The employer should assume that the employee is in receipt of Illness Benefit once the period of illness exceeds six consecutive days and start to account for Illness Benefit in this first pay period. The employer should assume the employee is in receipt of the full normal rate of illness benefit until notified otherwise.

In the event that the employer subsequently receives notification from the DSP and the actual amounts received by the employee differ to what has already been accounted for in BrightPay in previous pay periods, a dedicated facility is available within the program to account for any differences.

1) Click ‘Payroll’ on the menu bar and select the relevant employee’s name in the summary view.

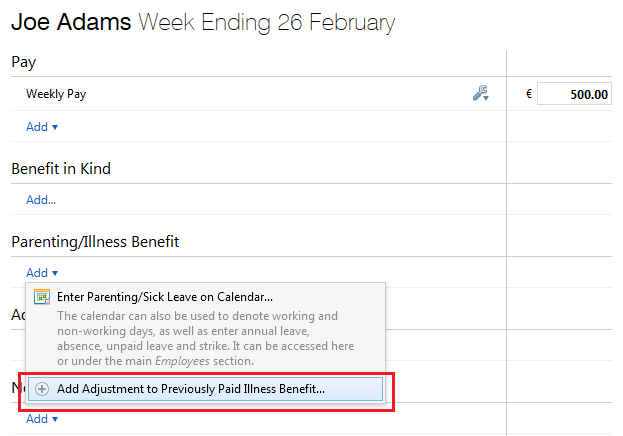

2) Within the ‘Parenting/ Illness Benefit’ section on the employee’s payslip, select to make an Adjustment to Previously Paid Illness Benefit.

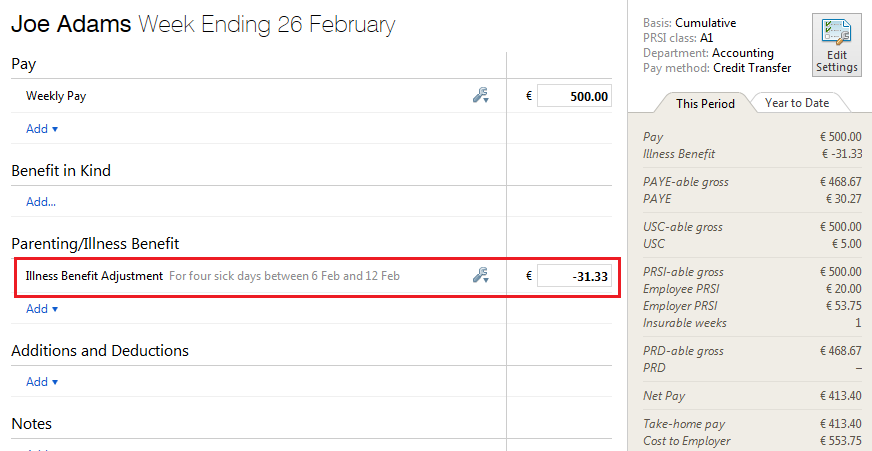

3) A list of the date ranges for which previous illness benefit has been recorded for this employee will be displayed. Simply select the appropriate date range that you wish to amend. Select Save. The payslip will now give an option to enter an adjustment to the current payslip to adjust the previous amount entered for Illness Benefit.

4) Enter the amount of the adjustment required. Both positive and negative amounts may be entered here, depending on whether the illness benefit already accounted for has been over or understated.

The Illness Benefit adjustment will be now be taken into account in the current pay period being processed and the PAYE adjusted accordingly. If any amendments are subsequently needed to the employee's periodic salary due to the over/ underpayment of illness benefit, these should be made before the employee's payslip is finalised.

Need help? Support is available at 01 8352074 or [email protected].