Holiday Pay due within the Current Pay Period:

1) Select the pay period

Select the pay period in which the holiday pay is to be processed on the schedule bar.

2) Select the Employee

From the employee listing, select the employee's name.

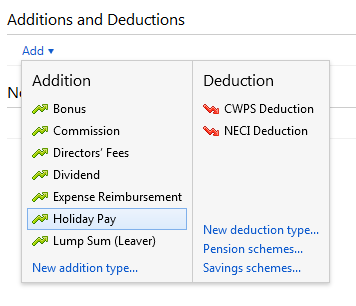

3) Additions And Deductions

Under 'Additions & Deductions', click 'Add,' followed by 'Holiday Pay'

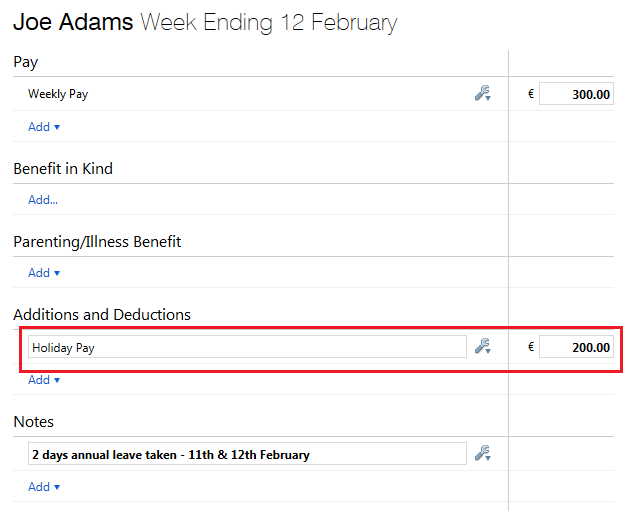

4) Enter the employee's holiday pay amount as well as any other payments, additions and deductions etc.

5) Enter a note on the employee's payslip, if required.

6) Finalise Payslips

Once all the employee's pay data has been entered on the payslip, simply click 'Finalise Payslips' to update the pay period.

To Pre-Pay Holiday Pay In Advance:

To pay an employee in advance, a 'pre-pay' option is available within BrightPay.

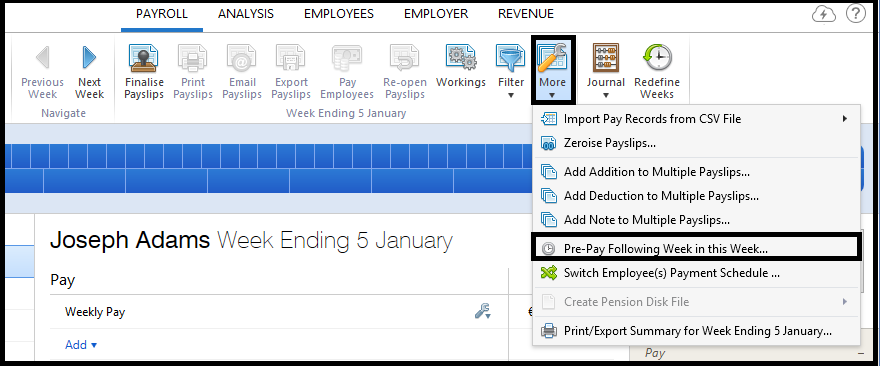

To pre-pay an employee, click into the Payroll utility:

1) Within the current open pay period, click "More" on the menu toolbar, followed by 'Pre-Pay Following Week/Fortnight/Month/4-Week in this Week/Fortnight/Month/4-Week.. '.

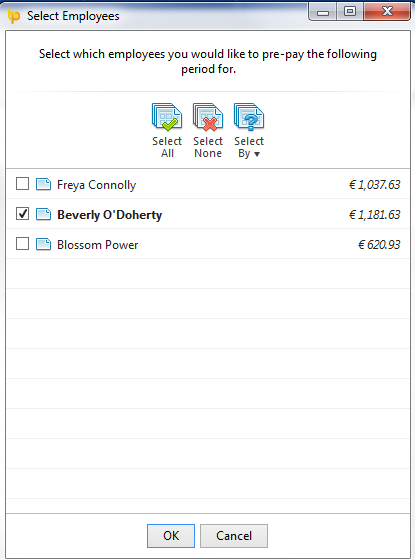

2) Select the employee(s) you wish to pay in advance and click 'OK'.

3) In the current open pay period, click the on screen alert 'Go to Following Week/Fortnight/Month/4-Week'.

![]()

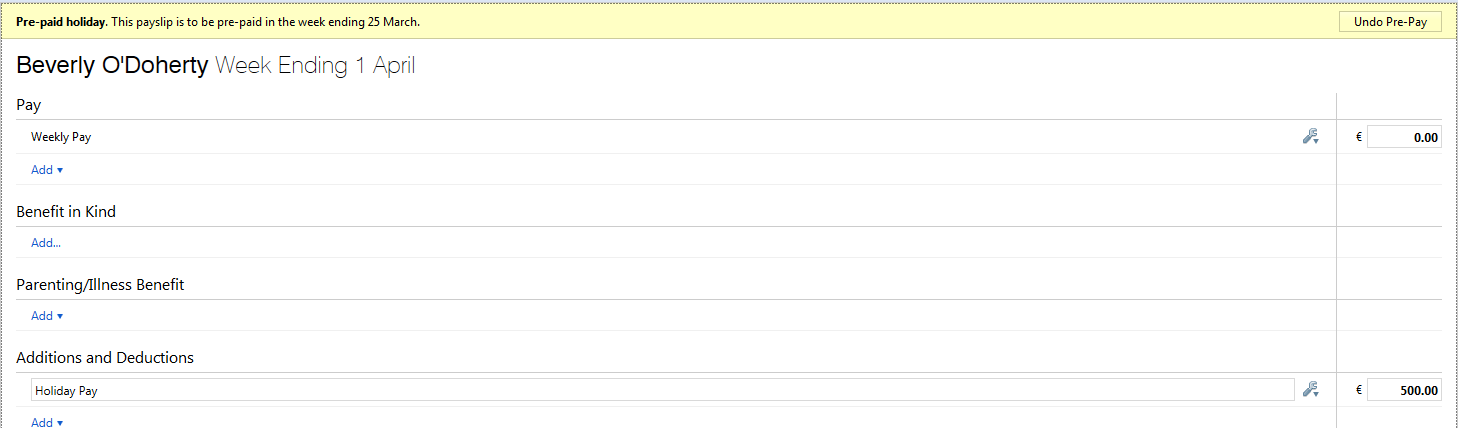

Enter the employee's payments, additions, deductions etc. as required in the pre-pay period:

4) Pre-Paying more than one period - should you wish to pay an employee or employees more than one pay period in advance, within the pre-pay period, simply click "More" on the menu toolbar, followed again by 'Pre-Pay Following Week/Fortnight/Month/4-Week in this Week/Fortnight/Month/4-Week.. ' and repeat the same process.

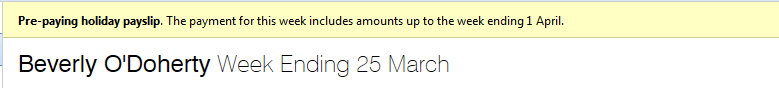

5) To finalise your pre-pay periods, return to your current open pay period by selecting this on the schedule bar. A confirmation message will appear to state that that this is a 'pre-paying payslip' and will confirm the future pay periods that will be included on the payslip. Simply click 'Finalise Payslips' to update the current period as well as the pre-pay periods.

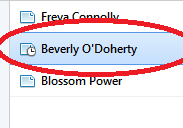

A pre-paid period will be indicated by a clock symbol next to the employee's name:

Any pre-paid period will subsequently be blocked from editing when this pay period is selected in the payroll.

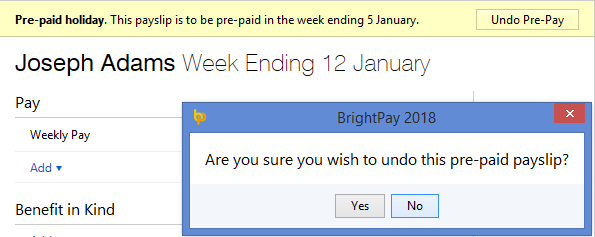

To Un-do a Pre-Pay Period:

Should you need to amend or un-do a pre-paid period for an employee, click 'Payroll':

1) Select the pay period in which the pre-paid payslip was included.

2) Select 'Re-open Payslips' on the menu toolbar, tick the employee in question and click 'OK'.

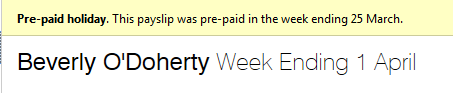

3) Now select the pre-paid period you wish to undo on the schedule bar and click 'Undo Pre-Pay'. Click 'Yes' to confirm you wish to undo this pre-paid payslip. The pre-paid period is now undone.

4) Return to the pay period in which the pre-paid period was originally included and finalise accordingly.

Need help? Support is available at 01 8352074 or [email protected].