Sep 2022

28

Budget 2023 - An employer focus

On 27th of September 2022, Minister for Finance, Paschal Donohoe, and Minister for Public Expenditure and Reform, Michael McGrath, presented the 2023 budget. Minister McGrath called the budget a “Cost of Living Budget”, and said it was focused on helping individuals, families and businesses deal with rising prices.

Below, we've listed some of the measures from the budget which will most affect employers.

Income Tax

There are no change to tax rates for 2023, the standard rate will remain at 20% and the higher rate at 40%.

• The Standard Rate Cut Off Point (SRCOP) has been increased by €3,200 from €36,800 to €40,000

• The Personal Tax Credit increased by €75 from €1,700 to €1,775

• The Employee Tax Credit increased by €75 from €1,700 to €1,775

• The Earned Income Credit increased by €75 from €1,700 to €1,775

• The Home Carer’s Tax Credit will increase by €100

Universal Social Charge (USC)

• Exemption threshold remains at €13,000

• There are no changes to the rates of USC

• The 2% USC rate band has increased by €1,625, from €21,295 to €22,920

USC Rates & Bands 2023

• €0 – €12,012 @ 0.5%

• €12,013 – €22,920@ 2%

• €22,921 – €70,044 @ 4.5%

• €70,045 + @ 8%

Medical card holders and individuals aged 70 years and older whose aggregate income does not exceed €60,000 will continue to pay a maximum rate of 2%.

The emergency rate of USC remains at 8%.

Non-PAYE income in excess of €100,000 will continue to be subject to USC at 11%.

Rent Tax Credit

Any taxpayer that are renting a property and are not receiving housing supports will qualify for a rent tax credit of €500 per annum. In the case of married couples or civil partners this credit will be doubled. This will come into effect in 2023 but can be claimed for rent paid in 2022 in early 2023.

Tax Relief for Remote Workers

The tax relief for remote workers remains unchanged at claiming relief of to 30% of the cost of vouched expenses for heat, electricity and broadband in respect of those days spent working from home.

Small Benefit Exemption

The Small Benefit Exemption has been increased from €500 to €1,000, with employers permitted to give employees two vouchers per year, as opposed to one voucher which was permitted to date. This applies for 2022 and years following.

ASC

There are no changes to the ASC rates for 2023.

National Minimum Wage

The National Minimum Wage will increase by 80 cent from €10.50 to €11.30 per hour from 1st January 2023.

Pay Related Social Insurance (PRSI)

Due to the increase in the minimum wage on 1st January 2023 the upper threshold for paying the 8.8% Class A rate of employer PRSI is being increased from €410 to €441 from the 1st January 2023. There is no change to the PRSI credit.

VAT

The reduced rate of 9% VAT for the tourism and hospitality sector and electricity and gas bills will continue to apply until the 28th February 2023. 0% rate of Vat is introduced in respect of newspapers and news periodicals, including digital editions, defibrillators, hormone replacement and nicotine replacement therapies, and certain period products from 1st January 2023.

Social Welfare Payments

There will be a €12 increase to core weekly Social Welfare payments with effect from January 2023. The maximum personal rate of Illness Benefit will be increased to € per week. Maternity/Paternity/Adoptive /Parent’s Benefit will increase to €262 per week from 1st January 2023.

Related articles:

- What’s the craic with Statutory Sick Pay in Ireland?

- BrightPay Customer Update: October 2022

- Employee paid sick leave: What you need to know

Jun 2022

17

Living wage to replace minimum wage in Ireland by 2026

It was announced this week that a new living wage, to replace the current minimum wage, is to be phased in for Irish workers, starting in 2023. A living wage is an hourly rate of pay calculated to be the minimum amount that a worker needs to earn to cover the basic cost of living.

The memo which Tánaiste and Minister for Enterprise, Trade and Employment, Leo Varadkar has brought to Cabinet proposes that the living wage is to be set at 60% of the median wage in a given year. Based on this percentage, if the living wage rate were introduced today, it would be set at €12.17 per hour.

Minimum wage in Ireland

The National Minimum Wage was first introduced in Ireland in April 2000 and was also roughly 60% of the median wage at the time. The minimum wage has increased by around 47% since it was first introduced, but it has not kept up with the average earnings or the cost of living.

Since 1st January 2022, the National Minimum Wage is €10.50 per hour for those aged 20 and over.

Rates for other workers are as follows:

| Age group | Minimum hourly rate of pay | % of minimum wage |

| Aged 19 | €9.45 | 90% |

| Aged 18 | €8.40 | 80% |

| Aged under 18 | €7.35 | 70% |

What does the living wage mean for employers?

The national minimum wage will remain in place until the living wage rate is fully phased in, in 2026. The minimum wage rate will increase between now and 2026, closing the gap between the minimum and the living wage. However, the full living wage may be introduced faster or slower than the proposed time frame, depending on prevailing economic circumstances. The Tánaiste has said that the reason the living wage is being introduced gradually is because if it is brought in too quickly businesses could close, or employees could see their hours cut. Leo Varadkar will consult with various interested parties, including employer and worker representative groups, unions and the public on the draft plan.

The living wage is just one of the improvements to workers' rights to be introduced over the coming years. Other changes we are set to see for employees is the introduction of statutory sick pay and automatic enrolment onto pension schemes.

Subscribe to our newsletter to keep up to date on legislation changes, webinar events, special offers and other payroll related news.

Related articles:

Jun 2022

2

Maximise efficiency and reduce errors when making payments

Automating your workflow in 2022 is the key to a successful business. The process of manually entering data is long gone, as automating tasks allows you to save time and reduce the number of repetitive tasks you manage.

BrightPay Payroll Software is now integrated with payment platform, Modulr, to provide a faster, easier and more reliable way to pay employees. The integration has created a more seamless way of paying your employees, saving you time for other tasks.

The importance of automating your payroll

Traditionally, employee payments are a time-consuming task that can cause major headaches for employers, when not done correctly. It can turn into an arduous process, especially when errors are made. As well as the time delays, when employees haven't been paid correctly or on time, it can damage employee morale. Errors that can occur when paying employees include:

- Double entry or incorrect input of figures

- Duplication of figures

- Forgetting to add overtime, statutory leave pay etc.

At BrightPay, we want to make our customers' payroll journey as easy as possible. BrightPay’s integration with payment platform, Modulr, has taken away the manual data entry workload associated with making payments to employees, and eliminates the need to create bank files.

What is Modulr?

Modulr is a payment platform integrated into your payroll software and is a faster, easier and more reliable way to pay employees. Modulr offers a safe and reliable way of paying your employees as it has built in multi-factor authentication, meaning you must confirm your identity through an app on your mobile.

The integration allows employees to be paid on the same day when payments have been authorised on a business day before 2pm. This helps reduce payment errors as it gives you the opportunity to make any last-minute changes to the payroll, such as adding overtime pay.

How to pay employees using Modulr

- Once you’ve finalised your employees' payslips through BrightPay, simply click the “Pay” tab and on the drop-down menu click the “Modulr” button.

- On the next screen, simply click “continue”.

- When asked, enter your Modulr username and password and click “Sign in to Modulr”. If you do not have a Modulr account set up, you can simply sign up here.

- Once you’re signed into Modulr, you will be asked to authenticate your account using authentication app, Authy. For this to be successful, you will need to have the Authy app installed on your mobile device.

- Once prompted, follow the instructions on your screen.

- When you are signed into the Authy app, a match attempt will be made to your Modulr account using your employer registration number entered into your BrightPay employer file. Once both accounts have synchronized, your customer name will be displayed. If you’ve been given more than one customer name, simply click the one that is most applicable to you.

- If your employee's payment method has been set to credit transfer, it will be displayed for review and will be asked to put in the following details:

- Pay from account – select the account you wish to make payment from

- Payment date – choose your payment date

- Payee – review the list of payees, and de-select any who are not included in this pay period

- IBAN – Make sure the correct bank details are logged

- Reference – enter a reference if you wish

- Amount – this reflects the payment amount for each of your employees

- When ready, click “continue”.

- A summary of your payment request will be displayed on screen for review. When ready to submit your payment request, simply click “Send to Modulr”. One last request will be sent to your mobile device via the Authy authentication app.

- Once successful, confirmation of your payment request will be displayed via Modulr for final approval.

Although there are several steps to get your Modulr account set up and activated, once set up, it is an efficient way to pay your employees. As mentioned, employees can be paid on the same day, when payments have been processed on a business day before 2 pm. Otherwise, they will be paid on the next business day. Thanks to the integration, you can maximise efficiency while allowing you to process your employees payments with ease. Book a free demo of BrightPay today to learn more.

Related articles:

Jan 2022

28

EWSS Update: Changes from 1st February

On the 21st January 2022, Minister for Finance Paschal Donohoe announced changes to Employment Wage Subsidy Scheme (EWSS) subsidy rates from 1st February.

Due to the COVID-19 restrictions which were brought in last December, the enhanced rates of the EWSS were extended for all businesses for December 2021 and January 2022. As well as this, the scheme was reopened in December for certain businesses who were previously registered for the EWSS and experienced a reduction in turnover as a direct effect of these new restrictions. With these restrictions now lifted from 21st January, many businesses have returned to normal, and the EWSS rates are now changing in line with this.

Changes to the EWSS from 1st February

From 1st February we will begin to see a gradual reduction in subsidy rates up until the scheme ends for all businesses in May. The EWSS rates which businesses are eligible to receive will depend on whether or not they were one of the businesses that were directly impacted by the COVID-19 regulations which were introduced in December.

The reduced rate of employer’s PRSI of 0.5% will continue to apply to wages paid before 1 March 2022 in relation to those who are eligible for the subsidy payment. The full rate of employers’ PRSI will be reinstated with effect from 1 March 2022 for all businesses.

Rates from 1st February for businesses directly impacted

For businesses that were directly impacted by the COVID-19 regulations that were introduced in December 2021, they will continue to receive the enhanced EWSS rates for the month of February, as outlined in the table below. For the month of March, the EWSS rates will revert to the original two-rate subsidy of €151.50 for employees with a gross weekly wage of between €151.50 to €202.99 and €203 for employees with a gross weekly wage of between €203 and €1461.99. For the months of April and May, businesses will receive a flat rate of €100 per employee. The scheme will eventually end for these businesses on 31st May 2022.

| Employee gross weekly wage | February 2022 | March 2022 | April 2022 | May 2022 |

| Less than €151.50 | Nil | Nil | Nil | Nil |

| €151.50 to €202.99 | €203 | €151.50 | €100 | €100 |

| €203 - €299.99 | €250 | €203 | €100 | €100 |

| €300 - €399.99 | €300 | €203 | €100 | €100 |

| €400 - €1,462 | €350 | €203 | €100 | €100 |

| Over €1,462 | Nil | Nil | Nil | Nil |

Rates from 1st February for other businesses

For businesses that were not directly impacted by the COVID-19 regulations that were introduced in December 2021, the enhanced subsidy rate will end on 31st January, and they will receive the two-rate subsidy for the month of February. For the months of March and April, these businesses will receive a flat rate of €100 per employee. The scheme will then end for these businesses on 30th April 2022.

| Employee gross weekly wage | February 2022 | March 2022 | April 2022 |

| Less than €151.50 | Nil | Nil | Nil |

| €151.50 to €202.99 | €151.50 | €100 | €100 |

| €203 - €1462 | €203 | €100 | €100 |

| Over €1462 | Nil | Nil | Nil |

Note: Revenue are working on updating their systems to cater for these changes. A BrightPay upgrade will also be released in line with these new changes.

EWSS Webinar

On February 4th, BrightPay will be holding a free online webinar where we will be joined by representatives from Revenue to discuss recent EWSS changes and the updated guidance for employers. We will also have a questions and answers section at the end of the webinar where we will answer any questions you may have regarding the scheme.

Feb 2021

1

EWSS Q&A - Common Support Queries

Due to the changes and updates to the COVID-19 Government schemes, our support team put together the top four common questions – asked by you and answered by us!

When earnings fluctuate and are within the limits for the Employment Wage Subsidy Scheme (EWSS) in some pay periods and not others, do we need to untick EWSS for the employee?

No. There is no need to remove the tick for EWSS, our software will remove the indicator from the payroll submission (PSR) in the pay periods the earnings fall outside the relevant limits.

The subsidy being received is more than we are paying the employees, do we pay the employees the difference or will we owe that money back to Revenue?

In some scenarios the employer will receive a subsidy greater than the wages they are paying; they will not have to repay that money to Revenue. The employee should only be paid the wages that are due and not any extra. In other scenarios the subsidy received from Revenue will be less than the wages they are paying.

What payments are permitted under EWSS e.g., can you pay the employees commission?

Yes. The EWSS is a subsidy payable to employers, therefore, it will not show on employee payslips or in myAccount. Under EWSS employers are required to pay employees in the normal manner i.e., calculating and deducting Income Tax, USC and employee PRSI through the payroll. Employees should be paid the wages that are due to them which can include commission, overtime etc.

When employees are claiming the Pandemic Unemployment Payment (PUP) from the Department of Social Protection, do we need to do anything on the payroll?

Yes. You should ensure that the employee’s payment is changed to zero, continue to update them with zero pay until such time you are paying them wages again.

More information can be found in the COVID-19 guidance section on our website or by visiting the COVID-19 Resources Hub.

Related Articles:

- Budget 2021: Employer Payroll Focus

- 7 Steps To Returning To Work After COVID-19

- BrightPay: The COVID Heroes of the Accounting World

Sep 2017

22

Public Holiday Pay Entitlement

There can often be some confusion surrounding an employee's entitlement to pay for a public holiday particularly where the employee may be part-time or the public holiday falls on a day that the employee does not normally work.

It is also worth noting that not every bank holiday is a public holiday though in most cases they coincide. Good Friday is a bank holiday but it is not a public holiday. The following dates are the official public holidays in Ireland.

- New Year's Day (1 January)

- St. Patrick's Day (17 March)

- Easter Monday

- First Monday in May, June, August

- Last Monday in October

- Christmas Day (25 December)

- St. Stephen's Day (26 December)

Employees who qualify for public holiday benefit will be entitled to one of the following:

- A paid day off on the public holiday

- An additional day of annual leave

- An additional day's pay

- A paid day off within a month of the public holiday

So, who is entitled to a payment?

- Part-time employees qualify for public holiday entitlement if they have worked at least 40 hours in the 5 weeks ending the day before the public holiday.

- Full time employees are not required to have worked up a minimum number of hours.

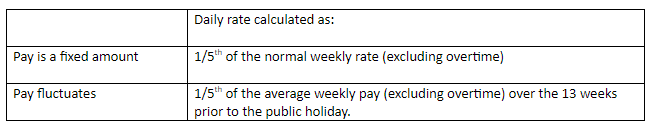

How to calculate the amount to be paid?

If the public holiday falls on a day which the employee would normally work:

- Full-time employees are entitled to one of the above four options at the employer’s discretion.

- Part-time employees have the same entitlement, so where the employee’s pay is a fixed amount the normal daily rate can be used. If the pay varies, the daily rate should be calculated over the 13 weeks immediately before the public holiday in question.

If the public holiday falls on a day which the employee does not normally work:

Further information can be found at Organisation of Working Time Act 1997.

Jul 2017

19

National Minimum Wage Proposed Increase of 30c per hour

The Low Pay Commission has recommended that the National Minimum Wage be increased by 30c per hour, from €9.25 per hour to €9.55 per hour from 1st January 2018. An employee working a 40 hour week will see their gross wage increase by €12.00 a week. Since 2011 this is the fourth increase in the national minimum wage.

In the report the Low Pay Commission has published it has explained with necessary data of its recommendation of the increase, including international competitive and risks to the economy research. In The Low Pay Commission’s findings submissions from interested parties and consultations with employees and employers in relevant economic sectors had taken place.

This increase will affect around 120,000 employees, increasing their national minimum wage by 3%. 10.1% of employees were earning the National Minimum Wage or less last year according to figures published from the Central Statistics Office last April.

While Taoiseach Leo Vardakar said ‘The Government welcomes the recommendation from the Low Pay Commission to increase the National Minimum Wage by 30c to €9.55 per hour’, the Programme for Government commitment for a minimum wage of €10.50 per hour is still a few steps off.

Jul 2017

6

Living Wage increased by 20 cent

The 2017 Living Wage has been set at €11.70 per hour, up from €11.50 last year. The new figure represents an increase of 20 cent per hour on the previous rate. The recommended living wage rate is now nearly a third higher than the legally required minimum wage, which is set at €9.25 an hour.

The 20 cent increase in the Living Wage was arrived at upon consideration of a number of changes in the cost of living and the taxation regime in the last year. The Living Wage for the Republic of Ireland was established in 2014, and is updated in July of each year. It is part of a growing international trend to establish an evidence-based hourly income that a full-time worker needs so that they can experience a socially acceptable minimum standard of living.

Mar 2017

31

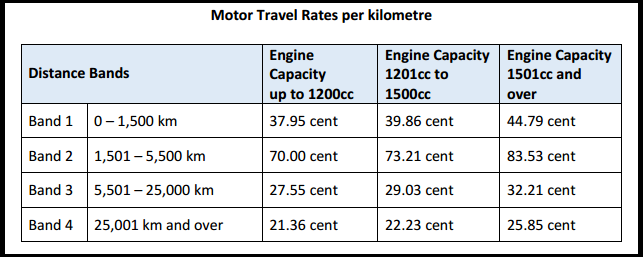

Important Information for Employers - Changes to Civil Service Travel Rates

Where employees use their own private cars or motorcycles for business purposes, reimbursement in respect of allowable motoring expenses can be effected by way of flat-rate mileage allowances.

There are two types of mileage allowance schemes which are acceptable for tax purposes if an employee bears all the motoring expenses:

- The prevailing schedule of Civil Service rates; or

- Any other schedule with rates not greater than the Civil Service rates

The Department of Public Expenditure and Reform has recently published circulars with new Civil Service Travel Rates, the revised rates are effective from 1st April 2017. The distance bands have increased from two to four with a lower recoupment rate for the first 1,500 kilometres.

Business travel carried out between 1st January and 31st March 2017 will not be affected by these new bands and rates, business travel to date from 1st January 2017 will count towards the cumulative business travel for the year.

Motor Travel Rates - Effective from 1st April 2017

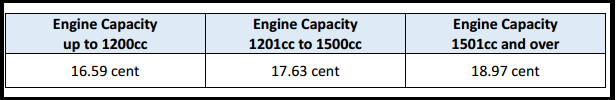

Reduced Motor Travel Rates per kilometre

The reduced rates are payable to Civil Service employees who undertake a journey associated with their job but not solely related to the performance of their duties, such as:

- Attendance at confined promotion competitions

- Attendance at approved courses of education

- Attendance at courses or conferences

- Return visits home at weekends during a period of temporary transfer

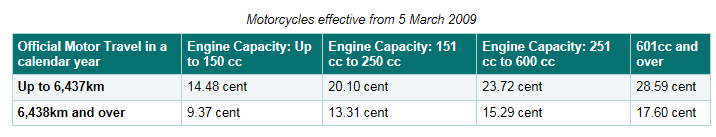

The Motor Travel Rates for motorcycles and bicycles remain unchanged as follows:

Motorcycle:

Bicycle: 8 cent per km

Please note, there are changes to subsistence rates which are also effective from 1st April 2017.

Please click here for the circular on Motor Travel Rates, and here for the circular on Subsistence

Feb 2017

14

2016 P35 Deadline

Employers – the P35 deadline is fast approaching, the deadline is February 15th. (Or 46 days after the cessation of the business) Failure to make a P35 return by this date may result in a fine.

The deadline for an employer who pays and files electronically via Revenue Online Services (ROS) is extended to the 23rd of February.

To view our online documentation for preparing and submitting your P35 to ROS via Thesaurus Payroll Manager or BrightPay please click on the links below:

Thesaurus Payroll Manager:

https://www.thesaurus.ie/docs/2016/year-end/preparing-the-ros-p35-file/

https://www.thesaurus.ie/docs/2016/year-end/submitting-the-ros-p35/

BrightPay:

https://www.brightpay.ie/docs/2016/year-end/preparing-a-p35-ros-file/

https://www.brightpay.ie/docs/2016/year-end/submitting-a-p35-to-ros/