff wanting to take holidays at the same time. It is inevitable that certain times of year like Easter or Christmas will be more popular than others. As we remain in lockdown, many employees will have saved their time off for when more restrictions are lifted, and they can enjoy their free time as much as possible.

With Hotels, B&Bs, guesthouses, self-catering accommodation and outdoor hospitality set to reopen in early June, we can expect a scramble in workplaces for employees to get their holiday requests in. While it might not be possible to please everyone and give them time off on their preferred dates, it is important that you deal with annual leave requests in a way which is transparent and fair. If they wish to, employers are permitted to specify when an employee should take their holidays, provided they give the required notice. However, this can leave some employees feeling hard done by and annoyed that they do not have control over the dates that they take off, especially if they are forced to take time off during COVID-19 restrictions. So, what is the best option for all parties involved?

An employee app that manages staff holidays

BrightPay Connect, an optional add-on to BrightPay’s payroll software, is the simplest way to manage your staff's annual leave – headache free. BrightPay Connect streamlines leave requests and leave approval. This is how it works:

1. The employee requests leave from the calendar in their BrightPay Connect mobile app or from their PC or tablet. This means employees can request leave anytime, anywhere.

2. The employer (or the person who has been assigned to oversee the management of that employee’s annual leave) is notified of the request on the dashboard of their own BrightPay Connect account.

3. The employer/manager can then either approve or deny the request at the click of a button.

4. The employee will receive a notification on their device informing them of whether their request has been approved or denied.

The most popular policy of granting annual leave is on a first come, first served basis. While this policy is the most fair; depending on the system in place, it can still be difficult to keep track of which employee requested the leave first. With BrightPay Connect, you don’t have that problem as you will be able to see the order in which requests come in. Employees also have the ability to request half days or request to cancel leave which has already been granted.

In the employer’s dashboard, from the calendar tab, the employer or manager can view a real time, company-wide calendar. At a glance, employers see which employees are on leave and the type of leave. This is especially handy nowadays when staff may be working from home and it is hard to keep track of who is off and who is not. Cloud integration means any approved leave requests will flow directly back to your BrightPay payroll software on your PC.

Using BrightPay Connect to manage employee’s leave means less conflict in the workplace and less stress all round. Book a demo today to find out the many other ways BrightPay Connect can improve employer/employee relationships.

Why not register now for our upcoming free webinar where we will discuss the EWSS scheme and highlight important tips to remember as you return to the workplace.

Related articles:

May 2021

4

BrightPay Customer Update: May 2021

Welcome to BrightPay's May update. Our most important news this month include:

-

BrightPay marks Earth Day 2021

-

Webinar on demand: TWSS Reconciliation & EWSS Changes

-

BrightPay and working from home

The TWSS reconciliation deadline is fast approaching

According to Revenue, just 28% of employers had accepted their TWSS reconciliation as of last week. By 30th June 2021, employers must have reviewed their reconciliation information, made any necessary corrections and accepted the reconciliation. If no action is taken by 30th June, Revenue will take it that you agree to the reconciliation balance. Any amount owing will be due and payable.

Free webinar: Leaving Lockdown: The End of the Wage Subsidy Scheme?

This webinar will discuss the current state of the Employment Wage Subsidy Scheme (EWSS). Will it be extended beyond its 30th June end date? Or perhaps a new scheme will be introduced to take its place. Plus, our payroll & HR experts will discuss the dos and don’ts of returning to the workplace.

How to avoid an annual leave backlog

As restrictions are lifted in Ireland, managers will likely be in a situation where many employees will ask to take leave at the same time. It is important that you deal with requests in a way that is transparent and fair. BrightPay Connect will show you who requested leave and when, and you can check the calendar prior to approving leave to make sure you have adequate staffing levels.

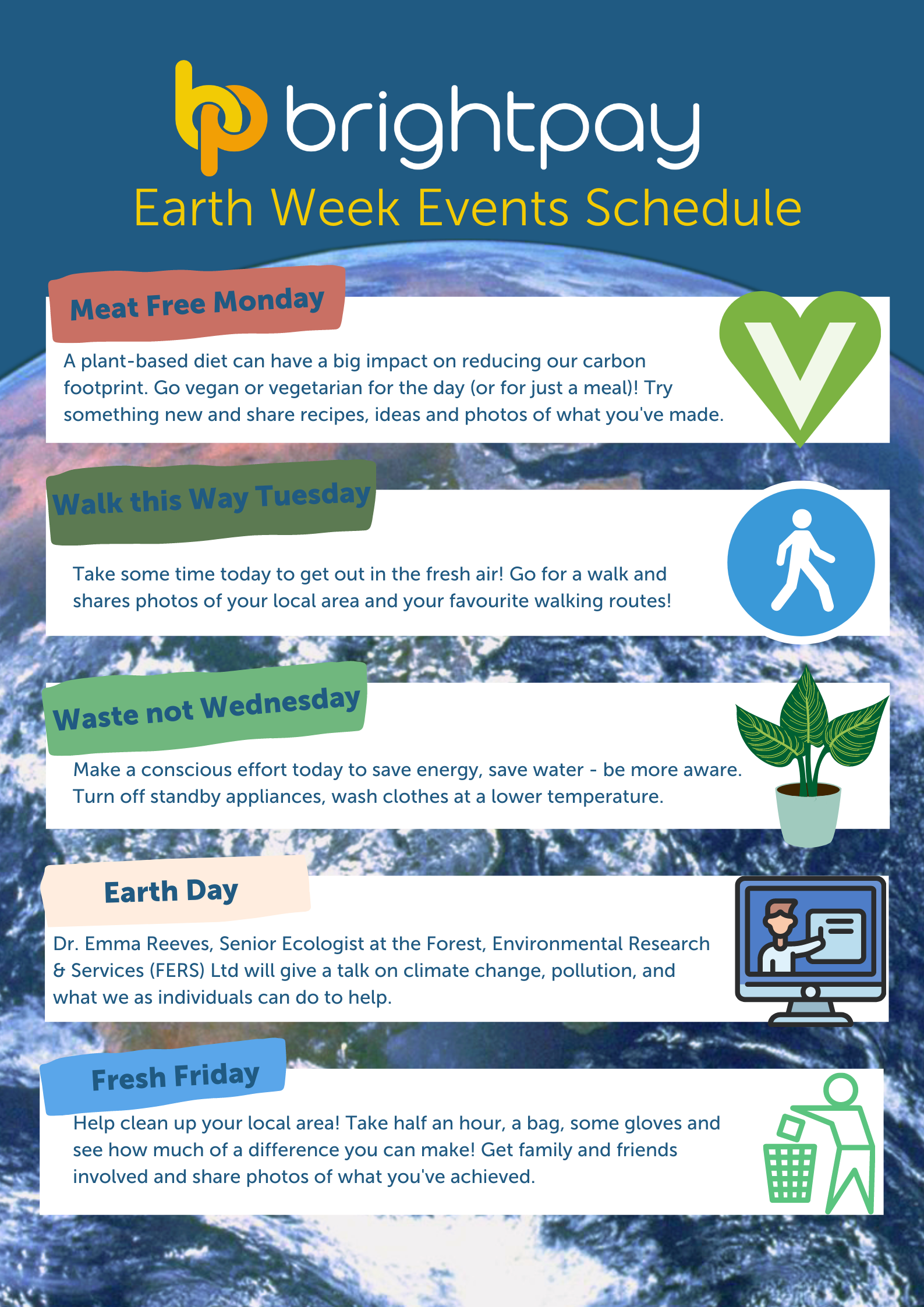

BrightPay celebrates Earth Day 2021

At BrightPay we are committed to a cleaner, greener future for all. Our Green Team celebrated Earth Day 2021 with a number of activities planned throughout the whole week. Here's what we got up to.

Apr 2021

28

How we celebrated Earth Day 2021

As you may know, at BrightPay we recently moved into our new offices which are purpose built to be energy efficient, affording us the opportunity to record and monitor our carbon emissions. It's a new start for the team and inspired by our energy efficient offices we would like to encourage employees to live a more sustainable lifestyle overall.

To help raise awareness amongst our employees, we have established the BrightPay Green Team which is made up of 12 team members, across multiple departments. The Green Team have been working on coming up with creative ways to make the company's operations more environmentally friendly. They also aim to encourage change amongst colleagues on an individual level, at home, at work and in the community.

In our first campaign to raise awareness, the Green Team celebrated Earth Day 2021 (April, 22nd) with a number of activities planned throughout the week.

As we continue to work remotely, we encouraged everyone to get involved and share photos of their activities online.

The BrightPay Team getting involved in Earth Day celebrations.

We started off our ‘Earth Week’ with ‘Meat Free Monday’. The production of meat and dairy products account for around 14.5% of global greenhouse gas emissions each year and so we encouraged employees to eat vegetarian or vegan meals for the day. On Tuesday we encouraged employees to take a walk in their local area. On Wednesday we asked employees to unplug devices, cut down on emails and have a ‘digital clean-up' to save C02 emissions. Thursday, April 22nd, was Earth Day and to celebrate we had a live online talk from Dr Emma Reeves, Senior Ecologist at the Forest, Environmental Research & Services (FERS) Ltd who discussed reducing our waste, the benefits of living a more eco-friendly lifestyle and the small changes we as individuals can make to help the planet. Friday was ‘Fresh Friday’ where we encouraged employees to go litter picking in their local areas.

Earth week was a success and we accomplished what we set out to do, which was to raise environmental awareness amongst our colleagues and encourage involvement in the company's sustainability efforts.

We will continue our dedication to creating a greener future. Subscribe to BrightPay’s sustainability newsletter to follow our journey.

Related articles:

Apr 2021

19

BrightPay marks Earth Day 2021

The first Earth Day launched fifty-one years ago in response to an emerging environmental consciousness, catalysed by a number of environmental disasters in the ‘60s. Although the stakes only grow as the years go by, we can appreciate that there has been a profound cultural shift since it began.

At BrightPay we are committed to a cleaner, greener future for all. This commitment will see us developing our business towards ecological sustainability at both a company and an individual level. Our new offices (opening soon!) are purpose built to be energy efficient, affording us the opportunity to record and monitor our carbon emissions. In addition to this, we have established the Green Team, an internal company initiative, to educate, promote and inspire sustainability among our colleagues and our loyal customers.

The Green Team members are brimming with ideas to identify and support the implementation of solutions to help BrightPay operate in a more environmentally sustainable way. Our plans, including those for Earth Day, are grounded in the belief that small actions at the individual level can build to create a larger change. We will leverage our individual power to influence, as an employee, a consumer, a voter, and as a member of our community.

In our first campaign to raise awareness, the Green Team will be celebrating Earth Day 2021 with a number of activities planned throughout the week. Take a look below at what we have planned. On Earth Day, we will be inviting Dr Emma Reeves, Senior Ecologist at the Forest, Environmental Research & Services (FERS) Ltd to discuss climate change, pollution, and what we as individuals can do to help.

Our dedication to the environment won’t stop at the end of the week. Subscribe to BrightPay’s sustainability newsletter to follow our journey.