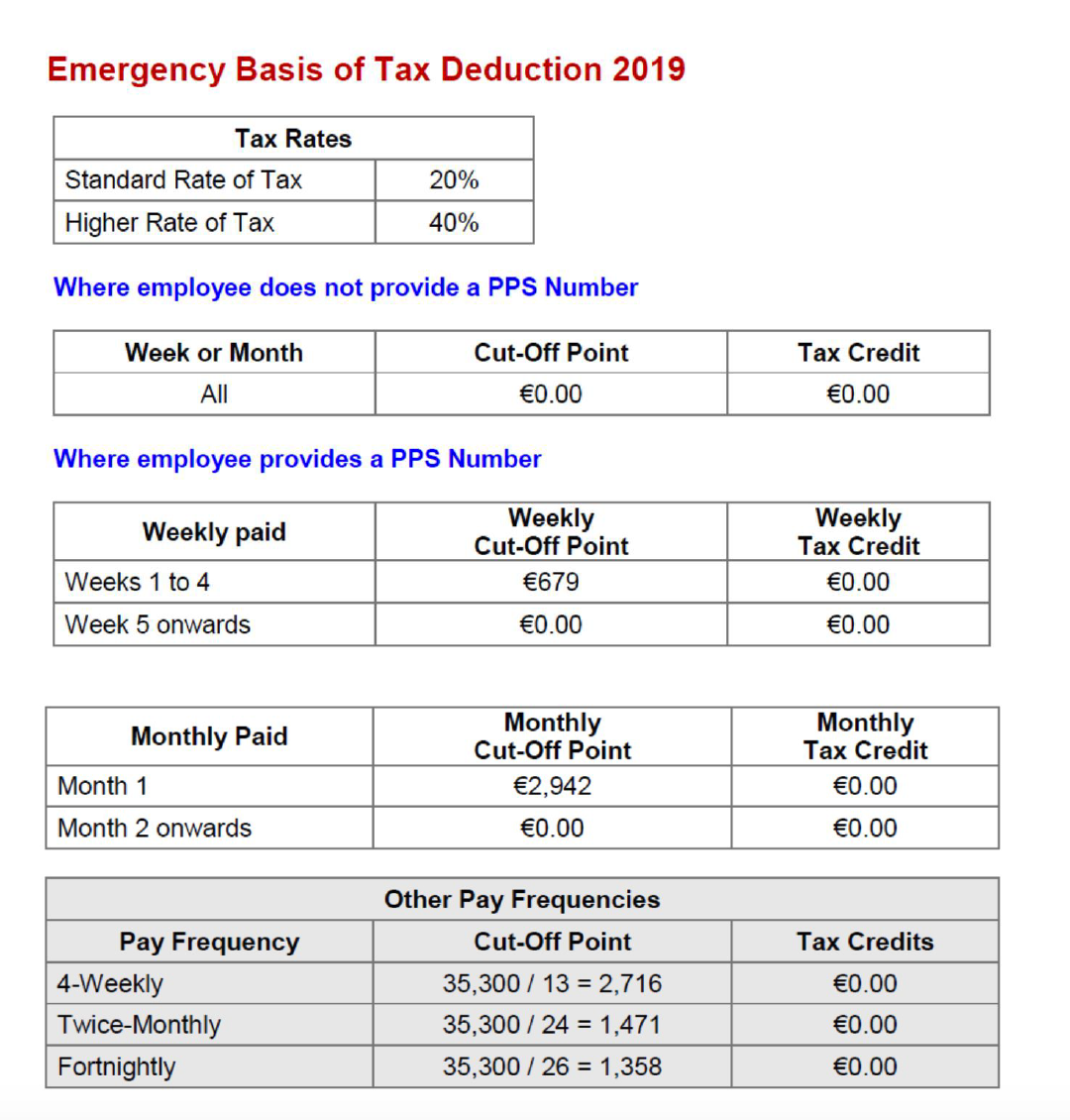

An employer is obliged to operate the Emergency Basis of PAYE and USC when they do not receive a Revenue Payroll Notification (RPN) for an employee.

RPNs will not be received when:

Employees will automatically be registered for PAYE when they register a job or pension using the 'Jobs and Pensions' service.

Need help? Support is available at 01 8352074 or [email protected].