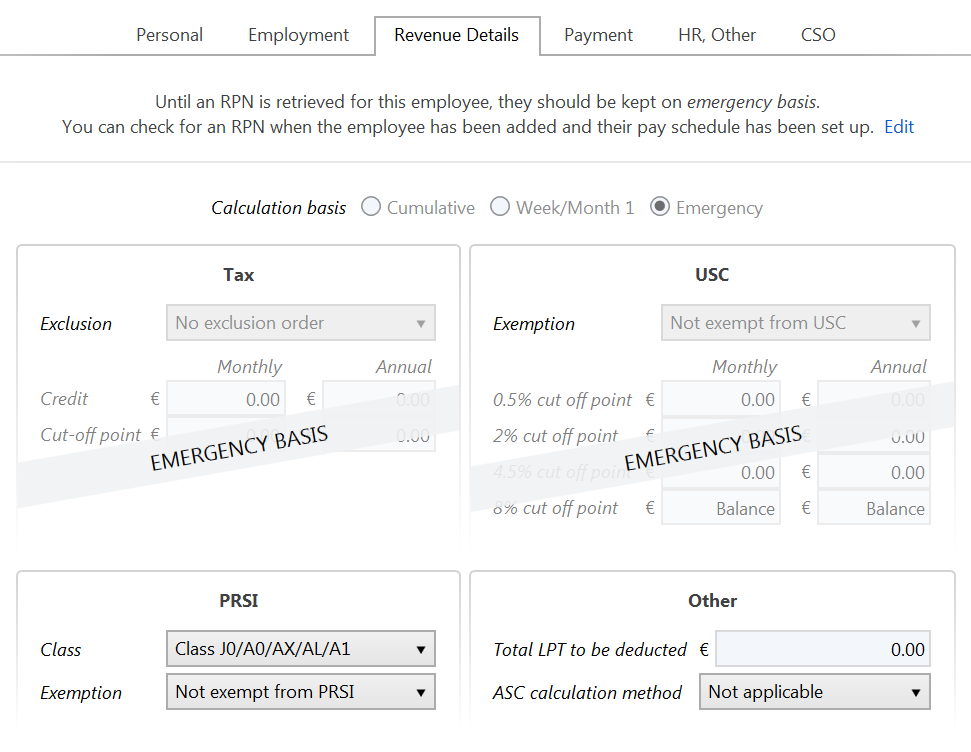

Under PAYE Modernisation, all employees will be placed on emergency tax until they are updated by a Revenue Payroll Notification.

Therefore, when setting up an employee record for the first time or on import of your employee records from the previous tax year, this will be brought to your attention when you access the employee's Revenue Details utility:

Please note: the emergency basis no longer resets at the start of the tax year.

Example:

An employee commences work in tax week 46 of 2019 and leaves in week 5 of 2020. The emergency basis will apply throughout as follows:

Need help? Support is available at 01 8352074 or [email protected].