Some important points relating to the calculation of the USC:

The USC is payable on gross income, including Notional Pay, before employee pension contributions.

Where an Employer makes a contribution to a PRSA then the employee gross income for USC purposes is adjusted to include employer PRSA contributions so that the employee is now charged USC on this employer contribution. This is not the case where an employer is contributing to a RBS.

From 2012 each Employer will be notified of the specific USC deduction method for each individual employee in the same manner as they are notified about an employees PAYE deductions, i.e. on the P2C on an employee by employee basis.

From 2013 any certain benefits issued to employees by the Department of Social Protection are to be taxed by the employer (in all circumstance), this applies to Illness Benefit from 01st January 2013 and Maternity related benefits from 01st July 2013. These benefits are subject to PAYE but are not subject to USC.

EXAMPLE 1

Weekly paid employee

P2C advises: Cumulative Basis - effective from 1 January 2013:

Week 12 Payroll

Employee earns €700 per week. To date, the employee has paid €1,001.86 in tax and €394.90 in USC

Cumulative USC Gross Pay: €8,400.00 (€700.00 x 12)

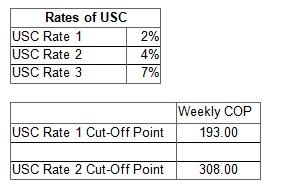

USC on €2,316 @ 2% € 46.32 (€193 x 12)

USC on €1,380 @ 4% € 55.20 ((€308 x 12) - (€193 x 12))

USC on €4,704 @ 7% € 329.28 (balance €8400 - €2316 - €1380)

Gross USC €430.80 (€46.32 + €55.20 + €329.28)

Cumulative USC paid up to Week 11 €394.90 as above

USC Due This Week: € 35.90 (€430.80 - €394.90)

EXAMPLE 2

Weekly paid employee

P2C advises: Week 1 / Month 1 Basis - effective from 1st February 2013:

Week 10

An employee earns €300 per week.

The Year to date Pay, USC and USC cut off points are irrelevant for the purpose of this period calculation. All that is relevant is the single week USC cut off point attributable solely to week 10.

USC

USC Gross Pay THIS PERIOD: €300.00

USC on €193 @ 2% € 3.86

USC on €107 @ 4% € 4.28 (€193 - €300)

Gross USC THIS WEEK € 8.14 (€3.86 + €4.28)

The Form P45 includes a dedicated section for the return of USC information and must be completed by all employers when an employee ceases to be employed by them.

When a new employee commences employment with you, you must capture the USC already paid by the employee as per the P45 issued from his previous employer.

Where the week 1 basis is used, the tax credits and cut-off points (both tax and USC) information on the P45 can be used on a week 1 basis but the previous pay, tax, pay for USC and USC deducted should not be used to operate the cumulative system. The previous pay, tax, pay for USC and USC deducted will be notified to the employer on the P2C issued by Revenue.

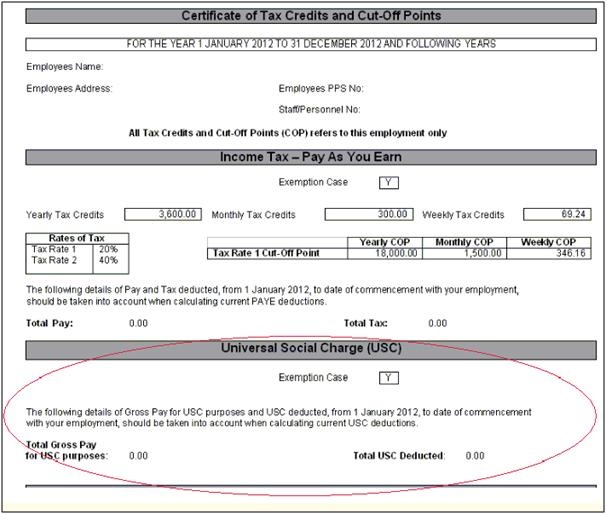

Where Revenue determine that the employee/pensioner’s total annual earnings (from all USC-able sources) will not exceed the USC exemption threshold (2013: €10,036), the USC exemption will be stated on the P2C issued by Revenue. This USC exemption marker is an instruction to the employer/pension provider not to deduct USC from payments being made.

Where the employer holds a P2C which does not show exemption and the employee/pensioner advises them that USC exemption applies to them, the employee/pensioner should be instructed to contact their local Revenue office to arrange to have a revised P2C issued. While awaiting a revised P2C the employer should continue to use the P2C currently held.

If an employee is exempt from USC the Tax Credit Certificate will show this:

With effect from 01st January the week 53 calculation of USC operates as follows:

Where payroll is operating on a cumulative basis

Continue to operate on a cumulative basis for the 53rd week, using the cumulative Cut-Off Points. Unlike PAYE, there are no additional thresholds granted in Week 53. Where the employee has used up all of their USC Cut-Off Points at cumulative Week 52, they will have no unused Cut-Off Points left to set against their Week 53 pay, and will therefore pay USC at the highest rate stated on the P2C on all their Week 53 pay.

Where payroll is operating on a week 1/month 1 basis

No cut off points, apply the top rate as per the P2C or where no P2C is in effect, from the P45.

Where the P2C advises that USC exemption applies

Continue to apply the exemption. Do not deduct USC from the Week 53 pay.

Where payroll is operating on the emergency basis

Continue to apply the emergency basis.

Need help? Support is available at 01 8352074 or [email protected].