Importing Deductions using CSV file

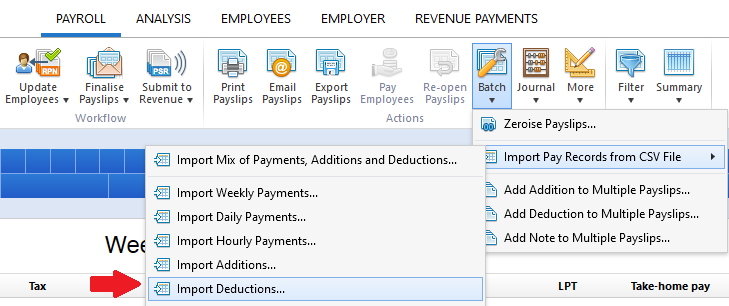

To import deductions each pay period, go to Payroll > Batch > Import Pay Records from CSV File > Import Deductions:

1) Browse to the location of your CSV File

2) Select the required file and click 'Open'

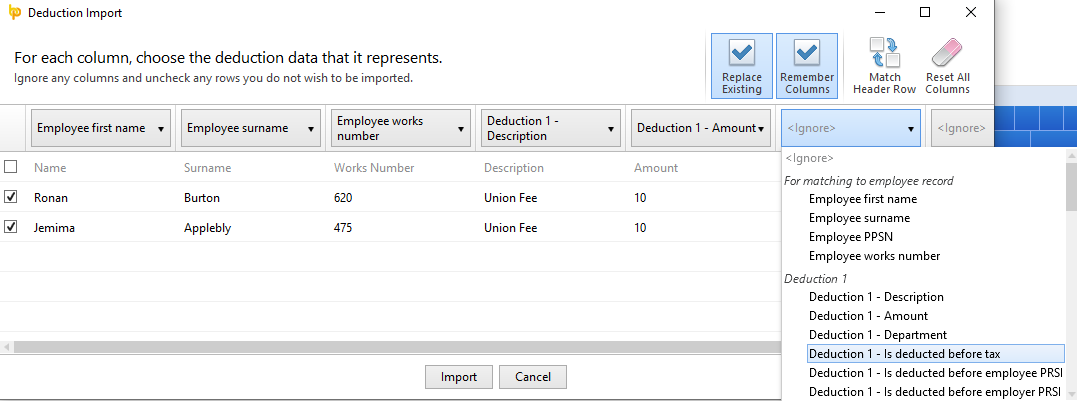

3) Your employee data will be displayed on screen. For each column, choose the payment data it represents. Ignore any columns and uncheck any rows you do not wish to be imported.

- To assist with column selection, simply select 'Match Header Row'. BrightPay will try and match as many columns as it can for you

- Also indicate whether you would like to replace the equivalent pay items that are already present on the employees' payslips with the new amounts being imported in by selecting/de-selecting 'Replace Existing'

- Should you wish to remember your column selection for future imports, instruct BrightPay to 'Remember Columns'. BrightPay will subsequently remember the column selection used in the previous import when next importing a CSV file.

- Should you wish to reset your column selection at any time, select 'Reset All Columns'.

4) Click Import to complete the import of your payment information.

Fields which can be imported into BrightPay using the 'Deductions' CSV File option are:

For matching to employee record:

Employee first name

Employee surname

Employee PPSN

Employee works number

Deductions using employer deduction type:

To allow for an amount to be allocated to a Deduction Type set up within the Employer utility

Deduction 1:

Description

Amount

Department

Is deducted before tax

Is deducted before employee PRSI

Is deducted before employer PRSI

Is deducted before USC

Is deducted before ASC

Is deducted before Pension

Is deducted before LPT

Deduction 2:

Description

Amount

Department

Is deducted before tax

Is deducted before employee PRSI

Is deducted before employer PRSI

Is deducted before USC

Is deducted before ASC

Is deducted before Pension

Is deducted before LPT

Deduction 3:

Description

Amount

Department

Is deducted before tax

Is deducted before employee PRSI

Is deducted before employer PRSI

Is deducted before USC

Is deducted before ASC

Is deducted before Pension

Is deducted before LPT

Deduction 4:

Description

Amount

Department

Is deducted before tax

Is deducted before employee PRSI

Is deducted before employer PRSI

Is deducted before USC

Is deducted before ASC

Is deducted before Pension

Is deducted before LPT

Deduction 5:

Description

Amount

Department

Is deducted before tax

Is deducted before employee PRSI

Is deducted before employer PRSI

Is deducted before USC

Is deducted before ASC

Is deducted before Pension

Is deducted before LPT

Need help? Support is available at 01 8352074 or brightpayirelandsupport@brightsg.com.