It is important to note that payment due dates for employers remain unchanged under the new PAYE Modernisation system.

If you are a quarterly or annual remitter, you will now have a monthly statement issued by Revenue to you, which will become your monthly return, however your payment due dates will not change.

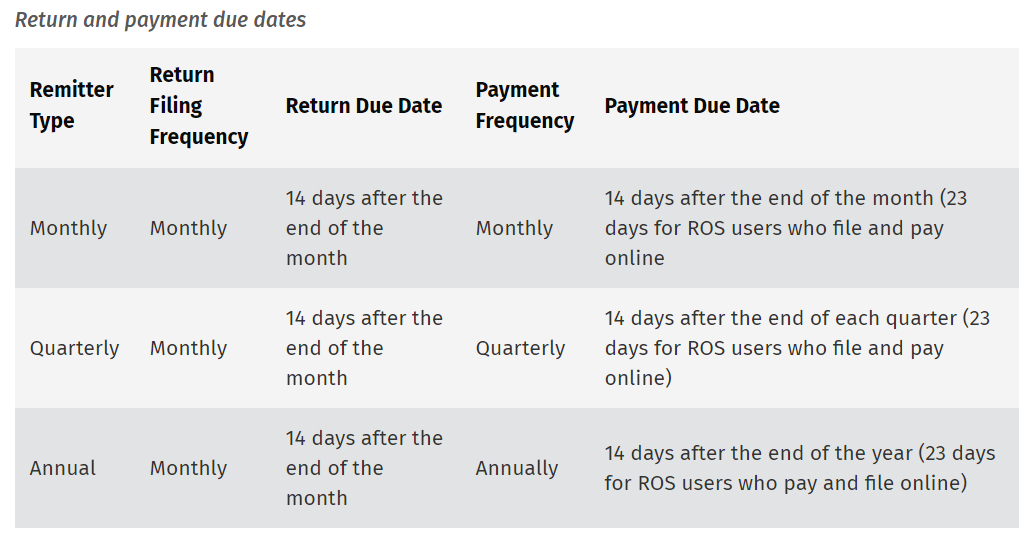

The following table summarises each Remitter Type and their respective return and payment due dates:

Need help? Support is available at 01 8352074 or [email protected].