The P2C is the employer's copy of an employee's PAYE tax credit certificate. It shows:

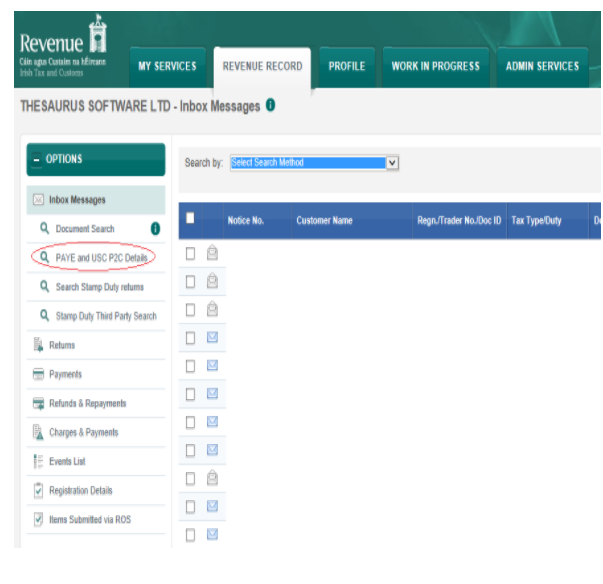

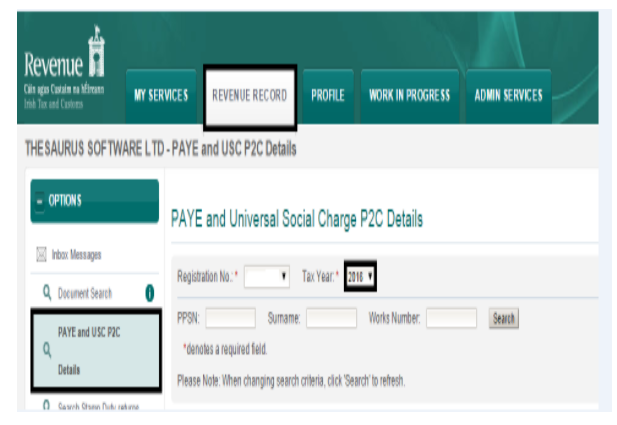

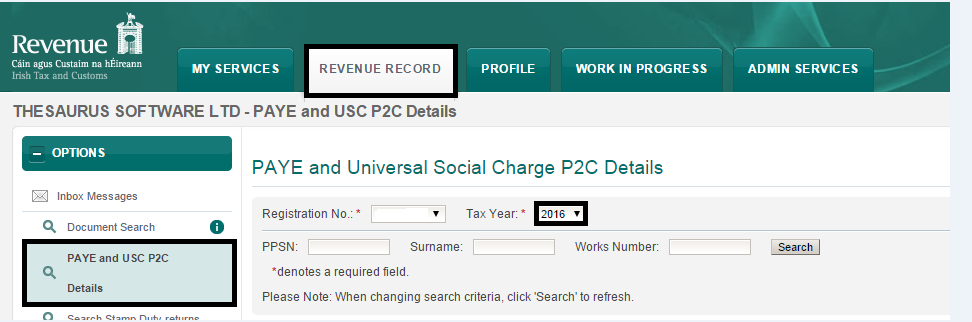

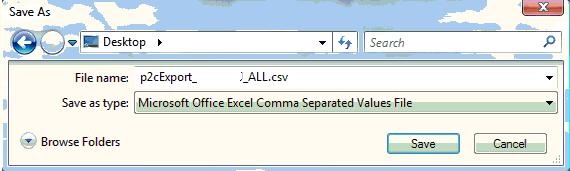

The electronic Tax Credit File (P2C) issued to the employer must be exported from your ROS Inbox.

To do this, go to www.revenue.ie > Login to ROS > Enter your login details

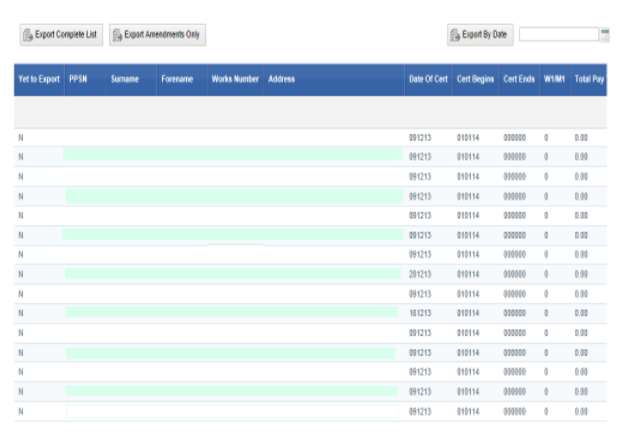

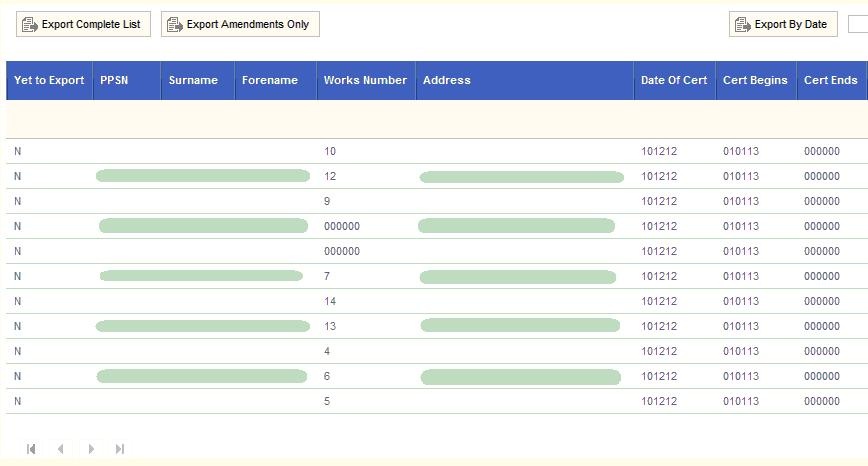

Y - Not yet exported to N - Previously exported

The employee listing will be displayed on screen along with their 2017 tax certificate information.

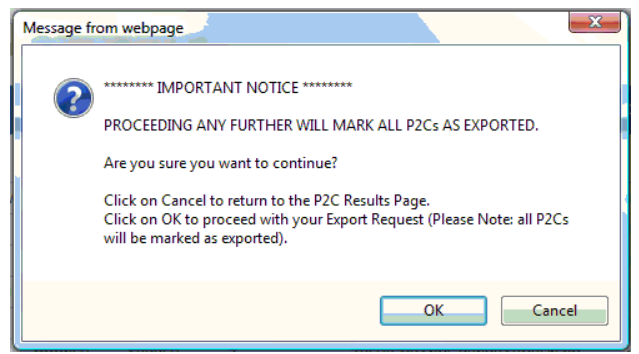

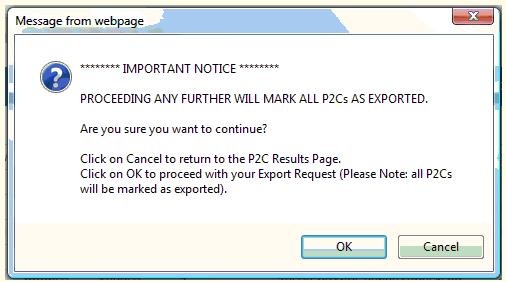

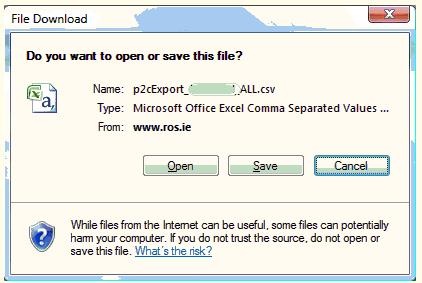

You will be advised that all P2C files will be flagged as exported:

Click OK to continue

Need help? Support is available at 01 8352074 or [email protected].