IT IS IMPORTANT TO READ THE FOLLOWING NOTES CAREFULLY BEFORE PROCEEDING.

IMPORTANT NOTES ON BENEFIT IN KIND

PAYE, USC & PRSI must be operated by employers in respect of the taxable value of most benefits in kind and other non-cash benefits provided by them to their employees. The amount to be taken into account is referred to as "notional pay".

SMALL NON-CASH BENEFITS NOT EXCEEDING €250

Where an employer provides a small non-cash benefit (that is a benefit not exceeding €250) PAYE, USC & PRSI need not be applied to that benefit. No more than one such benefit given to an employee in a tax year will qualify for such treatment. Where a benefit exceeds €250 in value the full value of the benefit is subjected to PAYE, USC & PRSI.

Share Based Remuneration relates to the payment of salary by means of shares in the company. The net value of any shares awarded is to be treated as notional pay at the time the shares are given to the employee.

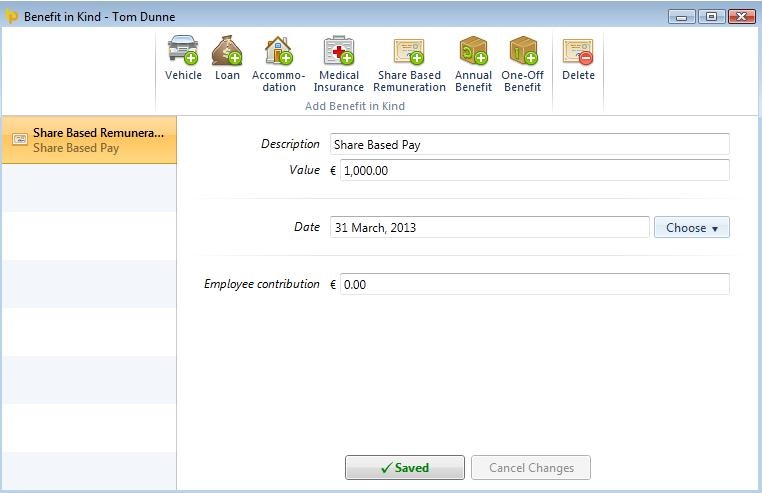

To access this utility go to Employees, select the employee in question from the listing and click Benefits on the menu toolbar, followed by Share Based Remuneration.

1) Description - enter a description of the shares being provided.

2) Value – enter the applicable value of the shares being provided.

3) Date - enter the date that the shares are given to the employee.

4) Employee contribution - enter any amount made good by the employee directly to the employer towards the cost of providing the benefit.

5) Click Save to save the Benefit In Kind entry.

The 'Notional Pay' will be added to the employee's gross income in the relevant pay period to ensure that the correct PAYE, Universal Social Charge and PRSI are charged.

Need help? Support is available at 01 8352074 or [email protected].