Jun 2022

29

5 reasons to choose Surf Accounts Production

When it comes to creating financial statements to submit to the CRO, you need to ensure they are compliant. If your accounts fail to comply with the requirements, they will be rejected by the CRO. To make sure you meet the requirements whilst working efficiently, you should use an accounts production software which is easy-to-use, saves you time, and can improve the accuracy of your service. Surf Accounts Production is the software which can do all this, and more.

Here are 5 reasons you should choose Surf Accounts Production:

1. Cloud-based

As a cloud accounts production software, Surf can provide you with many benefits, such as the ability to work remotely. As it is cloud based, you can access, edit and share data via the internet, meaning you no longer have to rely on physical servers and hard drives. The cloud is also extremely secure, thanks to its use of encryption, so you can rest assured your data is protected. By using a cloud-based software, you can do all the work you could in the office, from anywhere with an internet connection.

2. Compliance

Surf Accounts Production is the number one software on the market when it comes to compliance. This is due to a number of reasons:

- We have a dedicated compliance team in place, who’s sole responsibility is to ensure that the accounts you create are compliant with all legislation.

- All the formats we provide are FRS 102 Section 1A and FRS 105 compliant, while dual jurisdiction ROI/UK and NI compliant versions are available.

- All compliance updates are done automatically, in the background. This means you don’t have to waste time sitting through system installations or system re-starts.

- Surf Accounts Production has been designed to allow you to edit financial statements 'on the fly,'. Once you've produced the accounts, you can make revisions without ever having to leave the document. To see how our ‘on the fly compliance function works, click here.

3. Tailored entity types

Surf Accounts Production offers 9 entity types for creating financial statements, which is more than any other accounts production software on the market. Our development team are also working on adding to these in the future. In comparison, some accounts production software providers offer a single financial statement template, which then must be manually edited to suit the client’s needs. With Surf, you can reduce the time you spend editing templates as you simply select the client’s entity type upon creation.

The financial statement formats which Surf Accounts Production currently provide are:

- Company

- Schools

- Sole Trader

- Farmer

- Credit Union

- Industrial & Provident Societies

- Club

- LLP

- Partnership

4. E-signing

Surf Accounts Production’s electronic signature feature became the first of its kind in the accounts production software market. Our partnership with HelloSign allows you to request e-signatures for a range of different documents, track the status of the signature, and download the fully signed version to your PC. By allowing clients to sign documents digitally, you can send documents in seconds, complete tasks faster, and reduce costs associated with travel or having documents couriered.

5. Integration with Surf Accounts (and BrightPay)

Surf Accounts Production has direct API integration with our bookkeeping extension, Surf Accounts. This integration allows you to conduct all your year-end and bookkeeping work from the one platform, eliminating the need to switch between your accounts production and bookkeeping software.

Additionally, Surf Accounts has API integration with BrightPay Payroll Software, allowing you to seamlessly upload your payroll journals from BrightPay into the accounting software, which can be accessed by Surf Accounts Production users who also hold a bookkeeping licence.

Ultimately, Surf Accounts Production is packed full of accounts production features which can make creating financial statements a breeze. With time saving features such as automatic compliance, tailored entity types and electronic signatures, you can better allocate your time to improve your productivity. To learn more about Surf Accounts Production, or it’s bookkeeping extension, Surf Accounts, book a free one-to-one demo with one of our product experts below.

Mar 2022

29

How payroll and accounting software integration can enhance your business

Are you fed-up of the repetitive and tedious task of uploading all your payroll information into your accounting software?

We get it – not only is it time consuming, but as an employer, it also leaves room for human error – whether it's from duplications of data or inputting the wrong employee details. This leads to more time being lost in identifying and resolving these errors, which in turn can damage your employee morale, as well as the efficiency of your business across the board.

What can be done to resolve this?

Here at BrightPay, we have recently integrated with Surf Accounts, a cloud-based accounting software that helps businesses, whether you’re an employer or an accounting firm, to take charge of your accounts.

Together, BrightPay and Surf Accounts can streamline the entire payroll process for you, eliminating the need to export your payroll information from BrightPay and import it to the accounting software manually. This is all thanks to API, which stands for Application Programming Interface.

What does an API do?

An API simply allows two applications to communicate and work together with one another.

This means that APIs work almost like a middleman, placing information conveniently all in one place, with the ability to send information to other systems.

BrightPay does this with many applications, such as Revenue for example. BrightPay communicates with Revenue to retrieve the latest RPNs to ensure that employees’ correct tax deductions and cut-off points are applied.

This also comes into play when BrightPay automatically creates the Payroll Submission Request (PSR) which is ready to be sent directly to Revenue from within BrightPay’s software, once the payroll is finalised. This allows you to save an incredible amount of time, while also ensuring you don’t forget this important payroll step and reducing the possibility of uploading issues.

We use APIs every day without even realising it. APIs are working behind the scenes to make our lives as convenient as possible. For example, Google and Apple use APIs to display weather data in their systems. They don’t run weather stations, but instead simply allow the data from these weather providers to be displayed within their software, simplifying the process for you.

BrightPay integrates with five different accounting software to streamline your payroll process even further. Other examples of APIs in our software are our integration with payment platform Modulr, and pension providers.

Watch this quick three-minute video on a brief overview on BrightPay’s seamless API integration with Surf Accounts.

.png)

How does this help my business?

Payroll and accounting software have always been separate systems, never communicating with one another. Employee salary details have always needed to be entered manually into both software, which is an extremely time-consuming and repetitive task for employers.

With the BrightPay and Surf Accounts integration, your payroll information is now sent from the payroll software straight into the accounting software, eliminating the need for you to manually upload these details.

BrightPay simply produces a payroll journal which can be viewed and downloaded. You can then send this journal into the general ledger in Surf Accounts, directly through BrightPay.

This ensures your payroll information is accurate and correct, preventing errors across the board and improving the efficiency of your business.

Some of the main benefits include:

- Streamlining your entire payroll process from start to finish

- Allowing you to spend more time attending to more productive business matters

- Submitting data in just a few clicks

- Eliminating costly mistakes, saving you hours of time

- Improving the efficiency of your workflow

How does it work?

Simply click into the journal button on the menu bar within BrightPay’s payroll software, and click into Surf Accounts. After that, you choose a date range and BrightPay will retrieve your nominal accounts from Surf.

Next, all that’s left is to choose your nominal ledger mapping (where you want to post your data within the accounting software, adding any necessary variations). The nominal ledger mapping is saved, so you don’t need to redo do it each pay period. The information you submitted is then found in the journals section within Surf Accounts, ready to be processed.

Please view our short guide on how to use Surf Accounts’ API within BrightPay’s software.

Why should I use BrightPay?

Here at BrightPay, we are constantly developing our software to solve problems for payroll processors, whether you’re an employer, an accountant or a payroll bureau. We are an award-winning software, recently winning top payroll product at AccountingWeb’s Software Excellence Awards in 2021.

Our payroll software includes full functionality for PAYE modernisation and is fully Revenue complaint. We provide free phone and email customer support, with over 330,000 businesses using our software across Ireland and the UK, and a 98.8% customer satisfaction rate.

We also provide a range of online resources, including webinars, guides and video tutorials that are completely free for you to access from anywhere, at any time.

“I find BrightPay to be very user friendly and has all the features required to run payroll efficiently for an SME. The updates and customer support are excellent.

I recommended BrightPay to another SMB that I work for and they switched from another market provider in 2016 with ease and are very satisfied with BrightPay now.”

- Lorraine Walters , Acara Energy Ltd

Where can I find more information?

We recently hosted a live webinar covering a more in-depth analysis on how BrightPay’s integration with Surf Accounts works.

The webinar includes the following:

- The Importance of Automation

- What Payroll Journal Integration is

- How BrightPay’s Integration with Surf Accounts can help you

- The Benefits of Integrated Payroll & Accounting Systems

- Other API Integrations in BrightPay

Watch a recording of the webinar here.

Our cloud extension

Here at BrightPay we also have a cloud extension, BrightPay Connect, that allows both you and your employees to access payslips and HR information through a secure online self-service portal.

BrightPay Connect also backups up payroll data to the cloud every 15 minutes, to a fully secure remote location. This means that there’s always a backup available and ready to download, should a crisis arise.

Other BrightPay Connect features include:

- Annual leave management

- GDPR compliance

- Company calendar

- Interactive employee app

- Document sharing with emeployees

- The ability for employees to update their personal information

If you’re interested in BrightPay Connect, sign up for a free 15-minute demo to see how BrightPay Connect can work for your business.

Related articles:

Sep 2021

16

Seamless integration at your fingertips

BrightPay recently announced that new journal integrations were added to the payroll software. These integrations allow customers of AccountsIQ, Quickbooks Online, Sage Business Cloud Accounting, and Xero to send their payroll journal directly from BrightPay to their accounting software at the click of a button. In BrightPay, your payroll journal file is customised to the individual accounting software provider, with compatible files and built-in nominal ledger mapping. Using the integrated system means you can save time, reduce mistakes, and improve your payroll workflow.

How important is an integrated accounts and payroll system?

An integrated accounting and payroll system can simplify how you work and allows you to have the best of both worlds. You can have your payroll software with its easy-to-use interface and full functionality without having to spend unnecessary time exporting payroll data to your accounting software. With the journal API (Application Programme Interface) integrations you can:

Save time:

If you are responsible for carrying out payroll duties and sending this data to your accounting package each pay period, you are familiar with the amount of time it can take. By using the API you can significantly reduce the amount of time you spend on this task. Instead of exporting and importing the figures manually, the payroll journal is sent directly to your accounting software and the figures are automatically added to the general ledger.

Reduce costly mistakes:

Double entry of figures can result in costly mistakes that end up taking time to identify and correct. The API integration means that this data is transferred straight from BrightPay payroll software directly to the journal, avoiding any chance of errors occurring.

Improve efficiency:

The purpose of an API integration is to allow two systems to communicate with one another in order to improve business processes and enhance productivity. With the payroll journal integration you can benefit from a quicker and more efficient workflow. The payroll information can be set up to be sent to the relevant ledgers. For example, you can post wages and salaries cost from the payroll to the nominal ledger account in your accounting software called ‘Wages and Salaries’. If you want to create any exceptions to this, you can. For example, you can separate out the costs of directors’ salaries to be mapped into a separate nominal account.

How does the BrightPay journal integration work?

The set-up of the API for the different accounting software is very similar. Using the API for AccountsIQ as an example:

- First, sign into your AccountsIQ account in BrightPay.

- The nominal ledger accounts will be retrieved.

- Map each payroll data item to the relevant nominal account.

- The payroll journal can include records for payslips across multiple pay frequencies.

- A nominal account can be used for multiple items.

- Specify any circumstances for which amounts should be mapped to an alternate nominal account code.

If you are using a different accounting software, you can discover how to set it up by clicking the following links: Xero, Quickbooks, and Sage Business Cloud Accounting.

Learn more:

If you’re interested in learning how BrightPay can improve your payroll services and save you time, schedule a 15-minute demo with a member of our team today.

Related Articles:

Oct 2013

4

CPA Ireland – Practitioners’ Conference 2013

CPA Ireland held their Practitioners Conference in Carton House Friday 20th & Saturday 21st September 2013. Laura Murphy and Audrey Mooney from Thesaurus Software attended the conference. Laura and Audrey enjoyed meeting existing Thesaurus Payroll Manger and Solutions Plus customers – getting their feedback and comments.

It was also an opportunity to show Bright Contracts and our new payroll product BrightPay.

- Bright Contracts is an innovative software package that has everything you need to create and manage your staff handbook and and employment contracts.

- BrightPay is simple to use yet powerful and flexible, it will be offered alongside Thesaurus Payroll Manager giving customers a choice of payroll products.

Laura Murphy (left) and Audrey Mooney at the recent CPA conference

Sep 2013

24

What our customers say!

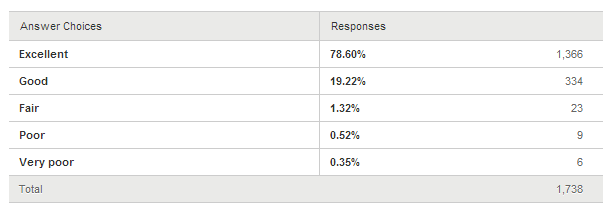

In a recent customer survey, 97.82% of respondents ranked the quality of our customer support as Excellent or Good.

This customer support covers our payroll software (Thesaurus Payroll Manager and BrightPay), our employment contracts software (Bright Contracts) and our accounts software (Solutions Plus) and is free to all registered users.

While the excellent/good percentage achieved would be way ahead of industry standards, we hope to reduce the 2.18% who ranked our support as fair or poor!