Additional Superannuation Contribution (ASC)

Additional Superannuation Contribution (ASC) was introduced on 1st January 2019, it replaced the Pension Related Deduction (PRD). Whereas PRD was a temporary emergency measure, ASC is a permanent contribution in respect of pensionable remuneration.

Application of ASC

Assessing ASC

Unlike PRD, ASC is only chargeable on pensionable remuneration. Pensionable remuneration includes:

- Basic Pay (excluding non-pensionable overtime) due to the public servant in respect of that period, and

- Allowances, emoluments and premium pay (or it's equivalent) which are treated as pensionable pay

ASC Treatment

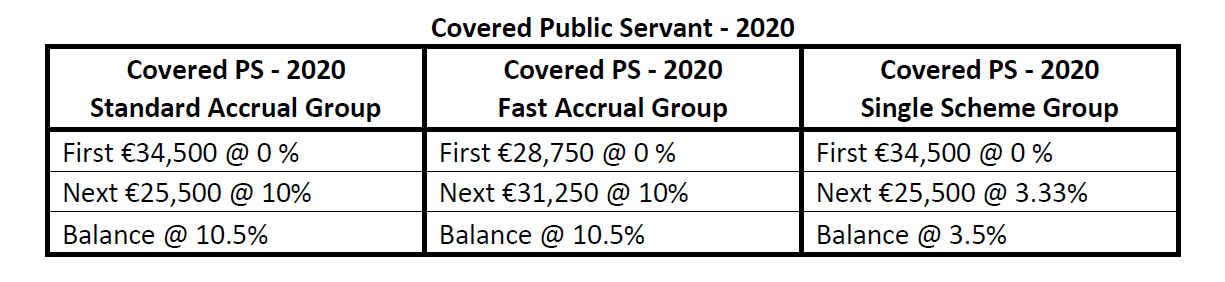

ASC RATES AND THRESHOLDS 2020

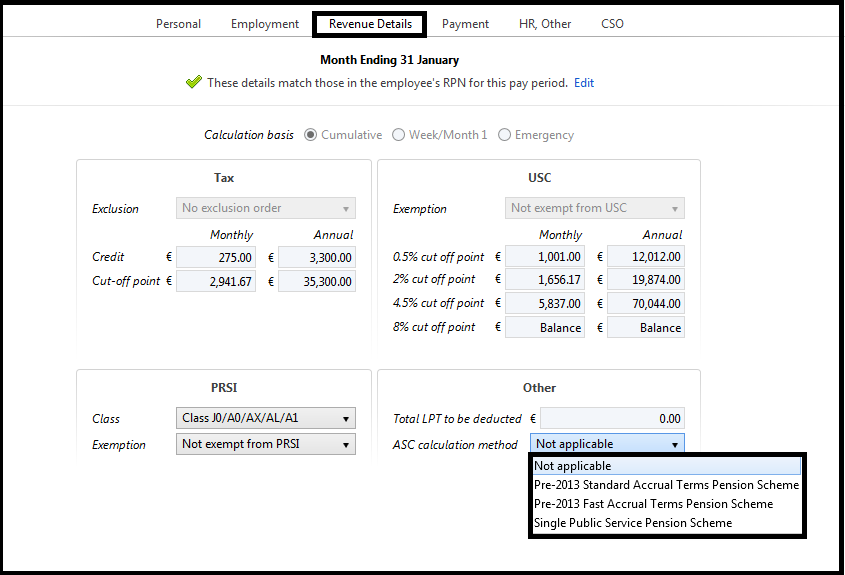

SETTING UP THE ADDITIONAL SUPERANNUATION CONTRIBUTION DEDUCTION WITHIN BRIGHTPAY

Go to Employees > Select Employee to whom the deduction will apply > Revenue Details > Select the appropriate ASC calculation method > 'Save Changes'.

Payslips

Additional Superannuation Contribution will display separately on the Employees Payslip as ASC under the deductions section.

Need help? Support is available at 01 8352074 or brightpayirelandsupport@brightsg.com.