Emergency Tax Basis

The Emergency Basis of PAYE and USC should be applied when:

- a form P45 for the current year or previous year,

- the employee has given the employer a completed form P45 indicating that the emergency basis applies,

- the employee has given the employer a completed P45 without a PPS number and not indicating that the emergency basis applies.

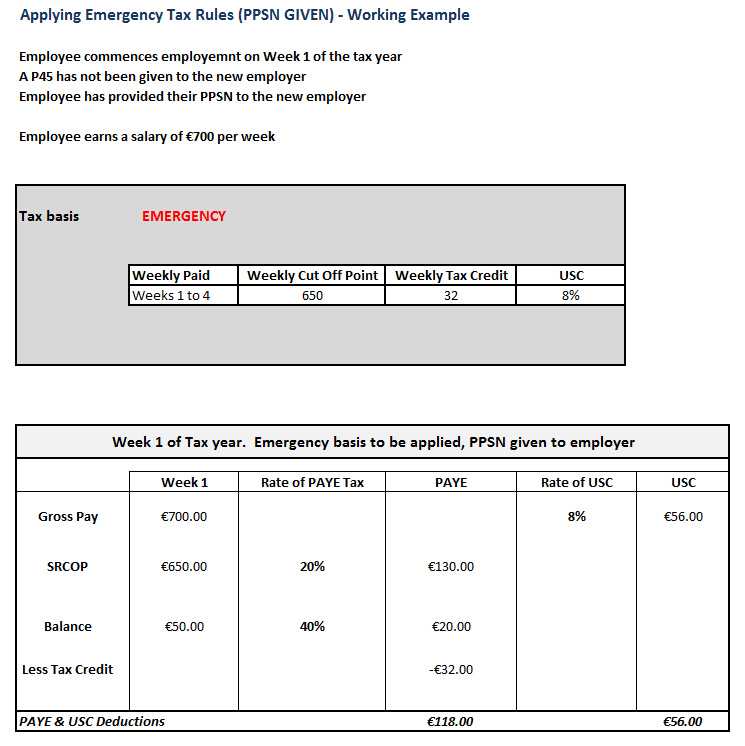

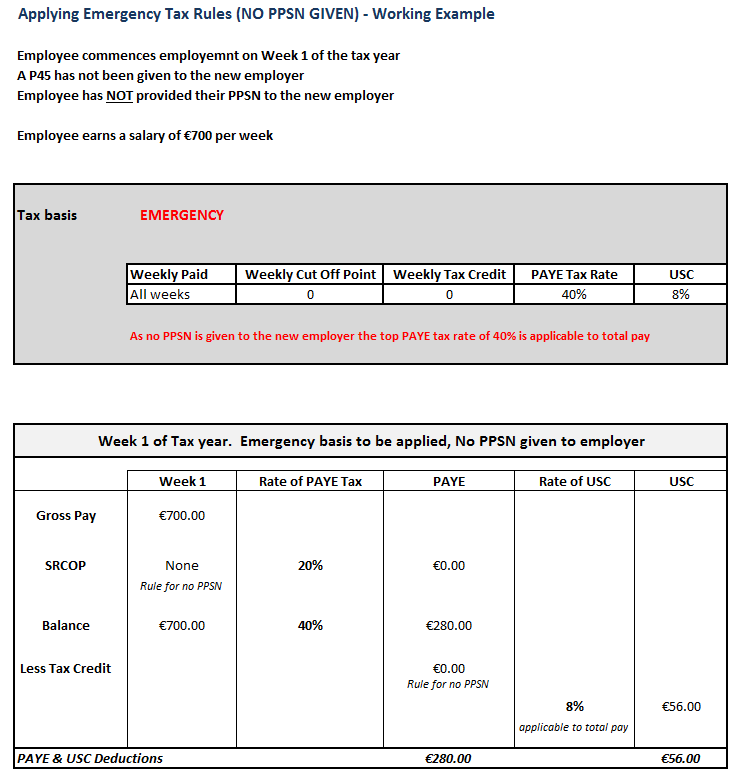

Where the employee does not provide their PPS number

Where the employee provides their PPS number

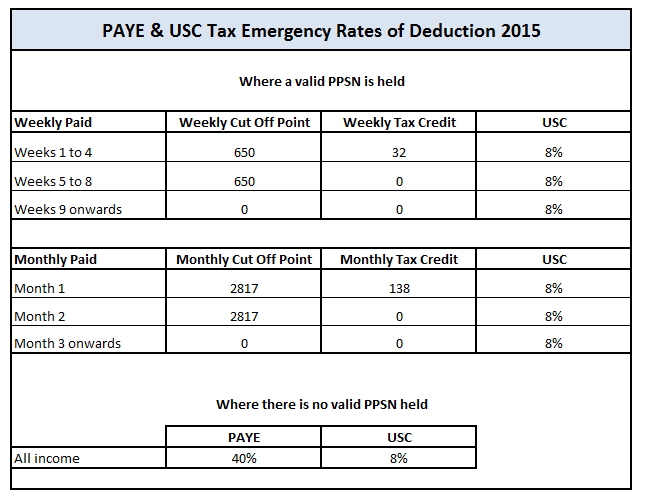

Emergency Tax Rules 2015

Separate periods of employment with one employer treated as one continuous period for emergency basis purposes

A weekly paid employee commences work in income tax week 10, leaves in week 14, resumes work with the same employer in week 28 and leaves finally in week 29. The emergency basis applies throughout.

- Weeks 10, 11, 12 and 13 are the first four weeks of employment for the purposes of the emergency procedure.

- Week 14 is the fifth week.

- Week 28 is the nineteenth week (i.e. fourteen weeks after week 14).

- Week 29 is the twentieth week for the purposes of the emergency procedure.

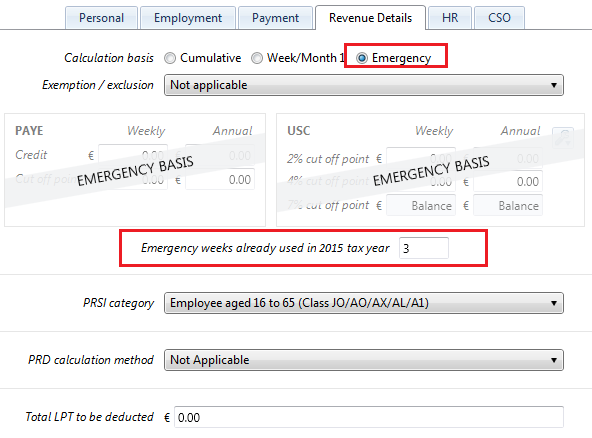

Accounting for previous emergency weeks

When an employee recommences employment with you, within the same tax year, for which the previous period of employment the emergency tax basis applied, you must indicate the number of weeks in this previous period of employment in order to recommence the emergency rules at the correct week.

- Set up the new employee

- In Revenue Details flag Emergency Basis

- Once Emergency Basis is selected the option to enter the number of weeks previously taxed under the emergency basis, in the current tax year in previous employment with the same employer, an option to enter this number of weeks will appear on screen.

- If the employee did not work previously simply enter the number zero

Separate periods of employment with one employer treated as one continuous period for emergency basis purposes - rule at change of Tax Year

If the emergency basis is still in operation on the following 1st January (new tax year), the employee is deemed to start a new period of employment on that date resetting the Emergency rules to restart the Emergency basis as if employment from 1st January is the commencement date of the emergency rules.

- Weeks 46, 47, 48 and 49 are the first four weeks of employment for the purposes of the emergency procedure.

- Weeks 50, 51 and 52 are weeks five, six and seven for the purposes of the emergency procedure.

- Weeks 1, 2, 3 and 4 in the new tax year are the first four weeks of employment for the purposes of the emergency procedure. (As stated above, the employee is 'deemed' to start a new period of employment on 1 January).

- Week 5 is the fifth week for the purposes of the emergency procedure.

Need help? Support is available at 01 8352074 or brightpayirelandsupport@brightsg.com.