Universal Social Charge

USC operates in the same manner as PAYE, varying by employee:

- USC credits and Cut Off Points are issued per employee

- Employers are advised of these rates and COP along with the basis on the P2C

- Employers should not alter treatment from the P2C instruction unless a new P2C is issued

- Employer should not change how an employee is treated for USC based on personal circumstance (medical card/over 70)

EMPLOYERS ARE TO OPERATE USC STRICTLY ON THE EMPLOYEE ASSIGNED USC RATES AND CUT-OFF POINTS AS ADVISED BY REVENUE IN THE P2C FILE, WITHOUT EXCEPTION.

P2C

Employer Tax Credit Certificates (P2Cs), display PAYE credits and cut-off points and also USC rates and cut-off points.

P45 and P45 Supplement

The Forms P45 and P45 Supplement include USC details.

Individuals aged 70 and over whose aggregate income is less than €60,000

and

Individuals who hold full medical Cards whose aggregate income is less than €60,000

It is NOT the responsibility of the employer to determine amendments to the operation of USC based on an employee’s personal circumstance. Where lower rates of USC apply in certain circumstances, for example, in the case of employees aged 70 and over whose aggregate income is less than €60,000, or where employees hold full medical cards whose aggregate income is less that €60,000, these lower rates will be stated on the P2C issued by Revenue. Where lower rates are not stated on the P2C currently held, the employee should be advised to contact their local Revenue office in order to update their USC status with Revenue.

USC Exemption

The 2016 USC exemption income threshold is €13,000 (formerly €12,012 for 2015).

Where Revenue determines that a USC exemption applies, it will be advised to the employer on the P2C. The employer does not make any adjustment unless advised to do so via the P2C/Tax Credit Certificate issued to them for an employee.

USC Emergency basis

No cut-off points are allowed. The emergency rate of USC is the highest rate applicable to a PAYE employee, currently 8% for 2016. While the rules applicable to emergency tax operable in PAYE include a gradual escalation in emergency tax rates over a given period, in USC there is just a flat % rate (with no cut-off point) applied to all payments.

What are employers to do where they have not received 2016 P2Cs in time to run January 2016 payroll(s)?

Revenue commenced issuing 2016 electronic Tax Credit Certificates (P2Cs) to all employers in December 2015. In the situation where an employer has not received 2016 P2Cs in time to run January 2016 payroll, then, as with PAYE, the 2015 USC rates and COPs are to be applied until the 2016 P2C is issued.

The rates and thresholds of the Universal Social Charge (USC) are changed with effect from 1 January 2016.

In December 2016, Revenue will issue to employers/pension providers 2016 Tax Credit Certificates (P2Cs) for all employees, advising the rates and thresholds applicable from 1 January 2016.

In the situation where an employer has not received 2016 P2Cs in time to run January 2016 payroll(s), the following instructions apply:

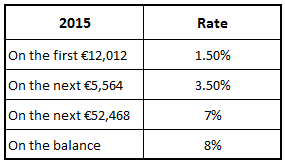

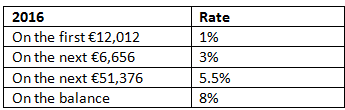

- Where standard rates (1%, 3.5% & 7% & 8%) were advised in the 2015 P2C, employers should use the following 2015 COPs with 2016 Rates from 1 January 2016, until the 2016 P2C is received:

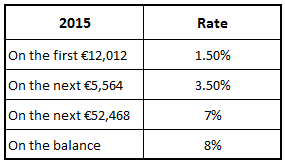

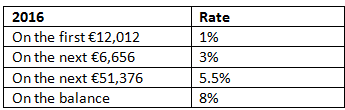

2015 Standard USC COPs & Rates 2016 Standard USC COPs & Rates

BrightPay will automatically apply the above 2016 rules on import from 2015 as appropriate.

- Where reduced rates (1.5% & 3.5%) were advised in the 2015 P2C, employers should use the COPS from the 2015 P2C and apply the 2016 rates from 1 January 2016, until the 2016 P2C is received:

BrightPay will automatically apply the above 2016 rules on import from 2015 as appropriate.

- Where USC Exemption was advised in the 2015 P2C, employers should continue to apply USC Exemption from 1 January 2016, until the 2016 P2C is received.

- Where the emergency basis of USC deduction applied, employers/pension providers should continue to apply the emergency basis of USC from 1 January 2016, until the 2016 P2C is received. The 2016 emergency USC rate is 8%.

It is imperative that once 2016 P2C files are received by an employer that they are imported into BrightPay 2016 immediately and before any further payroll is finalised.

CESSATION OF EMPLOYMENT

On the P45 there is a dedicated section for the return of USC information, this must be completed by all employers when an employee ceases to be employed by them.

EMPLOYEES COMMENCING EMPLOYMENT

When a new employee starts in your employment and provides you with a 2015 P45 with standard rates, employers should continue to use the 2015 COPs and apply the 2016 rates on the temporary basis. They are to be used on a week 1/month 1 basis until advised otherwise by Revenue on the P2C file.

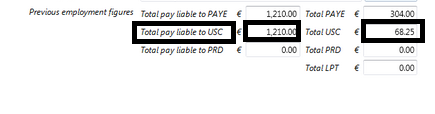

The Previous Employment utility of the employee record facilitates the recording of the additional USC information from the P45.

Where the Week 1 basis is used, the tax credits and cut-off points (both tax and USC) information on the P45 can be used on a week 1 basis but the previous pay, tax, pay for USC and USC deducted should not be used to operate the cumulative system.

The previous pay, tax, pay for USC and USC deducted will be notified to the employer on the P2C issued by Revenue.

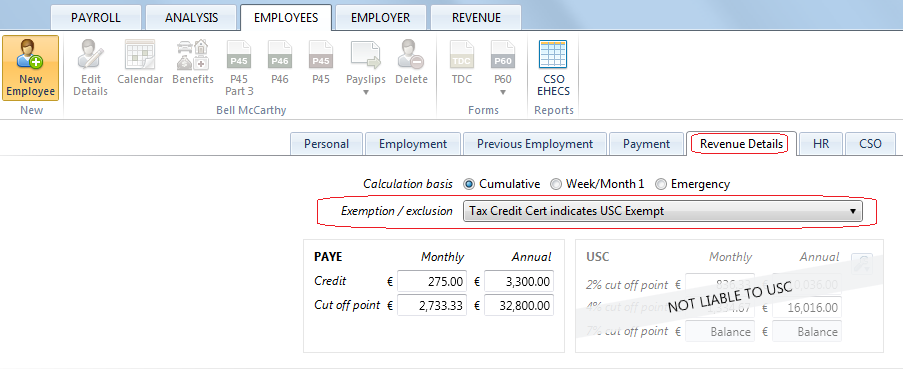

USC EXEMPTION MARKER

The annual income exemption threshold of €13,000 applies for 2016, the process of employee self election to Revenue still applies.

Where Revenue determine that the employee/pensioner’s total annual earnings (from all USC-able sources) will not exceed the USC exemption threshold of €13,000 (formerly €12,012 for 2015), the USC exemption will be stated on the P2C issued by Revenue. This USC exemption marker is an instruction to the employer/pension provider not to deduct USC from payments being made.

Where the employer holds a P2C which does not show exemption and the employee/pensioner advises them that USC exemption applies to them, the employee/pensioner must contact Revenue themselves to inform Revenue that their earnings will not exceed €13,000 in the tax year. Revenue will then issue a revised P2C to the employer with an updated USC instruction.

Once a new P2C is used to the employer which indicates that USC exemption is to be operated then any previous USC deducted will be refunded to the employee on the subsequent payslip.

CALCULATING USC ON WEEK 53

Where a week 53 occurs an additional period of USC threshold is allocated to the employee on a week 1 basis.