Sep 2016

10

Jobs & Pensions Service – New Online Service for Employees

The Jobs & Pensions Service available from Monday 12th of September 2016 is a new online service for employees. Irish employees can register their new job (or private pension) with Revenue using the service.

The Jobs and Pensions service replaces the Form 12A, meaning employees must register their first job in Ireland using the service. After registering employment using the service a tax credit certificate will issue to both the employer (P2C) and employee.

The service can also be used by employees who are:

• changing jobs provided the previous job has been ceased on Revenue records, employees will be able to see when they log in if the previous job has been ceased

• starting a second job in addition to their main job

• starting to receive payments from a private pension

Access to the service is available in myAccount, employees must register to use the service.

Employers should:

• encourage new employees to register for myAccount

• provide new employees with the information required to register their new job (registration can be done in advance of the start date):

- tax registration number

- start date of the new job

- pay frequency

- staff number is one has been allocated

• no longer submit a P46 form where employees register their own job using the service

• continue to upload P45(3) as normal

• continue to issue P45s immediately on cessation of employment

• operate the emergency basis for PAYE & USC if a pay day occurs before receipt of either P45 or P2C

Further information on the service can be found in Revenue’s Employer Notice September 2016, which can be found here.

Dec 2015

1

Week 53: Irish Payroll

Are you due a week 53?

Employers are only due a week 53 if there are 53 pay dates in the tax year. This situation will arise for employers in 2015 where their pay date falls on a Thursday. This is due to the fact that their first pay date fell on Thursday 1st January and their last pay date falls on Thursday 31st December. Employers with any other pay date will not be due a week 53. The same principle applies for employers who run fortnightly payroll (they are only due a week 54 if there are 27 pay periods in the tax year).

Week 53 PAYE Deductions

Employers should apply employee’s tax credits and standard rate cut off points on a week 1 basis. This means employees will get the benefit of more than one year’s tax credits and cut off points. Where an employee is on an emergency basis then an emergency basis should continue to apply.

Week 53 USC Deduction

Employers should apply USC standard cut offs on a week 1 basis. This is a change from last year where there were no additional thresholds granted. If an employee is on an emergency basis then an emergency basis should continue to apply for week 53. If an employee is exempt from USC they will continue to be exempt in week 53.

Week 53 PRSI Deduction

There is no change to the way PRSI is calculated.

Oct 2015

27

Small Benefit Exemption Scheme - Increase in threshold

The Minister for Finance Michael Noonan is set to fast track an increase in the threshold for the Small Benefit Exemption Scheme. The current threshold is €250; this will double and will increase to €500. The last time the threshold was increased was in 2005 when it was increased from €100 to €250. The move is contained in the Finance Bill, published last week. The new rules were expected to be implemented from 1st January 2016 however, The Department of Finance say the change will be implemented in time for Christmas.

Under the Revenue Commissioner’s Approved Small Benefit Exemption Scheme employers can provide employees with a small benefit, this small benefit is not subject to PAYE, USC or PRSI.

The following rules apply:

• The benefit cannot be cash, cash payments are fully taxable

• Only one such benefit can be given to an employee in one tax year

• Where a benefit exceeds the threshold the full value of the benefit is subject to PAYE, USC & PRSI

• The benefit can not form part of a "salary sacrifice" scheme

The small benefit is traditionally given as a voucher often at Christmas, as mentioned above only one such benefit can be given to an employee in one tax year. Where more than one benefit is given in a tax year only the first benefit will qualify under the Small Benefit Exemption Scheme.

Full details of Finance Bill 2015 can be found on Revenue’s website

http://www.revenue.ie/en/practitioner/law/bills/finance-bill-2015/index.html

Oct 2015

15

Budget 2016 – Employer Payroll Focus

Tax Rates and Standard Rate Cut Off Points (SRCOPs)

There has been no change to tax rates or SRCOPs. The standard rate of tax will remain at 20% and the higher rate of tax will remain at 40%.

There has been no change to the SRCOP and Tax Credits on the Emergency Basis of tax.

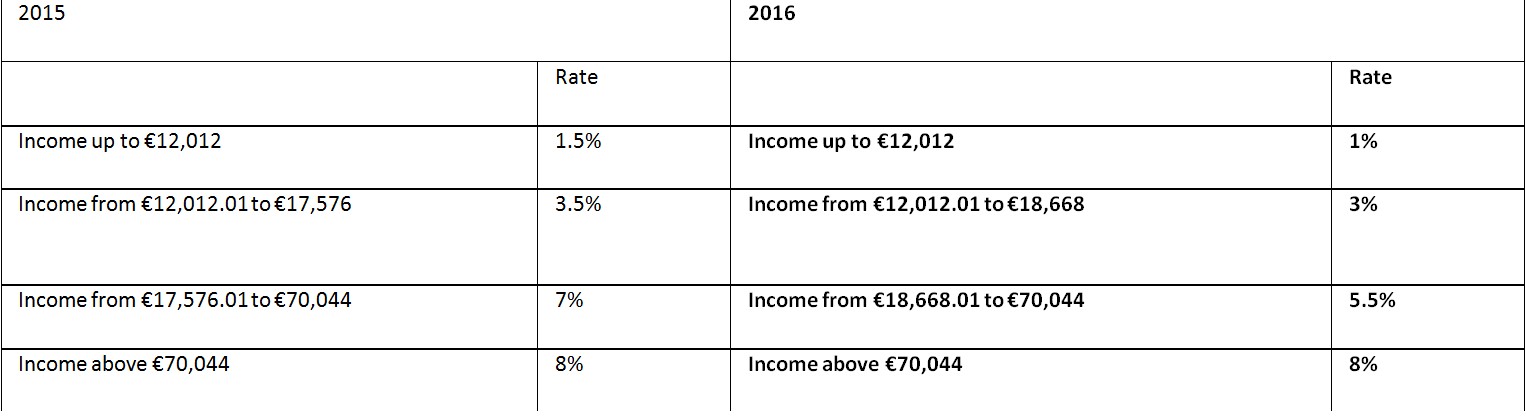

Universal Social Charge (USC)

The annual threshold for USC has been increased to €13,000 from €12,012.

Please note full medical card holders and individuals aged 70 and over whose aggregate income does not exceed €60,000 will pay a maximum rate of 3%.

The emergency rate of USC remains at 8%.

PRSI

Increase from €356.01 to €376.01 in the weekly threshold at which liability to employer’s PRSI increases from 8.5% to 10.75%.

A tapered PRSI credit has been introduced for employee PRSI; the PRSI credit will commence in respect of weekly income of €352.01 and will taper out as a weekly income reaches €424.

For earnings between €352.01 and €424, the maximum weekly PRSI credit of €12.00, is reduced by one-sixth of earnings in excess of €352.01.

Example:

Gross weekly earnings of €377

Maximum PRSI Credit €12

One-sixth of earnings in excess of €352.01

(€377-€352.01 = €24.99/6) (€4.17)

Reduced PRSI Credit €7.83

PRSI @ 4% €15.08

Less: Reduced PRSI Credit €7.83

Employee PRSI Weekly Liability €7.25

Jul 2015

1

PAYE Anytime

What is PAYE Anytime?

PAYE Anytime is the Revenues On-Line Service for employees. The service offers PAYE tax payers a secure way to manage their tax affairs online. PAYE Anytime is a self assessment system so employees are responsible for the information they provide.

You can register for PAYE Anytime by going to revenue.ie or by clicking on the below link.

https://www.ros.ie/selfservice/enterRegistrationDetails.faces

Fill in your personal details and a Revenue Pin will be posted to you.

What can you do on PAYE Anytime

• View your own tax records

• You can claim a wide range of tax credits

• You can use your profile to update your personal details; revenue can then use this information to suggest additional tax credits you may be entitled to

• You can claim a repayment for items such as health expenses (all receipts should be kept for a 6 year period)

• Request a P21 balancing statement (end of year review) for any of the last 4 years

• You can enter your bank account details so any refund due to you can be deposited directly to your bank account (revenue will not deduct money from your account if you have a tax liability)

• You can also declare additional income earned such as B.I.K’s and dividends

• If you are jointly accessed you can reallocate some of your tax credits or standard rate band between you and your spouse

• If you have multiple incomes you can reallocate your tax credits or standard rate band between your incomes

You don’t have to submit a paper claim when you submit transactions through PAYE Anytime. The service cannot be used by employees who submit a Form 11 or a Form 12 tax return to revenue on an annual basis.

PAYE Anytime now allows you to view your tax records from any computer or smart phone.

May 2015

22

IPASS - Annual Payroll Conference

IPASS (IRISH PAYROLL ASSOCIATION) held their annual payroll conference in Croke Park on the 21st May. Paul Byrne and Audrey Mooney from Thesaurus Software Limited attended the conference. They enjoyed meeting the other exhibitors, the delegates and listening to the guest speakers. The speakers included Lindsay Melvin the CEO of the Chartered Institute of Payroll Professionals (CIPP), John Kelly from the National Employment Rights Authority (NERA), representatives from Revenue and Department of Social Protection (DSP).

It was also an opportunity to show our payroll product BrightPay which is available for Irish and UK payroll. BrightPay is a simple but powerful payroll software package that makes managing payroll quick and easy. It is designed for small to medium sized businesses, accountants and other payroll bureau providers.

BrightPay Ireland can be downloaded from www.brightpay.ie

BrightPay UK can be downloaded from www.brightpay.co.uk

BrightPay installs as a trial version, which you can use licence free for 60 days at no cost.

Thank you and congratulations to Noelle Quinn and the IPASS team for another successful and enjoyable annual conference.

May 2015

21

Accrual of holidays during periods of long-term illness

Currently employees working in the private sector are not entitled to build up holidays whilst on sick leave - it is up to the discretion of the employer.

Under new laws about to take effect, private sector employees on long-term sick leave WILL be entitled to accrue annual leave.

The rule relating to the holiday accrual is contained within the Workplace Relations Bill, which makes sweeping changes and reforms to Irish Employment law. The new law will mean that employees will now be entitled to accrue holiday leave while off sick. (though they will have to use the holiday days within 15 months of accruing them.)

Traditionally in Ireland, by virtue of the Organisation of Working Time Act 1997, employees in Ireland don’t accrue annual leave in such circumstances. However, recent key decisions in the Court of Justice of the European Union (CJEU) have meant that the Irish approach was out of sync with European requirements. Minister of State for Business and Employment, Gerald Nash opened up discussions on including these amendments in the Workplace Relations Bill.

The Workplace Relations Bill has now passed both Houses of the Oireachtas and will be signed into law by the President in the coming weeks, with a commencement date of July 1st looking likely. However the holiday provisions will be commenced immediately following the signing by the President.

Apr 2015

26

FRIDAY 1ST MAY 2015 – SEPA PAYMENT PROCESSING RESTRICTIONS

The Banking & Payments Federation Ireland (BPFI) has issued a customer payments notice in light of Friday 1st May 2015 being a European Bank Holiday.

Friday 1st May 2015 is a European Bank Holiday; the Euro payments clearing and settlement system will be closed. Although Irish banks are open for business on the 1st May 2015 it is not possible to exchange payments with other banks. In addition Monday 4th May 2015 is a bank holiday in Ireland. SEPA Credit Transfer Bulk Files submitted with a debit date of Thursday 30th April 2015 or Friday 1st May 2015 may not be with the beneficiary bank until Tuesday 5th May 2015.

Employers due to pay wages on Friday 1st May 2015 may wish to submit their payments early to ensure beneficiary accounts are updated (credited) on Thursday 30th April 2015.

For further details on Euro payments processing over that weekend please check with your own bank.

Mar 2015

16

TaxSaver Commuter Ticket Scheme

Established in 2000, the TaxSaver Commuter Ticket Scheme is an incentive for workers to use public transport and is seen as a way to encourage the use of public transport. The scheme is operated in conjunction with the Revenue Commissioners. The scheme involves employers providing employees with bus and rail commuter tickets while saving on employer PRSI payments.

The employers and employees must sign a contract agreeing to participate. The employer then applies for commuter tickets for employees. Information on tickets are available from Dublin Bus, Irish Rail, Bus Éireann, Luas, and approved private operators websites. Detailed information sheets on each type of ticket are also available for distribution to employees.

Employees participating in the scheme may receive the tickets through salary sacrifice, in lieu of an annual cash bonus, or as a benefit-in-kind. It costs employers and employees nothing to join the scheme itself.

Through salary sacrifice employees receive TaxSaver commuter tickets as part of their basic salary package. They then benefit from reduced Income Tax, PRSI and Universal Social Charge (USC) payments due to the fact that the cost is a tax allowable deduction.

Employees only have to pay tax, PRSI and USC on the "money" portion of their salary. Employer PRSI is also calculated on the "money" portion of the employee's salary.

Employers can achieve PRSI savings of up to 10.75% and employees can save between 31% and 52% of travel costs as a result of tax, PRSI and USC savings by participating.

Companies must keep a receipt of purchase and a copy of the ticket for their tax records.

Dec 2014

17

Week 53 - Irish Payroll

Are you due a week 53?

Employers are only due a week 53 if there are 53 pay dates in the calendar year. This situation will arise for employers in 2014 where their pay date falls on a Wednesday. This is due to the fact that their first pay date fell on Wednesday 1st January and their last pay date falls on Wednesday 31st December. Employers with any other pay date will not be due a week 53. The same principle applies for employers who run fortnightly payroll (they are only due a week 27 if there are 27 pay periods in the calendar year).

Week 53 PAYE Deductions

Employers should apply employee’s tax credits and standard rate cut off points on a week 1 basis. This means employees will get the benefit of more than one year’s tax credits and cut off points. Where an employee is on an emergency basis then an emergency basis should continue to apply.

Week 53 USC Deduction

Where your employees operate on a cumulative basis continue to operate on a cumulative basis for week 53. For the purposes of USC there is no additional thresholds granted. If the employee has used all their USC cut offs in week 52 they will pay USC at the higher rate in week 53. Where your payroll operates on a week 1/month 1 basis employees will pay USC at the top rate. If an employee is on an emergency basis then an emergency basis should continue to apply for week 53. If an employee is exempt from USC they will continue to be exempt in week 53.

There is no change to the way PRSI is calculated.