During 2012, Revenue issued notifications advising employers that the treatment of Illness Benefit will change from 1st January 2013.

From 1st January 2013, the employer will be responsible for collecting PAYE due on Illness Benefit issued to employees, without exception. There is no alternative treatment or option but for the employer to calculate and collect the PAYE regardless of whether or not:

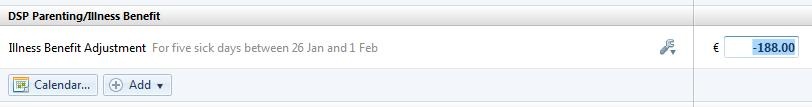

The employer should assume that the employee is in receipt of Illness Benefit once the period of illness exceeds three consecutive days and start to account for Illness Benefit in this first pay period. The employer should assume the employee is in receipt of the full €188 until notified otherwise.

In the event that the employer subsequently receives notification from the DSP and the actual amounts received by the employee differ to what has already been accounted for in BrightPay in previous pay periods, a dedicated facility is available within the program to account for any differences.

1) Click ‘Payroll’ on the menu bar and select the relevant employee’s name in the summary view.

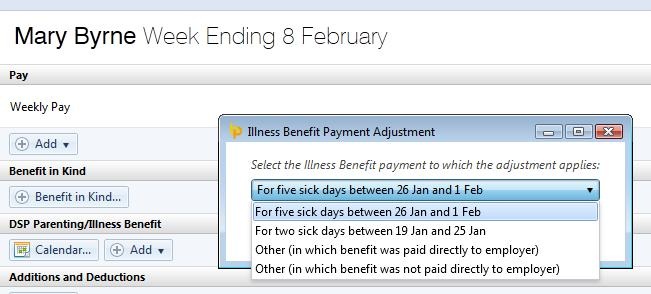

2) Within the ‘DSP Parenting/ Illness Benefit’ section on the employee’s payslip, click on Add > Adjustment to Previously Paid Illness Benefit.

3) From the drop down menu, select the illness benefit payment to which the adjustment applies and click Save.

4) Enter the amount of the adjustment required. Both positive and negative amounts may be entered here, depending on whether the illness benefit already accounted for has been over or understated.

The Illness Benefit adjustment will be now be taken into account in the current pay period being processed and the PAYE adjusted accordingly. If any amendments are subsequently needed to the employee's periodic salary due to the over/ underpayment of illness benefit, these should be made before the employee's payslip is finalised.

Need help? Support is available at 01 8352074 or [email protected].