Level 5 Restrictions - Possible Payroll Implications

The Government has decided that from midnight on Wednesday 21st October 2020, Ireland will be placed on Level 5 of the Plan for Living with COVID.

This may lead to payroll implications for many employers. Some eligible employers may wish to consider the Employment Wage Subsidy Scheme (EWSS) while others may lay their employees off with employees claiming the Pandemic Unemployment Payment (PUP) from the Department of Employment Affairs and Social Protection (DEASP).

- Further details on the Employment Wage Subsidy Scheme (EWSS) can be found here

- Further information on the Pandemic Unemployment Payment (PUP) can be found here

Employment Wage Subsidy Scheme – Level 5 Restriction Enhancements

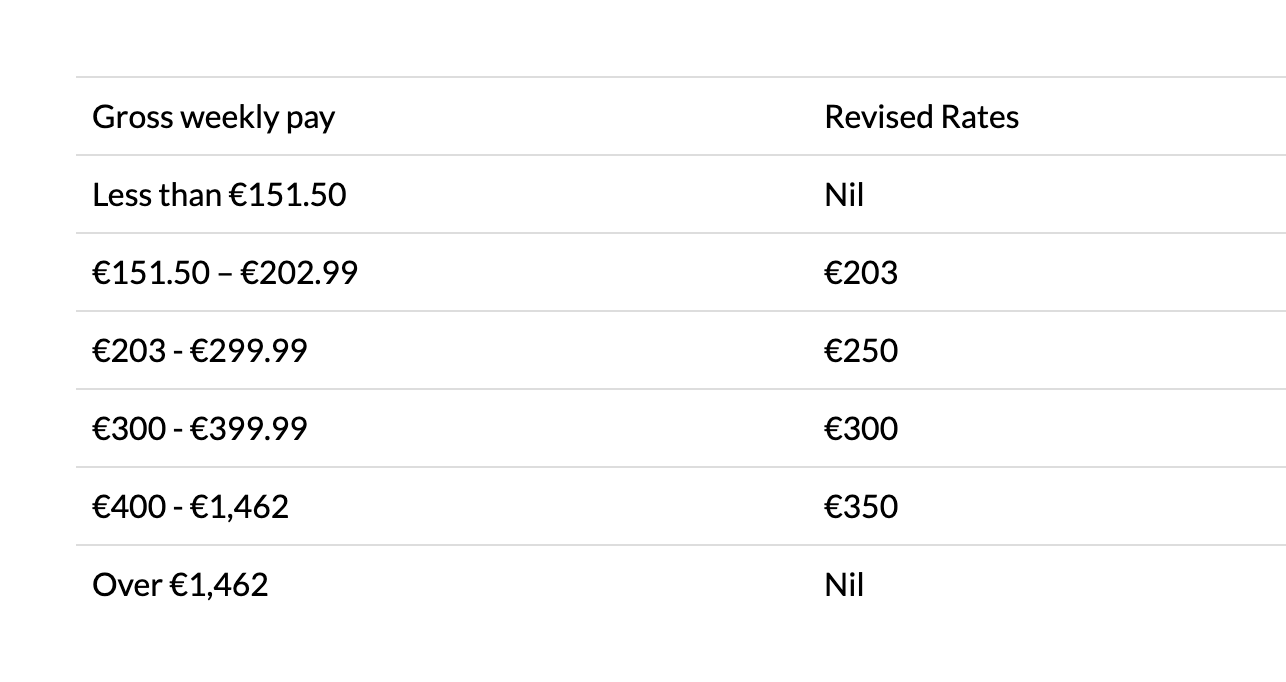

The rate of subsidy provided under the Employment Wage Subsidy Scheme (EWSS) has been revised to better support businesses dealing with Covid-19 Level 5 restrictions.

Broadly, the EWSS rates will be aligned with the rates of payment under the PUP. The revised rates are effective from the next payroll date after October 19th 2020, they will revert to the previous rates from February 1st 2021.

Please note: there is no change to the lower or upper threshold for EWSS or to the eligibility criteria. Therefore, the reporting to Revenue remains the same, Revenue will pay the revised subsidies based on the pay date.

Update to BrightPay

A software update will be released shortly solely for the purpose of the 'EWSS Estimated Amounts' report which is available within the software to show the expected subsidy and employer PRSI credit.

Please note: no other update is required.

Pandemic Unemployment Payment (PUP) – Enhanced Rate

The Government has now introduced a fourth rate of payment for people whose gross earnings were €400 per week or higher prior to the pandemic. They will now receive €350 in their Pandemic Unemployment Payment (PUP). The rate change takes effect for all new applications received since Friday 16th October 2020. Existing PUP recipients who previously earned more than €400 per week will have their PUP rate automatically increased.

There is no change to the three other rates of PUP payment (€203, €250 and €300).

The rates of payment will be reviewed in January 2021.

Please note: there is no requirement to cease employees on payroll when they are claiming the Pandemic Unemployment Payment (PUP) from DEASP. Employees should be left on the payroll on zero pay until such time as the employer will be paying them again.

New applicants should apply online at MyWelfare.ie

Need help? Support is available at 01 8352074 or brightpayirelandsupport@brightsg.com.