Pay As You Earn (PAYE)

There was no change to tax rates for 2018, the standard rate will remain at 20% and the higher rate at 40%.

Standard Rate Cut Off Points (SRCOPs) will be increased by €750 from 1st January 2018.

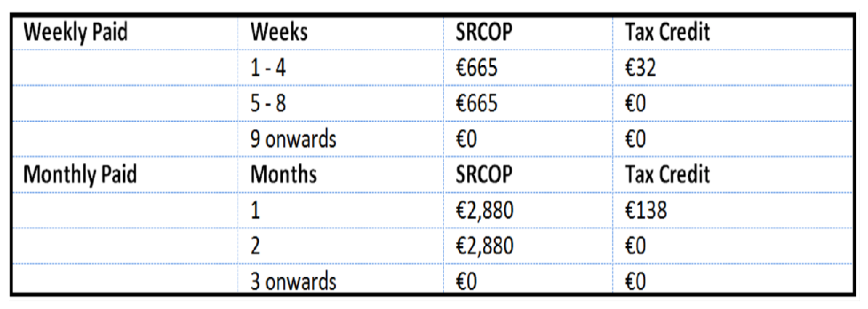

Emergency Basis of PAYE

Employee provides PPS Number:

Where an employee does not provide their PPS Number the higher rate of 40% tax applies to all earnings.

Earned Income Tax Credit

The Earned Income Tax Credit will be increased by €200 from €950 to €1,150.

Home Carer Tax Credit

The Home Carer Tax Credit will be increased from €1,100 to €1,200.

Universal Social Charge (USC)

Medical card holders and individuals aged 70 years and older whose aggregate income does not exceed €60,000 will pay a maximum rate of 2%.

The emergency rate of USC remains at 8%.

PRSI & USC

The Minister outlined his intention to establish a working group in 2018 to carry out a review of the possible integration of PRSI and USC.

National Training Levy

The National Training Levy of 0.7% which is currently collected as part of the employer PRSI contribution will increase to fund further and higher education, the increases are as follows:

Pay Related Social Insurance (PRSI)

There were no changes to general PRSI thresholds or employee PRSI announced in the Budget. However, as the National Training Levy is increasing and it is collected as part of the employer PRSI contribution, employer PRSI will increase as follows:

Benefit in Kind (BIK) - Electric Cars

A 0% rate of BIK will apply to electric vehicles provided by an employer to an employee in 2018 which is available for private use. Electricity used by the employee in the workplace to charge the car will also be exempt from BIK.

PAYE Modernisation

PAYE Modernisation will be effective from 1st January 2019. Budget 2018 has allocated €50 million for a project to enhance Revenue's IT capacity and to ensure employer compliance.

National Minimum Wage

The National Minimum Wage will increase from €9.25 to €9.55 per hour in respect of hours worked on or after 1st January 2018.

Social Welfare Payments

There will be a €5 increase in all weekly Social Welfare payments with effect from 26th March 2018. The maximum personal rate of Illness Benefit will be increased to €198 per week. Maternity Benefit and Paternity Benefit will be increased to €240 per week.

Need help? Support is available at 01 8352074 or [email protected].