Submitting a P45 to ROS

Once you have issued an employee's P45 within BrightPay, part 1 of the employee's P45 can be submitted through the Revenue Online Services website to inform Revenue that the employee has left your employment. This utility is only available if you have registered to use ROS.

To submit part 1 of the employee's P45 through ROS, you must first have prepared the ROS P45 file within BrightPay. For assistance with this, click here .

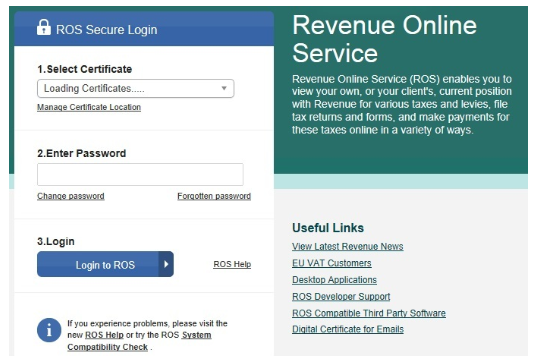

1) Log in to your ROS utility through www.revenue.ie > ROS Login:

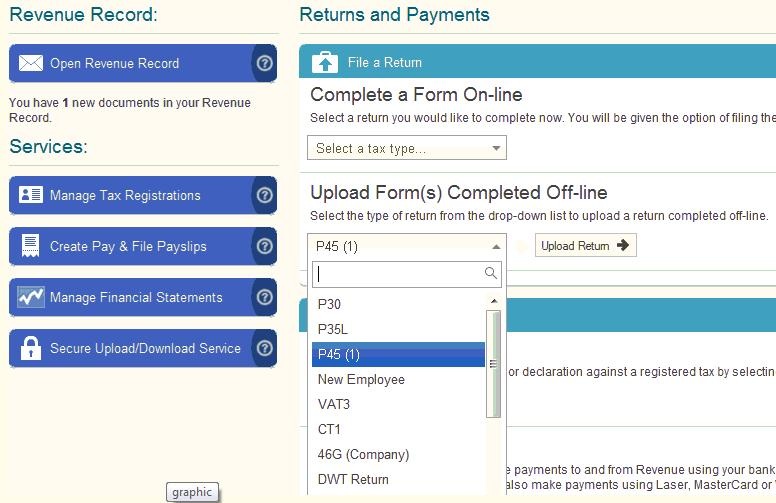

2) Under My Services - Select Upload Form(s) completed offline:

- Select P45 (1)

- Click Upload Return

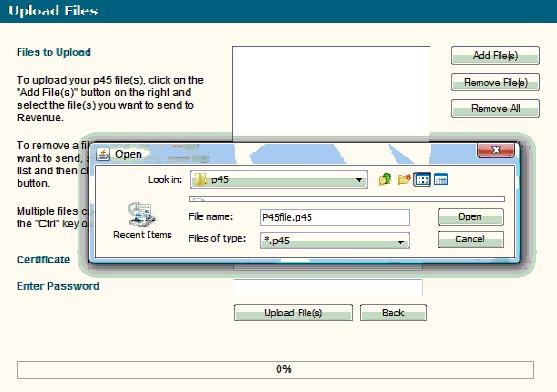

3) Click Add File:

- A browser will open, simply select the drive and directory where you saved the P45 file to.

- Select your P45 File

- Click Open

4) Select your Certificate

5) Enter your Password

6) Click Upload File(s)

When the upload is completed successfully, a confirmation number for the return will display on screen.

7) Access your ROS Inbox to view, save and print part 2, 3 and 4 of the P45 to give to the employee.

Important note: official Revenue P45 paper must be used when printing an employee's P45 - P45 stationery is available from Revenue’s Forms & Leaflets section (1890 306 706).

Need help? Support is available at 01 8352074 or brightpayirelandsupport@brightsg.com.