Loans

BENEFIT IN KIND - PREFERENTIAL LOANS

IT IS IMPORTANT TO READ THE FOLLOWING NOTES CAREFULLY BEFORE PROCEEDING.

IMPORTANT NOTES ON BENEFIT IN KIND

PAYE, USC & PRSI must be operated by employers in respect of the taxable value of most benefits in kind and other non-cash benefits provided by them to their employees. The amount to be taken into account is referred to as "notional pay".

SMALL NON-CASH BENEFITS NOT EXCEEDING €250

Where an employer provides a small non-cash benefit (that is a benefit not exceeding €250) PAYE, USC & PRSI need not be applied to that benefit. No more than one such benefit given to an employee in a tax year will qualify for such treatment. Where a benefit exceeds €250 in value the full value of the benefit is subjected to PAYE, USC & PRSI.

Benefit in Kind on Preferential Loans

What is a preferential loan?

A 'preferential loan' is a loan made by an employer to an employee, or the spouse of an employee, in respect of which no interest is payable or the interest is payable at a rate lower than the Revenue specified rate.

Current Specified Rates:

- 4% Qualifying Home Loans

- 13.5% All other Loans

PAYE, USC & PRSI is applied to the difference (interest rate saving) between the interest applied by the employer in the tax year and the amount of interest which would have been payable in the tax year if the loan had been subject to the specified rate.

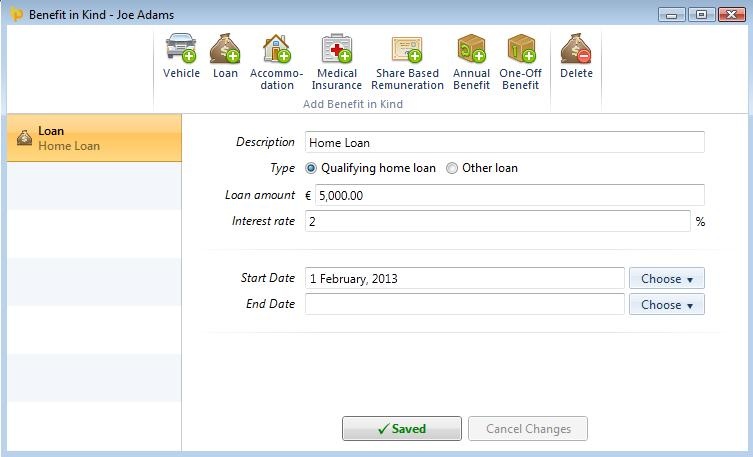

Processing Benefit in Kind on Preferential Loans in BrightPay

To access this utility go to Employees, select the employee in question from the listing and click Benefits on the menu toolbar, followed by Loan.

1) Description - enter a description of the loan.

2) Type - indicate whether the loan is a qualifying home loan or other loan.

3) Loan amount - enter the value of the loan being provided.

4) Interest rate - enter the interest rate percentage being charged on the loan.

5) Start Date - enter the start date of the loan.

6) End Date - enter the end date of the loan if the loan expires before 31st December.

7) Click Save to save the Benefit In Kind entry.

The 'Notional Pay' will be added to the employee's gross income each pay period to ensure that the correct PAYE, Universal Social Charge and PRSI are charged.

Need help? Support is available at 01 8352074 or [email protected].