Setting up a new employee mid-year

For new employees commencing mid-year, set up your employee in the normal manner. For assistance with this, please refer to the help section entitled Employee.

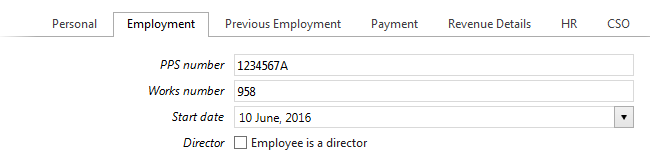

For a new employee starting mid –year, a start date is essential in order to ensure that the employee is added to the payroll in the correct pay period. The employee’s start date must be entered in the designated field provided in the ‘Employment’ tab.

After a start date has been entered a ‘Previous Employment’ section will become available in order to enter previous employer and pay history for the current tax year.

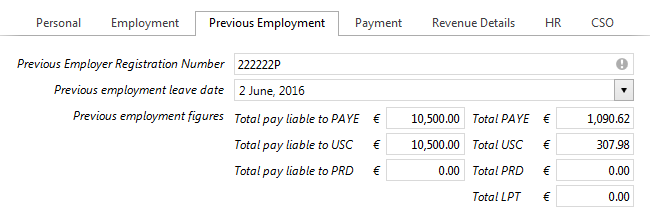

If the employee has worked elsewhere in the current tax year, complete the employee’s ‘Previous Employment Details’ accordingly using the P45 that the employee has given to the employer.

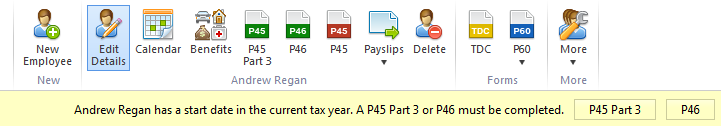

Once all employee details have been entered, simply click ‘Save Changes’ to add the Employee record.

As soon as the employee record is saved, BrightPay will inform you that a P45 Part 3 or a P46 must be completed and an asterisk will be placed next to the employee’s name as a reminder until this action is completed.

For assistance with preparing a P45 Part 3 or P46 file for ROS, please refer to the help section on these topics.

Need help? Support is available at 01 8352074 or brightpayirelandsupport@brightsg.com.