Since 1st March 2009 the Pension Related Deduction (PRD) must be applied to the remuneration of public servants.

Who does the Pension Related Deduction apply to?

The Pension Related Deduction applies to public servants who:

(i) Are members of a public pension scheme

(ii) Are entitled to benefit under such a scheme

or

(iii) Receive a payment in lieu of membership in such a scheme

What pay does the Pension Related Deduction apply to?

The Pension Related Deduction applies to all Schedule E remuneration covering all elements of gross pay, including overtime, arrears, all taxable allowances, Notional Pay on Benefits and taxable portions of Illness Benefit.

PRSI Relief on Pension Related Deduction Abolished

Since 1st January 2011 Gross income before the PRD deduction is subject to PRSI.

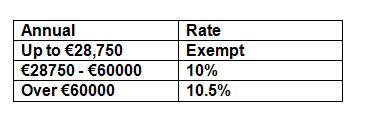

PRD RATES AND THRESHOLDS 2018

The exemption threshold for 2018 is €28,750.

Issuing a P45 to an Employee

No changes are required to the P45 issued to employees who leave employment from whom a Pension Related Deduction has been deducted, however, a statement of Pension Related Deductions should be issued with the P45 to the employee.

Issuing P45 to an Employee with a Pension Related Deduction within two years of commencement

Where an employee leaves employment within two years and neither transfers to another public service employment nor retains any pension benefits they are due a refund of both the pension contributions and the Pension Related Deduction. Per the Department of Finance this refund is to be calculated manually outside of the payroll software.

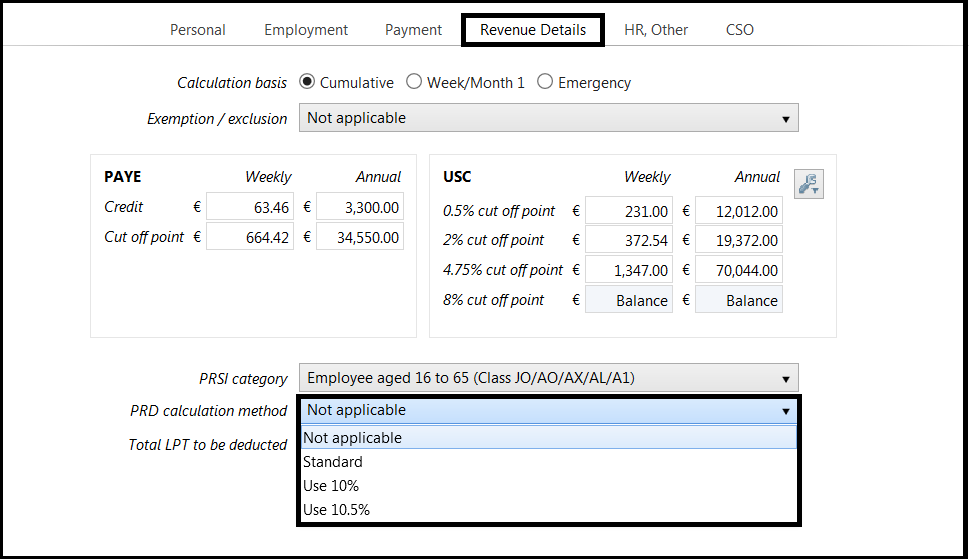

SETTING UP THE PENSION RELATED DEDUCTION WITHIN BRIGHTPAY

Go to Employees > Select Employee to whom the deduction will apply > Revenue Details > Select the appropriate PRD calculation method.

Payslips

The Pension Related Deduction will display separately on the employee's payslip as "PRD”.

Need help? Support is available at 01 8352074 or [email protected].