Oct 2019

9

Budget 2020 – Employer Focus

Finance Minister Paschal Donohoe announced Budget 2020 with very few changes:

- There is no change to tax credits, cut off points or the rates of PAYE

- There is no change to the rates of Universal Social Charge (USC)

- The Earned Income Tax Credit will increase by €150 to €1,500

- The Home Carer Tax Credit will increase by €100 to €1,600

- The Benefit In Kind will remain as 0% on electric vehicles provided by an employer to an employee until 2022

- The Minimum Wage increase of 30c recommended by the Low Pay Commission has been deferred due to the threat of a no-deal Brexit. The current rate of €9.80 per hour will remain until there is more clarity on Brexit.

PRSI:

The National Training Levy which is collected as part of Employer PRSI will increase by 0.1% from 0.9% to 1% in 2020 to fund further and higher education.

| 2019 | 2020 | |

| Employer PRSI Class A Reduced Rate | 8.7% | 8.8% |

| Employer PRSI Class A Higher Rate | 10.95% | 11.05% |

| Employer PRSI Class H | 10.25% | 10.35% |

Feb 2019

9

Employers - The P35 deadline is fast approaching!

The P35 deadline is fast approaching, the deadline is February 15th. The deadline for an employer who pays and files electronically via Revenue Online Services (ROS) is extended to the 23rd of February.

Although PAYE Modernisation is now live, it is important for employers to remember that this end of year return is still required for the 2018 tax year. Failure to make a P35 return by this date may result in a fine.

With PAYE Modernisation, employers are required to send a real time payroll submission to Revenue each pay period. This submission is similar to the P35, and contains details of each of your employees, including PAYE, PRSI, USC and LPT. As Revenue will be receiving the periodic file submissions in real time, from 2019 onwards this end of year process for employers is no longer required. 2018 is the final year for which a P35 is required.

Please note, the deadline for issuing employees with P60s is also February 15th. Tax year 2018 is also the final year in which P60s will be issued to employees.

Help Documentation

To view our online documentation click on the links below:

Extended Customer Support Hours

This year, our support team have extended and Saturday opening hours until Saturday the 16th of February 2019.

Our opening hours for this period are as follows:

- Monday to Thursday - 8 am to 7 pm

- Friday - 8 am to 6 pm

- Saturday - 9 am to 1 pm

Nov 2018

9

Manually Processing Payroll with PAYE Modernisation

PAYE Modernisation is the most significant change ever to happen to the Irish PAYE system. The new legislation will be a big change for all employers, especially those with little payroll experience. With the added workload required to process PAYE Modernisation, it is important that all employers prepare for PAYE Modernisation. From the very beginning of the year, employers must be ready to start reporting their payroll information to Revenue in real time.

Revenue estimates that a large number of employers still calculate their payroll manually. With PAYE Modernisation, these employers can still process their payroll using a manual, spreadsheet or paper-based system, but this outdated process will be time-consuming, cumbersome and prone to errors. Failing to comply with PAYE Modernisation will result in penalties or fines being imposed from Revenue.

Employers who process payroll manually will need to login to the ROS portal each pay period, be it weekly or monthly, and manually enter the required details for each of their employees, a bit like manually completing a P35 each pay period. Also, before processing the payroll in any week, manual users will need to login to ROS to get details of tax credits and cut off points.

Many business owners believe that a manual payroll system is a relatively easy way to manage their payroll and can seem like the most cost-effective option. However, along with the additional time required to process payroll, a manual system can result in inaccurate payroll processing as it does not have built-in processes to catch mistakes or notify you of payroll changes. Manual records are also very difficult to maintain, store securely under GDPR and are subject to greater human error. It is important to note that late periodic submissions or a constant pattern of correction submissions will potentially result in non-compliance penalties and fines.

PAYE Modernisation with Payroll Software

Revenue has strongly advised employers to review their payroll processes and systems to ensure they meet the new PAYE Modernisation requirements for January 2019. Payroll software which caters for PAYE Modernisation will improve and simplify communications between employers and Revenue.

If you have the correct payroll software tools in place, the ongoing reporting to Revenue will be seamless, ultimately saving time and reducing the risk of errors each pay period. Employers using payroll software that is Revenue compliant will be able to create and send the periodic PSR submission directly to Revenue from the payroll software at the click of a button. This integration with Revenue will also allow employers to automatically retrieve RPNs for employees from within the payroll software. Changes to an employees tax credits and cut-offs can then be updated in the payroll software with just one click.

Free Online Training

Thesaurus Software and Revenue have teamed up to bring you free PAYE Modernisation training webinars. We have put together a series of webinars aimed specifically at employers who are currently processing their payroll manually. During the webinars, we will look at the advantages and disadvantages of manually processing your payroll for PAYE Modernisation. Places are limited - Click here to book your place now.

Thesaurus Software is at the forefront when it comes to PAYE Modernisation complaint payroll software. With two different payroll packages to choose from - Thesaurus Payroll Manager and BrightPay - customers will be guaranteed leading-edge software and expertise. To help single-employee companies with their PAYE Modernisation duties, we are offering a free BrightPay employer licence for 2019. This free licence includes free email support and full functionality for PAYE Modernisation.

Related Articled:

- How do you submit payroll information with PAYE Modernisation?

- Manually processing payroll? It's time to modernise your payroll processing!

- How to master PAYE Modernisation

Thesaurus & BrightPay Newsletter - Are you missing out?

We will not be able to email you about webinar events, special offers, legislation changes, other group products and payroll related news without you subscribing to our newsletter. You will be able to unsubscribe at anytime. Don’t miss out - sign up to our newsletter today!

Thesaurus Payroll Software | BrightPay Payroll Software

Oct 2018

12

How to Master PAYE Modernisation

In January 2019 Revenue will begin to enforce a new Pay As You Earn system that will introduce real-time reporting of employee’s tax and other deductions directly to Revenue every time an employee is paid. This new system will be known as PAYE Modernisation.

Although the new system is expected to cause a lot of confusion, particularly for small and micro employers, PAYE Modernisation will seek to provide a much more accurate solution to the current PAYE system and ultimately benefit all employers and employees.

For over two decades, Thesaurus payroll software has supported businesses both large and small to pay hundreds of thousands of employees every month. At Thesaurus and BrightPay we are working directly with Revenue to make sure we’re ready for PAYE Modernisation. Our aim is to ensure the new PAYE process is a seamless and smooth process for our users.

Our development team have already experienced what it is like to implement real time processing and reporting in the UK. Our understanding and knowledge coupled with the reliability and maturity of Thesaurus payroll software will guarantee a user-friendly PAYE Modernisation experience.

We understand how stressful this change is going to be for payroll professionals and as a result, to help you get it right, Thesaurus have teamed up with a Revenue representative to bring you a series of webinars where you’ll gain the knowledge needed to comply with and master the new PAYE changes. Places are limited - secure your place today.

PAYE Modernisation: Key facts you must know to ensure 100% compliance.

Agenda:

- An overview of PAYE Modernisation

- Recent updates and changes to PAYE Modernisation

- Can PAYE Modernisation be processed manually?

- Elimination of the P forms - P30, P60 P35, P46 and P45 forms

- Making corrections in real-time

- The role of payroll software

- How PAYE Modernisation will affect small employers

- The benefits of PAYE Modernisation for you

- 10 step Checklist to PAYE Modernisation

- How Thesaurus Payroll handles PAYE Modernisation

The Panel

Main presenter: Paul Byrne

Guest presenter: Sinead Sweeney

Guest presenter: Sandra Clarke

More information | Secure your place

Read More Like This:

PAYE Modernisation: Meet the experts

PAYE Modernisation: What you need to know

GDPR and Payroll Processing. Do I need consent from my client's employees?

Thesaurus & BrightPay Newsletter - Are you missing out?

We will not be able to email you about webinar events, special offers, legislation changes, other group products and payroll related news without you subscribing to our newsletter. You will be able to unsubscribe at anytime. Don’t miss out - sign up to our newsletter today!

Thesaurus Payroll Software | BrightPay Payroll Software

Apr 2018

19

Real time reporting to become part of payroll processing

In less than a year the current PAYE system is going to change remarkably with the introduction of real time reporting known as PAYE Modernisation. The current payroll system hasn’t been modified since it was first introduced in the 60’s.

The main objective of PAYE Modernisation is to enable clear communication between Revenue and those who are processing payroll. This change will affect most, if not all businesses across Ireland.

Some of the common questions people have asked about PAYE Modernisation are:

- What do I have to do differently for PAYE Modernisation?

PAYE Modernisation will mean that people processing payroll will now how to submit a file to Revenue every pay period as opposed to the current annual ‘P’ forms. Payroll Software will make this a hassle free process, ensuring employers can easily comply with PAYE Modernisation.

- Will PAYE Modernisation be complicated?

PAYE Modernisation will likely cause a significant burden to employers, particularly small employers that do not currently utilise payroll software. BrightPay and Thesaurus Software will be fully equipped to make PAYE Modernisation a seamless process for payroll processors. Our developers have already implemented a similar real time reporting process for our UK payroll software.

- What will PAYE Modernisation cost my business?

As reports will need to be submitted to Revenue every pay period a lot of businesses will be relying on payroll software to do this for them. If you do not have payroll software in place, now is the time to think about purchasing. Luckily, low cost payroll software, like BrightPay and Thesaurus payroll will seamlessly handle PAYE Modernisation.

- Will PAYE Modernisation take up a lot of my time?

For companies still processing payroll manually, PAYE Modernisation will likely impose a significant time burden. For employers utilising payroll software like BrightPay and Thesaurus Software, administrative tasks will be significantly simplified. PAYE Modernisation reports required by Revenue can be sent easily from within the software. Also, the introduction of PAYE Modernisation has meant the elimination of the time consuming annual ‘P’ forms.

Free PAYE Modernisation Webinars

If there is something you’re still unsure of relating to PAYE Modernisation, we have teamed up with Revenue to bring you free online training webinars. These webinars are designed for employers and payroll bureaus to discuss what PAYE Modernisation will mean for your business and to help you prepare for the transition to the new system. You can sign up to our newsletter to get an invitation to our next PAYE Modernisation webinar.

Thesaurus & BrightPay Newsletter

GDPR is changing how we communicate with you. After May 2018, we will not be able to email you about webinar events, special offers, legislation changes, other group products and payroll related news without you subscribing to our newsletter. You will be able to unsubscribe at anytime. Don’t miss out - sign up to our newsletter today!

Thesaurus Payroll Software | BrightPay Payroll Software

Related Articles:

Feb 2018

5

PAYE Modernisation - Why it’s the SMART choice.

The current PAYE system is changing. The new system will be known as ‘PAYE Modernisation’. This change will be the biggest to hit PAYE since it was introduced almost 60 years ago. PAYE Modernisation will affect every business across the country. Instead of submitting an annual P35, employers will now have to calculate and report their employee’s pay and deductions as they are being paid.

PAYE Modernisation will no doubt be a huge change for employers but ultimately, employers will see a benefit from the change. Here are some of the key benefits employers can expect to see from PAYE Modernisation -

- Seamless integration into payroll.

- Minimize employer cost to comply.

- Abolition of P30s, P45s, P60s and end of year returns.

- Right tax paid on current due dates.

- Time savings.

We already have the relevant experience to ensure that PAYE Modernisation will be a seamless process for employers. In our BrightPay UK payroll software, we implemented what’s called RTI or Real Time Information which is a similar concept to PAYE Modernisation. Book a demo today to see what PAYE Modernisation will look like on your payroll software.

Related articles:

PAYE Modernisation - Are you ready?

Revenue moves to PAYE Modernisation/ Real Time Reporting

New Automatic Enrolment pension system to be in place by 2021

The objective of PAYE Modernisation

Thesaurus Payroll Software | BrightPay Payroll Software

Nov 2017

6

PAYE Modernisation - Are You Ready For January 2019?

Revenue has released an information leaflet titled “PAYE Modernisation – Are You Ready?”. This kick-starts their awareness campaign for businesses to get ready for payroll changes called PAYE Modernisation or Real Time Reporting (RTR). Revenue outlines the steps that all employers need to take in order to ensure that their current records and obligations are up-to-date and correct.

PAYE Modernisation will change how employers report payroll information for their employees to Revenue. A file will need to be submitted (electronically) to Revenue, containing all details of employee payments. The contents are similar to the annual P35, however, this file will be submitted every pay period (weekly, monthly, fortnightly, etc.).

If you are an employer who uses payroll software, then the work involved to comply with PAYE Modernisation will be minimal. However, for smaller employers who do not use payroll software, the process of complying with PAYE Modernisation will be time-consuming and stressful. Currently, these employers make one manual submission to Revenue through their annual P35. With PAYE Modernisation, these employers will be required to make an employer submission to Revenue each pay period in real time. The employer submission will contain details comparable to what currently appears on an employer’s P35 return.

With PAYE Modernisation in mind, Revenue has contacted nearly 400 employers regarding their P35L returns for 2016. These returns contained employees who were never previously registered as working with the employer. This communication reminds those employers of their obligation to comply with PAYE regulations and requests those employers to submit a P46 for the non linked employees currently in their employment, the commencement date should be input as 1st January 2017 for employees that commenced employment before the current tax year. This action will then result in a new P2C (tax credit certificate) being issued for these employees.

Related articles:

Jul 2017

19

National Minimum Wage Proposed Increase of 30c per hour

The Low Pay Commission has recommended that the National Minimum Wage be increased by 30c per hour, from €9.25 per hour to €9.55 per hour from 1st January 2018. An employee working a 40 hour week will see their gross wage increase by €12.00 a week. Since 2011 this is the fourth increase in the national minimum wage.

In the report the Low Pay Commission has published it has explained with necessary data of its recommendation of the increase, including international competitive and risks to the economy research. In The Low Pay Commission’s findings submissions from interested parties and consultations with employees and employers in relevant economic sectors had taken place.

This increase will affect around 120,000 employees, increasing their national minimum wage by 3%. 10.1% of employees were earning the National Minimum Wage or less last year according to figures published from the Central Statistics Office last April.

While Taoiseach Leo Vardakar said ‘The Government welcomes the recommendation from the Low Pay Commission to increase the National Minimum Wage by 30c to €9.55 per hour’, the Programme for Government commitment for a minimum wage of €10.50 per hour is still a few steps off.

Mar 2017

31

Important Information for Employers - Changes to Civil Service Travel Rates

Where employees use their own private cars or motorcycles for business purposes, reimbursement in respect of allowable motoring expenses can be effected by way of flat-rate mileage allowances.

There are two types of mileage allowance schemes which are acceptable for tax purposes if an employee bears all the motoring expenses:

- The prevailing schedule of Civil Service rates; or

- Any other schedule with rates not greater than the Civil Service rates

The Department of Public Expenditure and Reform has recently published circulars with new Civil Service Travel Rates, the revised rates are effective from 1st April 2017. The distance bands have increased from two to four with a lower recoupment rate for the first 1,500 kilometres.

Business travel carried out between 1st January and 31st March 2017 will not be affected by these new bands and rates, business travel to date from 1st January 2017 will count towards the cumulative business travel for the year.

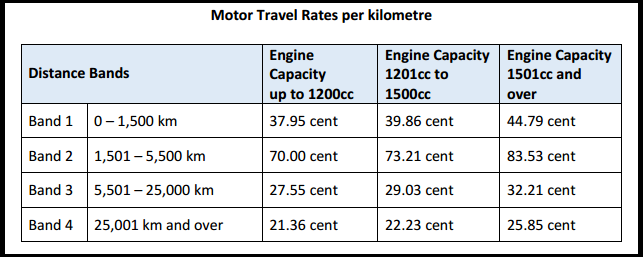

Motor Travel Rates - Effective from 1st April 2017

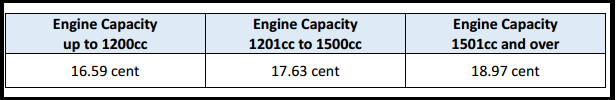

Reduced Motor Travel Rates per kilometre

The reduced rates are payable to Civil Service employees who undertake a journey associated with their job but not solely related to the performance of their duties, such as:

- Attendance at confined promotion competitions

- Attendance at approved courses of education

- Attendance at courses or conferences

- Return visits home at weekends during a period of temporary transfer

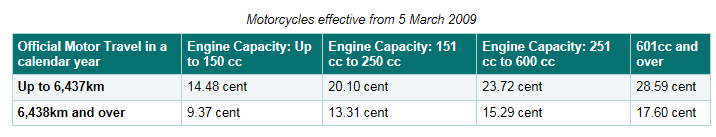

The Motor Travel Rates for motorcycles and bicycles remain unchanged as follows:

Motorcycle:

Bicycle: 8 cent per km

Please note, there are changes to subsistence rates which are also effective from 1st April 2017.

Please click here for the circular on Motor Travel Rates, and here for the circular on Subsistence

Mar 2017

20

New Illness, Maternity and Paternity Benefits rates in effect

Almost all welfare benefits and state pensions are to be increased in 2017.

The maximum weekly Illness Benefit payment will increase by €5.00 from €188 to €193 per week from week commencing 13 March 2017.

Illness benefit is considered as income for tax purposes and thus needs to be taken into account for PAYE purposes by an employer. It remains exempt from USC & PRSI.

No payment is made for the first six days of illness and for any Sunday.

Thesaurus Payroll Manager will automatically apply the increased rate of €193 per week as soon as Week 12 is reached in the software, which users should be aware of. Further information on how to process illness benefit in Payroll Manager can be found here:

In addition, standard Maternity and Paternity payments will increase from €230 to €235 per week from 13 March 2017. These are both taxable sources of income but aren’t liable to USC or PRSI. Unlike illness benefit, however, an employer must not tax these benefits through payroll. Instead, the Revenue will tax Maternity and Paternity Benefit via the employee’s tax credit Certificate by reducing the employee's SRCOP and tax credit on receipt of information from the Department of Social Protection.