IT IS IMPORTANT TO READ THE FOLLOWING NOTES CAREFULLY BEFORE PROCEEDING.

IMPORTANT NOTES ON BENEFIT IN KIND

PAYE, USC & PRSI must be operated by employers in respect of the taxable value of most benefits in kind and other non-cash benefits provided by them to their employees. The amount to be taken into account is referred to as "notional pay".

SMALL NON-CASH BENEFITS NOT EXCEEDING €500

Where an employer provides a small non-cash benefit (that is a benefit not exceeding €500) PAYE, USC & PRSI need not be applied to that benefit, provided that the benefit does not form part of a "salary sacrifice" arrangement. No more than one such benefit given to an employee in a tax year will qualify for such treatment. Where a benefit exceeds €500 in value the full value of the benefit is subjected to PAYE, USC & PRSI.

BENEFIT IN KIND ON CARS/VANS

Meaning of 'Car'

For the purposes of the PAYE, Universal Social Charge & PRSI calculation, a car means a mechanically propelled road vehicle constructed for the carriage of the driver or the driver and one or more passenger.

Meaning of 'Van'

For the purposes of the PAYE, Universal Social Charge & PRSI calculation, a van means a mechanically propelled road vehicle which is constructed for the carriage of goods and has a roofed area to the rear of the drivers seat which has no side windows or passenger seats.

Car/Van Pools

There will not be a charge to PAYE, Universal Social Charge & PRSI in respect of a car or van which is in a car/van pool. A car/van can be treated as being in a pool if:

- The car/van is made available to, and is used by more than one employee and is not ordinarily

used by one employee to the exclusion of others.

- Any private use of the car/van by an employee is merely incidental to business use.

- It is not normally kept overnight at the home of any employee

BENEFIT IN KIND ON PREFERENTIAL LOANS

What is a preferential loan?

A 'preferential loan' is a loan made by an employer to an employee, or the spouse of an employee, in respect of which no interest is payable or the interest is payable at a rate lower than the Revenue specified rate.

Specified Rates : 4% Qualifying Home Loans

13.5% All other Loans

PAYE, USC & PRSI is applied to the difference (interest rate saving) between the interest applied by the employer in the tax year and the amount of interest which would have been payable in the tax year if the loan had been subject to the specified rate.

BENEFIT IN KIND ON ANNUAL BENEFITS

Medical Insurance

In the case of medical insurance premiums, the cost to the employer is based on the Gross invoiced premium before TRS (Tax Relief at Source). The employer refunds the TRS to Revenue.

Accommodation

Where accommodation is owned and provided by the employer for use by an employee, the value of the taxable benefit is subject to PAYE, USC & PRSI.

Employer provided on site Crèche/Childcare facilities

Previously, where an employer provided day care facilities for employees on premises, this benefit carried a Benefit in Kind exemption. Budget 2011 abolished this exemption.

Employers now have to record the cost of this benefit, by relevant employee, within their payroll in order to deduct PAYE, USC and PRSI from the employees pay.

Employers can use the Annual facility to enter the start date and value of this benefit.

Professional Subscriptions paid by Employer on behalf of an employee

Previously, where an employer paid professional subscriptions on behalf of an employee, this benefit carried a Benefit in Kind exemption. Budget 2011 abolished this exemption.

Employers now have to record any professional subscription payments made on behalf of an employee as a benefit.

Employers can use the Annual facility to enter the start date and value of this benefit.

BENEFIT IN KIND ON ONE OFF BENEFITS

Vouchers

Expense incurred by the employer less any reimbursement to the employer by the employee, e.g. shopping vouchers, holiday vouchers, bonus bonds, cash vouchers. This one off payment is subject to PAYE, USC & PRSI on date of receipt by the employee.

Transfer of Assets

Where an employer gives an asset to an employee, the taxable benefit for the year must be calculated with reference to the higher of :-

- expense incurred by the employer, and

- realisable value of the asset less any reimbursement to the employer by the employee

Provision of Goods

Where an employer gives goods to an employee, the taxable benefit for the year must be calculated with reference to the higher of :-

- expense incurred by the employer, and

- realisable value of the goods less any reimbursement to the employer by the employee.

EXEMPT ANNUAL BENEFITS

In the case of subscriptions paid on behalf of an employee, it is the expense incurred by the employer less any reimbursement by the employee that is taken into account for PAYE, USC & PRSI purposes.

Sports Facilities

Where sports facilities are made available on the employers premises for the use of employees generally, a taxable benefit does NOT arise. The facility must be available to ALL employees.

Employee required to live on premises

A taxable benefit will NOT arise where an employee (not director) is required by terms of his or her employment to live in accommodation provided by the employer in part of the employers business premises so that the employee can properly perform his or her duties, i.e. night care staff, governors, chaplains in prisons, caretakers etc.

EMPLOYER CONTRIBUTIONS TO A PRSA

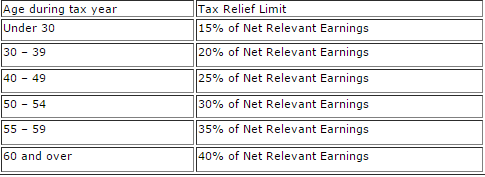

An employer may make contributions on behalf of an employee to a PRSA. The employers contributions will be treated as a Benefit in Kind in the employees hands. However the employee will be entitled to income tax relief (subject to the overall age related limit) in respect of such contributions.

In practice this means that a Benefit in Kind charge will only rise where the combined contribution (employer and employees) exceeds the age related exemption (shown below). This is unlikely to occur in most cases.

Where the combined contribution (employer and employees) exceeds the age related exemption it is subject to Benefit in Kind but it is not dealt with through the PAYE system. Employers will be required on request by the Revenue Commissioners to return particulars of PRSA contributions on behalf of employees on the form P11D. In addition employees will also be obliged to make a return of such contributions on their own individual returns of income (Form 12).

Need help? Support is available at 01 8352074 or [email protected].