Exporting a P2C file from ROS

The electronic Tax Credit File (P2C) issued to the Employer can be exported from your ROS Inbox.

To access this utility go to www.revenue.ie > ROS Login

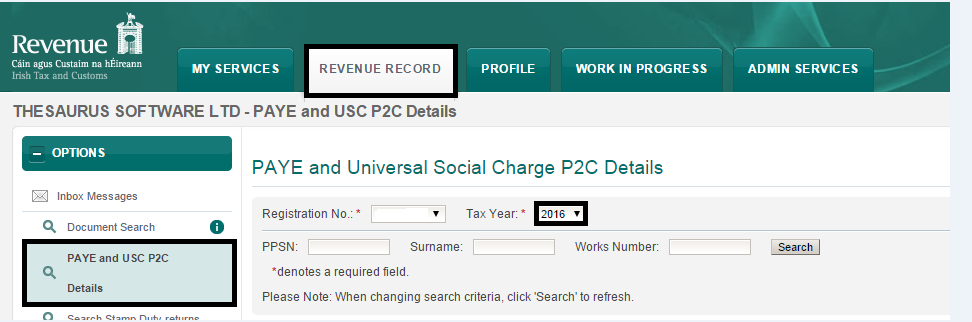

- Click Revenue Record

- Choose PAYE and USC P2C Details

- Choose the tax year you require the P2C files for, e.g. 2016

- Click Search

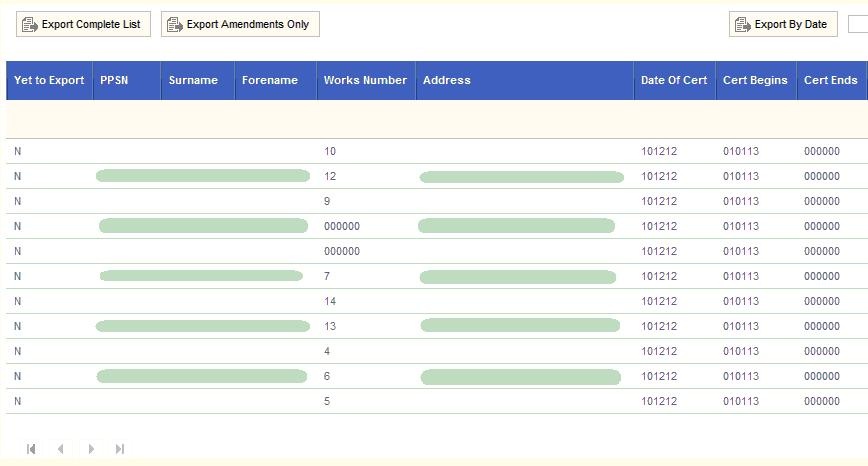

The employee listing will be displayed on screen along with their 2016 tax certificate information.

- Select Export Complete List - if you wish to export ALL P2C files. This is normally done at the beginning of a new tax year

- Select Export Amendments only- if you wish to export new P2C file

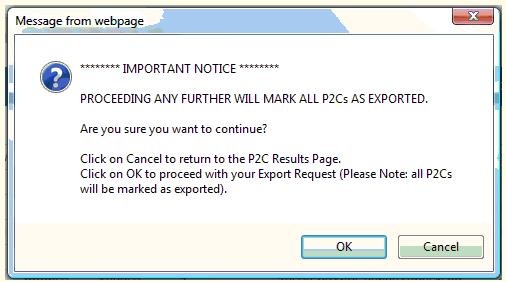

You will be advised that all P2C files will be flagged as exported:

Click OK to continue

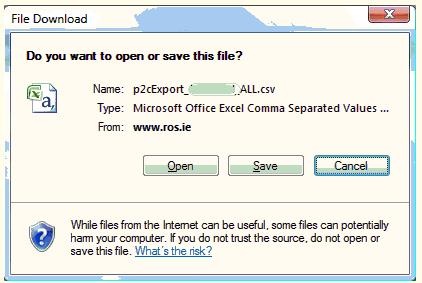

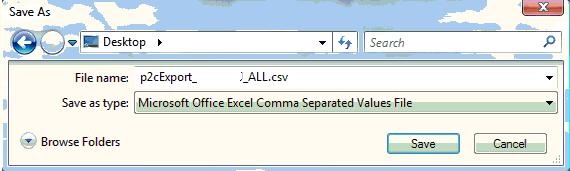

- You will now be prompted if you wish to open or save the file. Select "Save" so that you can import it into BrightPay:

- Click Save

- Select location to save file to (ensure that you take a note of the location of the saved file)

- Click Save

- The P2C file is now ready for import into BrightPay.

Need help? Support is available at 01 8352074 or brightpayirelandsupport@brightsg.com.