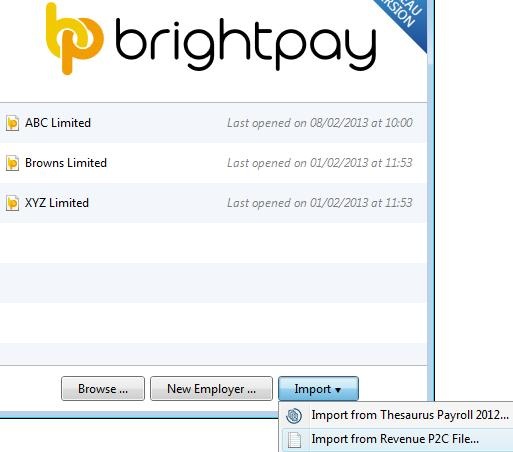

To import a company and its employees using a Revenue P2C file, select Import > Import from Revenue P2C File at the bottom of the 'Open Employer' screen.

The Welcome to BrightPay screen will confirm the details found in the selected Revenue P2C file. If happy to proceed, click Next to continue.

Three options are available:

a) Start at the Beginning of the Tax Year - select this option if you are starting at the beginning of the tax year

b) Start Partway in the Tax Year - select this option if you are starting payroll partway through a tax year, with no previous payroll records in the same tax year

c) Continue Partway in the Tax Year - select this option if you already have payroll records for the tax year up to this point, and wish to continue where you have left off. Selecting this option will allow you to enter year to date figures for each employee

Select the most appropriate option and click Next

1) Enter your Employer Registered Number - this field is mandatory and must be in the format XXXXXXXA (where X is a number and A is a letter). Some Employer Registration Numbers can have an additional letter at the end.

2) Enter your Employer Name

3) Enter your Employer Address

Click Next to continue

Employees can be organised into departments, which can subsequently be used in payroll processing and analysis.

Enter each Department Name you require in the fields provided. Additional departments can be added by clicking “Add Another” or can be added at a later date if required.

Click Next to continue

These settings will be used for any employees in the P2C file and will also be used as the default when adding a new employee. They can of course be changed on an individual basis if required. These settings are:

a) Typical Pay Frequency

b) Typical Pay Basis

c) Typical Pay Method

d) Typical Leave Year Starts

e) Typical Annual Leave Entitlement Method

f) Typical Annual Leave Days in Year

g) Typical Working Days

Select the default settings you require and click Next to continue

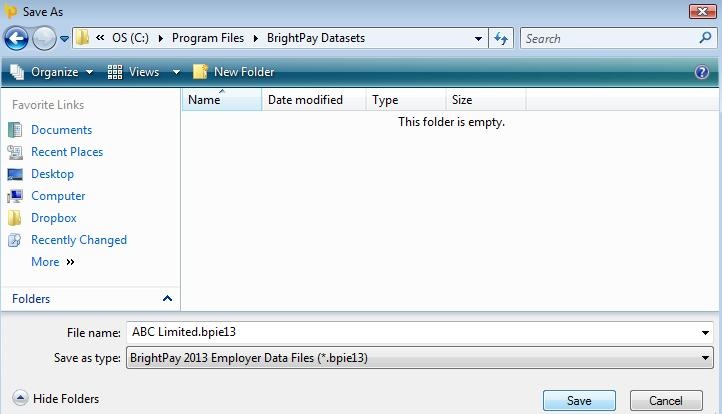

To protect the payroll information, a password must be set, which will then be required to open the employer data file in future. Enter and confirm a Password of your choice. Click Save & Finish.

You will now be asked where you would like to save your employer data file. Select a location of your choice and click Save.

Your employer and employee details have now been set up.

Please note: due to basic employee information contained within a P2C, it is recommended that any employee record set up in this manner is then reviewed within Employees following the import. This will allow the user to manually enter additional employee information not contained in the P2C file e.g. marital status, contact information, rates of pay etc.

Likewise, additional employer information (e.g. pension schemes, employer bank accounts etc) can be manually entered within Employer.

Need help? Support is available at 01 8352074 or [email protected].