Universal Social Charge - Calculations

Some important points relating to the calculation of the USC:

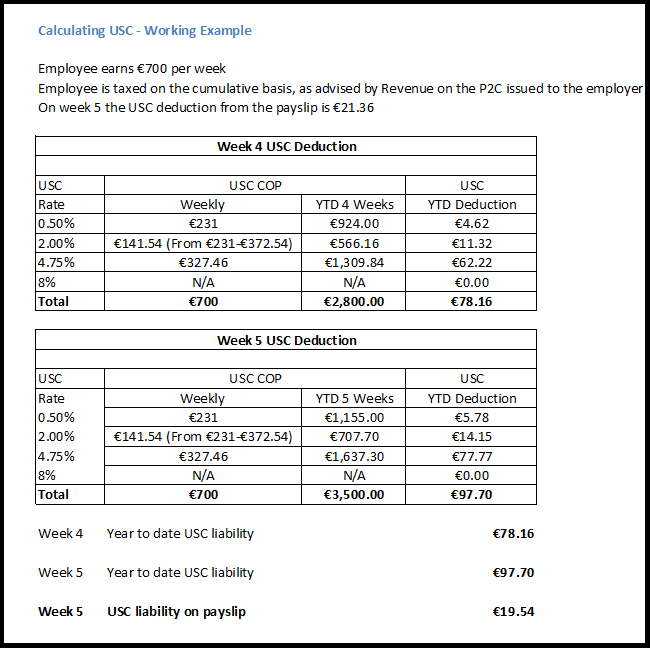

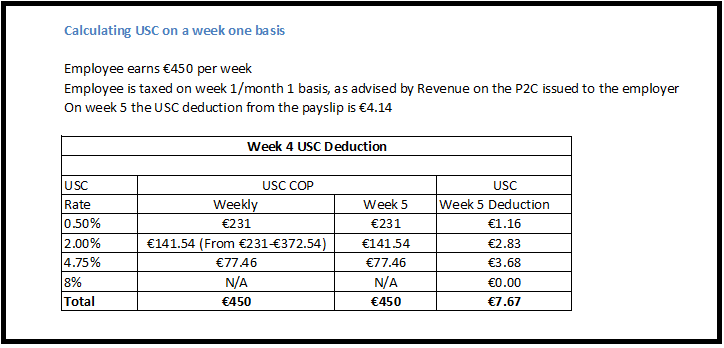

- The Universal Social Charge is collected in the same manner as PAYE and on the same calculation basis

- There is no USC relief on pension contributions

USC Exemption Marker

Employees Commencing Employment

RPNs will be available in real time for new employees, this will remove the need for the emergency basis in most cases.

Calculating USC on Week 53

Where a week 53 occurs an additional period of USC threshold is allocated to the employee on a week 1 basis.

Please note: if an employee's normal pay day has changed during this tax year or the preceding tax year, the

additional USC cut off points do not apply. You will need to instruct the software if the additional USC cut off

points are not applicable to an employee.

- To prevent the additional USC cut off points being allocated go to:

Employees > Select the employee > Click the 'Revenue Details' tab > Tick to exclude the employee from the week 53/54/56 USC concession > 'Save Changes'.

Need help? Support is available at 01 8352074 or brightpayirelandsupport@brightsg.com.