All employers must deduct PAYE from any Illness Benefit received by the employee, from the Department of Social Protection, regardless of whether or not the employer pays the employee while they are out of work on sick leave.

If you do not know how much Illness Benefit the employee is receiving then you must make a best estimate and deduct PAYE from it in the week it is due to the employee. Please note:

Illness Benefit is subject to PAYE only, not USC or PRSI. It is taxable from the first day of payment by the employer.

There are three scenarios that an employer must deal with in considering the treatment of Illness Benefit:

1. Employer does not pay the employee while they are out sick

2. Employer pays the employee while they are out sick, employee retains the Illness Benefit payment from DSP (does not give it to his employer)

3. Employer pays the employee while they are out sick, employer receives the Illness Benefit payment from DSP

In this instance, the employer reduces the employee's salary by the Illness Benefit they are receiving, so he is merely topping up the employee salary to their normal periodical salary.

Illness Benefit must still be recorded as a DSP payment to facilitate the figures being reported to Revenue accurately and for the appropriate tax treatment to apply.

Example:

Employee Weekly Tax Credit € 30.00

Employee Weekly SRCOP €600.00

Employee Gross Salary € 500.00

Employee Gross Salary € 312.00 Reduced from €500 to €312 (i.e. €500 – €188)

Illness Benefit €188.00

Pay subject to PAYE €500.00 Salary of €312 plus Illness Benefit of €188

PAYE 500.00 @ 20% €100.00

Less Tax Credit - € 30.00

PAYE payable € 70.00

Pay subject to USC € 312.00 Salary portion only, Illness Benefit is not subject to USC.

Pay subject to PRSI € 312.00 Salary portion only, Illness Benefit is not subject to PRSI.

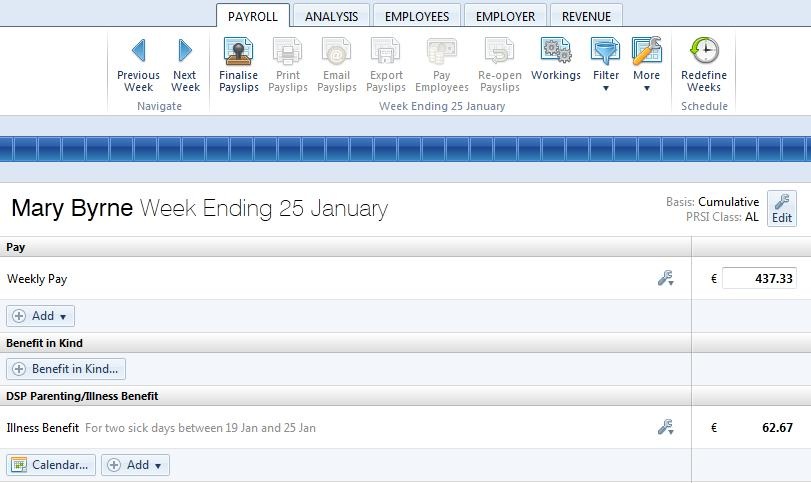

1) Click ‘Payroll’ on the menu bar and select the relevant employee’s name in the summary view.

2) Reduce the employee's paid hours or basic pay in accordance with the company sick pay scheme.

2) Within the ‘DSP Parenting/ Illness Benefit’ section on the employee’s payslip, click on Calendar.

3) Click on the employee's first day of sickness and drag your mouse over the days the employee is out sick. When all sick leave days are highlighted, click the dedicated Sick Leave button at the top right of the screen. The program will automatically calculate the non-qualifying days and the illness benefit days the employee is entitled to.

4) Close the calendar to return to the employee's payslip. Any illness benefit that the employee is entitled to claim will be displayed on screen.

5) To now instruct the program that the employer is receiving the illness benefit payment, within the ‘DSP Parenting/ Illness Benefit’ section, click the Edit button to the left of the illness benefit amount being calculated. Tick the box provided to indicate that the benefit is being paid directly to the employer.

6) Click out of the edit facility to capture this amendment.

The Illness Benefit will be added to the employee's periodic salary and PAYE deducted accordingly.

In the event that the employee is not entitled to illness benefit or the employer receives notification from the DSP of the amount of illness benefit that the employee is claiming and this differs to the amount being calculated by BrightPay, an edit facility is available.

1) Within the ‘DSP Parenting/ Illness Benefit’ section on the employee’s payslip, click the Edit button to the left of the illness benefit amount being calculated.

2) If the employee is not entitled to illness benefit, simply untick the box provided.

3) If an adjustment is needed to the illness benefit currently being calculated by BrightPay, amend the illness benefit in the field provided.

4) Click out of the edit facility to capture the amendments made.

Need help? Support is available at 01 8352074 or [email protected].