Form P30 is a monthly or quarterly return of PAYE, USC, PRSI & LPT to the Revenue Commissioners. A P30 must be submitted within 14 days of the month end. Failure to do so will result in a fine.

To qualify to become a Quarterly Remitter, taxpayers must satisfy the following requirements:

There is no need for employers to take any action in relation to this change as the Revenue have identified those employers who are eligible to avail of it.

90% of PAYE, USC, PRSI & LPT liability for the year must be returned by the 14th of January. The balancing payment can be submitted with your P35 but this payment must NOT exceed 10% if you wish to avoid interest for late payments.

To assist users in determining their monthly/ quarterly payments to the Revenue Commissioners, a dedicated reporting facility is available within BrightPay.

To access this facility, click Revenue:

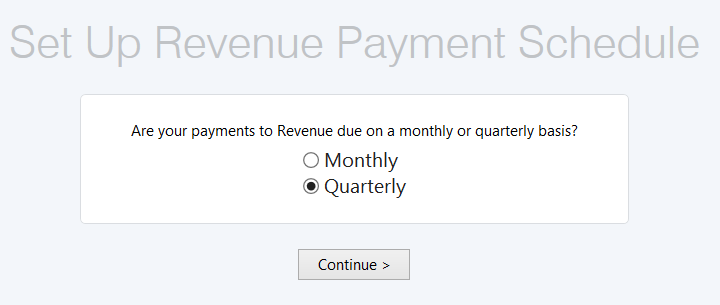

When the Revenue tab is selected for the very first time, you will be asked to set your Revenue Payment Schedule.

Choose Quarterly if you make your payments to Revenue on a quarterly basis.

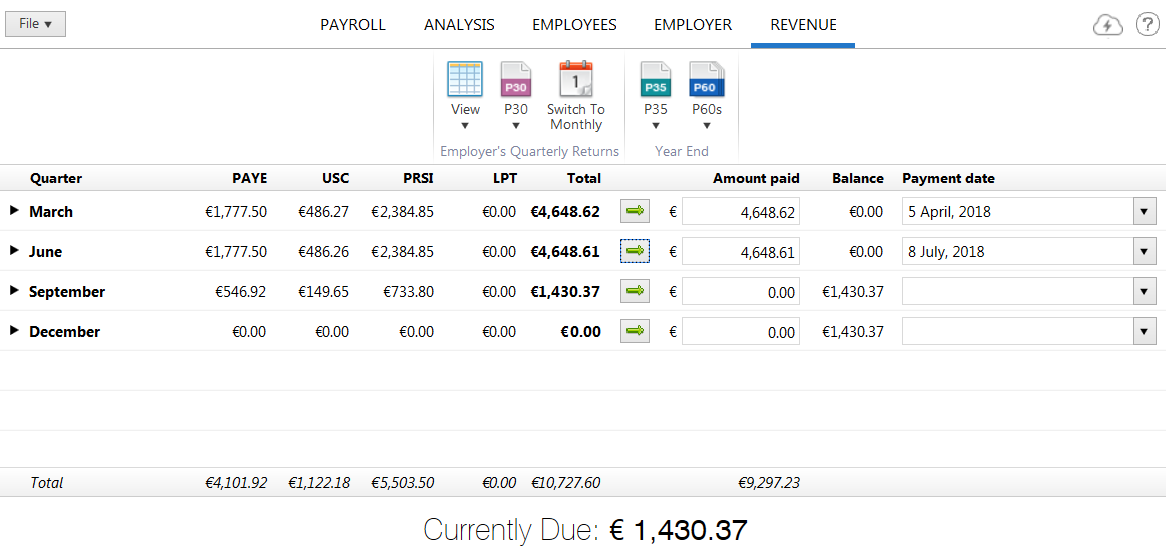

A summary of your PAYE, USC, PRSI & LPT liability for each month will be displayed on the screen.

To print/export a copy of your P30 quarterly return for your own records, click P30 > View/Print 30 button on the menu toolbar and select the quarter you wish to print. A print preview of the report will be displayed on screen. Press Print/Export PDF on the menu bar, as required.

Should you need to change the orientation, paper size or print margins for the report, these can be amended within the print preview screen by clicking Page Setup.

If, at any time, you need to switch your Revenue Payment Schedule from quarterly to monthly, simply click the 'Switch to Monthly' button on the menu toolbar.

Please note, however, that switching from one schedule to another will result in the loss of any amounts already entered in the previous schedule and amounts will need to be entered again.

Need help? Support is available at 01 8352074 or [email protected].