Revenue Payments - Finalised totals

With the introduction of PAYE Modernisation, the employer P30 return will be discontinued with effect from 1st January 2019.

Revenue will instead issue you with a monthly statement based on the periodic payroll submissions you have made within the tax month in question. This statement of account will be available to view within your ROS account by the fifth day of the following month.

The monthly statement will show a summary of the total liability due, as well as the individual breakdown of your liability for income tax, USC, PRSI and LPT.

Finalised Totals

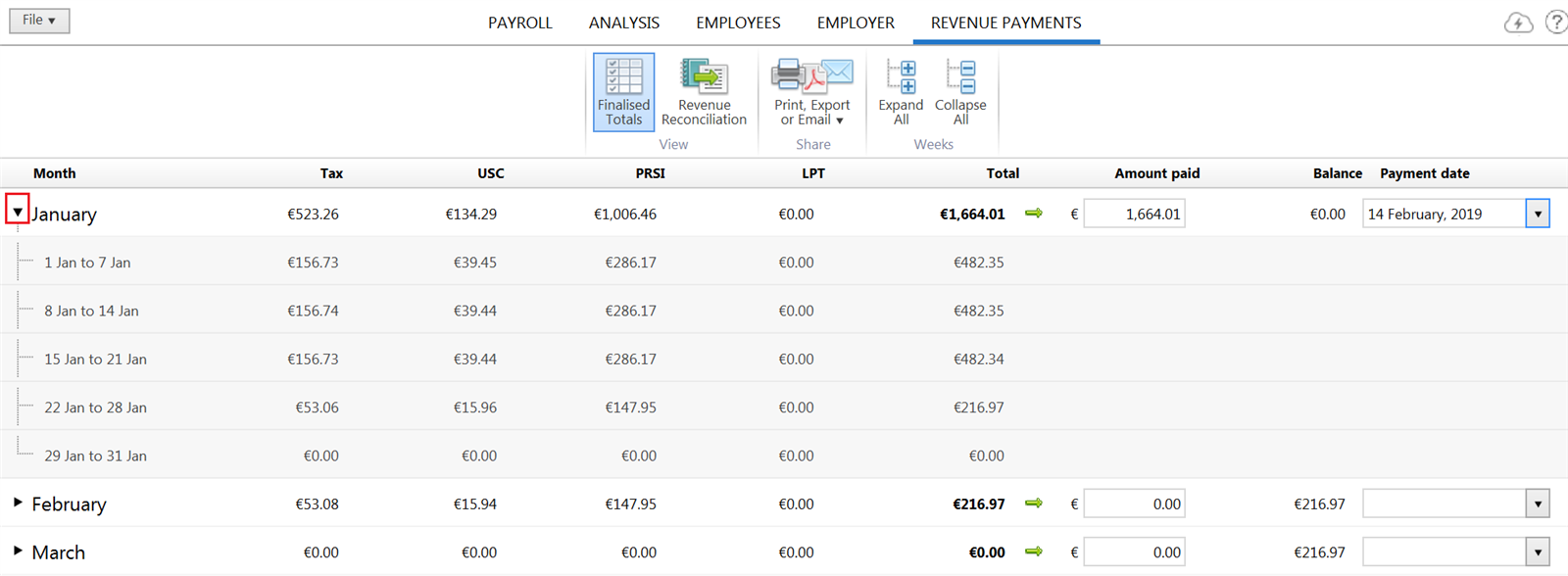

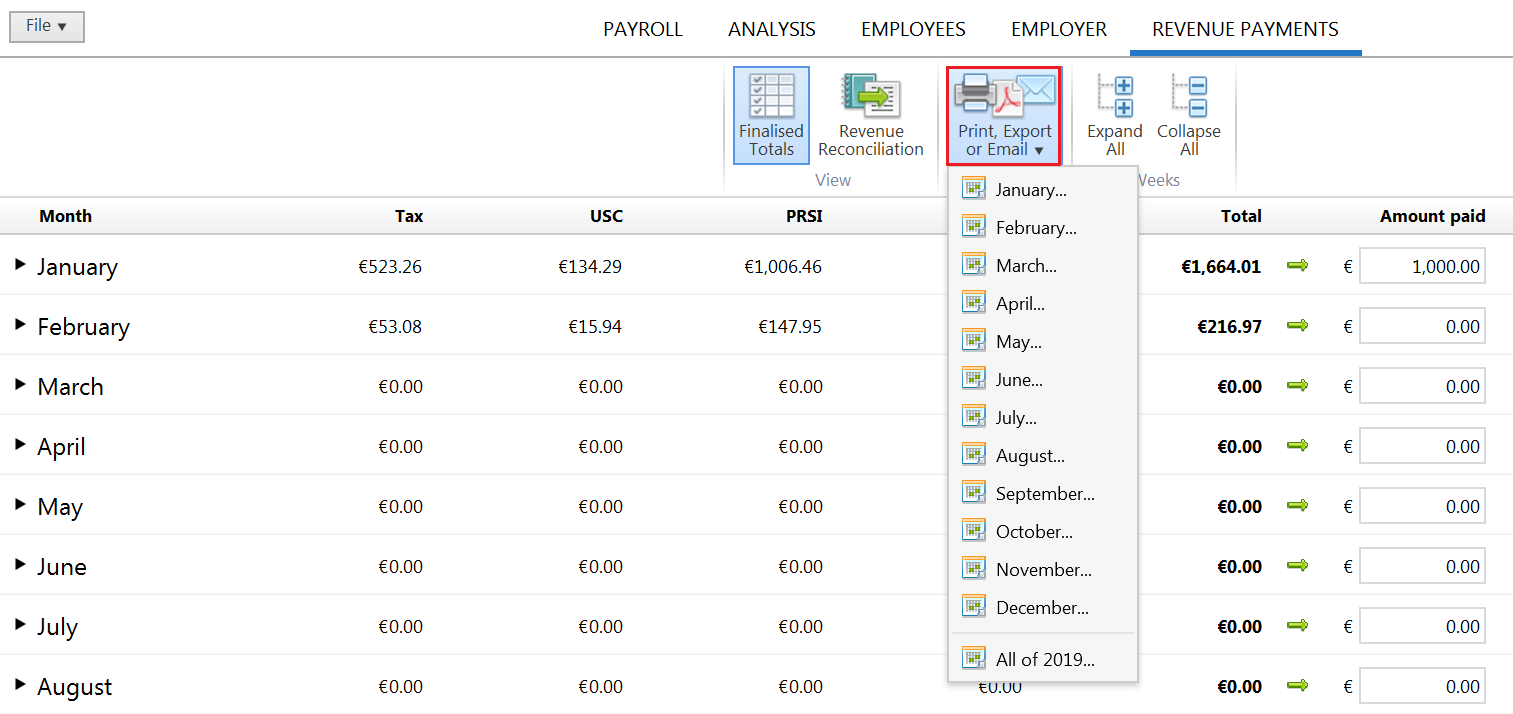

The Finalised Totals option within the Revenue Payments utility allows users to view a breakdown of their liability to Revenue, arising from all finalised payslips. It also allows users to reconcile amounts within the software with those on the monthly statement issued by Revenue.

- To access this facility, go to Revenue Payments > Finalised Totals:

- Details of the tax liability for each tax month will be displayed on screen. To expand a tax month to view a periodic breakdown of amounts, simply click the drop down arrow next to the month:

- Alternatively, click Expand All to expand all tax months at the same time:

It is important to note that payment due dates for employers remain unchanged under the new system, despite the fact that Revenue will issue a monthly statement to all employers each tax month.

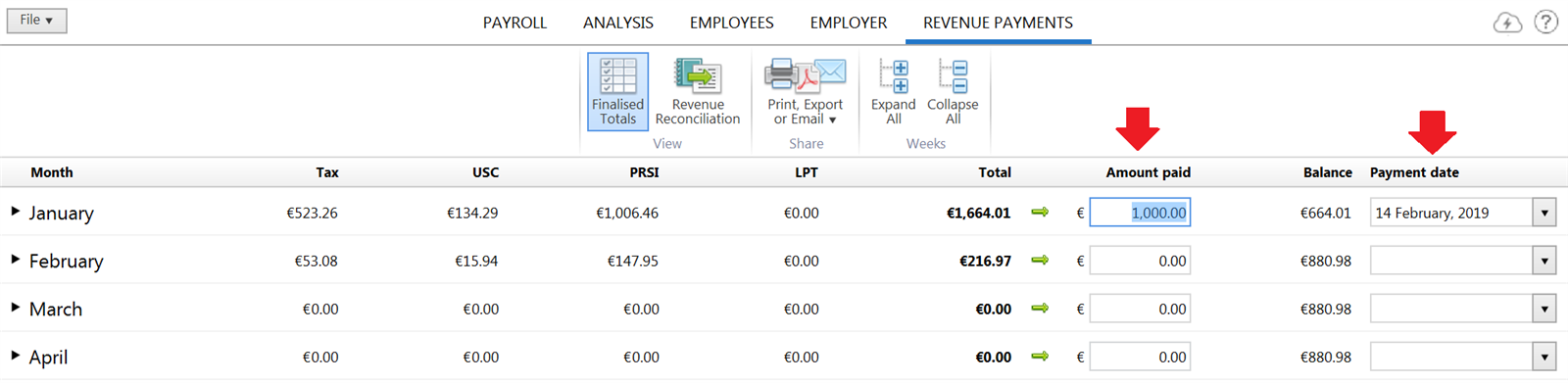

When payment is made to Revenue, this utility can be used to record the amount paid to Revenue as well as the date of payment.

- Simply enter the applicable payment amount in the Amount Paid field for the month in question and enter your payment date accordingly.

- If no payment is made for a particular month (e.g. if you are a quarterly or annual remitter), simply leave the Amount Paid field as zero.

- Should you wish to print, email or export the details for a particular tax month or all of the tax year, simply click the Print, Export or Email button on the menu bar and select the appropriate option:

Need help? Support is available at 01 8352074 or brightpayirelandsupport@brightsg.com.