Submitting a P46/P45 Part 3 to ROS

For new employees who have provided a P45 from previous employment, a P45 Part 3 can be submitted to ROS , in order to register the new employee.

For new employees commencing mid-year who do not provide their new employer with a P45, a P46 can be completed and submitted to ROS instead.

The submission of a P46 or P45 Part 3 to Revenue will result in Revenue issuing a P2C/ Tax Credit Certificate to the new employer for their new employee(s) via ROS.

For assistance with preparing a ROS P45 Part 3 file in BrightPay, click here . For assistance with preparing a ROS P46 file in BrightPay, click here .

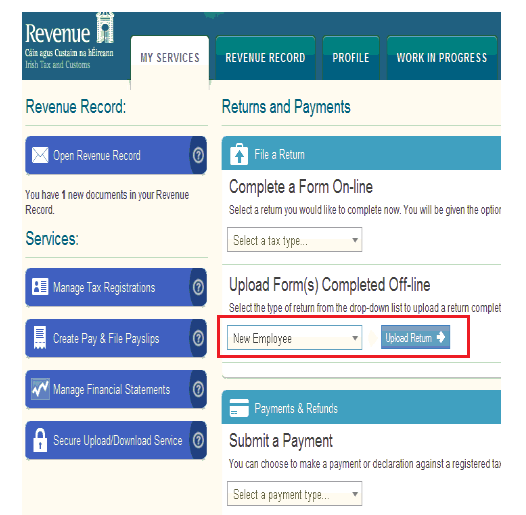

To submit a P46 or P45 Part 3 to ROS go to www.revenue.ie > ROS Login

- Under My Services - select Upload a Form Completed Offline

- Select New Employee from the listing

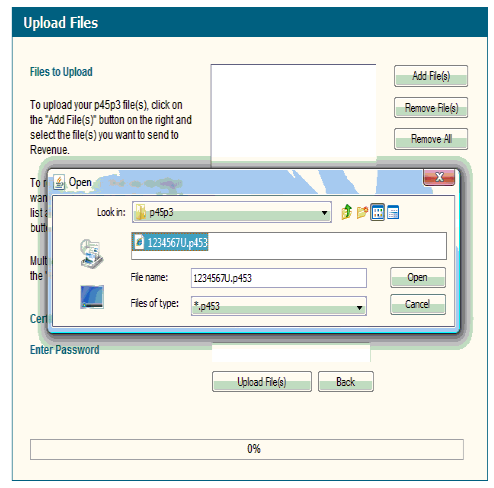

- Click Add File(s)

- Browse to where you have saved your ROS P46/ ROS P45 Part 3 file. Select your file and click 'Open'

- Enter your Password

- Click Upload File(s)

Once successfully submitted, confirmation will display on screen accompanied by a confirmation number for the submission.

Need help? Support is available at 01 8352074 or brightpayirelandsupport@brightsg.com.