For tax year 2018, if you have employees for whom you are paying medical insurance and in respect of which Benefit In Kind arises, you are required to return on the 2018 P35 the portions of these premiums that are eligible for tax relief.

Because you will generally be unable to calculate these amounts yourself by virtue of not having all the information to hand, the medical insurance providers will provide you with these amounts for each employee in order for you to be able to input this information into BrightPay.

Please note: tax relief on medical insurance premiums is capped to €1,000 per adult and €500 per child. Where premiums exceed these thresholds, the excess will not qualify for tax relief.

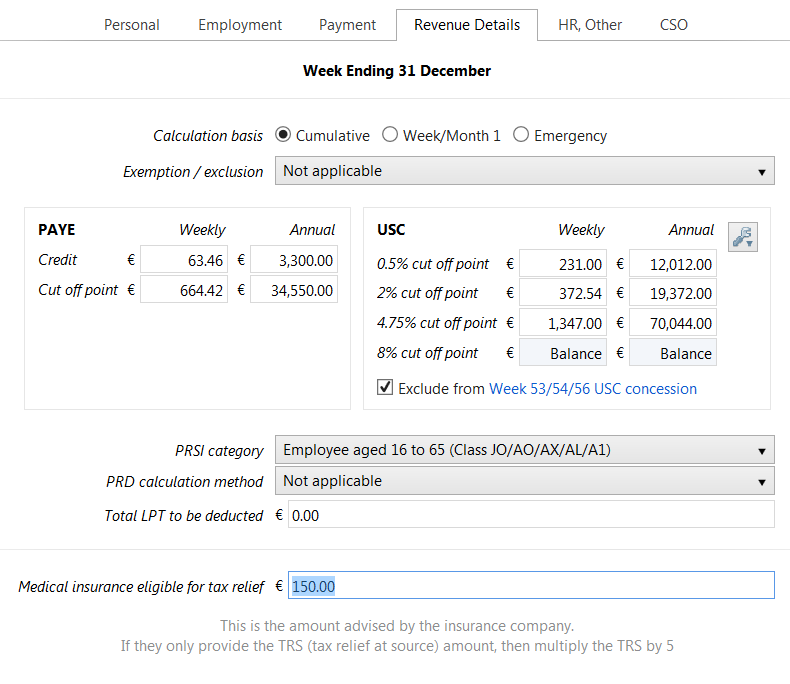

Once you have confirmation of the amount of medical insurance eligible for tax relief, within your 2018 software, simply go to Employees > select the Employee > Revenue Details:

Need help? Support is available at 01 8352074 or [email protected].