PAYE Modernisation introduces two new processes - the automated retrieval of Revenue Payroll Notifications for each of your employees from Revenue and the submission of your payroll data each payroll run to Revenue.

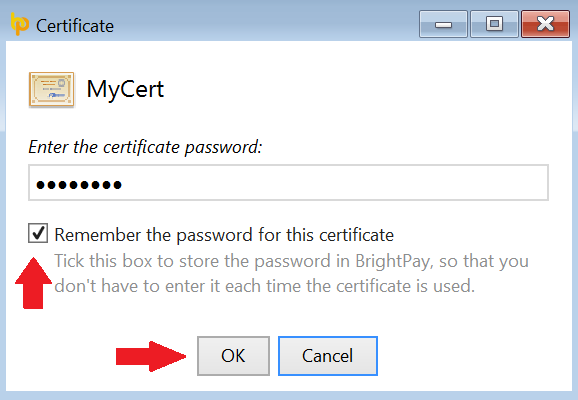

For this two-way communication to take place between BrightPay and Revenue’s systems, your ROS digital certificate will be used.

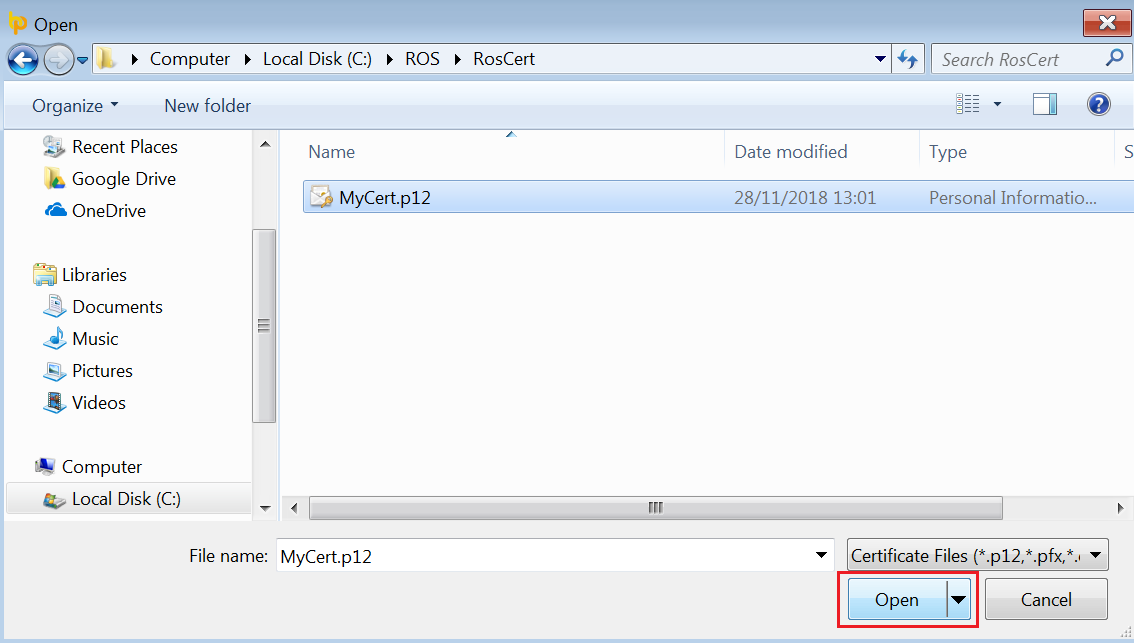

Therefore, the first task you will need to perform in BrightPay before you can commence with your payroll is to add your ROS digital certificate into the software. This is a once-off exercise and your digital certificate must already be on the same machine as the software itself.

Please note: in the event that your digital certificate is not on the same machine as your payroll software, guidance is provided here on how you can move your certificate from one machine to another.

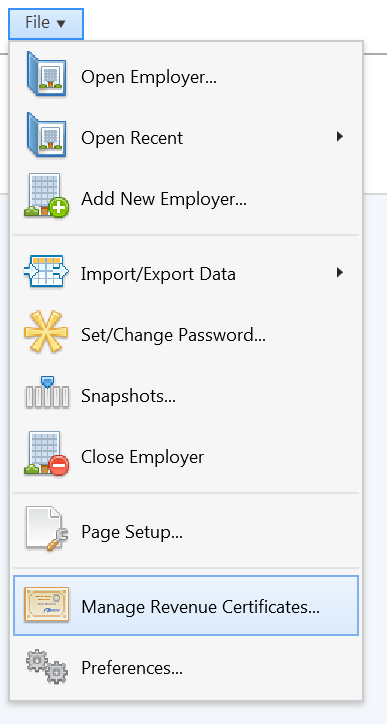

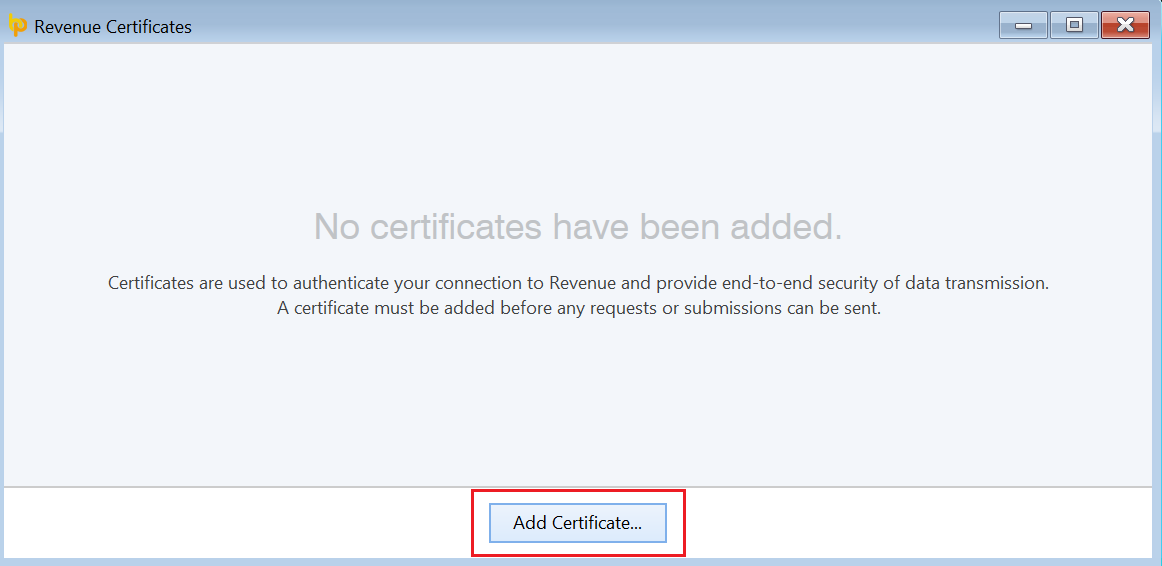

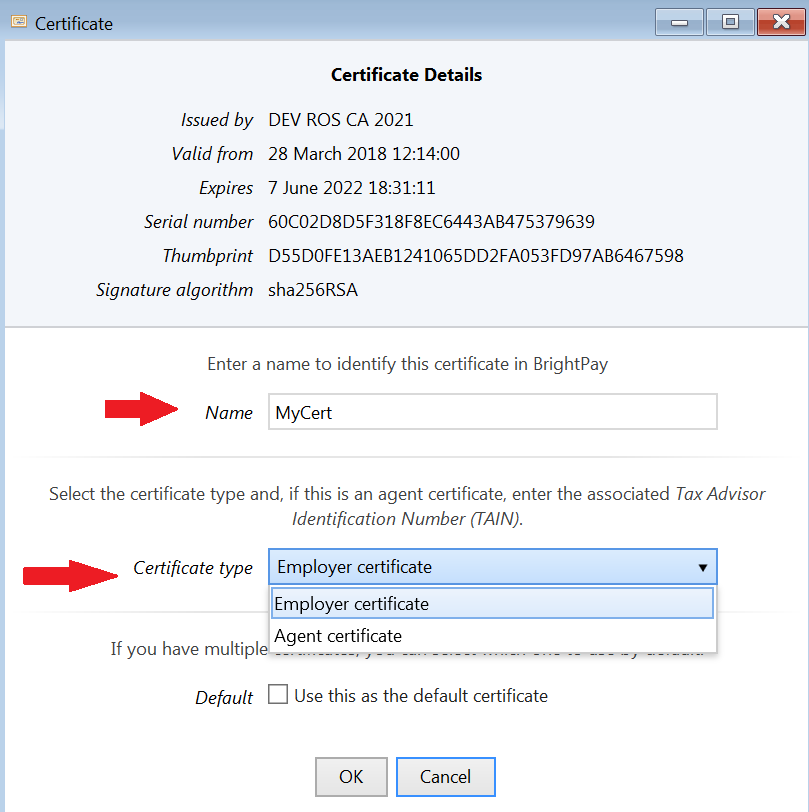

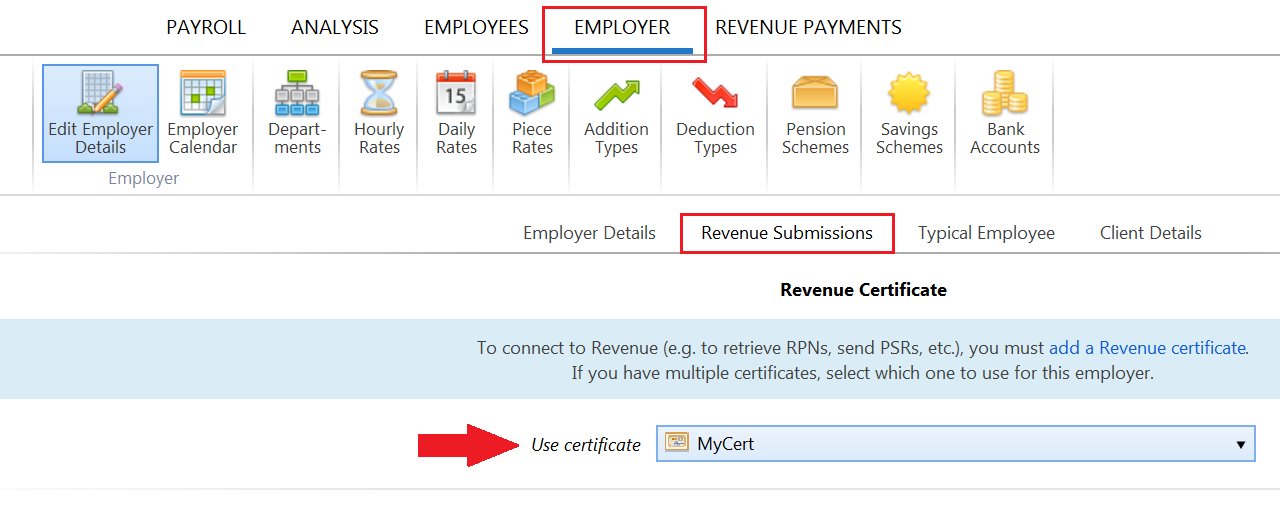

To add an employer digital certificate into the software:

Your Employer Certificate will now be added into the BrightPay software.

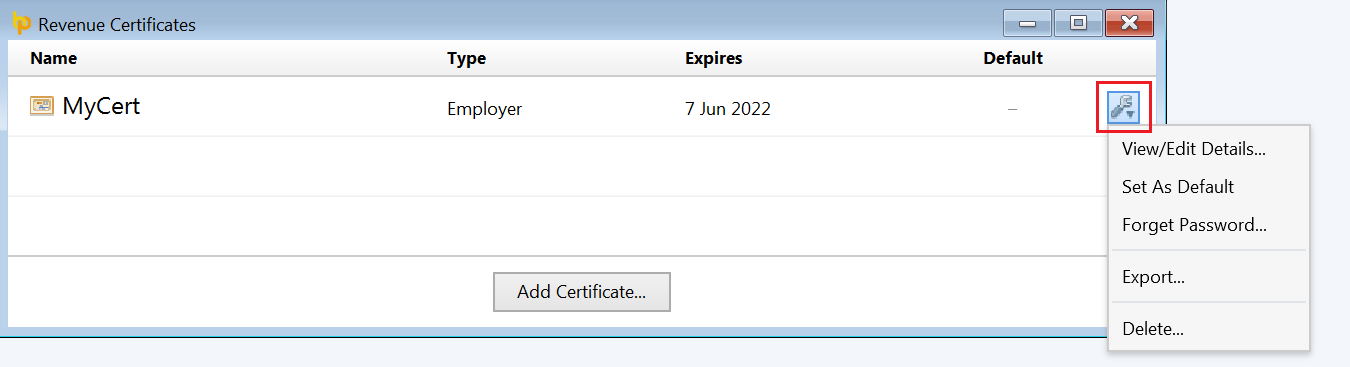

Once your certificate has been added, further functionality can be accessed at any time by going to 'File > Manage Revenue Certificates' and clicking the Edit button.

Need help? Support is available at 01 8352074 or [email protected].